U.S. Energy Corp. Announces Recent AcquisitionTargeting Industrial Gas Production

U.S. Energy Corp (NASDAQ: USEG) has acquired 80% interest in Synergy Offshore's assets in the Kevin Dome structure, Montana, comprising approximately 24,000 net acres targeting helium and industrial gas production. The transaction includes:

- $2.0 million in cash

- 1.4 million shares of restricted common stock

- $20.0 million carried working interest

- 18% share in carbon sequestration tax credits and future CO2 processing plant gains

The acquisition focuses on the Duperow formation, known for economic helium concentrations and CO2-dominated gas systems. The company plans to integrate the assets into its 2025 development program, including a two-well drilling commitment. The strategic move aims to capitalize on growing industrial gas demand while advancing carbon sequestration initiatives, leveraging recent state and federal legislation.

U.S. Energy Corp (NASDAQ: USEG) ha acquisito una partecipazione dell'80% negli asset di Synergy Offshore nella struttura di Kevin Dome, Montana, che comprende circa 24.000 acri netti destinati alla produzione di elio e gas industriali. La transazione include:

- 2,0 milioni di dollari in contante

- 1,4 milioni di azioni di azioni comuni vincolate

- 20,0 milioni di dollari di interesse di lavoro trasportato

- 18% di partecipazione nei crediti d'imposta per la sequestrazione del carbonio e futuri guadagni degli impianti di lavorazione del CO2

L'acquisizione si concentra sulla formazione Duperow, nota per le concentrazioni economiche di elio e per i sistemi di gas dominati dal CO2. L'azienda prevede di integrare gli asset nel suo programma di sviluppo per il 2025, compresa l'impegno di trivellare due pozzi. Questa mossa strategica mira a capitalizzare la crescente domanda di gas industriale, mentre promuove iniziative di sequestrazione del carbonio, sfruttando la recente legislazione statale e federale.

U.S. Energy Corp (NASDAQ: USEG) ha adquirido un interés del 80% en los activos de Synergy Offshore en la estructura de Kevin Dome, Montana, que comprende aproximadamente 24,000 acres netos dirigidos a la producción de helio y gas industrial. La transacción incluye:

- $2.0 millones en efectivo

- 1.4 millones de acciones de acciones comunes restringidas

- $20.0 millones de interés de trabajo cargado

- 18% de participación en créditos fiscales por captura de carbono y futuras ganancias de plantas de procesamiento de CO2

La adquisición se centra en la formación Duperow, conocida por concentraciones económicas de helio y sistemas de gas dominados por CO2. La empresa planea integrar los activos en su programa de desarrollo 2025, que incluye un compromiso de perforación de dos pozos. Este movimiento estratégico busca capitalizar la creciente demanda de gas industrial, al tiempo que avanza en iniciativas de captura de carbono, aprovechando la reciente legislación estatal y federal.

U.S. Energy Corp (NASDAQ: USEG)는 헬륨 및 산업가스 생산을 목표로 몬태나의 케빈 돔 구조에서 Synergy Offshore 자산의 80% 지분을 인수했습니다. 이 거래에는 24,000 에이커에 대한 내용이 포함됩니다:

- 현금 200만 달러

- 140만 주의 제한된 공모주

- 2000만 달러의 이자 보유권

- 탄소 격리 세금 크레딧 및 미래 CO2 처리 공장에서의 18% 지분

인수는 경제적 헬륨 농도와 CO2 지배 가스 시스템으로 알려진 듀퍼로우층에 초점을 맞추고 있습니다. 회사는 2025년 개발 프로그램에 자산을 통합할 계획이며, 두 개의 우물 시추를 약속하고 있습니다. 이 전략적 움직임은 산업 가스 수요의 증가를 활용하면서 최근의 주 및 연방 법안을 기반으로 탄소 격리 계획을 추진하는 것을 목표로 합니다.

U.S. Energy Corp (NASDAQ: USEG) a acquis la participation de 80 % dans les actifs de Synergy Offshore dans la structure de Kevin Dome, Montana, comprenant environ 24 000 acres nets ciblant la production d'hélium et de gaz industriels. La transaction comprend :

- 2,0 millions de dollars en espèces

- 1,4 million d'actions ordinaires restreintes

- 20,0 millions de dollars d'intérêts de travail reportés

- 18% de part dans les crédits d'impôt pour la séquestration du carbone et les gains futurs des usines de traitement du CO2

L'acquisition se concentre sur la formation Duperow, connue pour ses concentrations économiques d'hélium et ses systèmes de gaz dominés par le CO2. L'entreprise prévoit d'intégrer les actifs dans son programme de développement 2025, y compris un engagement de forage de deux puits. Ce mouvement stratégique vise à capitaliser sur la demande croissante de gaz industriels tout en faisant progresser les initiatives de séquestration du carbone, en tirant parti des législations récentes au niveau des États et du fédéral.

U.S. Energy Corp (NASDAQ: USEG) hat einen 80%igen Anteil an den Vermögenswerten von Synergy Offshore in der Kevin Dome-Struktur in Montana erworben, die ungefähr 24.000 Netto-Acres umfasst und auf die Produktion von Helium und Industriegas abzielt. Die Transaktion beinhaltet:

- 2,0 Millionen Dollar in bar

- 1,4 Millionen Aktien von eingeschränkten Stammaktien

- 20,0 Millionen Dollar an übertragendem Arbeitsinteresse

- 18% Anteil an den Steuervergünstigungen für Kohlenstoffspeicherung und zukünftigen Gewinnen von CO2-Verarbeitungsanlagen

Die Akquisition konzentriert sich auf die Duperow-Formation, die für wirtschaftliche Heliumkonzentrationen und CO2-dominierte Gassysteme bekannt ist. Das Unternehmen plant, die Vermögenswerte in sein Entwicklungsprogramm 2025 zu integrieren, das ein Engagement zur Bohrung von zwei Brunnen umfasst. Dieser strategische Schritt zielt darauf ab, von der wachsenden Nachfrage nach Industriegas zu profitieren und gleichzeitig Initiativen zur Kohlenstoffspeicherung voranzutreiben, indem die jüngsten staatlichen und bundesstaatlichen Gesetze genutzt werden.

- Acquisition of 24,000 net acres in strategic Kevin Dome location

- Multiple revenue streams: helium, industrial gases, and carbon sequestration

- Immediate integration into 2025 development program

- Asset includes active well with confirmed helium production

- Alignment with government legislation for carbon management solutions

- Significant upfront costs: $2.0M cash plus 1.4M shares

- $20.0M carried working interest obligation over 78 months

- Revenue sharing commitment of 18% on carbon sequestration and CO2 processing

Insights

This strategic acquisition marks a pivotal expansion into the industrial gas sector, particularly helium production and carbon sequestration. The deal structure, valued at approximately

The Kevin Dome assets represent a compelling opportunity in the industrial gas market, where helium commands premium pricing due to global supply constraints. The 24,000-net acre position, coupled with existing infrastructure and proven helium concentrations, positions USEG to capitalize on growing industrial demand across aerospace, semiconductor and medical sectors.

The carbon sequestration component adds a valuable revenue stream through tax credits, with Synergy retaining

The strategic significance of this acquisition cannot be overstated in the context of current global helium market dynamics. With major supply disruptions from Qatar and Russia creating significant shortages, domestic helium production assets are increasingly valuable. The Kevin Dome's helium-enriched formations, particularly in the Duperow formation, represent a important new supply source for critical industries.

The asset's CO₂-dominant composition (

The timing is optimal given the current supply chain disruptions affecting global helium distribution. U.S. Energy's position as a domestic supplier of both industrial gases and carbon sequestration services aligns perfectly with national security interests and environmental policies, potentially commanding premium pricing in the market.

HOUSTON, Jan. 10, 2025 (GLOBE NEWSWIRE) -- U.S. Energy Corporation (NASDAQ: USEG, “U.S. Energy” or the “Company”) today announced that the Company has closed a transaction (the “Agreement”) with Synergy Offshore, LLC (“Synergy” or “SOG”) for the acquisition of operated acreage targeting helium and other industrial gas production across the Kevin Dome structure in Toole County, Montana (the “SOG Asset”).

HIGHLIGHTS

- The SOG Asset includes:

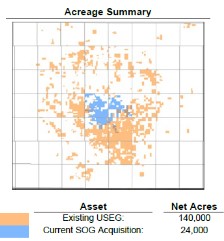

- Approximately 24,000 net acres strategically positioned across the core of the Kevin Dome.

- Multiple prospective industrial gas pay zones, primarily composed of carbon dioxide (CO2) and nitrogen heavy formations enriched with significant helium concentrations.

- Industry leading low environmental footprint focusing on the production of non-hydrocarbon-based helium and other industrial gases.

- Approximately 24,000 net acres strategically positioned across the core of the Kevin Dome.

- SOG Asset expected to be seamlessly integrated into U.S. Energy’s existing operations.

- The SOG Asset’s highly contiguous location to U.S. Energy’s existing position enhances the Company’s industrial gas operations within the Kevin Dome region.

- The Asset will be immediately incorporated into U.S. Energy’s 2025 development program, accelerating value creation.

- The SOG Asset’s highly contiguous location to U.S. Energy’s existing position enhances the Company’s industrial gas operations within the Kevin Dome region.

- Initiation of carbon sequestration business significantly expands opportunity.

- The acquisition marks a significant milestone in advancing U.S. Energy’s carbon management solutions, leveraging the SOG Asset to expand into the Company’s carbon sequestration business.

- Development plans align closely with local, state, and federal legislation, positioning U.S. Energy as a leader in sustainable industrial gas production.

- The acquisition marks a significant milestone in advancing U.S. Energy’s carbon management solutions, leveraging the SOG Asset to expand into the Company’s carbon sequestration business.

MANAGEMENT COMMENTARY

“With U.S. Energy’s acquisition of the Synergy Assets, encompassing a substantial position across the core of Montana’s Kevin Dome structure, we are confident that the Company is well-positioned to capitalize on what we believe to be a transformational resource and economic opportunity across multiple industrial gas streams,” said Ryan Smith, U.S. Energy’s Chief Executive Officer. He added, “The Kevin Dome structure represents immense resource potential, with full-cycle helium and industrial gas economics that are competitive with any location in North America.”

Mr. Smith continued, “Global industries—including aerospace, semiconductors, medical applications, and food and beverage production—are facing significant challenges in meeting the growing demand for helium and CO₂. These challenges are exacerbated by risks associated with foreign supply chains, including shipping disruptions and trade restrictions. The Synergy Asset acquisition strengthens our ability to provide reliable, clean, and domestically sourced industrial gases.

“We are positioned to begin operations on the acquired acreage immediately, integrating it into our 2025 development program. Additionally, U.S. Energy is proud to advance our carbon sequestration initiatives. We have entered the planning and permitting phase to leverage our existing infrastructure for CO₂ sequestration. This approach not only aligns with our commitment to greening the industrial gas production process but also takes full advantage of recent state and federal legislation. This is a win for all stakeholders, and we remain dedicated to pursuing this sustainable growth strategy.”

OVERVIEW OF ASSETS

The collective assets encompass approximately 24,000 net acres strategically located within the core of the Kevin Dome, a prominent geological structure historically recognized for its robust resource extraction potential. These assets are highly contiguous and complementary to U.S. Energy’s existing portfolio and development program. Recent drilling activity in the area has demonstrated significant success, particularly in helium production from multiple formations, predominantly composed of carbon dioxide and nitrogen.

Synergy Asset:

The SOG Asset, encompassing 24,000 net acres, is strategically located at the center of the Kevin Dome structure. The primary target for helium production within the asset is the Duperow formation, known for its carbon dioxide-dominated gas systems and recent data indicating economically viable helium concentrations. Notably, the acquisition includes an active well within the SOG Asset, with recent gas analysis confirming significant helium production from the Duperow formation.

U.S. Energy plans to prioritize its carbon sequestration initiatives within the SOG Asset, leveraging the area’s strategic potential. Synergy is controlled by Duane H. King, Chief Executive Officer of Synergy and a member of U.S. Energy’s Board of Directors, along with John A. Weinzierl, Chairman of U.S. Energy.

TRANSACTION CONSIDERATION DETAILS

Synergy Consideration:

Under the terms of the Agreement, SOG will assign to U.S. Energy

$2.0m m in cash.- 1,400,000 shares of U.S. Energy restricted common stock.

$20.0m m carried working interest for which U.S. Energy commits to pay Synergy’s exploration, drilling, and completion costs attributable to Synergy’s20.0% retained working interest for a period of 78 months.- An Area of Mutual Interest (the “SOG AMI”) under which Synergy will have the right to participate for its proportionate interest of

20.0% in any new leases with any leasing amounts being deducted from the carried working interest. 18.0% of future amounts realized by U.S. Energy in connection with tax credits obtained from carbon sequestration on the SOG AMI.18.0% of any future gain, after deducting U.S. Energy’s unrecovered capital costs, in connection with U.S. Energy’s initial CO2 processing plant located on the SOG AMI.

UPCOMING DRILLING AND DEVELOPMENT CATALYSTS

U.S. Energy has committed to a two-well drilling program as part of its acquisition of the SOG Assets. These commitments will be seamlessly integrated into the Company’s existing 2025 development program. The initial drilling efforts will target the Duperow formation, which boasts significant well control and has demonstrated highly economic helium concentrations, along with CO₂ levels comprising less than

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating high-quality energy and industrial gas assets in the United States with the potential to optimize production and generate free cash flow through low-risk development while maintaining an attractive shareholder returns program. We are committed to being a leader in reducing our carbon footprint in the areas in which we operate. More information about U.S. Energy Corp. can be found at www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com

(303) 993-3200

www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, risks associated with the integration of the recently acquired assets; the Company’s ability to recognize the expected benefits of the acquisitions and the risk that the expected benefits and synergies of the acquisition may not be fully achieved in a timely manner, or at all; the amount of the costs, fees, expenses and charges related to the acquisitions; the Company’s ability to comply with the terms of its senior credit facilities; the ability of the Company to retain and hire key personnel; the business, economic and political conditions in the markets in which the Company operates; fluctuations in oil and natural gas prices, uncertainties inherent in estimating quantities of oil and natural gas reserves and projecting future rates of production and timing of development activities; competition; operating risks; acquisition risks; liquidity and capital requirements; the effects of governmental regulation; adverse changes in the market for the Company’s oil and natural gas production; dependence upon third-party vendors; risks associated with COVID-19, the global efforts to stop the spread of COVID-19, potential downturns in the U.S. and global economies due to COVID-19 and the efforts to stop the spread of the virus, and COVID-19 in general; economic uncertainty relating to increased inflation and global conflicts; the lack of capital available on acceptable terms to finance the Company’s continued growth; the review and evaluation of potential strategic transactions and their impact on stockholder value; the process by which the Company engages in evaluation of strategic transactions; the outcome of potential future strategic transactions and the terms thereof; and other risk factors included from time to time in documents U.S. Energy files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. These reports and filings are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of any Sale Agreement Parties are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on U.S. Energy’s future results. The forward-looking statements included in this press release are made only as of the date hereof. U.S. Energy cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, U.S. Energy undertakes no obligation to update these statements after the date of this release, except as required by law, and takes no obligation to update or correct information prepared by third parties that are not paid for by U.S. Energy. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.