Vivakor Strengthens Permian Presence with 10 Pipeline Stations, Fueling Revenue and Margin Expansion

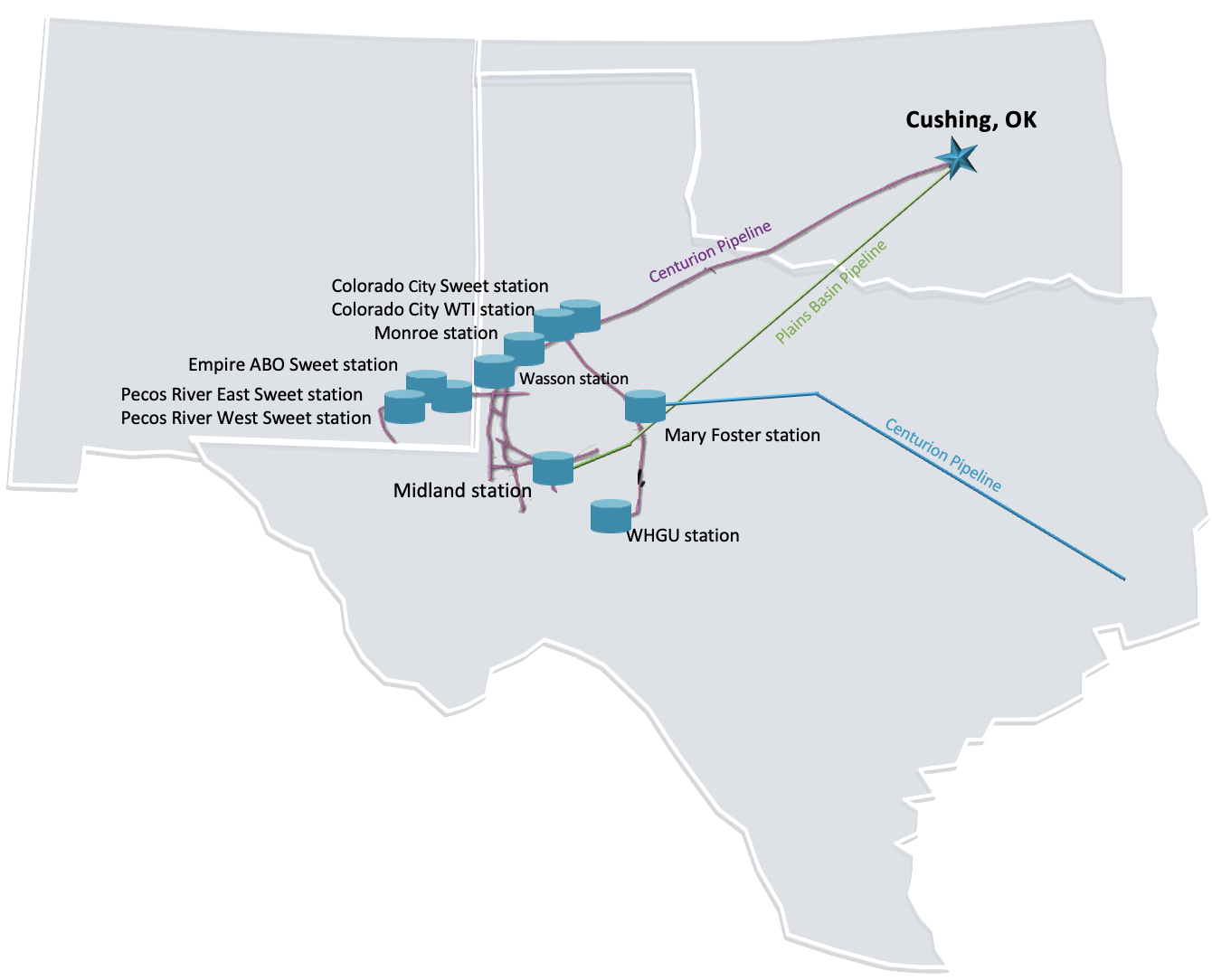

- Strategic ownership of 10 pipeline injection stations in the core Permian Basin

- Direct connection to major interstate crude oil pipelines (Centurion, Plains Basin, West Texas System)

- Operations in Permian Basin which contributes over 40% of U.S. oil production

- Capital-efficient business model generating returns through market access services

- None.

Insights

Vivakor leverages strategic Permian Basin pipeline network for revenue growth and operating leverage as regional production volumes continue scaling.

Vivakor's network of 10 pipeline injection stations across the Permian Basin represents a strategic infrastructure foothold in America's most productive oil region. These facilities serve as critical aggregation points where truck-delivered crude from production wells is injected into major interstate pipeline networks operated by Centurion, Plains All American, and Enterprise Products Partners.

The company's midstream positioning is particularly valuable as the Permian accounts for over

The value proposition hinges on Vivakor's ability to provide essential market access to upstream producers while capturing fees for transportation, storage, and potentially blending services. As production volumes increase in the Permian, Vivakor's fixed-cost infrastructure should deliver operating leverage, allowing revenue to grow faster than expenses.

The company's vertical integration strategy in the Permian indicates they're focused on capturing multiple value streams across the energy logistics chain. By controlling critical injection points that connect to major interstate pipelines (Centurion, Plains, and Enterprise), Vivakor has positioned itself at strategic bottlenecks in the region's oil transportation network, potentially enabling premium pricing for their services.

Dallas, TX, June 03, 2025 (GLOBE NEWSWIRE) -- Vivakor, Inc. (Nasdaq: VIVK) (“Vivakor” or the “Company”) is an integrated provider of energy transportation, storage, reuse, and remediation services. Vivakor’s growth strategy is anchored in the Permian and Eagle Ford Basins where the Company is positioned to opportunistically expand its integrated crude oil storage, logistics, and marketing value chains.

Vivakor owns and operates 10 strategically located pipeline injection stations in the core Permian Basin in Texas and New Mexico. These facilities receive and aggregate crude oil transported by truck from production wells, throughputting volumes into interstate crude oil pipelines that include Centurion (Lotus), Plains Basin Pipeline (PAA), and the West Texas System (EPD).

Vivakor’s Footprint in the Permian

“Our facilities position Vivakor as a critical logistics hub in the Permian,” said James Ballengee, Chairman, President, and CEO. “These assets enable us to support increasing volumes from upstream operators, enhance crude blending and compression efficiency, and ultimately drive revenue growth and operating leverage as activity scales.”

Mr. Ballengee continued, “The Permian continues to be biggest contributor to U.S. production of crude oil and NGLs, supporting international and domestic energy demand. Consistent drilling, quantities produced, and barrels brought to key markets bolster our revenues and business model. Our Permian facilities provide Vivakor with a capital-efficient means of giving producers needed market access while generating a rewarding return on capital for the Company.”

Vivakor’s infrastructure directly supports its broader strategy to deliver vertically integrated services in one of the world’s most productive oil regions. With the Permian accounting for more than

About Vivakor, Inc.

Vivakor, Inc. is an integrated provider of sustainable energy transportation, storage, reuse, and remediation services, operating one of the largest fleets of oilfield trucking services in the continental United States. Its corporate mission is to develop, acquire, accumulate, and operate assets, properties, and technologies in the energy sector. Vivakor’s integrated facilities assets provide crude oil and produced water gathering, storage, transportation, reuse, and remediation services under long-term contracts.

Once operational, Vivakor's oilfield waste remediation facilities will facilitate the recovery, reuse, and disposal of petroleum byproducts and oilfield waste products.

For more information, please visit our website: http://vivakor.com

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements. Forward-looking statements may be identified but not limited by the use of the words "anticipates," "expects," "intends," "plans," "should," "could," "would," "may," "will," "believes," "estimates," "potential," or "continue" and variations or similar expressions. Our actual results may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, including, but not limited to, pending or expected transaction and ownership structures, the valuation of such transactions, the likelihood and ability of the Company to successfully and timely consummate planned acquisitions, the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect Vivakor or the expected benefits of transactions, our ability to maintain the listing of our securities on The Nasdaq Capital Market, disruption and volatility in the global currency, capital, and credit markets, changes in federal, local and foreign governmental regulation, changes in tax laws and liabilities, tariffs, legal, regulatory, political and economic risks, our ability to successfully develop products, rapid change in our markets, changes in demand for our future products, and general economic conditions.

These risks and uncertainties include, but are not limited to, risks and uncertainties discussed in Vivakor's filings with the U.S. Securities and Exchange Commission, which factors may be incorporated herein by reference. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information about Vivakor or the date of such information in the case of information from persons other than Vivakor, and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication. Forecasts and estimates regarding Vivakor's industries and markets are based on sources we believe to be reliable; however, there can be no assurance these forecasts and estimates will prove accurate in whole or in part.

Investor Contact:

Phone: (949) 281-2606

info@vivakor.com

Attachment