Velocity Enters into Option Agreement to Acquire 75% Interest in the Kalabak Gold - Copper Property in Bulgaria

Underexplored property proximal to Ada Tepe gold mine and Rozino gold deposit

Vancouver, British Columbia--(Newsfile Corp. - August 9, 2023) - Velocity Minerals Ltd. (TSXV: VLC) (OTCQB: VLCJF) ("Velocity" or the "Company") announces that it has entered into a letter agreement with Zelenrok EOOD, a wholly-owned subsidiary of Raiden Resources Limited (collectively with Zelenrok, "Raiden"), whereby Velocity has been granted an exclusive option to acquire a

Kalabak Property Highlights

- Under-explored property, located in a highly prospective gold mineral belt

- Potential for epithermal gold-silver and porphyry copper-gold deposits

- Historical drilling is limited and focused only on one prospect

Location and Regional Setting

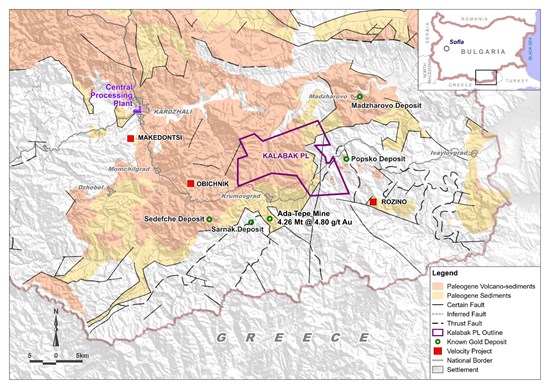

The Kalabak property is located approximately 10 kilometres north of Dundee Precious Metals Ada Tepe operating open pit mine (4.26 Mt at 4.8 g/t Au)1 and 6 kilometres northwest from Velocity's Rozino deposit (11.8 Mt at 1.22 g/t gold)2. The host stratigraphy at Ada Tepe and Rozino is preserved over a 10 kilometres strike length at Kalabak and represents a compelling regional target for sediment hosted epithermal gold-silver mineralization. Historical exploration completed by Raiden, including field mapping and sampling, confirmed the presence of a porphyry mineralizing environment. Additionally, three new structural zones with mineralization and vein textures are described which indicate an epithermal environment similar to that observed at Ada Tepe and Rozino.

The Kalabak prospecting license is located within a prolific epithermal and porphyry belt hosting gold and base metals (Figure 1 and 2), which transects southeastern Bulgaria, Northern Greece and western Turkey.

The property area covers Eocene to Oligocene gold-dominated magmatic mineralizing systems hosted within volcano-sedimentary pull-apart basins and underlying basement. The volcano-sedimentary package dips shallowly to the north-west and consists of clastic lacustrine sediments overlying the basement (similar to Ada Tepe and Rozino), volcanic rocks of andesitic composition, and limestones. Late andesite stocks intruded the volcano-sedimentary package at several locations and highlights the potential for a larger concealed feeder intrusive with copper-gold porphyry mineralization at depth.

Historically most of the exploration efforts, including 1,350m of historical drilling, were focused over the Sbor porphyry copper-moly-gold prospect. Exploration work throughout the remainder of the Property is limited to regional soil geochemistry, completed on very coarse grid.

Planned exploration includes geochemical screening planned to be completed in 2023, with drill testing of targets slated for 2024.

Figure 1. Map showing the location of the Property within the prospective Eocene gold - copper mineral belt transecting Bulgaria, Greece and Turkey and highlighting the location of operating mines, formerly operating mines, and mines under development. Readers are cautioned that aside from Rozino, Kalabak, Makedontsi, Obichnik, Iglika and Zlatusha, the mines and deposits labelled above are adjacent properties and that Velocity has no interest in or right to acquire any interest in the deposit, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not in any way indicative of mineral deposits on Velocity's properties or the potential production from, or cost or economics of, any future mining of any of Velocity's mineral properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4368/176566_584a364cd41afa6f_002full.jpg

1 Dundee Precious Metals NI 43-101 Technical Report from 2020 Proven and Probable Reserves of 4.26 Mt of 4.8 g/t Au (658,000 ounces Au) and 3.0 g/t Ag (414,000 ounces Ag).

2 Velocity Minerals NI 43-101 Technical Report from 2021 Probable Mineral Reserve at a 0.5 g/t gold cut-off grade of 11.8 Mt at 1.22 g/t gold for 464,000 ounces.

Figure 2. Map showing the Property location relative to the Rozino, Obichnik, and Makedontsi projects.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4368/176566_584a364cd41afa6f_003full.jpg

Commercial Terms

To exercise the Option in full and acquire a

Table 1. Requirements to Exercise Option.

| Date | Drilling (m) | Deliverable | Vesting |

| First Anniversary | - | -- | -- |

| Second Anniversary | 1,000 | -- | -- |

| Third Anniversary | 1,000 | - | |

| Fourth Anniversary | 2,000 | - | |

| Fifth Anniversary | 1,000 | Inferred Mineral Resource estimate | - |

| Option Total | 5,000 | -- |

Velocity will be under no obligation to fulfill any of the Option Earn-In Requirements, all of which will be at the sole discretion of Velocity. If Velocity exercises the Option, Velocity and Raiden will be deemed to have formed a Joint Venture with Velocity initially owning

The Property is subject to an existing

Pursuant to the terms of the Letter Agreement, the Velocity and Raiden will negotiate in good faith toward the execution and delivery of a definitive property option agreement (the "Definitive Agreement"), which will incorporate the terms and conditions of the Letter Agreement and such other terms and conditions as may be agreed to by the parties.

Advisory Services Agreement

Velocity also announces that it has received TSX Venture Exchange ("TSXV") acceptance for the previously announced advisory agreement (the "Advisory Agreement") with Leede Jones Gable Inc. (the "Advisor"), whereby the Advisor has agreed to assist in initiating a strategic review of the Company (see news release dated May 5, 2023). Pursuant to the terms of the Advisory Agreement, the Advisor will provide financial and general business advisory services to the Company over a 12-month period (unless terminated earlier in accordance with its terms).

In consideration of the Advisor providing advisory services to the Company, the Company (i) paid the Advisor a

Qualified Person

The technical content of this release has been approved for disclosure by Daniel Marinov, RPGeo, a Qualified Person as defined by NI 43-101 and the Company's Vice President Operations. Mr. Marinov is not independent of the Company as he is a director, officer, shareholder, and holds incentive stock options.

About Velocity Minerals Ltd.

Velocity is a precious metals and copper explorer focused in Eastern Europe. In Bulgaria, Velocity has a

On Behalf of the Board of Directors

"Keith Henderson"

President & CEO

For further information, please contact:

Keith Henderson

Phone: +1-604-484-1233

E-mail: info@velocityminerals.com

Web: www.velocityminerals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the exercise of the Option by Velocity, the entering into of the Definitive Agreement, the formation of the Joint Venture, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "will", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that it will obtain TSX Venture Exchange acceptance, if applicable, that market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Property in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Property, and the Company's ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Property, the fact that the Company's interest in the Property is an option only and there is no guarantee that such interest, if earned, will be certain, estimation or realization of mineral reserves and mineral resources, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSX Venture Exchange acceptance, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on the Company's business, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's latest Management Discussion and Analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

- 30 -

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/176566