United States Antimony Corporation Reports Record Fiscal Year 2024 Results

United States Antimony (NYSE American:UAMY) reported strong fiscal year 2024 results with significant growth across key metrics. Revenue increased 72% to $14.9 million, up from $8.7 million in 2023. Cost of sales decreased by 5% ($567K), leading to a 204% increase in gross profit.

Operating expenses rose by $2.1 million to $5.9 million, primarily due to new personnel costs ($1.7 million) and project development ($889K). The company reduced its net loss from $6.3 million in 2023 to $1.7 million in 2024. The balance sheet shows $18.2 million in cash with minimal debt of $328K.

The zeolite division achieved significant improvements, increasing production capacity from 4 to 12 tons per hour and reaching 98.4% run time in Q4. The company is expanding operations with the Madero Smelter in Mexico starting operations and plans to begin mining antimony from Alaskan claims in Q3 2025.

United States Antimony (NYSE American:UAMY) ha riportato risultati solidi per l'anno fiscale 2024 con una crescita significativa in vari indicatori chiave. I ricavi sono aumentati del 72% raggiungendo 14,9 milioni di dollari, rispetto agli 8,7 milioni di dollari del 2023. I costi di vendita sono diminuiti del 5% (567K dollari), portando a un aumento del 204% del profitto lordo.

Le spese operative sono aumentate di 2,1 milioni di dollari, raggiungendo i 5,9 milioni di dollari, principalmente a causa dei costi per nuovo personale (1,7 milioni di dollari) e dello sviluppo di progetti (889K dollari). L'azienda ha ridotto la sua perdita netta da 6,3 milioni di dollari nel 2023 a 1,7 milioni di dollari nel 2024. Il bilancio mostra 18,2 milioni di dollari in contante con un debito minimo di 328K dollari.

La divisione zeolite ha ottenuto miglioramenti significativi, aumentando la capacità produttiva da 4 a 12 tonnellate all'ora e raggiungendo il 98,4% di tempo di funzionamento nel Q4. L'azienda sta espandendo le operazioni con il Madero Smelter in Messico che inizia le operazioni e prevede di iniziare l'estrazione di antimonio da concessioni in Alaska nel Q3 2025.

United States Antimony (NYSE American:UAMY) reportó resultados sólidos para el año fiscal 2024 con un crecimiento significativo en métricas clave. Los ingresos aumentaron un 72% alcanzando los 14,9 millones de dólares, en comparación con los 8,7 millones de dólares en 2023. El costo de ventas disminuyó en un 5% (567K dólares), lo que llevó a un aumento del 204% en la ganancia bruta.

Los gastos operativos aumentaron en 2,1 millones de dólares, alcanzando los 5,9 millones de dólares, principalmente debido a nuevos costos de personal (1,7 millones de dólares) y desarrollo de proyectos (889K dólares). La empresa redujo su pérdida neta de 6,3 millones de dólares en 2023 a 1,7 millones de dólares en 2024. El balance muestra 18,2 millones de dólares en efectivo con una deuda mínima de 328K dólares.

La división de zeolitas logró mejoras significativas, aumentando la capacidad de producción de 4 a 12 toneladas por hora y alcanzando un 98,4% de tiempo de funcionamiento en el Q4. La empresa está expandiendo sus operaciones con el Madero Smelter en México comenzando operaciones y planea iniciar la minería de antimonio en reclamos de Alaska en el Q3 de 2025.

유나이티드 스테이츠 앤토미(UAMY, NYSE American)는 2024 회계 연도에 강력한 실적을 보고하며 주요 지표에서 상당한 성장을 보였습니다. 매출은 72% 증가하여 1,490만 달러에 달했습니다, 2023년의 870만 달러에서 증가한 수치입니다. 판매 비용은 5% 감소(567K 달러)하여 총 이익이 204% 증가했습니다.

운영 비용은 210만 달러 증가하여 590만 달러에 도달했으며, 이는 주로 신규 인력 비용(170만 달러)과 프로젝트 개발(889K 달러) 때문입니다. 회사는 2023년 630만 달러에서 2024년 170만 달러로 순손실을 줄였습니다. 재무제표에는 현금 1,820만 달러와 최소 부채 328K 달러가 표시되어 있습니다.

제올라이트 부문은 생산 능력을 시간당 4톤에서 12톤으로 증가시키고 4분기 동안 98.4%의 가동 시간을 달성하며 상당한 개선을 이루었습니다. 회사는 멕시코의 마데로 제련소에서 운영을 시작하고 2025년 3분기에는 알래스카의 채굴을 시작할 계획입니다.

United States Antimony (NYSE American:UAMY) a annoncé de solides résultats pour l'exercice fiscal 2024, avec une croissance significative dans plusieurs indicateurs clés. Le chiffre d'affaires a augmenté de 72 % pour atteindre 14,9 millions de dollars, contre 8,7 millions de dollars en 2023. Le coût des ventes a diminué de 5 % (567K dollars), entraînant une augmentation de 204 % du bénéfice brut.

Les frais d'exploitation ont augmenté de 2,1 millions de dollars pour atteindre 5,9 millions de dollars, principalement en raison des coûts liés au nouveau personnel (1,7 million de dollars) et au développement de projets (889K dollars). L'entreprise a réduit sa perte nette de 6,3 millions de dollars en 2023 à 1,7 million de dollars en 2024. Le bilan indique 18,2 millions de dollars en liquidités avec une dette minimale de 328K dollars.

La division des zéolites a réalisé des améliorations significatives, augmentant la capacité de production de 4 à 12 tonnes par heure et atteignant un temps de fonctionnement de 98,4 % au quatrième trimestre. L'entreprise élargit ses opérations avec le Madero Smelter au Mexique qui commence ses activités et prévoit de commencer l'extraction d'antimoine dans des concessions en Alaska au troisième trimestre 2025.

United States Antimony (NYSE American:UAMY) berichtete über starke Ergebnisse für das Geschäftsjahr 2024 mit signifikantem Wachstum in wichtigen Kennzahlen. Der Umsatz stieg um 72% auf 14,9 Millionen Dollar, verglichen mit 8,7 Millionen Dollar im Jahr 2023. Die Kosten der verkauften Waren sanken um 5% (567K Dollar), was zu einem 204%igen Anstieg des Bruttogewinns führte.

Die Betriebskosten stiegen um 2,1 Millionen Dollar auf 5,9 Millionen Dollar, hauptsächlich aufgrund neuer Personalkosten (1,7 Millionen Dollar) und Projektentwicklung (889K Dollar). Das Unternehmen reduzierte seinen Nettoverlust von 6,3 Millionen Dollar im Jahr 2023 auf 1,7 Millionen Dollar im Jahr 2024. Die Bilanz zeigt 18,2 Millionen Dollar in bar bei einer minimalen Verschuldung von 328K Dollar.

Die Zeolith-Abteilung erzielte signifikante Verbesserungen, indem sie die Produktionskapazität von 4 auf 12 Tonnen pro Stunde steigerte und im vierten Quartal eine Betriebszeit von 98,4% erreichte. Das Unternehmen erweitert seine Aktivitäten mit dem Madero Schmelzwerk in Mexiko, das den Betrieb aufnimmt, und plant, im dritten Quartal 2025 mit dem Abbau von Antimon aus Ansprüchen in Alaska zu beginnen.

- Revenue increased 72% YoY to $14.9 million

- Gross profit surged 204% YoY

- Cost of sales decreased 5% YoY

- Net loss improved by $4.6 million to $1.7 million

- Strong balance sheet with $18.2 million cash and minimal debt

- Zeolite production capacity tripled to 12 tons per hour

- Received $1.5 million from warrant exercises

- Operating expenses increased by $2.1 million to $5.9 million

- Still operating at a net loss of $1.7 million

- Issued 2,204,000 new common shares from warrant exercises

Insights

UAMY's fiscal 2024 results reveal remarkable financial improvement with

The balance sheet strength is impressive with

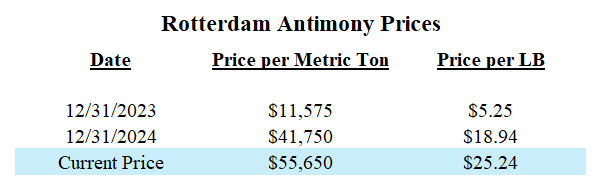

The antimony market dynamics create a perfect environment for UAMY's expanding operations, with prices increasing nearly five-fold in just over a year. As the only antimony smelter operator in both the US and Mexico, UAMY holds a uniquely advantageous position in a critical minerals market facing supply constraints and trade restrictions.

Their zeolite division transformation is equally noteworthy – plant availability increased from below

The substantial investment in human capital – adding eight executive positions and two sales roles – indicates management's confidence in sustaining this growth trajectory through 2025 and beyond.

"The Critical Minerals and ZEO Company"

Revenues Up

Cost of Sales Down

Gross Profit Up

DALLAS, TX / ACCESS Newswire / March 20, 2025 / United States Antimony Corporation ("USAC," the "Company" or "U.S. Antimony Corporation"), (NYSE American:UAMY) reported today its fiscal year 2024 financial and operational results.

Revenues for the full year of 2024 increased

The Company ended 2024 with another strong balance sheet with

Antimony continues to be a scarce commodity worldwide due to a combination of supply issues and trade restrictions imposed on and by certain countries. The result has been the best performing price of any critical mineral as indicated below:

With almost a five times increase in price of antimony in just over a year, and being the only antimony smelter in the United States as well as the only antimony smelter in Mexico, USAC is well positioned to capitalize on the opportunity at hand.

Our zeolite division in 2024 was a turn around year for USAC. We completed a substantial number of repairs that was a result of prior management negligence. We went from under a

Commenting on the Fiscal Year 2024 financial and operational results, Mr. Gary C. Evans, Chairman and CEO of U.S. Antimony Corporation stated, "This past year was a significant turning point for USAC. While we are proud to report the markedly improved operating and financial performance of the Company, the real meaningful changes are just now occurring. Once we are able to report our quarterly results in 2025, these overall financial improvements we are experiencing will become most evident. Since the beginning of last year, we have added a Controller, five Vice Presidents, one Senior Vice President, one Executive Vice President, and two sales personnel. These new hires are crucial to our expanded business operations and growth initiatives.

All divisions of the Company are improving on a monthly, and many times, weekly basis. This is a result of higher volumes through our facilities, improved pricing of our products and unprecedented demand. As we announced late last year, we are firing up our Madero Smelter in Mexico this month with new international antimony material arriving today at a key port in Mexico. Additional raw antimony inventory is on the water being shipped to Mexico. All necessary improvements to furnaces at Madero have been completed on time and below budget. We see this business becoming a key contributor to our financial results in the remaining three quarters of 2025.

Our previously announced plan to bring antimony ore from our own mining claims located in Alaska to Montana, are on track for the third quarter of this year. Additionally, when we begin trucking this antimony material to Thompson Falls, an improvement to our operating margins at our smelter located there should occur. This also will greatly reduce our dependence on foreign buying and sourcing of antimony ore. We will be the first company in the United States to begin mining antimony again in a material way. No other North American company has the capability to mine, float, and smelter antimony under one roof, as we will soon be doing. The next step in our plan is to further expand our capabilities by improving our overall in-take volumes. That will occur from a combination of efficiency improvements and expansion plans underway. This will likely occur at both our U.S. and Mexican smelters and will continue throughout 2025.

This is an extremely exciting time for our Company. Our Board of Directors and Management Team are very proud of the fact we are assisting our industrial customers and our government in bringing supply certainty into the antimony sector. Not three to five years down the road but today. We fully recognize we have a window of opportunity, and we are doing everything in our control to capture and seize on it as much as possible now, for the combined benefit of not only our customers but our shareholders as well."

USAC has historically not provided any financial guidance. While there exists many moving parts within the organization related to its operating assets, 2025 consolidated revenues are being currently estimated as follows:

United States Antimony Corporation and Subsidiaries

Consolidated Statements of Operations

| For the years ended |

| ||||||

| December 31, 2024 |

|

| December 31, 2023 |

| |||

REVENUES |

| $ | 14,937,962 |

|

| $ | 8,693,155 |

|

COST OF REVENUES |

|

| 11,471,044 |

|

|

| 12,037,939 |

|

GROSS PROFIT (LOSS) |

|

| 3,466,918 |

|

|

| (3,344,784 | ) |

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

General and administrative |

|

| 2,052,852 |

|

|

| 1,642,269 |

|

Salaries and benefits |

|

| 2,350,021 |

|

|

| 639,172 |

|

Professional fees |

|

| 968,750 |

|

|

| 643,208 |

|

Loss on sale or disposal of property, plant and equipment, net |

|

| 11,097 |

|

|

| 217,921 |

|

Other operating expenses |

|

| 475,010 |

|

|

| 581,647 |

|

TOTAL OPERATING EXPENSES |

|

| 5,857,730 |

|

|

| 3,724,217 |

|

LOSS FROM OPERATIONS |

|

| (2,390,812 | ) |

|

| (7,069,001 | ) |

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

Interest and investment income |

|

| 668,543 |

|

|

| 618,762 |

|

Trademark and licensing income |

|

| 27,987 |

|

|

| 32,007 |

|

Other miscellaneous income (expense) |

|

| (36,122 | ) |

|

| 69,945 |

|

TOTAL OTHER INCOME |

|

| 660,408 |

|

|

| 720,714 |

|

LOSS BEFORE INCOME TAXES |

|

| (1,730,404 | ) |

|

| (6,348,287 | ) |

Income tax expense |

|

| - |

|

|

| - |

|

Net loss |

|

| (1,730,404 | ) |

|

| (6,348,287 | ) |

Preferred dividends |

|

| (7,500 | ) |

|

| (7,500 | ) |

Net loss available to common stockholders |

| $ | (1,737,904 | ) |

| $ | (6,355,787 | ) |

|

|

|

|

|

|

|

| |

Net loss per share of common stock: |

|

|

|

|

|

|

|

|

Basic |

| $ | (0.02 | ) |

| $ | (0.06 | ) |

Diluted |

| $ | (0.02 | ) |

| $ | (0.06 | ) |

|

|

|

|

|

|

|

| |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

| 108,591,429 |

|

|

| 107,551,931 |

|

Diluted |

|

| 108,591,429 |

|

|

| 107,551,931 |

|

United States Antimony Corporation and Subsidiaries

Consolidated Balance Sheets

| December 31, 2024 |

|

| December 31, 2023 |

| |||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 18,172,120 |

|

| $ | 11,899,574 |

|

Certificates of deposit |

|

| - |

|

|

| 72,898 |

|

Accounts receivable, net |

|

| 1,156,564 |

|

|

| 625,256 |

|

Inventories |

|

| 1,245,724 |

|

|

| 1,386,109 |

|

Prepaid expenses and other current assets |

|

| 104,161 |

|

|

| 92,369 |

|

Total current assets |

|

| 20,678,569 |

|

|

| 14,076,206 |

|

Properties, plants and equipment, net |

|

| 12,891,447 |

|

|

| 13,454,491 |

|

Operating lease right-of-use asset |

|

| 565,289 |

|

|

| - |

|

Restricted cash for reclamation bonds |

|

| 98,778 |

|

|

| 55,061 |

|

IVA receivable and other assets, net |

|

| 408,519 |

|

|

| 509,237 |

|

Total assets |

| $ | 34,642,602 |

|

| $ | 28,094,995 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 1,545,708 |

|

| $ | 456,935 |

|

Accrued liabilities |

|

| 1,427,146 |

|

|

| 133,841 |

|

Accrued liabilities - directors |

|

| 141,287 |

|

|

| 124,810 |

|

Royalties payable |

|

| 133,434 |

|

|

| 153,429 |

|

Current portion of operating lease liability |

|

| 626,562 |

|

|

| - |

|

Long-term debt, current portion |

|

| 132,252 |

|

|

| 28,443 |

|

Total current liabilities |

|

| 4,006,389 |

|

|

| 897,458 |

|

Noncurrent liabilities: |

|

|

|

|

|

|

|

|

Noncurrent operating lease liability |

|

| 129,007 |

|

|

| - |

|

Long-term debt, net of current portion |

|

| 195,425 |

|

|

| - |

|

Stock payable to directors |

|

| - |

|

|

| 38,542 |

|

Asset retirement obligations |

|

| 1,711,108 |

|

|

| 1,638,027 |

|

Total liabilities |

|

| 6,041,929 |

|

|

| 2,574,027 |

|

COMMITMENTS AND CONTINGENCIES (Note 11) |

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Preferred stock |

|

|

|

|

|

|

|

|

Series A: 0 shares issued and outstanding |

|

| - |

|

|

| - |

|

Series B: 750,000 shares issued and outstanding (liquidation preference |

|

| 7,500 |

|

|

| 7,500 |

|

Series C: 177,904 shares issued and outstanding (liquidation preference |

|

| 1,779 |

|

|

| 1,779 |

|

Series D: 0 shares issued and outstanding |

|

| - |

|

|

| - |

|

Common stock, |

|

| 1,129,512 |

|

|

| 1,076,472 |

|

Additional paid-in capital |

|

| 68,610,905 |

|

|

| 63,853,836 |

|

Accumulated deficit |

|

| (41,149,023 | ) |

|

| (39,418,619 | ) |

Total stockholders' equity |

|

| 28,600,673 |

|

|

| 25,520,968 |

|

Total liabilities and stockholders' equity |

| $ | 34,642,602 |

|

| $ | 28,094,995 |

|

United States Antimony Corporation and Subsidiaries

Consolidated Statements of Cash Flows

| For the years ended |

| ||||||

| December 31, 2024 |

|

| December 31, 2023 |

| |||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net loss |

| $ | (1,730,404 | ) |

| $ | (6,348,287 | ) |

Adjustments to reconcile net loss to |

|

|

|

|

|

|

|

|

net cash provided (used) by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 1,085,747 |

|

|

| 959,445 |

|

Accretion of asset retirement obligation |

|

| 73,081 |

|

|

| 13,471 |

|

Changes in asset retirement obligation estimates |

|

| - |

|

|

| 324,984 |

|

Noncash operating lease expense |

|

| 222,188 |

|

|

| - |

|

Share-based compensation |

|

| 568,588 |

|

|

| - |

|

Loss on sale or disposal of property, plant and equipment, net |

|

| 11,097 |

|

|

| 217,921 |

|

Write-down of inventory to net realizable value |

|

| 65,647 |

|

|

| 2,073,404 |

|

Change in allowance for doubtful accounts on accounts receivable |

|

| (261,047 | ) |

|

| 239,772 |

|

Change in IVA receivable and other assets, net |

|

| 100,718 |

|

|

| 388,442 |

|

Other noncash items |

|

| (16,107 | ) |

|

| (7,500 | ) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

| (270,261 | ) |

|

| (80,571 | ) |

Inventories |

|

| 74,738 |

|

|

| (2,084,445 | ) |

Prepaid expenses and other current assets |

|

| (11,792 | ) |

|

| 45,230 |

|

Accounts payable |

|

| 1,088,773 |

|

|

| (171,868 | ) |

Accrued liabilities |

|

| 1,293,305 |

|

|

| (67,308 | ) |

Accrued liabilities - directors |

|

| 16,477 |

|

|

| 51,847 |

|

Stock payable to directors |

|

| (38,542 | ) |

|

| (22,917 | ) |

Change in operating lease liability |

|

| (31,908 | ) |

|

| - |

|

Royalties payable |

|

| (19,995 | ) |

|

| (281,646 | ) |

Net cash provided (used) by operating activities |

|

| 2,220,303 |

|

|

| (4,750,026 | ) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from redemption of certificates of deposit |

|

| 72,898 |

|

|

| 186,959 |

|

Proceeds from sale of properties, plants and equipment |

|

| 315,625 |

|

|

| - |

|

Purchases of properties, plant, and equipment |

|

| (430,596 | ) |

|

| (1,528,672 | ) |

Net cash used by investing activities |

|

| (42,073 | ) |

|

| (1,341,713 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Payments on dividends payable |

|

| - |

|

|

| (787,730 | ) |

Principal payments on long-term debt |

|

| (103,488 | ) |

|

| (283,562 | ) |

Proceeds from issuance of common stock, net of issuance costs |

|

| 2,759,681 |

|

|

| - |

|

Proceeds from exercise of warrants |

|

| 1,481,840 |

|

|

| - |

|

Net cash provided (used) by financing activities |

|

| 4,138,033 |

|

|

| (1,071,292 | ) |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH |

|

| 6,316,263 |

|

|

| (7,163,031 | ) |

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD |

|

| 11,954,635 |

|

|

| 19,117,666 |

|

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD |

| $ | 18,270,898 |

|

| $ | 11,954,635 |

|

|

|

|

|

|

|

|

| |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

Interest paid in cash |

| $ | 8,869 |

|

| $ | 10,521 |

|

NON-CASH FINANCING AND INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Equipment purchased with note payable |

| $ | 402,722 |

|

| $ | - |

|

Recognition of operating lease liability and right of use asset |

| $ | 787,477 |

|

| $ | - |

|

Common stock buyback and retirement |

| $ | - |

|

| $ | 202,980 |

|

Conversion of Preferred Series D to Common Stock |

| $ | - |

|

| $ | 16,926 |

|

About USAC:

United States Antimony Corporation and its subsidiaries in the U.S., Mexico, and Canada ("USAC," the "Company," "Our," "Us," or "We") sell antimony, zeolite, and precious metals primarily in the U.S. and Canada. The Company processes third party ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals at its facilities located in Montana and Mexico. Antimony oxide is used to form a flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings, and paper, as a color fastener in paint, and as a phosphorescent agent in fluorescent light bulbs. Antimony metal is used in bearings, storage batteries, and ordnance. Antimony trisulfide is used as a primer in ammunition. The Company also recovers precious metals, primarily gold and silver, at its Montana facility from third party ore. At its facility located in Idaho, the Company mines and processes zeolite, a group of industrial minerals used in water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation, animal nutrition, soil amendment and fertilizer, and other miscellaneous applications. The Company acquired mining claims and leases located in Alaska and Ontario, Canada and leased a metals concentration facility in Montana in 2024 that could expand its operations as well as its product offerings.

Forward-Looking Statements:

Readers should note that, in addition to the historical information contained herein, this press release may contain forward-looking statements within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon current expectations and beliefs concerning future developments and their potential effects on the Company including matters related to the Company's operations, pending contracts and future revenues, financial performance and profitability, ability to execute on its increased production and installation schedules for planned capital expenditures, and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-K and Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "pro forma," and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

Contact:

United States Antimony Corp.

4438 W. Lover's Lane, Unit 100

Dallas, TX 75209

Jonathan Miller, VP, Investor Relations

E-Mail: Jmiller@usantimony.com

Phone: 406-606-4117

SOURCE: United States Antimony Corp.

View the original press release on ACCESS Newswire