U.S. Insurance Industry Begins to See Surplus Recovery, Boosted by First Quarter Capital Gains and Signs of U.S. Property and Casualty Firms Inching Towards Stabilization

Rhea-AI Summary

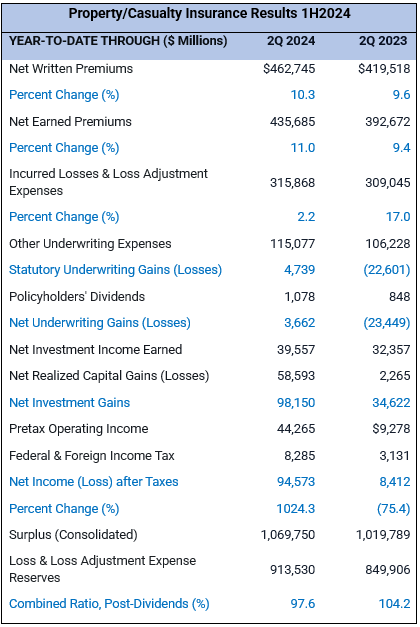

Verisk and APCIA report that the U.S. insurance industry is showing signs of recovery in the first half of 2024. Key highlights include:

1. Half-year 2024 gains estimated at $95 billion, with adjusted gains of $45 billion

2. Underwriting income improved from a $22.6 billion loss in 1H2023 to a $4.7 billion gain in 1H2024

3. Premiums written increased to $463 billion, up from $420 billion in 1H2023

4. Combined ratio improved to 97.6% from 104.2% in 1H2023

5. Policyholders' surplus increased to $1,070 billion from $1,014 billion at the end of 2023

However, challenges remain, including inflation impacts, natural catastrophes, and evolving risks like cyber threats. The industry's recovery is still ongoing, with surplus not yet reaching inflation-adjusted 2022 levels.

Positive

- Underwriting income improved from a $22.6 billion loss in 1H2023 to a $4.7 billion gain in 1H2024

- Premiums written increased by 10.2% to $463 billion in 1H2024

- Combined ratio improved to 97.6% from 104.2% in 1H2023

- Policyholders' surplus increased to $1,070 billion from $1,014 billion at the end of 2023

- Rate of return on average policyholders' surplus increased to 9.1% in 1H2024 from 3.6% at the end of 2023

Negative

- Current surplus has not recovered to inflation-adjusted levels seen in early 2022

- Personal lines are still struggling to keep up with rising losses

- Increased non-traditional catastrophe activity, characterized by numerous smaller convective storms

- Ongoing challenges from extreme weather patterns and new exposures like cyber risks

News Market Reaction – VRSK

On the day this news was published, VRSK gained 0.95%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Verisk & APCIA report that capital gains helped fuel surplus recovery and offset industry losses, amidst inflation impacts and natural catastrophe events

JERSEY CITY, N.J., Aug. 28, 2024 (GLOBE NEWSWIRE) -- Verisk (Nasdaq: VRSK), a leading global data analytics and technology provider, and The American Property Casualty Insurance Association (APCIA), the primary national trade association for home, auto and business insurers, today reported that half-year 2024 gains for the insurance industry are estimated to be

“While there are some positive signals in the 1H2024 results, insurers are still recovering from significant underwriting losses in recent years,” said Robert Gordon, senior vice president of policy, research, and international at APCIA. “Insurers’ underwriting income swung from a

- Premiums written: Insurers wrote

$463 billion in premiums during the first half of this year, compared to$420 billion during the same period in 2023. Similarly, earned premiums grew 11 percent to$436 billion for the first half of 2024. - Underwriting gain: The estimated U.S. insurance industry net underwriting gain of

$3.7 billion is an improvement over the$23.4 billion loss reported at this point in 2023, and$5.6 billion loss in 2022. - Incurred losses and loss adjustment expenses increased by 2.2 percent, while earned premiums grew by 11 percent in the first half of 2024. The combined ratio, a crucial measure of profitability for insurers, was 97.6 percent during the first half of 2024 versus 104.2 percent for the same time period in 2023.

- Surplus: In the first half of 2024, the policyholders’ surplus increased slightly from

$1,014 billion at the end of 2023 to$1,070 billion ; however, insurers’ rate of return on average policyholders’ surplus, a crucial component of overall profitability, increased to 9.1 percent in the first half of 2024, up from 3.6 percent at the end of 2023.

“After years of consistent losses, premium growth is helping the overall industry move towards stabilization, with positive first-half underwriting gains for the first time since 2021,” said Saurabh Khemka, co-president of underwriting solutions at Verisk. “To maintain this momentum, it is critical we continue to address the evolving risks that challenge society today, especially the factors that continue to drive increased personal auto and homeowner rates.”

The first half of 2024 saw an increase in non-traditional catastrophe activity, characterized by numerous smaller convective storms.

Khemka added: “This trend, which began in 2023, contrasts from the larger, individual catastrophe events we have historically experienced later in the year. Looking ahead, insurers must prioritize actionable insights and analytics to understand and help fuel a healthy insurance industry, which is pivotal to protection of policyholders.”

The preliminary 1H2024 property/casualty insurance industry results shown in the table below represent consolidated estimates derived from annual statements submitted by insurers to insurance regulators. These results are based on approximately 91 percent of all business underwritten by private U.S. property/casualty insurers.

Note: The results above are based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers' compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers. The figures are consolidated estimates based on reports accounting for about 91 percent of all business written by U.S. property/casualty insurers. All figures are net of reinsurance unless otherwise noted and occasionally may not balance due to rounding.

###

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and technology partner to the global insurance industry. It empowers clients to strengthen operating efficiency, improve underwriting and claims outcomes, combat fraud and make informed decisions about global risks, including climate change, extreme events, sustainability and political issues. Through advanced data analytics, software, scientific research and deep industry knowledge, Verisk helps build global resilience for individuals, communities and businesses. With teams across more than 20 countries, Verisk consistently earns certification by Great Place to Work and fosters an inclusive culture where all team members feel they belong. For more, visit Verisk.com and the Verisk Newsroom.

About APCIA

The American Property Casualty Insurance Association (APCIA) is the primary national trade association for home, auto, and business insurers. APCIA promotes and protects the viability of private competition for the benefit of consumers and insurers, with a legacy dating back 150 years. APCIA members represent all sizes, structures, and regions-protecting families, communities, and businesses in the U.S. and across the globe.