UBS reports 3Q24 net profit of USD 1.4bn with 6.2trn in invested assets; delivering for clients, executing on integration at pace and investing for growth (Ad hoc announcement pursuant to Article 53 of the SIX Exchange Regulation Listing Rules)

UBS reported a net profit of USD 1.4bn in Q3 2024, with profit before tax of USD 1.9bn and underlying profit before tax of USD 2.4bn. The bank achieved USD 25bn in net new assets in Global Wealth Management, with total Group invested assets reaching USD 6.2trn, up 15% year-over-year. The bank realized USD 0.8bn in gross cost savings during Q3 and expects USD ~7.5bn for full-year 2024. UBS maintains a strong capital position with a CET1 capital ratio of 14.3% and successfully completed first wave of client account migrations in Luxembourg and Hong Kong.

UBS ha riportato un utile netto di USD 1,4 miliardi nel terzo trimestre del 2024, con un utile ante imposte di USD 1,9 miliardi e un utile sottostante ante imposte di USD 2,4 miliardi. La banca ha raggiunto USD 25 miliardi in nuovi attivi netti nella gestione patrimoniale globale, con un totale di attivi investiti del Gruppo pari a USD 6,2 trilioni, in aumento del 15% su base annua. UBS ha realizzato USD 0,8 miliardi di risparmi sui costi lordi durante il terzo trimestre e prevede circa USD 7,5 miliardi per l'intero anno 2024. UBS mantiene una solida posizione di capitale con un rapporto di capitale CET1 del 14,3% e ha completato con successo la prima fase delle migrazioni dei conti dei clienti in Lussemburgo e a Hong Kong.

UBS reportó una utilidad neta de USD 1.4 mil millones en el tercer trimestre de 2024, con una utilidad antes de impuestos de USD 1.9 mil millones y una utilidad subyacente antes de impuestos de USD 2.4 mil millones. El banco logró USD 25 mil millones en nuevos activos netos en Gestión de Patrimonios Globales, con activos totales del Grupo alcanzando USD 6.2 billones, un aumento del 15% interanual. El banco realizó USD 0.8 mil millones en ahorros de costos brutos durante el tercer trimestre y espera USD ~7.5 mil millones para todo el año 2024. UBS mantiene una fuerte posición de capital con un ratio de capital CET1 del 14.3% y completó con éxito la primera ola de migraciones de cuentas de clientes en Luxemburgo y Hong Kong.

UBS는 2024년 3분기에 USD 14억의 순이익을 보고했으며, 세전 이익은 USD 19억, 세전 기본 이익은 USD 24억에 달했습니다. 은행은 글로벌 자산 관리에서 USD 250억의 순 신규 자산을 달성했으며, 그룹 총 투자 자산은 USD 6.2조에 도달하여 전년 대비 15% 증가했습니다. 은행은 3분기 동안 USD 8억의 총 비용 절감을 실현하였고, 2024년 전체 연도에 대해 약 USD 75억을 예상하고 있습니다. UBS는 CET1 자본 비율 14.3%로 강력한 자본 위치를 유지하고 있으며, 룩셈부르크와 홍콩에서 고객 계좌 이관의 첫 번째 단계를 성공적으로 완료했습니다.

UBS a déclaré un bénéfice net de USD 1,4 milliard au troisième trimestre 2024, avec un bénéfice avant impôt de USD 1,9 milliard et un bénéfice sous-jacent avant impôt de USD 2,4 milliards. La banque a réalisé USD 25 milliards d'actifs nets nouveaux dans la gestion de patrimoine mondiale, avec un total d'actifs investis du Groupe atteignant USD 6,2 billions, en hausse de 15 % par rapport à l'année précédente. La banque a réalisé USD 0,8 milliard d'économies sur les coûts bruts au troisième trimestre et s'attend à environ USD 7,5 milliards pour l'année 2024. UBS maintient une solide position en capital avec un ratio de capital CET1 de 14,3 % et a réussi à compléter la première vague de migrations de comptes clients au Luxembourg et à Hong Kong.

UBS hat im dritten Quartal 2024 einen Nettogewinn von USD 1,4 Milliarden berichtet, mit einem Gewinn vor Steuern von USD 1,9 Milliarden und einem underlying Gewinn vor Steuern von USD 2,4 Milliarden. Die Bank erzielte USD 25 Milliarden an netto neuen Vermögenswerten im Bereich Global Wealth Management, wobei die Gesamtveranlagungen der Gruppe USD 6,2 Billionen erreichten, ein Anstieg von 15% im Vergleich zum Vorjahr. Die Bank realisierte USD 0,8 Milliarden an Brutto-Kosteneinsparungen im dritten Quartal und erwartet für das gesamte Jahr 2024 ca. USD 7,5 Milliarden. UBS hält eine starke Kapitalposition mit einer CET1-Kapitalquote von 14,3% und hat die erste Welle von Kundenkonto-Migrationen in Luxemburg und Hongkong erfolgreich abgeschlossen.

- Net profit of USD 1.4bn in Q3 2024

- Strong net new assets of USD 25bn in Global Wealth Management

- Group invested assets up 15% YoY to USD 6.2trn

- Global Markets revenues up 31% YoY

- Additional USD 0.8bn in gross cost savings realized in Q3

- Mid-single digit decline expected in Q4 net interest income for Global Wealth Management

- Higher quarterly tax rate expected at around 35%

- Non-core and Legacy expected to generate quarterly pre-tax loss

- Personal & Corporate Banking revenues decreased by 8%

Insights

The Q3 results showcase a strong performance with

The integration of Credit Suisse is progressing ahead of schedule, with

However, challenges include expected net interest income headwinds and a high cost-to-income ratio of

Client momentum remains robust across key markets, particularly in Americas and APAC. The

The investment banking division showed impressive growth with Global Markets revenues up

Market outlook suggests continued volatility with geopolitical tensions and US elections as key risk factors. The bank's strategic focus on wealth management and investment banking, combined with cost optimization, creates a solid foundation for sustainable growth despite macroeconomic uncertainties.

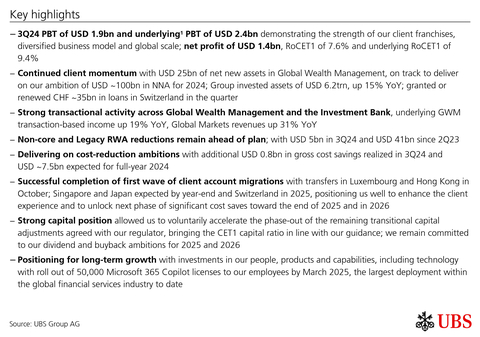

Key highlights (Graphic: UBS Group AG)

UBS (NYSE:UBS) (SWX:UBSN):

Key highlights

-

3Q24 PBT of

USD 1.9bn and underlying1 PBT ofUSD 2.4bn demonstrating the strength of our client franchises, diversified business model and global scale; net profit ofUSD 1.4bn , RoCET1 of7.6% and underlying RoCET1 of9.4% -

Continued client momentum with

USD 25bn of net new assets in Global Wealth Management, on track to deliver on our ambition of USD ~100bn in NNA for 2024; Group invested assets ofUSD 6.2trn , up15% YoY; granted or renewed CHF ~35bn in loans inSwitzerland in the quarter -

Strong transactional activity across Global Wealth Management and the Investment Bank, underlying GWM transaction-based income up

19% YoY, Global Markets revenues up31% YoY -

Non-core and Legacy RWA reductions remain ahead of plan; with

USD 5bn in 3Q24 andUSD 41bn since 2Q23 -

Delivering on cost-reduction ambitions with additional

USD 0.8bn in gross cost savings realized in 3Q24 and USD ~7.5bn expected for full-year 2024 -

Successful completion of first wave of client account migrations with transfers in Luxembourg and

Hong Kong in October;Singapore andJapan expected by year-end andSwitzerland in 2025, positioning us well to enhance the client experience and to unlock next phase of significant cost saves toward the end of 2025 and in 2026 - Strong capital position allowed us to voluntarily accelerate the phase-out of the remaining transitional capital adjustments agreed with our regulator, bringing the CET1 capital ratio in line with our guidance; we remain committed to our dividend and buyback ambitions for 2025 and 2026

- Positioning for long-term growth with investments in our people, products and capabilities, including technology with roll out of 50,000 Microsoft 365 Copilot licenses to our employees by March 2025, the largest deployment within the global financial services industry to date

“Our performance in the third quarter demonstrates the power of our unique client franchises, global scale and diversified business model. Against a market backdrop that, while constructive, still exhibited periods of high volatility and dislocation, our businesses delivered impressive revenue growth as we maintained strong client momentum, particularly in the

Selected financials for 3Q24

Profit before tax 1.9 USD bn |

Cost/income ratio 83.4 % |

RoCET1 capital 7.6 % |

Net profit 1.4 USD bn |

CET1 capital ratio 14.3 % |

Underlying1

2.4 USD bn |

Underlying1

78.5 % |

Underlying1

9.4 % |

Diluted

0.43 USD |

CET1

4.6 % |

Information in this news release is presented for UBS Group AG on a consolidated basis unless otherwise specified. |

||||

1 Underlying results exclude items of profit or loss that management believes are not representative of the underlying performance. Underlying results are a non-GAAP financial measure and alternative performance measure (APM). Refer to “Group Performance” and “Appendix-Alternative Performance Measures” in the financial report for the third quarter of 2024 for a reconciliation of underlying to reported results and definitions of the APMs. |

||||

Group summary

Strong financial performance

In 3Q24, we reported PBT of

Reported revenues were

Continued franchise strength and client momentum

During the third quarter, we remained close to our clients, guiding them through a market environment that while constructive, also showed signs of dislocation and volatility. Clients continue to value the investment opportunities we provide across our advice platform, as demonstrated by

As a leading provider of credit to Swiss companies and the economy, we are also delivering on our commitments to our home market. In the quarter, we granted or renewed CHF ~35bn of loans in

Transactional activity was strong during the quarter across both private and institutional clients. In GWM, underlying transaction-based income increased by

In Global Banking, underlying revenues increased

Ahead of plan on financial and operational integration priorities

We continue to execute on our integration plans, de-risking our balance sheet, and delivering on our cost reduction ambitions.

In 3Q24, we further reduced NCL RWA by

In the quarter, we maintained our cost optimization momentum across the Group, delivering an additional

Since June, we have also significantly advanced our work on migrating wealth management client accounts and data to UBS platforms. In October, we successfully achieved another milestone, moving all client accounts serviced out of Luxembourg and

With this we are well positioned to enhance the client experience and to unlock further cost reductions toward the end of 2025 and into 2026, as we deliver on our ambition of USD ~13bn in gross cost saves by the end of 2026.

Maintaining strong capital position; expecting to operate at ~

In the third quarter of 2024, reflecting our strong capital position, completion of legal entity mergers, overall progress on the integration and the winding down of NCL, we voluntarily accelerated the amortization of the remaining transitional purchase price allocation (PPA) adjustments for common equity tier 1 (CET1) capital purposes. This resulted in a

In connection with the acquisition of the Credit Suisse Group in 2023, the Swiss Financial Market Supervisory Authority (FINMA) had approved neutralizing a CET1 capital effect of

As these transitional adjustments only applied to UBS Group AG, the regulatory capital position of UBS AG was not impacted by the decision to fully amortize them. On a standalone basis as of 30 September 2024, UBS AG’s fully applied CET1 capital ratio is expected to be around

We expect that the adoption of the final Basel III standards in January 2025 will lead to a low single-digit percentage increase in the UBS Group’s RWA, reducing the CET1 capital ratio by around 30 basis points. This estimate is based on our current understanding of the relevant standards as we are in an active dialogue with FINMA regarding various aspects of the final rules. We continue to expect to operate with a CET1 capital ratio of around

We expect to complete our planned

Investing for long-term growth in our people, products and capabilities

In addition to meeting the current needs of our clients, executing the integration, and delivering on short term plans, we remain focused on positioning UBS for long-term growth. We continue to self-fund our investments in our people, products and capabilities to further develop our client offerings across all of our businesses, including our growth regions,

This includes building on our long-standing AI expertise and industry-leading cloud position to accelerate development and adoption of GenAI solutions that benefit clients and employees.

With the rollout of 50,000 Copilot licenses between now and the end of March 2025, UBS is currently implementing the largest Microsoft 365 Copilot deployment within the global financial services industry to date. Another example is Red, a proprietary new AI assistant that will provide 20,000 employees in

In these, and the many other AI deployments that are underway across the entire firm, we are focused on responsible AI. For example, all employees Group-wide are currently completing a ‘Responsible use of Generative AI’ training.

Outlook

In the third quarter of 2024 we saw strong client activity against a market backdrop that, while constructive, still exhibited periods of high volatility and dislocation.

Entering the fourth quarter, we see a continuation of these market conditions sustained by the prospects of a soft landing in the US economy. However, the macroeconomic outlook in the rest of the world remains clouded. In addition to seasonality, the ongoing geopolitical conflicts and the upcoming US elections are creating uncertainties that are likely to affect investor behavior.

In the fourth quarter, we anticipate a mid-single digit decline in net interest income in Global Wealth Management and a low single-digit decline in Personal & Corporate Banking. Non-core and Legacy is expected to generate a quarterly pre-tax loss in line with our earlier guidance.

The Group’s non-personnel costs are expected to show a seasonal sequential uptick. The Group’s quarterly tax rate is expected to be around

As we stay close to clients, helping them navigate this environment, and execute on our priorities, we will continue to invest to drive sustainable long-term value for our stakeholders while maintaining a balance sheet for all seasons.

Third quarter 2024 performance overview – Group

Group PBT

PBT of

Global Wealth Management (GWM) PBT

Total revenues increased by

Personal & Corporate Banking (P&C) PBT

Total revenues decreased by

Asset Management (AM) PBT

Total revenues increased by

Investment Bank (IB) PBT

Total revenues increased by

Non-core and Legacy (NCL) PBT

Total revenues decreased by

Group Items PBT

UBS’s sustainability highlights

We are guided by our ambition to be a global leader in sustainability. We remain committed to supporting our clients in the transition to a low-carbon world, leading by example in our own operations, and sharing our lessons learned along the way.

In September, MSCI reaffirmed our AA ESG rating and we increased our S&P Global Corporate Sustainability Assessment score. These are our first fully consolidated ESG ratings post the acquisition of Credit Suisse.

To build on our strong foundation, we are evolving our sustainability strategy, based on three pillars:

− Protect: manage our business aligned to our sustainable, long-term strategy;

− Grow: continue to expand our sustainability and impact offering for our clients to meet their evolving needs; and

− Attract: be the bank of choice for clients and employees.

We will communicate further details on our approach in our 2024 Sustainability Report, which will be published on 17 March 2025.

Selected financial information of the business divisions and Group Items |

|||||||

|

For the quarter ended 30.9.24 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

6,199 |

2,394 |

873 |

2,645 |

262 |

(39) |

12,334 |

of which: PPA effects and other integration items1 |

224 |

278 |

|

185 |

|

(25) |

662 |

Total revenues (underlying) |

5,975 |

2,116 |

873 |

2,461 |

262 |

(14) |

11,672 |

Credit loss expense / (release) |

2 |

83 |

0 |

9 |

28 |

0 |

121 |

Operating expenses as reported |

5,112 |

1,465 |

722 |

2,231 |

837 |

(84) |

10,283 |

of which: integration-related expenses and PPA effects2 |

419 |

198 |

86 |

156 |

270 |

(11) |

1,119 |

Operating expenses (underlying) |

4,693 |

1,267 |

636 |

2,076 |

567 |

(74) |

9,165 |

Operating profit / (loss) before tax as reported |

1,085 |

846 |

151 |

405 |

(603) |

45 |

1,929 |

Operating profit / (loss) before tax (underlying) |

1,280 |

766 |

237 |

377 |

(333) |

60 |

2,386 |

|

|||||||

|

For the quarter ended 30.6.24 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

6,053 |

2,272 |

768 |

2,803 |

401 |

(392) |

11,904 |

of which: PPA effects and other integration items1 |

233 |

246 |

|

310 |

|

(8) |

780 |

Total revenues (underlying) |

5,820 |

2,026 |

768 |

2,493 |

401 |

(384) |

11,124 |

Credit loss expense / (release) |

(1) |

103 |

0 |

(6) |

(1) |

0 |

95 |

Operating expenses as reported |

5,183 |

1,396 |

638 |

2,332 |

807 |

(15) |

10,340 |

of which: integration-related expenses and PPA effects2 |

523 |

182 |

98 |

245 |

325 |

(2) |

1,372 |

Operating expenses (underlying) |

4,660 |

1,213 |

540 |

2,087 |

481 |

(13) |

8,969 |

Operating profit / (loss) before tax as reported |

871 |

773 |

130 |

477 |

(405) |

(377) |

1,469 |

Operating profit / (loss) before tax (underlying) |

1,161 |

710 |

228 |

412 |

(80) |

(371) |

2,060 |

|

|||||||

|

For the quarter ended 30.9.233 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

5,953 |

2,517 |

775 |

2,162 |

366 |

(78) |

11,695 |

of which: PPA effects and other integration items1 |

388 |

333 |

|

251 |

|

(14) |

958 |

Total revenues (underlying) |

5,565 |

2,184 |

775 |

1,911 |

366 |

(64) |

10,737 |

Credit loss expense / (release) |

10 |

160 |

0 |

4 |

59 |

5 |

239 |

Operating expenses as reported |

5,017 |

1,400 |

738 |

2,412 |

2,068 |

6 |

11,640 |

of which: integration-related expenses and PPA effects2 |

448 |

174 |

126 |

368 |

920 |

(5) |

2,031 |

of which: acquisition-related costs |

|

|

|

|

|

26 |

26 |

Operating expenses (underlying) |

4,569 |

1,226 |

612 |

2,043 |

1,149 |

(15) |

9,583 |

Operating profit / (loss) before tax as reported |

926 |

957 |

37 |

(254) |

(1,762) |

(89) |

(184) |

Operating profit / (loss) before tax (underlying) |

986 |

798 |

163 |

(136) |

(842) |

(55) |

914 |

1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

|

|||||||

Selected financial information of the business divisions and Group Items (continued) |

||||||||

|

Year-to-date 30.9.24 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

|

Total |

Total revenues as reported |

18,395 |

7,089 |

2,416 |

8,199 |

1,664 |

(786) |

|

36,976 |

of which: PPA effects and other integration items1 |

691 |

780 |

|

787 |

|

(37) |

|

2,221 |

Total revenues (underlying) |

17,705 |

6,308 |

2,416 |

7,412 |

1,664 |

(749) |

|

34,755 |

Credit loss expense / (release) |

(2) |

229 |

0 |

34 |

63 |

(2) |

|

322 |

Operating expenses as reported |

15,340 |

4,265 |

2,025 |

6,728 |

2,655 |

(132) |

|

30,880 |

of which: integration-related expenses and PPA effects2 |

1,347 |

540 |

255 |

543 |

837 |

(12) |

|

3,511 |

Operating expenses (underlying) |

13,993 |

3,725 |

1,770 |

6,185 |

1,817 |

(120) |

|

27,370 |

Operating profit / (loss) before tax as reported |

3,057 |

2,594 |

392 |

1,437 |

(1,054) |

(652) |

|

5,773 |

Operating profit / (loss) before tax (underlying) |

3,713 |

2,354 |

647 |

1,193 |

(216) |

(627) |

|

7,063 |

|

||||||||

|

Year-to-date 30.9.233,4 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Negative goodwill |

Total |

Total revenues as reported |

16,002 |

5,604 |

1,861 |

6,562 |

551 |

(602) |

|

29,979 |

of which: PPA effects and other integration items1 |

574 |

477 |

|

306 |

|

(20) |

|

1,336 |

Total revenues (underlying) |

15,428 |

5,128 |

1,861 |

6,257 |

551 |

(582) |

|

28,643 |

Negative goodwill |

|

|

|

|

|

|

27,264 |

27,264 |

Credit loss expense / (release) |

174 |

398 |

1 |

142 |

178 |

7 |

|

901 |

Operating expenses as reported |

12,663 |

2,996 |

1,649 |

6,302 |

3,304 |

422 |

|

27,336 |

of which: integration-related expenses and PPA effects2 |

516 |

211 |

140 |

529 |

1,024 |

342 |

|

2,763 |

of which: acquisition-related costs |

|

|

|

|

|

202 |

|

202 |

Operating expenses (underlying) |

12,147 |

2,785 |

1,509 |

5,773 |

2,279 |

(122) |

|

24,371 |

Operating profit / (loss) before tax as reported |

3,165 |

2,210 |

211 |

118 |

(2,930) |

(1,031) |

27,264 |

29,006 |

Operating profit / (loss) before tax (underlying) |

3,107 |

1,945 |

351 |

341 |

(1,906) |

(467) |

|

3,371 |

1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 4 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

|

||||||||

Our key figures |

|

|

|

|

|

|

|

|

|

|

As of or for the quarter ended |

|

As of or year-to-date |

||||

USD m, except where indicated |

|

30.9.24 |

30.6.24 |

31.12.231 |

30.9.231 |

|

30.9.24 |

30.9.231 |

Group results |

|

|

|

|

|

|

|

|

Total revenues |

|

12,334 |

11,904 |

10,855 |

11,695 |

|

36,976 |

29,979 |

Negative goodwill |

|

|

|

|

|

|

|

27,264 |

Credit loss expense / (release) |

|

121 |

95 |

136 |

239 |

|

322 |

901 |

Operating expenses |

|

10,283 |

10,340 |

11,470 |

11,640 |

|

30,880 |

27,336 |

Operating profit / (loss) before tax |

|

1,929 |

1,469 |

(751) |

(184) |

|

5,773 |

29,006 |

Net profit / (loss) attributable to shareholders |

|

1,425 |

1,136 |

(279) |

(715) |

|

4,315 |

27,645 |

Diluted earnings per share (USD)2 |

|

0.43 |

0.34 |

(0.09) |

(0.22) |

|

1.29 |

8.46 |

Profitability and growth3,4 |

|

|

|

|

|

|

|

|

Return on equity (%) |

|

6.7 |

5.4 |

(1.3) |

(3.4) |

|

6.8 |

52.1 |

Return on tangible equity (%) |

|

7.3 |

5.9 |

(1.4) |

(3.7) |

|

7.4 |

57.7 |

Underlying return on tangible equity (%)5 |

|

9.0 |

8.4 |

4.8 |

1.5 |

|

9.1 |

3.8 |

Return on common equity tier 1 capital (%) |

|

7.6 |

5.9 |

(1.4) |

(3.7) |

|

7.5 |

60.0 |

Underlying return on common equity tier 1 capital (%)5 |

|

9.4 |

8.4 |

4.8 |

1.5 |

|

9.2 |

4.0 |

Return on leverage ratio denominator, gross (%) |

|

3.1 |

3.0 |

2.6 |

2.8 |

|

3.1 |

3.0 |

Cost / income ratio (%)6 |

|

83.4 |

86.9 |

105.7 |

99.5 |

|

83.5 |

91.2 |

Underlying cost / income ratio (%)5,6 |

|

78.5 |

80.6 |

93.0 |

89.3 |

|

78.8 |

85.1 |

Effective tax rate (%) |

|

26.0 |

20.0 |

n.m.7 |

n.m.7 |

|

24.4 |

4.6 |

Net profit growth (%) |

|

n.m. |

(95.8) |

n.m. |

n.m. |

|

(84.4) |

362.5 |

Resources3 |

|

|

|

|

|

|

|

|

Total assets |

|

1,623,941 |

1,560,976 |

1,716,924 |

1,643,684 |

|

1,623,941 |

1,643,684 |

Equity attributable to shareholders |

|

87,025 |

83,683 |

85,624 |

83,265 |

|

87,025 |

83,265 |

Common equity tier 1 capital8 |

|

74,213 |

76,104 |

78,002 |

76,926 |

|

74,213 |

76,926 |

Risk-weighted assets8 |

|

519,363 |

511,376 |

546,505 |

546,491 |

|

519,363 |

546,491 |

Common equity tier 1 capital ratio (%)8 |

|

14.3 |

14.9 |

14.3 |

14.1 |

|

14.3 |

14.1 |

Going concern capital ratio (%)8 |

|

17.5 |

18.0 |

16.8 |

16.4 |

|

17.5 |

16.4 |

Total loss-absorbing capacity ratio (%)8 |

|

37.5 |

38.7 |

36.4 |

35.4 |

|

37.5 |

35.4 |

Leverage ratio denominator8 |

|

1,608,341 |

1,564,201 |

1,695,403 |

1,615,817 |

|

1,608,341 |

1,615,817 |

Common equity tier 1 leverage ratio (%)8 |

|

4.6 |

4.9 |

4.6 |

4.8 |

|

4.6 |

4.8 |

Liquidity coverage ratio (%)9 |

|

199.2 |

212.0 |

215.7 |

196.5 |

|

199.2 |

196.5 |

Net stable funding ratio (%) |

|

126.9 |

128.0 |

124.7 |

120.7 |

|

126.9 |

120.7 |

Other |

|

|

|

|

|

|

|

|

Invested assets (USD bn)4,10 |

|

6,199 |

5,873 |

5,714 |

5,373 |

|

6,199 |

5,373 |

Personnel (full-time equivalents) |

|

109,396 |

109,991 |

112,842 |

115,981 |

|

109,396 |

115,981 |

Market capitalization2,11 |

|

106,528 |

101,903 |

107,355 |

85,768 |

|

106,528 |

85,768 |

Total book value per share (USD)2 |

|

27.32 |

26.13 |

26.68 |

25.75 |

|

27.32 |

25.75 |

Tangible book value per share (USD)2 |

|

25.10 |

23.85 |

24.34 |

23.44 |

|

25.10 |

23.44 |

1 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 2 Refer to the “Share information and earnings per share” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 3 Refer to the “Targets, capital guidance and ambitions” section of the UBS Group Annual Report 2023, available under “Annual reporting” at ubs.com/investors, for more information about our performance targets. 4 Refer to “Alternative performance measures” in the appendix to the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for the definition and calculation method. 5 Refer to the “Group performance” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information about underlying results. 6 Negative goodwill is not used in the calculation as it is presented in a separate reporting line and is not part of total revenues. 7 The effective tax rate for the fourth and third quarters of 2023 is not a meaningful measure, due to the distortive effect of current unbenefited tax losses at the former Credit Suisse entities. 8 Based on the Swiss systemically relevant bank framework as of 1 January 2020. Refer to the “Capital management” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 9 The disclosed ratios represent quarterly averages for the quarters presented and are calculated based on an average of 65 data points in the third quarter of 2024, 61 data points in the second quarter of 2024, 63 data points in the fourth quarter of 2023 and 63 data points in the third quarter of 2023. Refer to the “Liquidity and funding management” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 10 Consists of invested assets for Global Wealth Management, Asset Management (including invested assets from associates) and Personal & Corporate Banking. Refer to “Note 32 Invested assets and net new money” in the “Consolidated financial statements” section of the UBS Group Annual Report 2023, available under “Annual reporting” at ubs.com/investors, for more information. 11 The calculation of market capitalization reflects total shares issued multiplied by the share price at the end of the period.

|

||||||||

Income statement |

|

|

|

|

|

|

|

|

|

|

|

|

For the quarter ended |

|

% change from |

|

Year-to-date |

||||

USD m |

|

30.9.24 |

30.6.24 |

30.9.231 |

|

2Q24 |

3Q23 |

|

30.9.24 |

30.9.231 |

Net interest income |

|

1,794 |

1,535 |

2,107 |

|

17 |

(15) |

|

5,270 |

5,202 |

Other net income from financial instruments measured at fair value through profit or loss |

|

3,681 |

3,684 |

3,226 |

|

0 |

14 |

|

11,547 |

8,425 |

Net fee and commission income |

|

6,517 |

6,531 |

6,056 |

|

0 |

8 |

|

19,540 |

15,790 |

Other income |

|

341 |

154 |

305 |

|

122 |

12 |

|

619 |

563 |

Total revenues |

|

12,334 |

11,904 |

11,695 |

|

4 |

5 |

|

36,976 |

29,979 |

Negative goodwill |

|

|

|

|

|

|

|

|

|

27,264 |

Credit loss expense / (release) |

|

121 |

95 |

239 |

|

28 |

(49) |

|

322 |

901 |

|

|

|

|

|

|

|

|

|

|

|

Personnel expenses |

|

6,889 |

7,119 |

7,567 |

|

(3) |

(9) |

|

20,957 |

17,838 |

General and administrative expenses |

|

2,389 |

2,318 |

3,124 |

|

3 |

(24) |

|

7,120 |

7,157 |

Depreciation, amortization and impairment of non-financial assets |

|

1,006 |

903 |

950 |

|

11 |

6 |

|

2,804 |

2,341 |

Operating expenses |

|

10,283 |

10,340 |

11,640 |

|

(1) |

(12) |

|

30,880 |

27,336 |

Operating profit / (loss) before tax |

|

1,929 |

1,469 |

(184) |

|

31 |

|

|

5,773 |

29,006 |

Tax expense / (benefit) |

|

502 |

293 |

526 |

|

71 |

(5) |

|

1,407 |

1,346 |

Net profit / (loss) |

|

1,428 |

1,175 |

(711) |

|

21 |

|

|

4,366 |

27,660 |

Net profit / (loss) attributable to non-controlling interests |

|

3 |

40 |

4 |

|

(92) |

(22) |

|

51 |

15 |

Net profit / (loss) attributable to shareholders |

|

1,425 |

1,136 |

(715) |

|

25 |

|

|

4,315 |

27,645 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income |

|

3,910 |

1,614 |

(2,622) |

|

142 |

|

|

5,279 |

25,679 |

Total comprehensive income attributable to non-controlling interests |

|

27 |

18 |

(8) |

|

47 |

|

|

40 |

4 |

Total comprehensive income attributable to shareholders |

|

3,883 |

1,596 |

(2,614) |

|

143 |

|

|

5,239 |

25,675 |

1 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. |

||||||||||

Information about results materials and the earnings call

UBS’s third quarter 2024 report, news release and slide presentation are available from 06:45 CET on Wednesday, 30 October 2024, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its third quarter 2024 results on Wednesday, 30 October 2024. The results will be presented by Sergio P. Ermotti (Group Chief Executive Officer), Todd Tuckner (Group Chief Financial Officer) and Sarah Mackey (Head of Investor Relations).

Time

09:00 CET

08:00 GMT

04:00 US EDT

Audio webcast

The presentation for analysts can be followed live on ubs.com/quarterlyreporting with a simultaneous slide show.

Webcast playback

An audio playback of the results presentation will be made available at ubs.com/investors later in the day.

Cautionary statement regarding forward-looking statements

This news release contains statements that constitute “forward-looking statements”, including but not limited to management’s outlook for UBS’s financial performance, statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development and goals or intentions to achieve climate, sustainability and other social objectives. While these forward-looking statements represent UBS’s judgments, expectations and objectives concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. In particular, the global economy may be negatively affected by shifting political circumstances, including as a result of elections, increased tension between world powers, growing conflicts in the

Rounding

Numbers presented throughout this news release may not add up precisely to the totals provided in the tables and text. Percentages and percent changes disclosed in text and tables are calculated on the basis of unrounded figures. Absolute changes between reporting periods disclosed in the text, which can be derived from numbers presented in related tables, are calculated on a rounded basis.

Tables

Within tables, blank fields generally indicate non-applicability or that presentation of any content would not be meaningful, or that information is not available as of the relevant date or for the relevant period. Zero values generally indicate that the respective figure is zero on an actual or rounded basis. Values that are zero on a rounded basis can be either negative or positive on an actual basis.

Websites

In this news release, any website addresses are provided solely for information and are not intended to be active links. UBS is not incorporating the contents of any such websites into this news release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241029198989/en/

UBS Group AG

Investor contact

Media contact

APAC: +852-297-1 82 00

Source: UBS