Vista Gold Announces Feasibility Study Delivering 7 Million Ounce Gold Reserve Underpinning Large-Scale Production at High Operating Margins over a 16-Year Mine Life

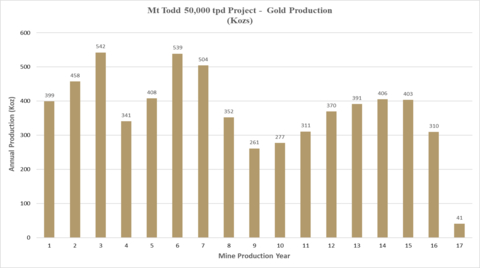

Mt Todd Gold Production (Graphic: Business Wire)

Highlights of the FS for a 50,000 tonne per day (“tpd”) project include:

-

After-tax NPV

5% of$999.5 million 20.6% at a$1,600 $0.71 -

After-tax NPV

5% of$1.5 billion 26.7% at a$1,800 $0.71 -

After-tax cash flow at a

$1,800 $2.1 billion -

19% increase in proven and probable mineral reserves, now estimated to be 6.98 million ounces of gold (280.4 million tonnes at 0.77 grams of gold per tonne (“g Au/t”)) at a cut-off grade of 0.35 g Au/t; life of mine grade to the grinding circuit after ore sorting of 0.84 grams of gold per tonne; - Average annual life of mine production of 395,000 ounces, including average annual production of 479,000 ounces of gold during the first seven years of commercial operations;

-

Life of mine average gold recovery of

91.6% ; -

Average cash costs of

$817 $752 -

Average all-in sustaining cost (“AISC”) of

$928 $860 - Mine life of 16 years (increase of 3 years); and

-

Initial capital requirements of

$892 million 8% increase), which reflects the use of a third-party owner/operator of the power plant.

(1) |

All dollar amounts stated herein are in |

(2) |

Cash costs per ounce and AISC per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to |

Vista’s President and CEO,

With Q4 2021 costs, the FS reflects the inflationary pressures being faced currently by all operators in the mining industry. While we believe this inflationary trend is transitory, the resilience of Mt Todd is amply demonstrated by the robust project economics reflected in the FS. Mt Todd’s attributes, together with the deep understanding of the various Project components create valuable optionality in the approach to its development.

Mt Todd’s economic returns benefit from the increase in the gold reserve estimate, favorable results of the power plant trade-off study and slightly lower energy costs in the NT. In view of the current gold price, we increased the gold price used in the reserve estimate from

In addition to securing the approval of the Mining Management Plan since our last technical report, we have modernized our agreement with the

Overview

The technical aspects of the FS are underpinned by extensive metallurgical testing and stringent design criteria that continue to reflect Vista’s rigorous approach to ensuring Mt Todd will meet design and operating specifications. This includes utilizing modern, proven technologies and oversizing processing equipment to best ensure throughput capacity. The FS also incorporates provisions of the recently approved Mt Todd Mine Management Plan, which will subsequently be amended to align with design changes in the FS.

A summary of the FS results is presented in the table below.

| 50,000 tpd Project (1) | Years 1-7 (2) |

Life of Mine (3) |

(16 years) |

||

| Average |

1.01 |

0.84 |

| Average Annual Gold Production (koz) | 479 |

395 |

| Average Recovery (%) |

|

|

| Total Payable Gold (koz) | 3,353 |

6,313 |

| Cash Costs ($/oz) (5) |

|

|

| AISC ($/oz) (5) |

|

|

| Strip Ratio (waste:ore) | 2.77 |

2.51 |

|

|

|

| After-tax Payback (months) |

|

47 |

| After-tax NPV |

|

|

| IRR (after-tax) |

|

|

(1) |

Economics presented using |

(2) |

Years 1 - 7 start after the 6 month commissioning and ramp up period. |

(3) |

Life of Mine is from start of commissioning and ramp up through final closure. |

(4) |

Post-sorted grinding circuit feed grade (g Au/t). |

(5) |

Cash costs per ounce and AISC per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to |

Sensitivity Analysis

The following table provides additional details of the Project’s after-tax economics at variable gold prices and exchange rate assumptions. The Project economics are robust at the FS gold price of

Gold Price |

|

|

|

|

|

|

|

|||||||

FX Rate |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

NPV(5) |

IRR (%) |

0.74 |

|

8.6 |

|

12.4 |

|

15.7 |

|

19.0 |

|

22.1 |

|

25.0 |

|

27.7 |

0.71 |

|

10.2 |

|

14.0 |

|

17.3 |

|

20.6 |

|

23.7 |

|

26.7 |

|

29.4 |

0.68 |

|

11.9 |

|

15.6 |

|

19.0 |

|

22.3 |

|

25.7 |

|

28.5 |

|

31.3 |

Note: NPV

Capital Costs

Management placed a high priority on controlling capital costs while maintaining the operating cost benefits of a large-scale project. Initial capital costs increased

Capital expenditures for initial and sustaining capital requirements are summarized in the following table.

Capital Expenditures 50,000 tpd Project |

($ millions) |

Sustaining Capital ($ millions) |

||||

| Mining | $ |

81 |

$ |

531 |

||

| Process Plant | $ |

474 |

$ |

28 |

|

|

| Project Services | $ |

56 |

$ |

89 |

|

|

| Project Infrastructure | $ |

45 |

$ |

8 |

|

|

| Site Establishment & Early Works | $ |

24 |

$ |

0 |

|

|

| Management, Engineering, EPCM Services | $ |

100 |

$ |

0 |

|

|

| Preproduction Costs | $ |

27 |

$ |

0 |

|

|

| Contingency | $ |

86 |

$ |

44 |

|

|

| Sub-Total | $ |

892 |

$ |

700 |

|

|

| Asset Sale and Salvage | $ |

0 |

$ |

(37 |

) |

|

| Total Capital | $ |

892 |

$ |

663 |

|

|

| Total Capital Per Payable ounce gold | $ |

141 |

$ |

105 |

|

|

Note: Components may not add to totals due to rounding.

Operating Costs

Operating costs continue to benefit from the economies of scale associated with a 50,000 tonne per day process plant, a low 2.5:1 stripping ratio (unchanged from the last technical report), and a locally-based labor force. Operating costs were impacted by the additional royalty granted to the Jawoyn in exchange for their prior right to a

| 50,000 tpd Project | Years 1-7 | Years 8-14 | Life of |

|||

| Operating Cost | Per tonne processed | Per ounce | Per tonne processed | Per ounce | Per tonne processed | Per ounce |

| Mining |

|

|

|

|

|

|

| Processing |

|

|

|

|

|

|

| Site General and Administrative |

|

|

|

|

|

|

| Water Treatment |

|

|

|

|

|

|

| Tailings Management |

|

|

|

|

|

|

| Refining |

|

|

|

|

|

|

| Jawoyn Royalty |

|

|

|

|

|

|

| Total Cash Costs (1) |

|

|

|

|

|

|

Note: Jawoyn royalty and refinery costs calculated at

(1) |

Cash costs per tonne processed and cash costs per ounce are non-GAAP financial measures. See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation to |

Mining and Production

The mine plan contemplates that 280.4 million tonnes of ore, containing an estimated 6.98 million ounces of gold at an average grade of 0.77 g Au/t, will be processed over the life of the Project. Total recovered gold is expected to be 6.31 million ounces with average annual gold production expected to be 395,000 ounces. Average annual production over the first seven years of commercial operations is expected to be 479,000 ounces. The Company expects commercial production to commence after two years of construction and six months of commissioning and ramp-up.

The table below highlights the FS production schedule. The shaded portion of the table demonstrates the benefit of sorting that reduces the tonnage processed by

Years |

Mined (kt) |

Waste Mined (kt) |

Ore Crushed (kt) |

Crushed Grade (g/t) |

Contained Ounces (kozs) |

Ore to CIP (Post Sorting) (kt) |

CIP Grade (g/t) |

Contained Ounces (kozs) |

Gold Produced (kozs) |

Recovery (%) |

-1 |

7,188 |

14,066 |

0 |

0 |

0 |

0 |

0.00 |

0 |

0 |

0 |

1(*) |

18,216 |

25,904 |

12,334 |

1.10 |

436 |

11,100 |

1.21 |

431 |

399 |

|

2 |

30,578 |

38,623 |

17,750 |

0.88 |

503 |

15,975 |

0.97 |

497 |

458 |

|

3 |

19,696 |

63,199 |

17,750 |

1.04 |

594 |

15,975 |

1.14 |

587 |

542 |

|

4 |

15,218 |

69,774 |

17,799 |

0.66 |

378 |

16,019 |

0.73 |

373 |

341 |

|

5 |

27,591 |

66,264 |

17,750 |

0.79 |

451 |

15,975 |

0.87 |

445 |

408 |

|

6 |

25,499 |

74,510 |

17,823 |

1.03 |

591 |

16,041 |

1.13 |

583 |

539 |

|

7 |

13,229 |

77,291 |

17,750 |

0.97 |

554 |

15,975 |

1.06 |

546 |

504 |

|

8 |

7,779 |

71,277 |

17,774 |

0.69 |

392 |

15,997 |

0.75 |

386 |

352 |

|

9 |

13,866 |

59,499 |

17,774 |

0.52 |

295 |

15,997 |

0.57 |

291 |

261 |

|

10 |

14,523 |

50,082 |

17,750 |

0.55 |

312 |

15,975 |

0.60 |

308 |

277 |

|

11 |

20,830 |

40,490 |

17,750 |

0.61 |

347 |

15,975 |

0.67 |

343 |

311 |

|

12 |

18,523 |

13,685 |

17,774 |

0.72 |

410 |

15,997 |

0.79 |

404 |

370 |

|

13 |

11,307 |

4,388 |

17,774 |

0.76 |

433 |

15,997 |

0.83 |

428 |

391 |

|

14 |

13,829 |

1,866 |

17,750 |

0.79 |

448 |

15,975 |

0.86 |

442 |

406 |

|

15 |

9,149 |

412 |

17,750 |

0.78 |

446 |

16,120 |

0.85 |

440 |

403 |

|

16 (1) |

0 |

0 |

16,710 |

0.64 |

344 |

15,968 |

0.66 |

341 |

310 |

|

17 (1) |

0 |

0 |

2,612 |

0.54 |

45 |

2,612 |

0.54 |

45 |

41 |

|

Total (2) |

267,021 |

671,331 |

280,375 |

0.77 |

6,979 |

253,673 |

0.84 |

6,891 |

6,313 |

|

(*) |

|

Six months commissioning and ramp-up period ahead of full production. |

(1) |

|

Years 16 and 17 process Heap Leach ore after the pit ore is exhausted. |

(2) |

|

Components may not add to totals due to rounding. |

As demonstrated in the accompanying chart, the

Mineral Resources and Mineral Reserves

The tables below present the estimated mineral resources and mineral reserves for the Project. The effective date of the mineral resources and mineral reserves estimates is

| Batman Deposit | Heap Leach Pad | Quigleys Deposit | Total | |||||||||

|

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

Tonnes |

Grade |

Contained Ounces (000s) |

| (000s) | (g/t) | (000s) | (g/t) | (000s) | (g/t) | (000s) | (g/t) | |||||

| Measured (M) | 77,725 |

0.88 |

2,191 |

- |

- |

- |

594 |

1.15 |

22 |

78,319 |

0.88 |

2,213 |

| Indicated (I) | 200,112 |

0.80 |

5,169 |

13,354 |

0.54 |

232 |

7,301 |

1.11 |

260 |

220,767 |

0.80 |

5,661 |

| Measured & Indicated | 277,837 |

0.82 |

7,360 |

13,354 |

0.54 |

232 |

7,895 |

1.11 |

282 |

299,086 |

0.82 |

7,874 |

| Inferred (F) | 61,323 |

0.72 |

1,421 |

- |

- |

- |

3,981 |

1.46 |

187 |

65,304 |

0.77 |

1,608 |

Notes: |

||

1) |

|

Measured & Indicated Mineral Resources include Proven and Probable Reserves. |

2) |

|

Batman and Quigleys mineral resources are quoted at a 0.40g-Au/t cut-off grade. Heap Leach resources are the average grade of the heap, no cut-off applied. |

3) |

|

Batman: Mineral resources constrained within a |

4) |

|

Quigleys: Resources constrained within a |

5) |

|

Differences in the table due to rounding are not considered material. Differences between Batman and Quigleys mining and metallurgical parameters are due to their individual geologic and engineering characteristics. |

6) |

|

|

7) |

|

|

8) |

|

The effective date of the Heap Leach, Batman and Quigleys resource estimate is |

9) |

|

Mineral resources that are not mineral reserves have no demonstrated economic viability and do not meet all relevant modifying factors. |

| Batman Deposit | Heap Leach Pad | Total P&P | |||||||

|

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

Tonnes (000) |

Grade (g/t) |

Contained Ounces (000) |

| Proven | 81,277 |

0.84 |

2,192 |

- |

- |

- |

81,277 |

0.84 |

2,192 |

| Probable | 185,744 |

0.76 |

4,555 |

13,354 |

0.54 |

232 |

199,098 |

0.75 |

4,787 |

| Proven & Probable | 267,021 |

0.79 |

6,747 |

13,354 |

0.54 |

232 |

280,375 |

0.77 |

6,979 |

| Notes: | ||

1) |

|

Thomas L. Dyer, P.E., is the QP responsible for reporting the Batman Deposit Proven and Probable Mineral Reserves. |

2) |

|

Batman deposit mineral reserves are reported using a 0.35 g Au/t cutoff grade. |

3) |

|

|

4) |

|

Because all the heap-leach pad reserves are to be fed through the mill, these mineral reserves are reported without a cutoff grade applied. |

5) |

|

The mineral reserves point of reference is the point where material is fed into the mill. |

6) |

|

The effective date of the mineral reserve estimates is |

Project Description

Gold mineralization in the Batman Deposit occurs in sheeted veins within silicified greywackes/shales/siltstones. The Batman deposit strikes north-northeast and dips steeply to the east. Higher grade zones of the deposit plunge to the south. The core zone is approximately 200-250 meters wide and 1.5 kilometers long, with several hanging wall structures providing additional width to the deposit. Mineralization is open at depth as well as along strike, although the intensity of mineralization weakens to the north and south along strike.

The Project is designed to be a conventional, owner-operated, open-pit mining operation that will utilize large-scale mining equipment in a drill/blast/load/haul operation. The Company continues to evaluate the potential use of contract mining and/or autonomous truck haulage. Ore is planned to be processed in a comminution circuit consisting of a gyratory crusher, two cone crushers, two high pressure grinding roll crushers with primary grinding by two ball mills and secondary grinding by 10 FLSmidth VXP mills. Vista plans to recover gold in a conventional carbon-in-pulp recovery circuit.

Opportunities for Adding Value

Additional resources are predominantly at depth and lateral along strike. A portion of the Inferred Mineral Resources are contained within the existing pit design and are currently included in the mine plan as waste material. Potential to convert part of the mineral resources to mineral reserves represents an opportunity to improve existing LOM economics and extend mine life.

The Company also has known mineral resources at the Quigleys Deposit, which is close to the planned processing plant. The estimated grade of the Quigleys Deposit is higher than the estimated average grade of the Batman Deposit and could provide a source of higher-grade feed in the mid years of the Project when the average grade of feed to the plant is expected to decrease. Additional drilling and metallurgical testing are required to develop mine plans and ultimately establish proven and probable mineral reserves at the Quigleys deposit.

Growth through exploration represents additional opportunity to add value at Mt Todd. Both the Batman Deposit and Quigleys Deposit remain open. Recent drilling demonstrates the continuity of mineralization between these two deposits. In addition, Vista controls over 1,500 sq. km of contiguous exploration licenses at the southeast end of the

The FS uses a natural gas price comparable to other facilities that self-generate power in the NT. Due to the location of the Project and its close proximity to the main NT natural gas transmission line, the Company believes that there is significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract. This belief is in part based on local expectations of significantly increased gas reserves in the

Conference Call Details

A conference call and webcast to discuss highlights of the FS will be held

Toll-free in

International: 647-689-4225

Confirmation Code: 5074108

To participate in the webcast and view the slide presentation, please follow the steps below at least 15 minutes prior to the start time:

Step 1 – Registration Page:

https://onlinexperiences.com/Launch/QReg/ShowUUID=803ED6AB-ABDC-4C7F-B282-A98D4DCB25D7

Step 2 –

https://onlinexperiences.com/Launch/Event/ShowKey=187237

This call will be archived and available at www.vistagold.com after

Detailed Report

A technical report for the FS prepared in accordance with NI 43-101 disclosure standards will be filed on SEDAR and a technical report summary prepared in accordance with S-K 1300 will be filed on EDGAR with our annual report on Form 10-K, in each case, within 45 days of the date hereof and will be available on our website at that time.

About

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of

For further information, please contact

For more information about our projects, including technical studies and mineral resource estimates, please visit our website at www.vistagold.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the

Note Regarding Non-GAAP Financial Measures

In this press release, we have provided information prepared or calculated according to non-

The non-

We believe that these metrics help investors understand the economics of the Project. We present the non-

Cash Operating Costs, Cash Costs, AISC and Respective Unit Cost Measures

Cash Operating Costs is a non-

Cash Costs and AISC are non-

Cash Operating Costs consist of Project operating costs and refining costs, and exclude the Jawoyn royalty. Cash Operating Costs are presented by year in the operating margin summary.

Cash Costs consist of Cash Operating Costs (as described above), plus the Jawoyn royalty. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively.

AISC consists of Cash Costs (as described above), plus sustaining capital costs. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively.

Other costs excluded from Cash Operating Costs, Cash Costs, and AISC include depreciation and amortization, income taxes, government royalties, financing charges, costs related to business combinations, asset acquisitions other than sustaining capital, and asset dispositions.

The following tables demonstrate the calculation of Cash Operating Costs, Cash Costs, AISC, and related unit-cost metrics for amounts presented in this press release.

| Units | Years 1-7* | Life of Mine | |

| Payable Gold | koz | 3,353 |

6,313 |

| Operating Costs | $ Millions |

|

|

| Refining Cost | $ Millions | 12 |

22 |

| Cash Operating Costs | $ Millions | 2,413 |

4,958 |

| Jawoyn Royalty | $ Millions | 107 |

202 |

| Cash Costs | $ Millions |

|

|

| Cash Cost per ounce | $/oz |

|

|

| Sustaining Capital | $ Millions | 363 |

700 |

| All-In-Sustaining Costs | $ Millions |

|

|

| AISC per ounce | $/oz |

|

|

Note: Amounts may not add to totals due to rounding. |

* Years 1-7 start after the 6-month commissioning and ramp up period. |

| Units | Years 1-7* | Years 8-14* | Life of Mine | |

| Payable Gold | koz | 3,353 |

2,359 |

6,313 |

| Tonnes processed | kt | 124,298 |

124,347 |

280,375 |

| Mining Costs | $ Millions |

|

|

|

| Processing Costs | $ Millions | 1,167 |

1,167 |

2,648 |

| Site General and Administrative Costs | $ Millions | 131 |

117 |

278 |

| Water Treatment | $ Millions | 33 |

30 |

83 |

| Tailings Management | $ Millions | 11 |

10 |

24 |

| Operating Costs | $ Millions | 2,402 |

2,088 |

4,936 |

| Refining Cost | $ Millions | 12 |

8 |

22 |

| Cash Operating Costs | $ Millions | 2,413 |

2,096 |

4,958 |

| Jawoyn Royalty | $ Millions | 107 |

75 |

202 |

| Cash Costs | $ Millions |

|

|

|

| Per Payable Ounce: | ||||

| $/oz |

|

|

|

|

| Processing Cost per ounce | $/oz | 348.23 |

494.68 |

419.35 |

| Site General and Administrative Costs per ounce | $/oz | 39.19 |

49.61 |

44.04 |

| Water Treatment per ounce | $/oz | 9.81 |

12.91 |

13.10 |

| Tailings Management per ounce | $/oz | 3.10 |

4.41 |

3.74 |

| Refining Cost per ounce | $/oz | 3.45 |

3.50 |

3.48 |

| Jawoyn Royalty per ounce | $/oz | 32.00 |

32.00 |

32.00 |

| Cash Cost per ounce | $/oz |

|

|

|

| Per Tonne Processed: | ||||

| $/tonne |

|

|

|

|

| Processing Cost per tonne processed | $/tonne | 9.39 |

9.38 |

9.44 |

| Site General and Administrative Costs per tonne processed | $/tonne | 1.06 |

0.94 |

0.99 |

| Water Treatment per tonne processed | $/tonne | 0.26 |

0.24 |

0.29 |

| Tailings Management per tonne processed | $/tonne | 0.08 |

0.08 |

0.08 |

| Refining Cost per tonne processed | $/tonne | 0.09 |

0.07 |

0.08 |

| Jawoyn Royalty per tonne processed | $/tonne | 0.86 |

0.61 |

0.72 |

| Cash Cost per tonne processed | $/tonne |

|

|

|

Note: Amounts may not add to totals due to rounding. |

* Years 1-7 and 8-14 are measured after the start of the 6-month commissioning and ramp up period. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220207006009/en/

(720) 981-1185

Source: