Vanda Pharmaceuticals Reports First Quarter 2022 Financial Results

Vanda Pharmaceuticals (Nasdaq: VNDA) reported a net loss of $6.4 million for Q1 2022, a significant shift from a net income of $8.7 million in Q1 2021. Total net product sales decreased by 4% to $60.2 million, with HETLIOZ® sales down 6% to $37.0 million. The company is optimistic about expanding access to HETLIOZ® for Medicaid patients and completing the Fanapt® bipolar study by year-end. Financial guidance for 2022 is set at $240 to $280 million in total revenues, with a year-end cash expectation exceeding $440 million.

- None.

- None.

Insights

Analyzing...

WASHINGTON , May 5, 2022 /PRNewswire/ -- Vanda Pharmaceuticals Inc. (Vanda) (Nasdaq: VNDA) today announced financial and operational results for the first quarter ended March 31, 2022.

"We are excited with our progress in improving patient access for HETLIOZ®, especially for Medicaid beneficiaries with Non-24 and SMS diagnoses," said Mihael H. Polymeropoulos, M.D., Vanda's President, CEO and Chairman of the Board. "Further, we now anticipate completing enrollment of the Fanapt® bipolar disorder study by the end of this year and look forward to expanding our psychiatry franchise. Today we are sharing details of our advanced analysis of data from the tradipitant clinical program in gastroparesis, which support the efficacy of tradipitant, and we look forward to discussing our planned New Drug Application with the FDA."

Financial Highlights

- Total net product sales from HETLIOZ® and Fanapt® were

$60.2 million in the first quarter of 2022, a4% decrease compared to$62.7 million in the first quarter of 2021. - HETLIOZ® net product sales were

$37.0 million in the first quarter of 2022, a6% decrease compared to$39.3 million in the first quarter of 2021, due in part to the continued reimbursement challenges for prescriptions for patients with Non-24. - Fanapt® net product sales were

$23.2 million in the first quarter of 2022, a1% decrease compared to$23.3 million in the first quarter of 2021. - Net loss was

$6.4 million in the first quarter of 2022 compared to net income of$8.7 million in the first quarter of 2021. - Cash, cash equivalents and marketable securities (Cash) was

$435.2 million as of March 31, 2022, representing an increase to Cash of$57.0 million compared to March 31, 2021 and an increase to Cash of$2.4 million compared to December 31, 2021.

Key Operational Highlights

HETLIOZ® (tasimelteon)

- Clinical trials for HETLIOZ® in delayed sleep phase disorder (DSPD) and symptoms of autism spectrum disorder (ASD) are currently enrolling patients.

- Since November 2021, more than 15 states have revised or agreed to revise their Medicaid prior authorization criteria to broaden access to HETLIOZ® for patients with Non-24 and nighttime sleep disturbances in Smith-Magenis Syndrome (SMS).

- In January 2022, Vanda settled its HETLIOZ® patent litigation against one of the defendants. The trial for the consolidated lawsuit against the remaining defendants was held in March 2022. A decision is expected from the court in the second half of 2022.

Tradipitant

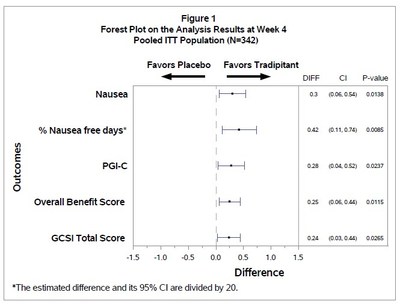

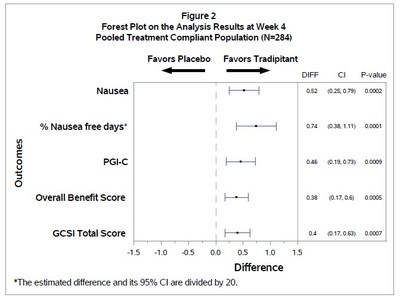

Tradipitant is a neurokinin-1 (NK-1) receptor antagonist in development for the treatment of idiopathic and diabetic gastroparesis. Earlier in the year, Vanda reported results of a clinical study and initial exploratory analysis. Vanda has now completed a pooled analysis of two clinical studies of tradipitant in gastroparesis consisting of 342 patients with relevant clinical endpoints. We believe these studies are adequate and well controlled and support substantial evidence of efficacy of tradipitant. Figure 1 and Table 1 show the results of such pooled analysis of all patients randomized in the two studies (intent to treat population, ITT) and Figure 2 and Table 2 show the results for the same parameters in the population of patients who were judged as compliant to treatment based on analysis of drug exposure (treatment compliant population).

Table 1: Week 4 Pooled Analysis: ITT Population for Study 1 and Study 2

Tradipitant n=175 | Placebo n=167 | P-value | |

DD-Nausea | -1.15 | -0.85 | 0.0138 |

% Nausea Free Days | 20.96 | 12.52 | 0.0085 |

PGI-C | 2.72 | 3.00 | 0.0237 |

Overall Benefit Score | 1.13 | 0.88 | 0.0115 |

GCSI | -0.99 | -0.76 | 0.0265 |

Table 2: Week 4 Pooled Analysis: Treatment Compliant Population for Study 1 and Study 2

Tradipitant n=117 | Placebo n=167 | P-value | |

DD-Nausea | -1.37 | -0.85 | 0.0002 |

% Nausea Free Days | 27.44 | 12.58 | 0.0001 |

PGI-C | 2.53 | 2.99 | 0.0009 |

Overall Benefit Score | 1.27 | 0.88 | 0.0005 |

GCSI | -1.15 | -0.75 | 0.0007 |

Consistently, both pooled analyses show tradipitant to be superior to placebo in key clinical parameters including improvement in DD-Nausea (primary endpoint parameter), percent Nausea Free Days, Patient Global Impression scale change (PGI-C), Overall Benefit Score and Gastroparesis Cardinal Symptom Index (GCSI) score.

- Vanda is continuing to conduct an open-label study of safety for tradipitant in gastroparesis and continues to receive requests from patients reaching out to gain access to tradipitant through the Expanded Access program which has multiple patients continuing to take tradipitant for more than a year.

- Vanda has scheduled a pre-NDA meeting with the U.S. Food and Drug Administration (FDA) to discuss the planned New Drug Application submission for tradipitant in the short-term treatment of nausea in gastroparesis.

- The Phase III study of tradipitant in the treatment of motion sickness has restarted enrollment and is already over

15% enrolled. A prior Phase II study of tradipitant in the treatment of motion sickness observed a significantly lower incidence of vomiting in tradipitant-treated patients as compared to placebo-treated patients.

Fanapt® (iloperidone)

- A Phase III study of Fanapt® in acute manic episodes in patients with bipolar disorder is over

75% enrolled and expected to complete enrollment by the end of 2022.

GAAP Financial Results

Net loss was

2022 Financial Guidance

Vanda expects to achieve the following financial objectives in 2022:

Full Year 2022 Financial Objectives |

Full Year 2022 Guidance

|

Total revenues

| |

HETLIOZ® net product sales

| |

Fanapt® net product sales

| |

Year-end 2022 Cash | Greater than |

Conference Call

Vanda has scheduled a conference call for today, Thursday, May 5, 2022, at 4:30 PM ET. During the call, Vanda's management will discuss the first quarter 2022 financial results and other corporate activities. Investors can call 1-866-688-9426 (domestic) or 1-409-216-0816 (international) and use passcode number 1355275. A replay of the call will be available on Thursday, May 5, 2022, beginning at 7:30 PM ET and will be accessible until Thursday, May 12, 2022 at 7:30 PM ET. The replay call-in number is 1-855-859-2056 for domestic callers and 1-404-537-3406 for international callers. The passcode number is 1355275.

The conference call will be broadcast simultaneously on Vanda's website, www.vandapharma.com. Investors should click on the Investors tab and are advised to go to the website at least 15 minutes early to register, download, and install any necessary software or presentations. The call will also be archived on Vanda's website for a period of 30 days.

About Vanda Pharmaceuticals Inc.

Vanda is a leading global biopharmaceutical company focused on the development and commercialization of innovative therapies to address high unmet medical needs and improve the lives of patients. For more on Vanda Pharmaceuticals Inc., please visit www.vandapharma.com and follow us on Twitter @vandapharma.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Various statements in this press release, including, but not limited to, the guidance provided under "2022 Financial Guidance" above and statements regarding Vanda's plans for continued pursuit of regulatory approval of tradipitant for the treatment of gastroparesis, the timing of the court's decision with respect to the Company's HETLIOZ® patent litigation and the clinical development timelines for Fanapt® are "forward-looking statements" under the securities laws. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are based upon current expectations and assumptions that involve risks, changes in circumstances and uncertainties. Important factors that could cause actual results to differ materially from those reflected in Vanda's forward-looking statements include, among others, Vanda's assumptions regarding the strength of its business in the U.S., the FDA's willingness to meet with Vanda to discuss the planned NDA submission for tradipitant and Vanda's ability to complete enrollment of the Phase III clinical study of Fanapt® in bipolar disorder. Therefore, no assurance can be given that the results or developments anticipated by Vanda will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Vanda. Forward-looking statements in this press release should be evaluated together with the various risks and uncertainties that affect Vanda's business and market, particularly those identified in the "Cautionary Note Regarding Forward-Looking Statements", "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Vanda's Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as updated by Vanda's subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov.

All written and verbal forward-looking statements attributable to Vanda or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Vanda cautions investors not to rely too heavily on the forward-looking statements Vanda makes or that are made on its behalf. The information in this press release is provided only as of the date of this press release, and Vanda undertakes no obligation, and specifically declines any obligation, to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

VANDA PHARMACEUTICALS INC. | |||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||

(in thousands, except for share and per share amounts) | |||

(unaudited) | |||

Three Months Ended | |||

March 31 | March 31 | ||

Revenues: | |||

HETLIOZ® net product sales | $ 37,031 | $ 39,343 | |

Fanapt® net product sales | 23,161 | 23,326 | |

Total revenues | 60,192 | 62,669 | |

Operating expenses: | |||

Cost of goods sold excluding amortization | 5,665 | 6,030 | |

Research and development | 20,969 | 16,131 | |

Selling, general and administrative | 40,848 | 29,797 | |

Intangible asset amortization | 379 | 370 | |

Total operating expenses | 67,861 | 52,328 | |

Income (loss) from operations | (7,669) | 10,341 | |

Other income | 105 | 87 | |

Income (loss) before income taxes | (7,564) | 10,428 | |

Provision (benefit) for income taxes | (1,134) | 1,778 | |

Net income (loss) | $ (6,430) | $ 8,650 | |

Net income (loss) per share, basic | $ (0.11) | $ 0.16 | |

Net income (loss) per share, diluted | $ (0.11) | $ 0.15 | |

Weighted average shares outstanding, basic | 56,105,239 | 55,145,789 | |

Weighted average shares outstanding, diluted | 56,105,239 | 56,505,087 | |

VANDA PHARMACEUTICALS INC. | |||

CONDENSED CONSOLIDATED BALANCE SHEETS | |||

(in thousands) | |||

(unaudited) | |||

March 31 | December 31 | ||

ASSETS | |||

Current assets: | |||

Cash and cash equivalents | $ 66,927 | $ 52,071 | |

Marketable securities | 368,249 | 380,742 | |

Accounts receivable, net | 30,497 | 32,467 | |

Inventory | 1,290 | 1,025 | |

Prepaid expenses and other current assets | 25,305 | 11,996 | |

Total current assets | 492,268 | 478,301 | |

Property and equipment, net | 2,917 | 3,113 | |

Operating lease right-of-use assets | 8,945 | 9,272 | |

Intangible assets, net | 19,702 | 20,081 | |

Deferred tax assets | 70,798 | 74,878 | |

Non-current inventory and other | 8,928 | 8,147 | |

Total assets | $ 603,558 | $ 593,792 | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |||

Current liabilities: | |||

Accounts payable and accrued liabilities | $ 51,394 | $ 34,438 | |

Product revenue allowances | 39,348 | 39,981 | |

Total current liabilities | 90,742 | 74,419 | |

Operating lease non-current liabilities | 9,660 | 10,055 | |

Other non-current liabilities | 1,033 | 4,390 | |

Total liabilities | 101,435 | 88,864 | |

Stockholders' equity: | |||

Common stock | 56 | 56 | |

Additional paid-in capital | 674,001 | 669,223 | |

Accumulated other comprehensive loss | (1,328) | (175) | |

Accumulated deficit | (170,606) | (164,176) | |

Total stockholders' equity | 502,123 | 504,928 | |

Total liabilities and stockholders' equity | $ 603,558 | $ 593,792 | |

Corporate Contact:

Kevin Moran

Senior Vice President, Chief Financial Officer and Treasurer

Vanda Pharmaceuticals Inc.

202-734-3400

pr@vandapharma.com

Elizabeth Van Every

Head of Corporate Affairs

Vanda Pharmaceuticals Inc.

202-734-3400

pr@vandapharma.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/vanda-pharmaceuticals-reports-first-quarter-2022-financial-results-301541281.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/vanda-pharmaceuticals-reports-first-quarter-2022-financial-results-301541281.html

SOURCE Vanda Pharmaceuticals Inc.