Vista Outdoor Board of Directors Sends Letter to Stockholders Highlighting Reasons to Vote FOR Value Maximizing CSG Transaction

Vista Outdoor Inc. (NYSE: VSTO) urges stockholders to vote 'FOR' the transaction with Czechoslovak Group a.s. (CSG) at the September 27th special meeting. The CSG Transaction involves acquiring The Kinetic Group and investing in Revelyst, offering:

- $28 per share cash consideration

- One share of Revelyst common stock for each Vista Outdoor share

- Opportunity to participate in Revelyst's upside and potential change of control premium

- Expected closing in October 2024

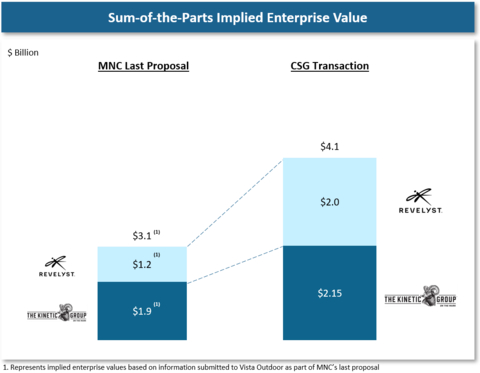

The Board believes this deal maximizes stockholder value, surpassing MNC Capital's proposal by ~$250 million for The Kinetic Group. Revelyst anticipates doubling Adjusted EBITDA sequentially and annually, targeting $100 million in cost savings by FY2027 and mid-teens EBITDA margin long-term. The Board remains open to exploring all opportunities to maximize Revelyst's value, including a potential sale.

Vista Outdoor Inc. (NYSE: VSTO) invita gli azionisti a votare 'A FAVORE' della transazione con Czechoslovak Group a.s. (CSG) nella riunione speciale del 27 settembre. La transazione CSG prevede l'acquisizione di The Kinetic Group e investimenti in Revelyst, offrendo:

- $28 per azione in contanti

- Un'azione di Revelyst per ogni azione di Vista Outdoor

- Opportunità di partecipare all'upside di Revelyst e al potenziale premio per il cambiamento di controllo

- Chiusura prevista per ottobre 2024

Il Consiglio ritiene che questo accordo massimizzi il valore per gli azionisti, superando la proposta di MNC Capital di circa $250 milioni per The Kinetic Group. Revelyst prevede di raddoppiare l'Adjusted EBITDA sia sequenzialmente che annualmente, puntando a $100 milioni di risparmi sui costi entro l'anno fiscale 2027 e un margine EBITDA a lungo termine nella fascia media delle percentuali. Il Consiglio è aperto a esplorare tutte le opportunità per massimizzare il valore di Revelyst, inclusa una potenziale vendita.

Vista Outdoor Inc. (NYSE: VSTO) insta a los accionistas a votar 'A FAVOR' de la transacción con Czechoslovak Group a.s. (CSG) en la reunión especial del 27 de septiembre. La transacción con CSG implica adquirir The Kinetic Group e invertir en Revelyst, ofreciendo:

- $28 por acción en efectivo

- Una acción de Revelyst por cada acción de Vista Outdoor

- Oportunidad de participar en el potencial aumento de Revelyst y en el posible premio por cambio de control

- Cierre previsto en octubre de 2024

La Junta cree que este acuerdo maximiza el valor para los accionistas, superando la propuesta de MNC Capital en aproximadamente $250 millones por The Kinetic Group. Revelyst anticipa duplicar su EBITDA ajustado tanto secuencial como anualmente, apuntando a $100 millones en ahorros de costos para el año fiscal 2027 y un margen EBITDA a largo plazo en la media de los dígitos. La Junta está abierta a explorar todas las oportunidades para maximizar el valor de Revelyst, incluida una posible venta.

Vista Outdoor Inc. (NYSE: VSTO)는 주주들에게 9월 27일 특별 회의에서 Czechoslovak Group a.s. (CSG)와의 거래에 '찬성' 투표를 하도록 촉구하고 있습니다. CSG 거래는 The Kinetic Group을 인수하고 Revelyst에 투자하는 것으로, 다음과 같은 혜택을 제공합니다:

- 주당 $28 현금 보상

- Vista Outdoor 주식 1주당 Revelyst 보통주 1주

- Revelyst의 상승 가능성과 잠재적 지배구조 변경 프리미엄에 참여할 기회

- 2024년 10월 종료 예정

이사회는 이 거래가 주주 가치를 극대화한다고 믿으며, The Kinetic Group에 대한 MNC Capital의 제안을 약 2억 5천만 달러 초과합니다. Revelyst는 조정된 EBITDA를 순차적으로 및 년간 두 배로 늘릴 것으로 예상하며, 2027 회계연도까지 1억 달러의 비용 절감 목표와 장기적으로 중간 십대 EBITDA 마진을 목표로 하고 있습니다. 이사회는 Revelyst의 가치를 극대화하기 위한 모든 기회를 탐색할 의향이 있으며, 잠재적인 판매도 포함됩니다.

Vista Outdoor Inc. (NYSE: VSTO) exhorte les actionnaires à voter 'POUR' la transaction avec Czechoslovak Group a.s. (CSG) lors de l'assemblée spéciale du 27 septembre. La transaction CSG implique l'acquisition de The Kinetic Group et un investissement dans Revelyst, offrant :

- 28 $ par action en espèces

- Une action de Revelyst pour chaque action de Vista Outdoor

- Opportunité de participer à l'augmentation de Revelyst et au potentiel de prime de changement de contrôle

- Clôture prévu en octobre 2024

Le Conseil estime que cet accord maximise la valeur pour les actionnaires, dépassant la proposition de MNC Capital d'environ 250 millions de dollars pour The Kinetic Group. Revelyst prévoit de doubler l'EBITDA ajusté de manière séquentielle et annuelle, visant 100 millions de dollars d'économies de coûts d'ici l'exercice 2027 et une marge EBITDA à long terme dans les moyens de la dizaine. Le Conseil reste ouvert à explorer toutes les opportunités pour maximiser la valeur de Revelyst, y compris une vente potentielle.

Vista Outdoor Inc. (NYSE: VSTO) fordert die Aktionäre auf, bei der Sonderversammlung am 27. September 'FÜR' die Transaktion mit der Czechoslovak Group a.s. (CSG) zu stimmen. Die CSG-Transaktion umfasst den Erwerb der Kinetic Group und Investitionen in Revelyst, und bietet:

- $28 pro Aktie in bar

- Eine Aktie von Revelyst für jede Vista Outdoor Aktie

- Möglichkeit zur Teilnahme am Aufwärtstrend von Revelyst und einem möglichen Kontrollwechsel-Prämie

- Voraussichtlicher Abschluss im Oktober 2024

Der Vorstand ist der Meinung, dass dieser Deal den Aktionärswert maximiert und das Angebot von MNC Capital um etwa 250 Millionen Dollar für die Kinetic Group übertrifft. Revelyst erwartet, das bereinigte EBITDA sowohl sequenziell als auch jährlich zu verdoppeln, mit dem Ziel, bis zum Geschäftsjahr 2027 100 Millionen Dollar an Kosteneinsparungen zu erzielen und eine langfristige EBITDA-Marge im mittleren Teenagerbereich anzustreben. Der Vorstand ist offen für die Erkundung aller Möglichkeiten zur Maximierung des Wertes von Revelyst, einschließlich eines möglichen Verkaufs.

- CSG Transaction offers $28 per share cash consideration

- Stockholders receive one share of Revelyst common stock for each Vista Outdoor share

- Opportunity for stockholders to participate in Revelyst's potential upside

- CSG deal surpasses MNC Capital's proposal by ~$250 million for The Kinetic Group

- Revelyst expects to double Adjusted EBITDA sequentially and for the full year

- Revelyst targets $100 million in run-rate cost savings by fiscal year 2027

- Revelyst aims for mid-teens EBITDA margin long-term

- Board remains open to exploring all opportunities to maximize Revelyst's value, including potential sale

- Transaction requires stockholder approval at the September 27th special meeting

- Merger agreement can be terminated after October 15th if not approved

(Graphic: Business Wire)

The full text of the letter sent to stockholders follows:

Dear Vista Outdoor Stockholders,

The September 27th special meeting of stockholders is fast approaching, and your vote is important.

Following a robust process over the past two years to evaluate all opportunities to maximize value for Vista Outdoor stockholders, your Board of Directors unanimously recommends stockholders approve the transaction with Czechoslovak Group a.s. (“CSG”) to acquire The Kinetic Group and invest in Revelyst (the “CSG Transaction”) and strongly believes the CSG Transaction is the best path forward to deliver maximum value to Vista Outdoor stockholders.

Your Board urges all stockholders to vote “FOR” the CSG Transaction in order to realize compelling value for The Kinetic Group now, while preserving the opportunity to participate in the upside of Revelyst, including a potential change of control premium.

The CSG Transaction Delivers the Most Value for Stockholders

On September 12th, Vista Outdoor entered into an amended agreement with CSG, which delivers significant value to stockholders, including:

-

Cash consideration of

$28 - One share of Revelyst common stock for each Vista Outdoor common stock

- Opportunity to participate in the upside of Revelyst and a potential change of control premium for Revelyst

- Closing in October 2024, once stockholder approval is obtained (and subject to the satisfaction of other customary closing conditions)

The CSG Transaction is superior to the last proposal from MNC Capital, which significantly undervalues Vista Outdoor, and undervalues The Kinetic Group by

We are Taking Action to Unlock the Value of Revelyst

There is strong momentum underway at Revelyst and we believe there is significant upside for stockholders in the near-term. Revelyst expects to double Adjusted EBITDA sequentially for the quarter and for the full year, with a clear path to

Your Board is also committed to continuing to explore all opportunities to maximize the value of Revelyst, including a potential sale. We have been engaged in active discussions with the private equity firm partnered with MNC regarding a potential sale of Revelyst, separate and apart from MNC, and we are committed to considering any and all offers from interested parties that may deliver greater value to stockholders.

Vote “FOR” the CSG Transaction Today to Lock In Significant Value for Your Investment

After October 15th, the merger agreement between Vista Outdoor and CSG can be terminated. We urge you to vote “FOR” the CSG Transaction TODAY to realize compelling value for The Kinetic Group now, while preserving the opportunity to participate in the upside of Revelyst, including a potential change of control premium.

Sincerely,

Vista Outdoor Inc.’s Board of Directors

By Michael Callahan, Chairman of the Board of Directors

YOUR VOTE IS IMPORTANT – TIME IS SHORT!

We encourage you to vote via internet or telephone following the instruction on your proxy. If you need assistance completing the proxy card, additional copies of the proxy materials or have questions regarding the upcoming meeting, contact the Company’s proxy solicitor, Innisfree M&A Incorporated at +1 (877) 750-9499 (toll free) or +1 (212) 750-5833 (banks and brokers). |

Morgan Stanley & Co. LLC is acting as sole financial adviser to Vista Outdoor and Cravath, Swaine & Moore LLP is acting as legal adviser to Vista Outdoor. Moelis & Company LLC is acting as sole financial adviser to the independent directors of Vista Outdoor and Gibson, Dunn & Crutcher LLP is acting as legal adviser to the independent directors of Vista Outdoor.

About Vista Outdoor Inc.

Vista Outdoor (NYSE: VSTO) is the parent company of more than three dozen renowned brands that design, manufacture and market sporting and outdoor products. Brands include Bushnell, CamelBak, Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal Ammunition, Remington Ammunition and more. Our reporting segments, Outdoor Products and Sporting Products, provide consumers with a wide range of performance-driven, high-quality and innovative outdoor and sporting products. For news and information, visit our website at www.vistaoutdoor.com.

Forward-Looking Statements

Some of the statements made and information contained in this press release, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or “our”) plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our actual results to differ materially from the expectations described in such forward-looking statements, including the following: risks related to the previously announced transaction among Vista Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. (the “Transaction”), including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by our stockholders, (ii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in circumstances which would require Vista Outdoor to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from our ongoing business operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be completed in accordance with our expected plans or anticipated timelines, or at all; risks related to the review of strategic alternatives announced on July 30, 2024 (“Review”), including (i) the terms, structure, benefits and costs of any transaction that may result from the Review, (ii) the timing of any such transaction that may result from the Review and whether any such transaction will be consummated at all, (iii) the effect of the announcement of the Review on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (iv) risks related to the Review diverting management’s attention from our ongoing business operations, (v) the costs or expenses resulting from the Review, (vi) any litigation relating to the Review and (vii) the Review may not achieve some or all of any anticipated benefits of the Review; impacts from the COVID-19 pandemic on our operations, the operations of our customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting our operating costs; the supply, availability and costs of raw materials and components; increases in commodity, energy, and production costs; seasonality and weather conditions; our ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected changes in or our inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of our primary delivery and shipping services for our products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; our ability to take advantage of growth opportunities in international and commercial markets; our ability to obtain and maintain licenses to third-party technology; our ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with our sales to significant retail customers, including unexpected cancellations, delays, and other changes to purchase orders; our competitive environment; our ability to adapt our products to changes in technology, the marketplace and customer preferences, including our ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; our ability to maintain and enhance brand recognition and reputation; our association with the firearms industry; others’ use of social media to disseminate negative commentary about us, our products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; our ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to our business, such as federal and state ammunition regulations; risks associated with cybersecurity and other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and fluctuations in those rates; general economic and business conditions in

You are cautioned not to place undue reliance on any forward-looking statements we make, which are based only on information currently available to us and speak only as of the date hereof. A more detailed description of risk factors that may affect our operating results can be found in Part 1, Item 1A, Risk Factors, of our Annual Report on Form 10-K for fiscal year 2024, and in the filings we make with the SEC from time to time. We undertake no obligation to update any forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in respect of the Transaction. In connection with the Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with the SEC on January 16, 2024 a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to Vista Outdoor stockholders pursuant to the Transaction, which Form S-4 includes a proxy statement of Vista Outdoor that also constitutes a prospectus of Revelyst (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING OUR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement was declared effective by the SEC on March 22, 2024, and we have mailed the definitive proxy statement/prospectus to each of our stockholders entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/prospectus and any other documents free of charge through the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Vista Outdoor are available free of charge on our website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from our stockholders in respect of the Transaction. Information about our directors and executive officers is set forth in our proxy statement on Schedule 14A for our 2024 Annual Meeting of Stockholders, which was filed with the SEC on July 24, 2024, and subsequent statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of proxies in connection with the Transaction, which may, in some cases, be different than those of our stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240920383039/en/

Investor Contact:

Tyler Lindwall

Phone: 612-704-0147

Email: investor.relations@vistaoutdoor.com

Media Contact:

Eric Smith

Phone: 720-772-0877

Email: media.relations@vistaoutdoor.com

Source: Vista Outdoor Inc.

FAQ

What is the cash consideration per share in the Vista Outdoor (VSTO) CSG Transaction?

When is the special stockholder meeting for Vista Outdoor (VSTO) to vote on the CSG Transaction?

How does the CSG offer compare to MNC Capital's proposal for Vista Outdoor (VSTO)?

What are Revelyst's financial targets according to Vista Outdoor's (VSTO) announcement?