New Veeva Pulse Findings Show Connected Engagement Creates an Advantage as HCP Access Drops

Rhea-AI Summary

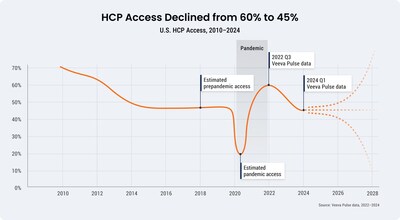

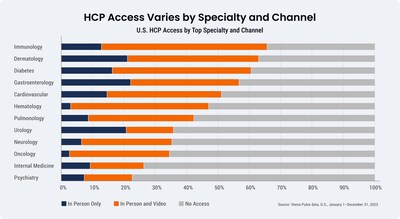

Veeva Systems (NYSE: VEEV) unveiled findings from its Veeva Pulse Field Trends Report, highlighting a significant drop in healthcare professional (HCP) access, now at 45% compared to 60% eighteen months ago. The report underscores the effectiveness of a connected engagement model, where sales, marketing, and medical teams coordinate efforts to build more relevant and trusted HCP relationships. This approach helps biopharma companies overcome access barriers, increasing HCP engagement through digital and in-person touchpoints. The findings indicate that HCPs are more selective, often engaging with only three or fewer companies, and that specialties such as internal medicine, oncology, psychiatry, and urology have stricter access limitations. Despite these challenges, coordinated engagement has proven beneficial in extending conversations and improving treatment adoption.

Positive

- Connected engagement model helps biopharma companies build more relevant and trusted HCP relationships.

- Increased share of HCPs open to in-person and video engagement.

- Coordinated efforts between sales, marketing, and medical teams extend HCP interactions.

- Digital and in-person touchpoints give biopharma an advantage despite access challenges.

- Focus on relevance and real-time communication improves customer conversations and patient benefits.

- Companies leveraging compliant chat and synchronizing field activity with digital advertising strengthen engagement.

Negative

- HCP access has dropped to 45%, down from 60% eighteen months ago.

- Half of accessible HCPs meet with only three or fewer companies.

- Significant access restrictions in specialties like internal medicine, oncology, psychiatry, and urology.

- Overall reduction in HCP access could limit opportunities for engagement and treatment adoption.

News Market Reaction – VEEV

On the day this news was published, VEEV declined 0.57%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

With less than half of HCPs now accessible, coordinated engagement across sales, marketing, and medical makes the most of limited time

Despite access challenges, some field teams are extending HCP relationships by becoming one connected resource across sales, marketing, and medical to build more relevant and trusted relationships. This new connected engagement model coordinates touchpoints across channels and roles to continuously build on the last interaction, helping companies overcome access barriers. Commercial teams are evolving as valuable partners to HCPs, responding to their needs faster and improving treatment adoption.

"We need three things from the industry to get the right patient outcome: trustworthy, high-quality product information, scientific education for us as physicians, and research insights," said Dr. Vital Hevia, a urologist on Veeva's HCP Advisory Board. "Physicians must be continuously educated. Every interaction should inform the next communication."

The latest Veeva Pulse findings on HCP access reveal that:

- Access drops but HCPs want to expand engagement channels: With

45% accessible to biopharmas compared to60% in 2022, HCPs open to in-person and video engagement with field teams increase in share of overall access compared to prior years. - HCPs are more selective across specialties: Half of accessible HCPs meet with three or fewer companies. Access also varies significantly across specialties with nearly

30% of those in internal medicine, oncology, psychiatry, and urology restricting access to just one company. - Connected engagement breaks through: Coordinated engagement models where sales, marketing, and medical teams work together as a single resource are extending conversations with HCPs and increasing treatment adoption. From educating key experts before launch and leveraging compliant chat to share relevant content during meetings, to synchronizing field activity with digital advertising, biopharmas are strengthening engagement and improving outcomes.

"Despite a drop in HCP access, digital and in-person touchpoints seamlessly coordinated across sales, marketing, and medical teams are proving to give biopharmas an advantage in the field," said Dan Rizzo, vice president of business consulting at Veeva. "Companies focused on relevance and real-time communication, instead of reach and frequency, will pave the way for more impactful customer conversations that benefit patients."

About the Veeva Pulse Field Trends Report

Analyzing over 600 million HCP interactions and activities annually from more than

Additional Information

To download a copy of the Veeva Pulse Field Trends Report, visit: veeva.com/FieldTrends

Learn more about Veeva Business Consulting: veeva.com/BusinessConsulting

Connect with Veeva on LinkedIn: linkedin.com/company/veeva-systems

About Veeva Systems

Veeva is the global leader in cloud software for the life sciences industry. Committed to innovation, product excellence, and customer success, Veeva serves more than 1,000 customers, ranging from the world's largest biopharmaceutical companies to emerging biotechs. As a Public Benefit Corporation, Veeva is committed to balancing the interests of all stakeholders, including customers, employees, shareholders, and the industries it serves. For more information, visit veeva.com.

Veeva Forward-looking Statements

This release contains forward-looking statements regarding Veeva's products and services and the expected results or benefits from use of our products and services. These statements are based on our current expectations. Actual results could differ materially from those provided in this release and we have no obligation to update such statements. There are numerous risks that have the potential to negatively impact our results, including the risks and uncertainties disclosed in our filing on Form 10-K for the fiscal year ended January 31, 2024, which you can find here (a summary of risks which may impact our business can be found on pages 9 and 10), and in our subsequent SEC filings, which you can access at sec.gov.

Contact:

Alison Borris

Veeva Systems

925-226-8821

alison.borris@veeva.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-veeva-pulse-findings-show-connected-engagement-creates-an-advantage-as-hcp-access-drops-302153747.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-veeva-pulse-findings-show-connected-engagement-creates-an-advantage-as-hcp-access-drops-302153747.html

SOURCE Veeva Systems

FAQ

What are the key findings of the Veeva Pulse Field Trends Report for VEEV?

How has HCP access changed for VEEV?

What is the significance of the connected engagement model for VEEV?

How are HCPs engaging with VEEV according to the latest report?

Which specialties have stricter HCP access according to VEEV's findings?