Vista Gold Phase 2 Drilling Continues to Intercept High Grade Gold Mineralized Intervals in the South Cross Lode at Mt Todd

Vista Gold Corp. (VGZ) announced additional results from Phase 2 of its 2024 drilling program at the Mt Todd gold project in Northern Territory, Australia. The drilling program in the South Cross Lode zone revealed significant high-grade gold intercepts, with grades up to 6.82 g Au/t near surface. Notable results include multiple mineralized intervals, with VB24-025 returning 20.8 meters at 1.96 g Au/t. The company plans to update the Mt Todd mineral resource estimate and anticipates a feasibility study targeting daily throughput of 12,000-17,000 tonnes, aiming for 150,000-200,000 ounces of annual gold production with initial capex below $400 million.

Vista Gold Corp. (VGZ) ha annunciato ulteriori risultati della Fase 2 del suo programma di perforazione 2024 presso il progetto d'oro Mt Todd nel Territorio del Nord, Australia. Il programma di perforazione nella zona South Cross Lode ha rivelato importanti intercettazioni di oro ad alta legge, con leghe fino a 6,82 g Au/t vicino alla superficie. I risultati notevoli includono molteplici intervalli mineralizzati, con il VB24-025 che ha restituito 20,8 metri a 1,96 g Au/t. L'azienda prevede di aggiornare la stima delle risorse minerali di Mt Todd e si aspetta uno studio di fattibilità mirato a una capacità giornaliera di 12.000-17.000 tonnellate, puntando a una produzione annuale di oro compresa tra 150.000 e 200.000 once, con un capex iniziale sotto i 400 milioni di dollari.

Vista Gold Corp. (VGZ) anunció resultados adicionales de la Fase 2 de su programa de perforación 2024 en el proyecto de oro Mt Todd en el Territorio del Norte, Australia. El programa de perforación en la zona South Cross Lode reveló interceptaciones significativas de oro de alta ley, con leyes de hasta 6.82 g Au/t cerca de la superficie. Resultados notables incluyen múltiples intervalos mineralizados, con el VB24-025 reportando 20.8 metros a 1.96 g Au/t. La compañía planea actualizar la estimación de recursos minerales de Mt Todd y anticipa un estudio de viabilidad que apunte a un rendimiento diario de 12,000-17,000 toneladas, con un objetivo de producción anual de 150,000-200,000 onzas de oro y un capex inicial por debajo de $400 millones.

비스타 골드 코퍼레이션(VGZ)은 호주 노던 테리토리의 Mt Todd 금 프로젝트에서 2024년 시추 프로그램 2단계의 추가 결과를 발표했습니다. South Cross Lode 지역의 시추 프로그램은 표면 근처에서 6.82g Au/t까지의 고품위 금 이행을 밝혀냈습니다. 주목할 만한 결과로는 VB24-025가 1.96g Au/t에서 20.8미터를 반환하는 등 여러 개의 광화 간격이 포함됩니다. 이 회사는 Mt Todd의 광물 자원 추정치를 업데이트할 계획이며, 하루 처리량을 12,000-17,000톤으로 목표로 하는 타당성 연구를 예상하고 있으며, 연간 금 생산 목표는 150,000-200,000 온스이고, 초기 자본 지출은 4억 달러 이하로 설정하고 있습니다.

Vista Gold Corp. (VGZ) a annoncé des résultats supplémentaires de la Phase 2 de son programme de forage 2024 au projet d'or Mt Todd dans le Territoire du Nord, en Australie. Le programme de forage dans la zone South Cross Lode a révélé des interceptions significatives d'or de haute teneur, avec des teneurs allant jusqu'à 6,82 g Au/t près de la surface. Les résultats notables incluent plusieurs intervalles minéralisés, le VB24-025 ayant retourné 20,8 mètres à 1,96 g Au/t. L'entreprise prévoit de mettre à jour l'estimation des ressources minérales de Mt Todd et anticipe une étude de faisabilité visant une capacité de traitement quotidienne de 12 000 à 17 000 tonnes, visant une production annuelle d'or de 150 000 à 200 000 onces avec un capex initial inférieur à 400 millions de dollars.

Vista Gold Corp. (VGZ) hat weitere Ergebnisse der Phase 2 ihres Bohrprogramms 2024 im Goldprojekt Mt Todd im Northern Territory, Australien, bekannt gegeben. Das Bohrprogramm in der South Cross Lode-Zone zeigte signifikante Goldinterzeptionen mit hohen Gehalten von bis zu 6,82 g Au/t in der Nähe der Oberfläche. Erwähnenswerte Ergebnisse umfassen mehrere mineralisierte Intervalle, wobei VB24-025 20,8 Meter mit 1,96 g Au/t lieferte. Das Unternehmen plant, die Schätzung der mineralischen Ressourcen von Mt Todd zu aktualisieren und erwartet eine Machbarkeitsstudie, die auf eine tägliche Verarbeitung von 12.000-17.000 Tonnen abzielt und eine jährliche Goldproduktion von 150.000-200.000 Unzen bei einer anfänglichen Investition von unter 400 Millionen US-Dollar anstrebt.

- High-grade gold intercepts discovered with grades up to 6.82 g Au/t

- Multiple mineralized intervals found near surface

- Potential expansion identified in northeast portion of current resource shell

- Planned production target of 150,000-200,000 ounces annually

- Initial capex projected under $400 million

- None.

Insights

The latest drilling results from Vista Gold's Mt Todd project reveal significant high-grade gold mineralization in the South Cross Lode zone, with notable intercepts up to 9.19 g Au/t. The shallow mineralization and multiple high-grade zones near surface are particularly promising, suggesting potential resource expansion. The company's planned feasibility study targeting 150,000-200,000 ounces of annual gold production with a relatively modest capex of

The drill results demonstrate consistent mineralization patterns with multiple high-grade intercepts, particularly impressive given the true thickness measurements ranging from 0.5 to 11.9 meters. The quality control measures, including the systematic insertion of blanks and standards at 1:10 ratio, validate the reliability of these results. The planned update to mineral resource estimates, combined with the focus on a more modest scale operation of 12,000-17,000 tonnes per day, suggests a strategic shift toward a more economically viable development approach. This could potentially lead to improved project economics through lower capital requirements while maintaining attractive grades around 1 gram per tonne in reserves.

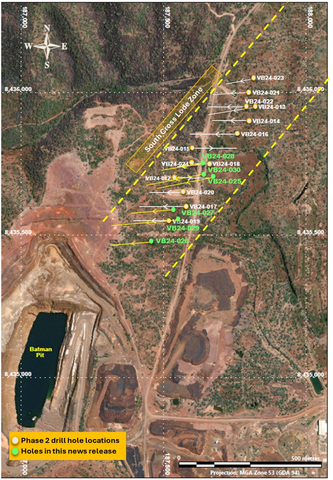

Figure 1: Plan view of the Mt Todd terrain showing Phase 2 drill hole locations with respective orientation to date, including the six holes announced in this release. (Graphic: Business Wire)

Drilling Highlights

VB24-025 – Returned multiple mineralized intervals, including

- 8.0 meters at 1.20 grams of gold per tonne (“g Au/t) from 22.5 meters downhole

-

20.8 meters at 1.96 g Au/t from 142.5 meters downhole, including

- 1.0 meter at 9.19 g Au/t from 155.0 meters downhole

VB24-027 – Returned multiple mineralized intervals near surface

- 15.0 meters at 0.77 g Au/t from 37.0 meters downhole

- 2.3 meters at 2.09 g Au/t from 59.7 meters downhole

- 23.0 meters at 0.93 g Au/t from 68.0 meters downhole

VB24-028 – Returned multiple mineralized intervals near surface

- 12.0 meters at 0.96 g Au/t from 25.0 meters downhole

-

4.0 meters at 2.49 g Au/t from 71.2 meters downhole, including

- 1.2 meters at 6.82 g Au/t from 74.0 meters downhole

Phase 2 drilling is focused on the shallow portion of the SXL. The six holes reported in this release have intercepts with gold grades up to 6.82 g Au/t near surface. Results to date indicate potential for expansion in the northeast portion of the current resource shell, including an area previously classified as waste. Additionally, drilling continued to intersect mineralization at depth with intercepts ranging from 3.06 to 9.19 g Au/t and confirm the presence of several high-grade sub-structures within the SXL.

Frederick H. Earnest, President and CEO, commented, “Results from the ongoing drilling program continue to indicate that the SXL is a narrower mineralized structure with well-defined packages of high-grade quartz-sulfide veins. Today’s results continue to demonstrate encouraging mineralized intervals near surface and at depth. We are currently working to better understand the geometry of the mineralization in the SXL as we assess a possible extension of the resource shell. Phase 2 of the drilling program is expected to be completed by the end of this year.

“At the conclusion of the 2024 drilling program, we plan to update the Mt Todd mineral resource estimate and anticipate moving forward with a feasibility study targeting daily throughput in the range of 12,000 – 17,000 tonnes per day (4-6 million tonnes per annum), 150,000 to 200,000 ounces of annual gold production with an initial capex of less than

Figure 1 illustrates the Phase 2 drill hole locations and orientations to date. Figure 2 shows the locations of the drill holes relative to the 2024 Feasibility Study (as defined below) resource shell and the current pit design. Figure 3 is a photo of core from hole VB24-025 displaying an example of the high-grade mineralization encountered in the recent drill holes. Table 1 summarizes assay results and highlights multiple vein intercepts with grades above 5.0 g Au/t for the six holes announced in this press release.

Table 1. Summary of Phase 2 Drill Holes VB24-025 through VB24-030 – highlighting intercepts greater than 5.0 g Au/t.

Hole No. |

Grid Coordinates |

Survey Data |

Intersections |

||||||||||

MGA94 Grid Easting |

MGA94 Grid Northing |

RL (m) |

Azimuth (°) |

Dip (°) |

Depth (m) |

|

From (m) |

To (m) |

Interval (m) |

True Thickness (m) |

Grade (g Au/t ) |

Sample Type |

|

VB24-025 |

187622 |

8435694 |

137 |

268.8 |

-60.4 |

167.4 |

|

22.5 |

30.5 |

8.0 |

3.9 |

1.20 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

27.9 |

30.5 |

2.7 |

1.3 |

3.22 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

46.0 |

52.0 |

6.0 |

3.0 |

0.50 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

60.0 |

63.8 |

3.8 |

1.9 |

0.50 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

70.0 |

91.0 |

21.0 |

10.4 |

0.60 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

70.0 |

71.0 |

1.0 |

0.5 |

5.57 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

96.0 |

106.0 |

10.0 |

5.0 |

0.61 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

119.0 |

122.4 |

3.4 |

1.7 |

0.57 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

142.5 |

163.3 |

20.8 |

10.9 |

1.96 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

147.0 |

150.9 |

3.9 |

2.0 |

3.06 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

155.0 |

156.0 |

1.0 |

0.5 |

9.19 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

160.0 |

163.3 |

3.3 |

1.7 |

4.93 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VB24-026 |

187415 |

8435502 |

150 |

271.2 |

-60.1 |

119.5 |

|

41.2 |

43.6 |

2.4 |

1.2 |

0.93 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VB24-027 |

187545 |

8435600 |

138 |

268.5 |

-60.3 |

121.1 |

|

11.3 |

14.0 |

2.8 |

1.4 |

0.66 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

37.0 |

52.0 |

15.0 |

7.5 |

0.77 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

59.7 |

62.0 |

2.3 |

1.2 |

2.09 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

68.0 |

91.0 |

23.0 |

11.9 |

0.93 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

72.2 |

76.0 |

3.8 |

2.0 |

2.84 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

102.0 |

107.0 |

5.0 |

2.7 |

0.82 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VB24-028 |

187628 |

8435747 |

138 |

270.3 |

-60.0 |

125.5 |

|

25.0 |

37.0 |

12.0 |

6.5 |

0.96 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

31.0 |

32.2 |

1.2 |

0.6 |

3.66 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

71.2 |

75.2 |

4.0 |

2.0 |

2.49 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

74.0 |

75.2 |

1.2 |

0.6 |

6.82 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

84.0 |

91.0 |

7.0 |

3.4 |

0.99 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

84.0 |

85.0 |

1.0 |

0.5 |

3.24 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

120.4 |

124.4 |

4.1 |

2.0 |

2.48 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

123.5 |

124.4 |

1.0 |

0.5 |

4.14 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VB24-029 |

187545 |

8435554 |

138 |

264.3 |

-60.8 |

212.4 |

|

18.2 |

20.0 |

1.9 |

0.9 |

0.96 |

HQ ½ Core |

|

|

|

|

|

|

and |

62.0 |

66.0 |

4.0 |

2.0 |

0.45 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VB24-030 |

187594 |

8435701 |

137 |

270.4 |

-60.1 |

203.1 |

|

92.2 |

97.0 |

4.8 |

2.4 |

1.11 |

HQ ½ Core |

|

|

|

|

|

|

|

including |

92.2 |

93.0 |

0.8 |

0.4 |

4.07 |

HQ ½ Core |

|

|

|

|

|

|

|

and |

142.0 |

146.2 |

4.2 |

2.1 |

0.64 |

HQ ½ Core |

Notes: |

||

(i) |

|

Results are based on ore grade 50g fire assay for Au. |

(ii) |

|

Intersections are from diamond core drilling with half-core samples. |

(iii) |

|

Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters. |

(iv) |

|

Mean grades have been calculated on a 0.4g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters. |

(v) |

|

All mineralized interval lengths reported are downhole intervals. |

(vi) |

|

True Thicknesses are estimated based on the orientation of veining as measured relative to the core axis. |

(vii) |

|

All downhole deviations have been verified by downhole camera and or downhole gyro. |

(viii) |

|

Collar coordinates are given as Map Grid Australia MGA94 using a multi-band GNSS Garmin GPS 750i. |

(ix) |

|

The Company maintains a Quality Assurance and Quality Control procedures (QA/QC) program in accordance with the requirements and guidelines of CIM Standards of Disclosure for Mineral Projects. |

(x) |

|

The independent laboratory responsible for the assays was North Australian Laboratories Pty Ltd, Pine Creek, NT. |

QA/QC Protocols and Sampling Procedure

All sampling was conducted under the supervision of the Company's geologists and the chain of custody from Mt Todd facilities to the independent sample preparation facility at North Australian Laboratories Pty Ltd. (“NAL”) in Pine Creek, NT was continuously monitored.

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves using diamond saws. One-half is placed into pre-numbered sample bags as per industry standards with sample lengths between a minimum of 0.2 meters to a maximum of 1.2 meters. The other half of the core is retained for future reference by the Company. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork.

- Following common industry practices, blanks and standards are also placed in plastic bags for inclusion in the shipment. A reference blank or a standard is inserted at a minimum ratio of 1 in 10 and additional blank samples are added at suspected high-grade intervals. Standard reference material is sourced from Ore Research & Exploration Pty Ltd and provided in 60-gram sealed packets. When a sequence of four samples is completed, they are placed in a shipping bag and tied closed. All of these samples are kept in a secure area on-site until crated for shipping.

- Vista employees ship and transport the samples to the NAL. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish.

- For the purposes of this release, mineralized intervals are defined as runs of mineralization with a maximum internal waste of 4.0 meters.

- NAL is independent of Vista.

It is the opinion of the QP (as defined below) that the sample preparation methods and quality control measures employed before the dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person (“QP”) as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided to inform the reader of the advancement of the 2024 drilling program for the Mt Todd project.

For more information on the Company’s March 2024 feasibility study (the “2024 Feasibility Study”), including with respect to mineral resource and mineral reserve estimates, please refer to the technical report summary entitled “S-K 1300 Technical Report Summary – Mt Todd Gold Project – 50,000 tpd Feasibility Study –

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a shovel-ready development-stage gold deposit located in the Tier-1 mining jurisdiction of

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the

View source version on businesswire.com: https://www.businesswire.com/news/home/20241030238882/en/

Pamela Solly

Vice President of Investor Relations

(720) 981-1185

Source: Vista Gold Corp.