United Lithium Expands Holdings with Addition of Three Highly Prospective Properties in Finland and Sweden

United Lithium Corp. has expanded its holdings in Finland and Sweden by acquiring three new properties, increasing its total land position by nearly 300%. The properties are located in highly prospective geological terrains capable of hosting lithium-bearing pegmatites. The Company acquired the rights to these properties by purchasing the issued and outstanding common shares of two private companies, PR1 Finland Oy and Scandinavian Battery Metals. This strategic move aligns with the growing demand for domestic sources of raw materials in Europe, particularly in the EV market, and positions United Lithium well for future growth and shareholder value.

The Company paid AUD$20,112 to Pure Resources and made payments of CAD$40,050 and USD$110,984 to acquire the properties. Pure Resources will retain a 2% NSR Royalty on two of the properties, with a buyback option available to United Lithium. The acquisition enhances the Company's portfolio and strengthens its presence in the Nordic region.

United Lithium Corp. has expanded its land position by almost 300% with the acquisition of three new properties in Finland and Sweden, strategically positioning itself in highly prospective geological terrains for lithium exploration.

The Company incurred significant costs in acquiring the properties, including payments of AUD$20,112, CAD$40,050, and USD$110,984, which may impact its short-term financial position.

VANCOUVER, British Columbia, April 29, 2024 (GLOBE NEWSWIRE) -- United Lithium Corp. (“United Lithium” or the “Company”) (CSE: ULTH; OTCQX: ULTHF; FWB: 0UL) is pleased to announce that it has increased its land position in Finland and Sweden after acquiring the rights to the 54,400 hectare (“ha”) Kova Property reservation and the 13,900 ha Kast Property reservation in Finland, and the 14,000 ha Axmarby Property in Sweden (collectively, the “Properties”).

United Lithium has increased its Nordic holdings by almost

“Europe is the second largest EV market in the world and the continent is at the forefront of global carbon footprint reduction. The demand for domestic sources of raw materials to support decarbonization represents an opportunity for United Lithium and its shareholders. The acquisition of three new Properties increases our holdings within the underexplored Nordics in geological settings similar to the Keliber Lithium Mine, which is currently being built. Axmarby, in Sweden, is situated immediately north of our flagship Bergby Project and shares the same key infrastructure. Furthermore, the acquisition of Kast and Kova add additional prospective opportunities to our portfolio of properties in Finland,” commented President and CEO, Scott Eldridge.

As consideration for acquiring the Properties, the Company paid AUD

Pure Resources Ltd. will retain a

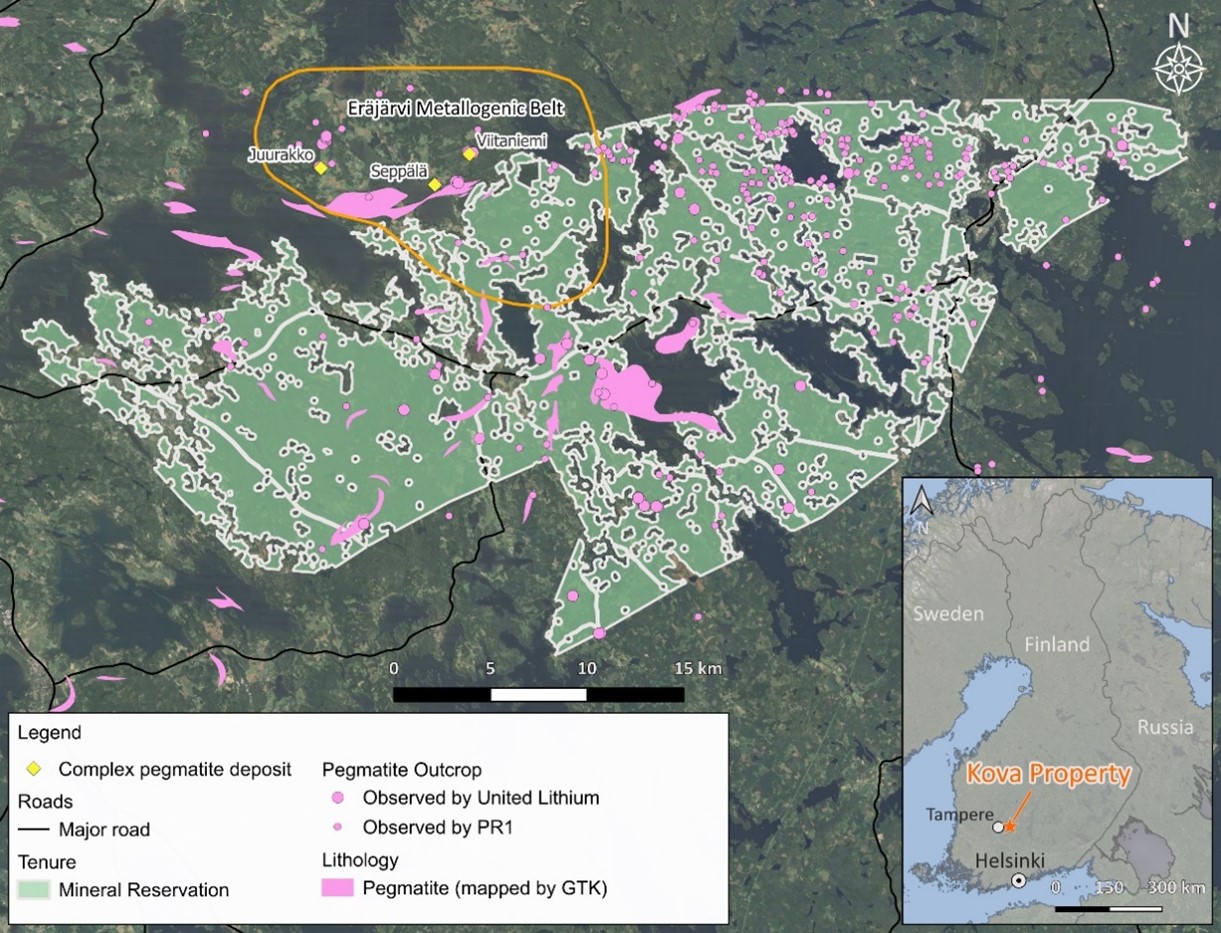

About the Kova Property

The Kova Property is situated approximately 150 km north of Helsinki and 50 km east of the City of Tampere (Figure 1) and covers 54,400 ha (54.4 sq. km). It is located on the northern margin of the Pirkanmaa migmatite belt (1.96 – 1.91 Ga), immediately to the south of the Tampere schist belt. Kova sits directly to the south from the Eräjärvi LCT-metallogenic area, where more than 70 pegmatite dykes enriched in B, Be, Li, Nb, Sn, and Ta have been identified (Lahti 1981, Alviola 2004). The area is in a prospective geological setting with the presence of late-orogenic (1.80 Ga) LCT type complex pegmatites that were previously mined.

The local geology is comprised of migmatites made up of mica (para) gneiss (turbidites, graywackes) with a lesser extent of mafic-intermediate volcanic rocks and amphibolites. Felsic plutonic rocks in the Kova area include granodiorites, aplite, pegmatite and tonalite and are considered early Svecofennian (1.91-1.88 Ga). In addition, complex structures with sheared and schistose metasediments further provided possible conduits for the pegmatite melts. Nearby known complex pegmatite deposits include the Seppalä LCT pegmatite and the historical Juurakko and Viitaniemi pegmatite mines are located directly north of the Kova claims.

Bedrock in the project area is well exposed with 220 pegmatites sites mapped by PR1 (see Pure Resources ASX announcement dated July 12, 2023). A field visit completed by United Lithium in the summer of 2023 confirmed the presence of dyke-like pegmatites striking NW-SE, ranging in thickness from centimeters to 5-10 meters and up to several tens of meters in length. The pegmatites are comprised of K-feldspar and quartz with variable amounts of biotite and muscovite. Tourmalines, ranging in size from medium to coarse to pegmatite-sized are found locally. Li-silicates were not observed.

Figure 1: Kova Property Outline, Finland

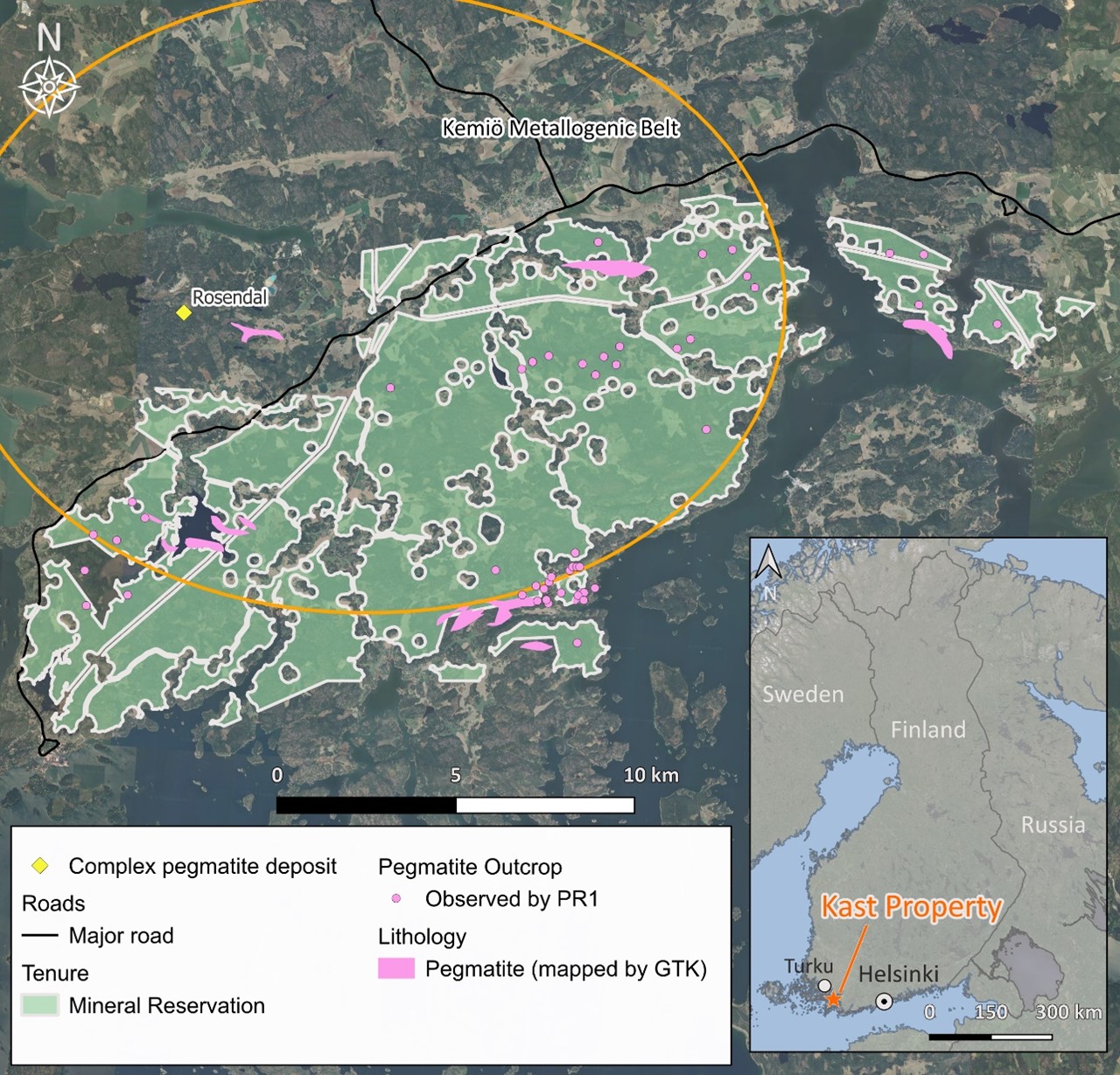

About the Kast Property

Located adjacent to the Rosendal tantalum deposit, the Kast Property is approximately 110 km west of Helsinki and covers approximately 13,900 ha (13.9 sq. km) in the Kemiö metallogenic area region of Finland (Figure 2). Kast is located on the western part of the Uusimaa supracrustal belt (~1.89 Ga) and is defined by the presence of gneisses, schists, amphibolites, mafic to felsic volcanic rocks and carbonates. The area is intruded by Svecofennian orogenic felsic intrusive of the Southern Finland Granite and Plutonic Suites. The area is prospective for mixed or hybrid rare-element pegmatites which have REE signatures and are a mix between LCT (Li, Cs, Ta) and NYF (Nb, Y, F) pegmatites.

Historical and GTK data suggest that the Rosendal deposit contains Ta, Be and Li mineralization, as well as recoverable albite, quartz and muscovite (Alviola 1997). The presence of the Rosendal deposit and the known Ta-Nb mineral pegmatites in the region indicate that the Kemiö metallogenic may have a significant, largely untested Li-Ta potential.

Bedrock exposures over the Kast Property are relatively sparse and PR1 observed 49 pegmatites during their work in 2023 (see Pure Resources ASX announcement dated July 12, 2023), however no assays are available. Historical drilling has been completed in the Kast area, and logging reports indicate intercepts of approximately 501 intersections of pegmatite and granite, however, none of the pegmatite intercepts have been sampled or assayed.

Figure 2: Kast Property Outline, Finland

The Kast and Kova Property reservations were issued to PR1 on June 21, 2023 and are valid until April 23, 2025, at which time, the Company will need to evaluate its results and determine whether to convert any portion of each property into an exploration permit. Until that time, under a reservation status, the Company has the right to complete field work including mapping and sampling to potentially identify future drill targets.

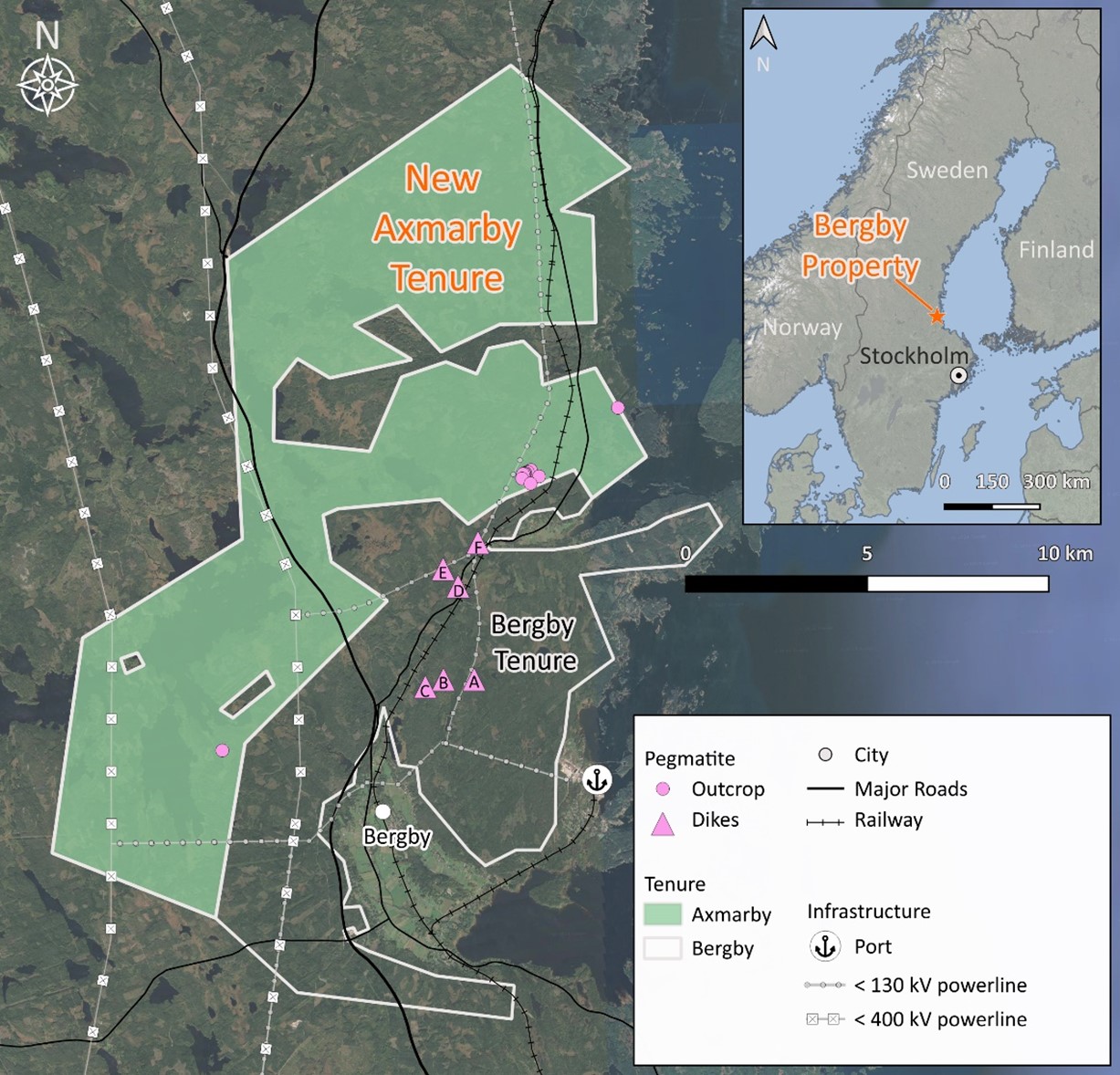

About the Axmarby Property

The 14,015 ha (140 sq. km) Axmarby Property is located approximately 200 km north of Stockholm via highway E4 and 40 km north of the city of Gävle (Figure 3). Axmarby is also directly north of United Lithium’s flagship Bergby Project, near the Gulf of Bothnia coast in central Sweden. To date, five pegmatite dyke systems have been identified on the Bergby claims.

Part of the Axmarby Property is situated within the Hamrånge synform in the west-central part of the Fennoscandian Shield. The stratigraphy in the area consists of mica schist overlain by 1.88 billion years (“Ga”) old felsic and mafic volcanic rocks, followed by metaquartzite (< 1.86 Ga) believed to have formed during an 1.86-1.83 Ga intra-orogenic phase. Geological and isotopic data suggests an oceanic island arc signature of the metavolcanic rocks. The surrounding 1.86 Ga granitoids of the Ljusdal Batholith is believed to have been formed in an active continental margin setting. Directly to the north of Axmarby, the granitoid rocks are believe the be older and mostly gneissic or in part migmatitic.

Pegmatite dykes have been observed approximately 2 km north of the town of Axmarby and seem to be associated with the same structures that host the pegmatite at Bergby. Pegmatites were between 40 cm and up to 4 m and could be traced up to 20 m in some cases.

Figure 3: Axmarby Property Outline, Sweden

Patriot Project Claims

The Company also announces that it received notice from the Bureau of Land Management, notifying the Company that 104 of the 321 claims staked at the Patriot Project in 2022 are null and void as they are located on lands that were designated under the National Wilderness Preservation System and the Colorado Wilderness Act of 1993. The Company is entitled to a refund of US

Qualified Person

The scientific and technical information in this news release was reviewed, verified and approved by Isabelle Lépine, M.Sc., P.Geo. Ms. Lépine is a Registered Professional Geologist in British Columbia and a Qualified Person as defined by NI 43- 101 Standards of Disclosure for Minerals Projects. Ms. Lépine is the Director of Mineral Resources of the Company and is not independent of the Company.

On Behalf of The Board of Directors

“Scott Eldridge”

President, Chief Executive Officer and Director

Telephone: +1-604-428-6128

Email: scott@unitedlithium.com

About United Lithium

United Lithium is an exploration & development company energized by the global demand for lithium. The Company is targeting lithium projects in politically safe jurisdictions with advanced infrastructure that allows for rapid and cost-effective exploration, development, and production opportunities.

The Company’s consolidated financial statements and related management’s discussion and analysis are available on the Company’s website at https://unitedlithium.com or under its profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with statements with respect to the potential of the Kast, Kova and/or Axmarby properties; the timing, completion and successful execution of any planned exploration activities at any of the Properties; and prospective opportunities about the Properties. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; contests over title to properties; and changes in project parameters as plans continue to be refined. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of lithium and other metals and minerals; the demand for lithium and other metals and minerals; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Canadian Securities Exchange has not approved nor disapproved the contents of this news release and does not accept responsibility for the adequacy or accuracy of this release.

FAQ

What properties did United Lithium acquire in Finland and Sweden?

United Lithium acquired the Kova Property, Kast Property, and Axmarby Property in Finland and Sweden.

How much did United Lithium pay for the acquisition of the properties?

United Lithium paid AUD$20,112 to Pure Resources and made payments of CAD$40,050 and USD$110,984 to an arm’s-length third party vendor for the acquisition.

Who will retain a royalty on the Kast and Kova Properties?

Pure Resources will retain a 2% NSR Royalty on the Kast and Kova Properties, with a buyback option available to United Lithium.

What is the significance of the acquisition for United Lithium?

The acquisition strengthens United Lithium's portfolio, expands its presence in the Nordic region, and positions it well to capitalize on the growing demand for raw materials in the EV market.