Update: U.S. Insurance Industry Begins to See Surplus Recovery, Boosted by First Half Capital Gains and Signs of U.S. Property and Casualty Firms Inching Towards Stabilization

Verisk and APCIA report that the U.S. insurance industry is showing signs of recovery in the first half of 2024. Key highlights include:

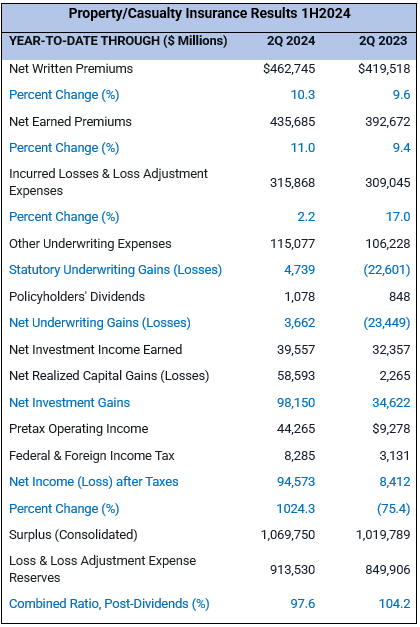

- Estimated gains of $95 billion, or $45 billion when adjusting for one insurer's capital gains

- Underwriting income improved from a $22.6 billion loss in 1H2023 to a $4.7 billion gain in 1H2024

- Premiums written increased to $463 billion, up from $420 billion in 1H2023

- Combined ratio improved to 97.6% from 104.2% in 1H2023

- Policyholders' surplus grew to $1,070 billion from $1,014 billion at the end of 2023

Despite these improvements, the industry faces ongoing challenges from inflation, natural catastrophes, and emerging risks like cyber threats. The recovery is still incomplete when adjusted for inflation, and the upcoming hurricane and wildfire seasons pose potential risks.

Verisk e APCIA riferiscono che l'industria assicurativa statunitense sta mostrando segni di ripresa nella prima metà del 2024. Le principali evidenze includono:

- Guadagni stimati di 95 miliardi di dollari, o 45 miliardi di dollari se si considera il guadagno in capitale di un assicuratore

- Il reddito da sottoscrizione è migliorato da una perdita di 22,6 miliardi di dollari nella prima metà del 2023 a un guadagno di 4,7 miliardi di dollari nella prima metà del 2024

- I premi scritti sono aumentati a 463 miliardi di dollari, rispetto ai 420 miliardi di dollari nella prima metà del 2023

- Il rapporto combinato è migliorato al 97,6% rispetto al 104,2% nella prima metà del 2023

- Il surplus degli assicurati è cresciuto a 1.070 miliardi di dollari rispetto ai 1.014 miliardi di dollari alla fine del 2023

Nonostante questi miglioramenti, l'industria affronta sfide continue dovute all'inflazione, a catastrofi naturali e a rischi emergenti come le minacce informatiche. La ripresa è ancora incompleta se si considera l'inflazione, e le prossime stagioni degli uragani e degli incendi boschivi possono presentare rischi potenziali.

Verisk y APCIA informan que la industria de seguros de EE. UU. está mostrando signos de recuperación en la primera mitad de 2024. Los aspectos más destacados incluyen:

- Ganancias estimadas de 95 mil millones de dólares, o 45 mil millones de dólares al ajustar por las ganancias de capital de un asegurador

- Los ingresos por suscripción mejoraron de una pérdida de 22.6 mil millones de dólares en 1H2023 a una ganancia de 4.7 mil millones de dólares en 1H2024

- Las primas escritas aumentaron a 463 mil millones de dólares, desde 420 mil millones de dólares en 1H2023

- El ratio combinado mejoró al 97.6% desde el 104.2% en 1H2023

- El excedente de los asegurados creció a 1,070 mil millones de dólares desde 1,014 mil millones de dólares a finales de 2023

A pesar de estas mejoras, la industria enfrenta desafíos continuos debido a la inflación, catástrofes naturales y riesgos emergentes como las amenazas cibernéticas. La recuperación sigue siendo incompleta al ajustarse por la inflación, y las próximas temporadas de huracanes e incendios forestales presentan riesgos potenciales.

Verisk와 APCIA는 미국 보험 업계가 2024년 상반기에 회복 조짐을 보이고 있다고 보고합니다. 주요 내용은 다음과 같습니다:

- 한 보험사의 자본 이익을 조정한 후 450억 달러 또는 950억 달러의 추정 이익

- 보험 인수 손익이 2023년 상반기 -226억 달러에서 2024년 상반기 +47억 달러로 개선됨

- 인수한 보험료가 2023년 상반기 4200억 달러에서 4630억 달러로 증가

- 결합 비율이 2023년 상반기 104.2%에서 97.6%로 개선됨

- 보험 가입자의 잉여금이 2023년 말 1014억 달러에서 1070억 달러로 증가함

이러한 개선에도 불구하고, 업계는 인플레이션, 자연 재해 및 사이버 위협과 같은 새로운 위험으로 인한 지속적인 도전에 직면해 있습니다. 인플레이션을 고려할 때 회복이 여전히 완전하지 않으며, 다가오는 허리케인과 산불 시즌은 잠재적인 위험을 안고 있습니다.

Verisk et APCIA rapportent que l'industrie des assurances aux États-Unis montre des signes de récupération au premier semestre 2024. Les points clés incluent:

- Gains estimés à 95 milliards de dollars, ou 45 milliards de dollars si l'on tient compte des gains en capital d'un assureur

- Les revenus d'assurance se sont améliorés, passant d'une perte de 22,6 milliards de dollars au premier semestre 2023 à un gain de 4,7 milliards de dollars au premier semestre 2024

- Les primes souscrites ont augmenté à 463 milliards de dollars, contre 420 milliards de dollars au premier semestre 2023

- Le ratio combiné s'est amélioré à 97,6% contre 104,2% au premier semestre 2023

- Le surplus des assurés a crû à 1 070 milliards de dollars, contre 1 014 milliards de dollars à la fin de 2023

Malgré ces améliorations, l'industrie fait face à des défis continus dus à l'inflation, aux catastrophes naturelles et aux risques émergents tels que les menaces cybernétiques. La récupération reste encore incomplète une fois ajustée pour l'inflation, et les saisons à venir des ouragans et des incendies de forêt présentent des risques potentiels.

Verisk und APCIA berichten, dass die US-Versicherungsbranche in der ersten Hälfte des Jahres 2024 Anzeichen einer Erholung zeigt. Wichtige Highlights umfassen:

- Geschätzte Gewinne von 95 Milliarden Dollar, oder 45 Milliarden Dollar, wenn man die Kapitalgewinne eines Versicherers berücksichtigt

- Die Underwriting-Einnahmen verbesserten sich von einem Verlust von 22,6 Milliarden Dollar in der ersten Hälfte von 2023 auf einen Gewinn von 4,7 Milliarden Dollar in der ersten Hälfte von 2024

- Die geschriebenen Prämien stiegen auf 463 Milliarden Dollar, im Vergleich zu 420 Milliarden Dollar in der ersten Hälfte von 2023

- Die kombinierte Schadenquote verbesserte sich auf 97,6% von 104,2% in der ersten Hälfte von 2023

- Das Eigenkapital der Versicherungsnehmer wuchs von 1.014 Milliarden Dollar Ende 2023 auf 1.070 Milliarden Dollar

Trotz dieser Verbesserungen sieht sich die Branche fortwährenden Herausforderungen durch Inflation, Naturkatastrophen und aufkommenden Risiken wie Cyberbedrohungen gegenüber. Die Erholung ist inflationsbereinigt weiterhin unvollständig, und die bevorstehenden Hurrikan- und Waldbrandsaisons stellen potenzielle Risiken dar.

- Underwriting income improved from a $22.6 billion loss in 1H2023 to a $4.7 billion gain in 1H2024

- Premiums written increased by 10.2% to $463 billion in 1H2024

- Combined ratio improved to 97.6% from 104.2% in 1H2023

- Policyholders' surplus grew to $1,070 billion from $1,014 billion at the end of 2023

- Rate of return on average policyholders' surplus increased to 9.1% from 3.6% at the end of 2023

- Current surplus has not recovered to early 2022 levels when adjusted for inflation

- Personal lines are still struggling to keep up with rising losses

- Upcoming hurricane season and remaining wildfire season pose potential risks to industry profitability

- Non-traditional catastrophe activity increased in 1H2024, characterized by numerous smaller convective storms

Insights

The U.S. insurance industry is showing signs of recovery, with a $95 billion gain in the first half of 2024. However, it's important to note that $50 billion came from one insurer's capital gains, leaving a more modest $45 billion industry-wide gain. The sector's underwriting performance has improved significantly, swinging from a

The insurance industry's recovery is a positive sign, but it's important to contextualize this within broader trends. The

While the insurance industry's financial recovery is promising, several risk factors warrant attention. The increasing frequency of non-traditional catastrophes, particularly convective storms, is altering the risk landscape. This shift from larger, individual catastrophic events to numerous smaller ones requires a fundamental reevaluation of risk models and pricing strategies. Additionally, emerging risks like cyber threats add another layer of complexity. The industry's surplus, though growing, may need to be substantially higher to adequately cover these evolving risks. Insurers must prioritize data analytics and predictive modeling to stay ahead of these challenges. The positive underwriting gains are encouraging, but sustained profitability will depend on the industry's ability to accurately assess and price these new risk patterns.

Verisk & APCIA report that capital gains helped fuel surplus recovery and offset industry losses, amidst inflation impacts and natural catastrophe events

JERSEY CITY, N.J., Aug. 28, 2024 (GLOBE NEWSWIRE) -- Verisk (Nasdaq: VRSK), a leading global data analytics and technology provider, and The American Property Casualty Insurance Association (APCIA), the primary national trade association for home, auto and business insurers, today reported that half-year 2024 gains for the insurance industry are estimated to be

“While there are some positive signals in the 1H2024 results, insurers are still recovering from significant underwriting losses in recent years,” said Robert Gordon, senior vice president of policy, research, and international at APCIA. “Insurers’ underwriting income swung from a

- Premiums written: Insurers wrote

$463 billion in premiums during the first half of this year, compared to$420 billion during the same period in 2023. Similarly, earned premiums grew 11 percent to$436 billion for the first half of 2024. - Underwriting gain: The estimated U.S. insurance industry net underwriting gain of

$3.7 billion is an improvement over the$23.4 billion loss reported at this point in 2023, and$5.6 billion loss in 2022. - Incurred losses and loss adjustment expenses increased by 2.2 percent, while earned premiums grew by 11 percent in the first half of 2024. The combined ratio, a crucial measure of profitability for insurers, was 97.6 percent during the first half of 2024 versus 104.2 percent for the same time period in 2023.

- Surplus: In the first half of 2024, the policyholders’ surplus increased slightly from

$1,014 billion at the end of 2023 to$1,070 billion ; however, insurers’ rate of return on average policyholders’ surplus, a crucial component of overall profitability, increased to 9.1 percent in the first half of 2024, up from 3.6 percent at the end of 2023.

“After years of consistent losses, premium growth is helping the overall industry move towards stabilization, with positive first-half underwriting gains for the first time since 2021,” said Saurabh Khemka, co-president of underwriting solutions at Verisk. “To maintain this momentum, it is critical we continue to address the evolving risks that challenge society today, especially the factors that continue to drive increased personal auto and homeowner rates.”

The first half of 2024 saw an increase in non-traditional catastrophe activity, characterized by numerous smaller convective storms.

Khemka added: “This trend, which began in 2023, contrasts from the larger, individual catastrophe events we have historically experienced later in the year. Looking ahead, insurers must prioritize actionable insights and analytics to understand and help fuel a healthy insurance industry, which is pivotal to protection of policyholders.”

The preliminary 1H2024 property/casualty insurance industry results shown in the table below represent consolidated estimates derived from annual statements submitted by insurers to insurance regulators. These results are based on approximately 91 percent of all business underwritten by private U.S. property/casualty insurers.

Note: The results above are based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers' compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers. The figures are consolidated estimates based on reports accounting for about 91 percent of all business written by U.S. property/casualty insurers. All figures are net of reinsurance unless otherwise noted and occasionally may not balance due to rounding.

###

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and technology partner to the global insurance industry. It empowers clients to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud and make informed decisions about global risks, including climate change, extreme events, sustainability and political issues. Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk helps build global resilience for individuals, communities and businesses. With teams across more than 20 countries, Verisk consistently earns certification by Great Place to Work and fosters an inclusive culture where all team members feel they belong. For more, visit Verisk.com and the Verisk Newsroom.

About APCIA

The American Property Casualty Insurance Association (APCIA) is the primary national trade association for home, auto, and business insurers. APCIA promotes and protects the viability of private competition for the benefit of consumers and insurers, with a legacy dating back 150 years. APCIA members represent all sizes, structures, and regions-protecting families, communities, and businesses in the U.S. and across the globe.