Uranium Energy Corp Expands U.S. Production Capacity with Acquisition of Rio Tinto';s Sweetwater Plant and Wyoming Uranium Assets

Rhea-AI Summary

Uranium Energy Corp (NYSE American: UEC) has agreed to acquire Rio Tinto's Wyoming assets for $175 million. The acquisition includes the Sweetwater Plant and a portfolio of uranium mining projects with approximately 175 million pounds of historic resources. This transaction creates UEC's third U.S. hub-and-spoke production platform, expanding their uranium production capacity.

Key highlights of the deal include:

- Addition of a 3,000 ton per day processing mill with a licensed capacity of 4.1 million pounds per year

- Acquisition of over 53,000 acres of prospective land for exploration

- Extensive geological database from over 6.1 million feet of drilling

- Potential for both ISR and conventional mining methods

The acquisition is strategically timed amid growing demand for domestically sourced uranium, driven by geopolitical factors and increasing clean energy needs.

Positive

- Acquisition of Sweetwater Plant and uranium mining projects with 175 million pounds of historic resources for $175 million

- Creation of UEC's third U.S. hub-and-spoke production platform

- Addition of 3,000 ton per day processing mill with 4.1 million pounds per year licensed capacity

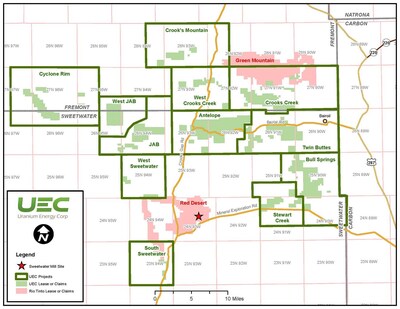

- Expansion of land package by 53,000 acres, totaling 108,000 acres in the Great Divide Basin

- Acquisition of extensive geological database from 6.1 million feet of drilling

- Potential for both ISR and conventional mining methods, providing production flexibility

Negative

- Significant capital outlay of $175 million for the acquisition

News Market Reaction

On the day this news was published, UEC gained 11.73%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

NYSE American: UEC

Transaction Rationale and Highlights:

- Creates UEC's Third

U.S. Hub-and-Spoke Production Platform – UEC currently controls 12 uranium projects in the Great Divide Basin ofWyoming . The addition of Rio Tinto's Sweetwater Plant and portfolio of permitted and exploration stage projects is highly strategic and enables UEC to unlock the development potential of the Company's extensive portfolio in the Great Divide Basin, creating a thirdU.S. hub-and-spoke production platform within UEC's pure-play uranium business. - Highly Invested Asset Base with Operating Synergies – Significant asset base with high replacement value and substantial time and cost-savings compared to building and licensing a new processing facility and assembling similar levels of geological data, with minimal capital required to prepare the Sweetwater Plant for in-situ recovery ("ISR") processing. In addition, the Transaction provides UEC critical scale in the Great Divide Basin, with opportunities to realize synergies from shared infrastructure and project personnel expertise.

- Sizeable and Accretive Resource Growth – Addition of approximately 175 million pounds of historic uranium resources(1), at an in-situ valuation multiple well below UEC's current trading levels. Approximately half of these resources appear amenable to ISR mining methods and half to conventional mining. ISR amenable resources will be prioritized for development and near-term production, with conventional resources providing substantial optionality for further production growth.

- Significant Scarcity Value and Production Optionality – The Transaction represents an increasingly rare opportunity to acquire licensed facilities and permitted uranium mining resource properties from a global mining leader. These assets significantly enhance and expedite UEC's production capabilities in the Great Divide Basin. The Sweetwater Plant, a 3,000 ton per day processing mill, with a licensed capacity of 4.1 million pounds per year, can also be adapted for recovery of uranium from loaded resins produced by ISR operations. This provides UEC with production flexibility for both ISR and conventional mining.

- Extensive Land Package, Geological Data and Exploration Opportunities – Adds more than 53,000 highly prospective acres of land for future exploration along with an extensive geological database gathered from over 6.1 million feet of drilling (approximately 13,000 drill holes with 26,000 assay records, and downhole geophysical logs with equivalent uranium grades) facilitating historical resource conversion and more effective exploration. Combined with UEC's existing 54,615 acres of mining rights in the Great Divide Basin, this will establish a portfolio of approximately 108,000 acres of mining and exploration prospects.

- Attractive Industry Tailwinds, Driven by Geopolitical Catalysts and Growing Clean Energy Demand – As illustrated by the recently announced planned restart of Three Mile Island Unit 1 and Microsoft's long-term power purchase agreement with the facility,

U.S. nuclear energy will be a critical supplier of the carbon-free energy needed to fuel the artificial intelligence boom. The growing demand for domestically sourced uranium is further bolstered by recent geopolitical events, including theU.S. import ban on Russian uranium, theU.S. Department of Energy's recently issued Request for Proposal to purchase domestically sourced supply and Russian threats to limit or ban exports to the western world.

Amir Adnani, President and CEO, stated:

"Expanding our production capabilities with the acquisition of highly sought after and fully licensed uranium assets in the

With this Transaction, we are building upon our transformative acquisition of Uranium One Americas in 2021, which added a large portfolio of holdings in the Great Divide Basin of Wyoming. We recognized early on that there are meaningful development synergies with the Rio Tinto assets, particularly the Sweetwater Plant. These assets will unlock tremendous value by establishing our third hub-and-spoke production platform and cement UEC as the leading uranium developer in

We're witnessing unprecedented global growth in nuclear energy and demand for uranium as demonstrated by the recently proposed Three Mile Island restart in support of Microsoft's AI growth. The Russian uranium ban and recent comments by Russian government officials regarding restricting future uranium exports to the west underscore the critical importance of maintaining reliable domestic supply chains to power our growing requirements for clean baseload energy. With our fourth acquisition since 2021, UEC is continuing to execute towards building the premier and fastest growing North American uranium company."

Donna Wichers, Vice President of Wyoming Operations, stated:

"In my 46 years of operating experience in

After closing, our next steps to advance these assets are expected to include:

1) completing an S-K 1300 resource report to upgrade and confirm historic estimates;

2) building a dedicated team to advance our third hub-and-spoke production platform; and

3) refurbishing parts of the Sweetwater Plant and completing equipment modifications for ISR processing."

About the Red Desert Uranium Project

The Red Desert Project is a development-stage uranium project, encompassing approximately 20,005 acres of exploration and mining rights in the Great Divide Basin, including 17,750 acres of unpatented mining claims, 1,975 acres of patented lands and 1,280 acres of state uranium leases. Between three deposits, historic uranium resources are estimated at approximately 42 million pounds of U3O8 .(1) There is potential for further discoveries, particularly in the shallow mineralization adjacent to the Sweetwater Plant. The deposits are favorable for ISR mining, with uranium hosted below the water table at depths suitable for oxygen dissolution, and in fluvial sands confined by low permeability silts or clays.

About the Green Mountain Uranium Project

The Green Mountain Project is a development-stage uranium project located 22 miles north of the Sweetwater Plant. The project spans approximately 32,040 acres of exploration and mining rights, including 29,400 acres of unpatented mining claims, 640 acres of patented lands and 2,000 acres of state uranium leases. Between five deposits, historic uranium resources are estimated at approximately133 million pounds of U3O8 .(1) Desert View and Whiskey Peak have large areas that have been identified as having good potential for ISR mining, whereas the other deposits are considered appropriate for conventional mining.

About the Sweetwater Plant

The Sweetwater Plant is a 3,000 ton per day conventional processing mill with a licensed capacity of 4.1 million pounds of U3O8. It is located approximately 40 miles northwest of

The plant has considerable infrastructure in place, including well-maintained buildings and equipment, a wash bay, warehouse, workshop, offices, access road and utilities. There is potential for the plant to be adapted for the recovery of uranium from loaded resins produced by ISR operations, subject to obtaining any necessary modifications to permits and licenses.

The Transaction

The Transaction is being completed pursuant to a stock purchase agreement between a subsidiary of the Company and Rio Tinto. Under the agreement, UEC will acquire

Note: | |

|

Advisors and Counsel

Goldman Sachs & Co. LLC and Rothschild & Co are acting as financial advisors to UEC in connection with the Transaction.

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly ISR mining uranium projects in

Stock Exchange Information:

NYSE American: UEC

WKN: AØJDRR

ISN: US916896103

Safe Harbor Statement

Except for the statements of historical fact contained herein, the information presented in this news release constitutes "forward-looking statements" as such term is used in applicable

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/uranium-energy-corp-expands-us-production-capacity-with-acquisition-of-rio-tintos-sweetwater-plant-and-wyoming-uranium-assets-302255092.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/uranium-energy-corp-expands-us-production-capacity-with-acquisition-of-rio-tintos-sweetwater-plant-and-wyoming-uranium-assets-302255092.html

SOURCE Uranium Energy Corp