Talisker Intersects 51.50 g/t Gold Over 0.65m Within 29.79 g/t Gold Over 1.15m at the Bralorne Gold Project

Talisker Resources Ltd. (TSKFF) has released promising drill assay results from its Bralorne Gold Project in British Columbia. The ongoing resource drill program, utilizing four rigs, has confirmed the continuity of both bulk tonnage gold mineralization at the Charlotte Zone and high-grade veins at depth. Key highlights include intersections of 1.26 g/t gold over 10.20m and 10.05 g/t gold over 1.10m in the Charlotte Zone, indicating significant potential. Talisker aims to further update investors as laboratory turnaround times normalize, enhancing the frequency of operational updates.

- Drilling confirms structural continuity of near-surface gold mineralization at Charlotte Zone.

- Highlighted assays include 1.26 g/t gold over 10.20m and 10.05 g/t gold over 1.10m.

- Current drilling program now at 8,200 metres out of 50,000 metre target.

- Four drill rigs operational on-site, improving exploration capabilities.

- None.

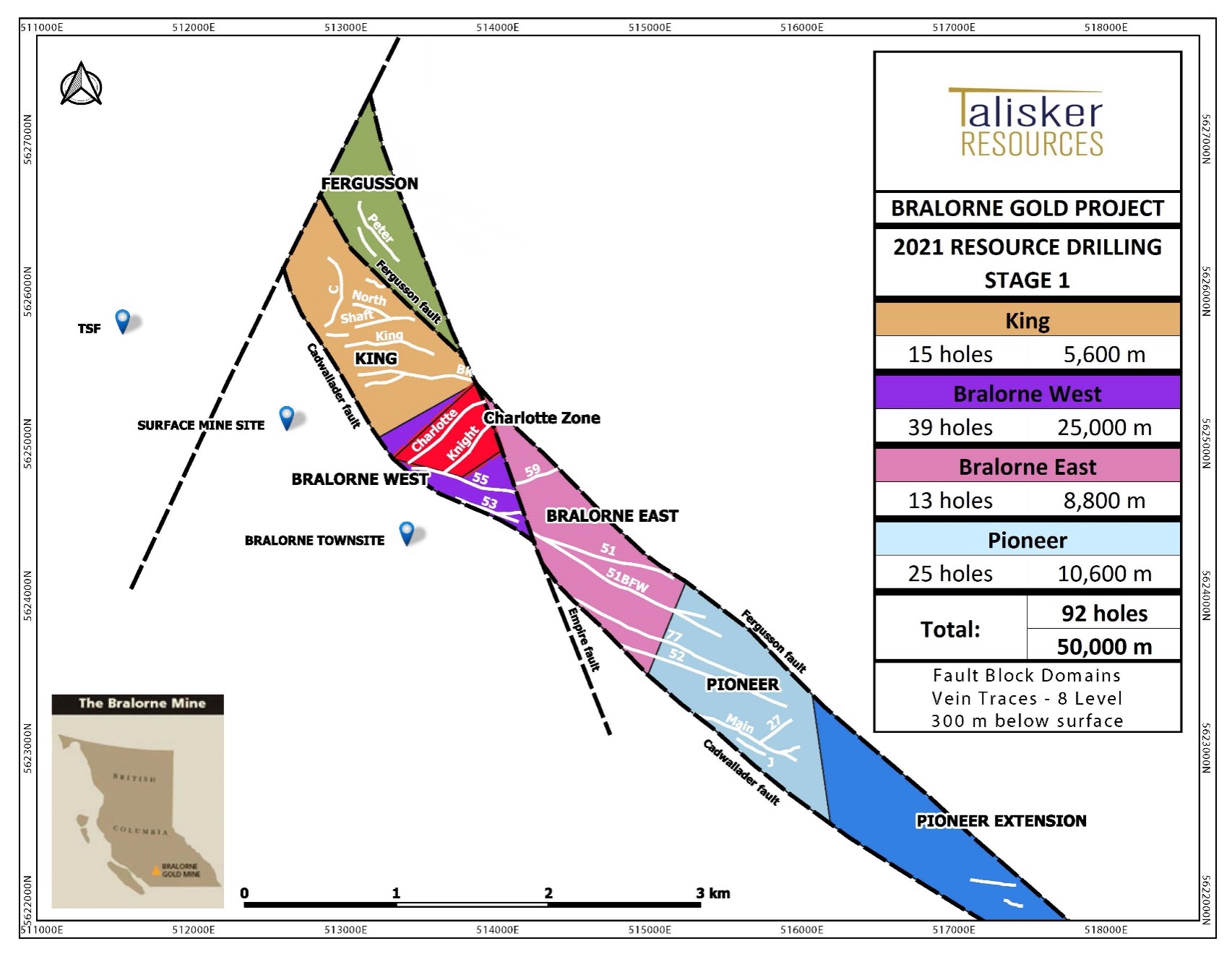

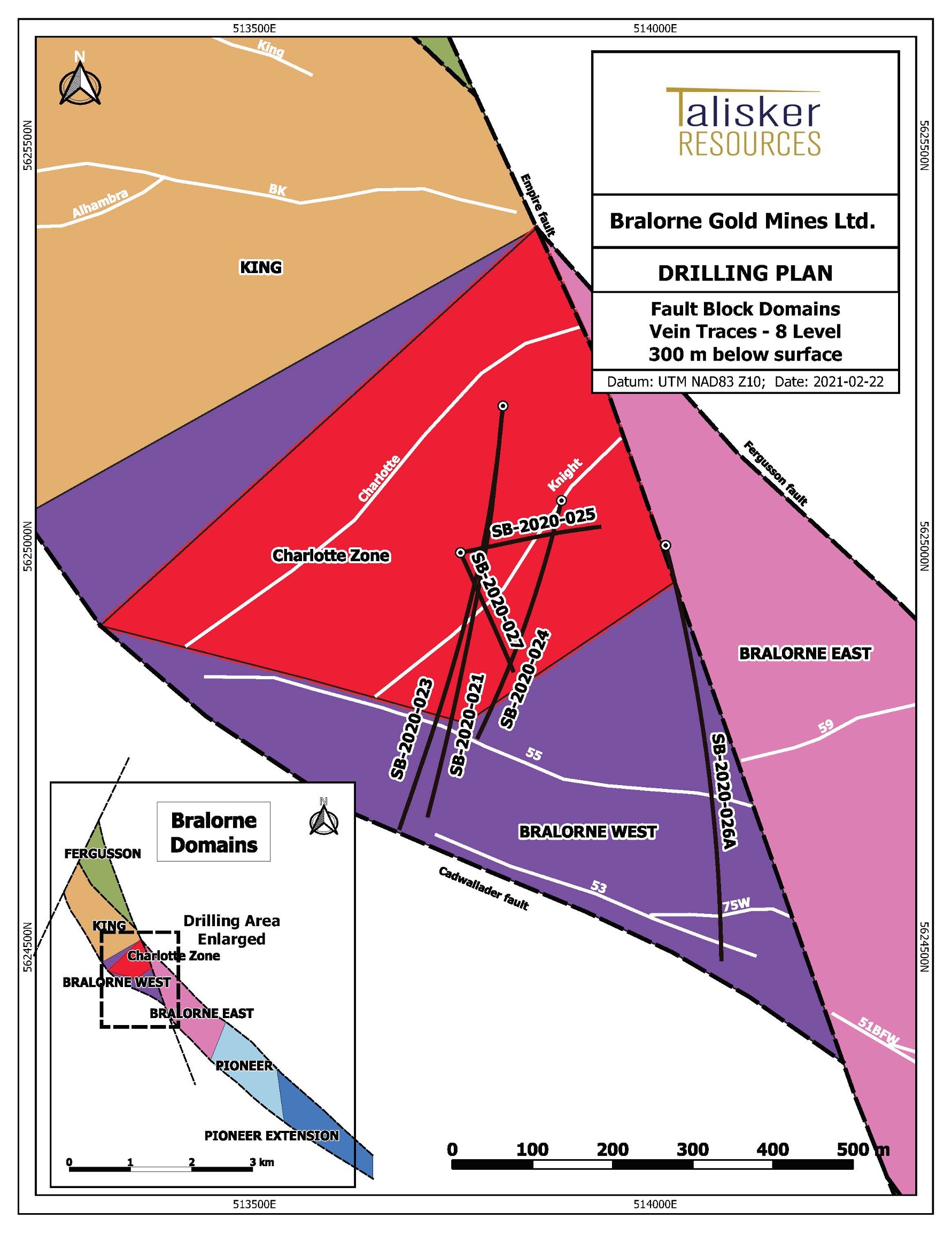

TORONTO, ON / ACCESSWIRE / February 23, 2021 / Talisker Resources Ltd. ("Talisker" or the "Company") (TSX:TSK)(OTCQX:TSKFF) is pleased to announce complete and partial drill assay results from its Bralorne Gold Project in British Columbia. Holes SB-02020-023, SB-02020-024, SB-02020-025, SB-02020-026A and SB-02020-027 are part of Talisker's resource drill out program which is currently underway with four drill rigs on site. Today's release comprises results from both the near-surface bulk tonnage Charlotte Zone and the high-grade vein that comprise the primary focus of the current drill program at depth (see Figures 1 and 2).

Key Points:

- Charlotte Zone: Drilling continues to confirm structural continuity of broad, near-surface gold mineralization discovered by Talisker at the Charlotte Zone in 2020. Current dimensions are 600m by 270m by 300m.

- High-Grade Veins: Drilling has intersected high-grade veins and continues to demonstrate the exceptional structural continuity Bralorne is well-known for.

- 2021 Drill Program: Talisker currently has four drill rigs on site and has completed 8,200 metres of its current 50,000 metre drill program.

- Assay Lab Turnaround: A total of 4,965 samples are awaiting assay at the lab.

"Today's results continue to demonstrate the potential for both near-surface bulk tonnage gold mineralization at the Charlotte Zone and the well-known high-grade gold mineralization located directly below," stated Terry Harbort, President and CEO of Talisker, who added, "With four drill rigs now operating on site and laboratory turnaround times returning to normal, we anticipate providing our investors more regular updates on our operations including the continued expansion of the Charlotte Zone."

Charlotte Zone: The Charlotte Zone, which outcrops at surface, is located immediately above the high-grade veins at Bralorne West (see Figure 1) and is comprised of broad intervals of stacked, parallel veins. Holes SB-2020-23 through to SB-2020-26A all intersected significant intervals of gold mineralization through the Charlotte Zone, from depths as shallow as 34 metres downhole. To date, drilling has defined near-surface, bulk tonnage gold mineralization at the Charlotte Zone over a 600m by 270m by 350m zone.

Highlights from the Charlotte Zone include:

- SB-2020-026A

- 1.26 g/t gold over 10.20m from 336.80m to 347.00m within 0.73 g/t gold over 30.50m from 326.00m to 356.50m.

- 10.05 g/t gold over 1.10m from 138.00m to 139.85m

- SB-2020-024

- 2.47 g/t gold over 6.00m from 313.90m to 319.90m

- 5.40 g/t gold over 2.65m from 149.55m to 152.20m

- SB-2020-025

- 0.51 g/t gold over 7.15m from 87.10m to 94.25m

- 0.83 g/t gold over 9.40m from 149.6m to 159.00m

Bralorne Gold Project Drill Holes SB-2020-024, 025, 026A, 027 Charlotte Zone - Bulk Tonnage Target | ||||||

Diamond Drill Hole Name | From (m) | To (m) | Interval (m) | Au (g/t) | Zone | Method Reported |

SB-2020-024 | 149.55 | 150.05 | 0.50 | 0.14 | Charlotte Zone | Au-AA24 |

SB-2020-024 | 150.05 | 150.55 | 0.50 | 18.55 | Au-SCR24 | |

SB-2020-024 | 150.55 | 151.20 | 0.65 | 0.01 | Au-AA24 | |

SB-2020-024 | 151.20 | 151.70 | 0.50 | 9.58 | Au-AA24 | |

SB-2020-024 | 151.70 | 152.20 | 0.50 | 0.35 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-024 | 313.90 | 315.00 | 1.10 | 0.94 | Knight Zone | Au-AA24 |

SB-2020-024 | 315.00 | 315.50 | 0.50 | 1.90 | Au-AA24 | |

SB-2020-024 | 315.50 | 316.10 | 0.60 | 3.13 | Au-AA24 | |

SB-2020-024 | 316.10 | 316.90 | 0.80 | 1.21 | Au-AA24 | |

SB-2020-024 | 316.90 | 317.40 | 0.50 | 2.83 | Au-AA24 | |

SB-2020-024 | 317.40 | 318.40 | 1.00 | 6.40 | Au-AA24 | |

SB-2020-024 | 318.40 | 318.90 | 0.50 | 3.41 | Au-AA24 | |

SB-2020-024 | 318.90 | 319.40 | 0.50 | 0.74 | Au-AA24 | |

SB-2020-024 | 319.40 | 319.90 | 0.50 | 0.17 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-025 | 34.80 | 35.30 | 0.50 | 0.41 | Charlotte HW | Au-AA24 |

SB-2020-025 | 35.30 | 36.65 | 1.35 | 0.02 | Au-AA24 | |

SB-2020-025 | 36.65 | 37.15 | 0.50 | 2.47 | Au-AA24 | |

SB-2020-025 | 37.15 | 37.65 | 0.50 | 1.73 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-025 | 87.10 | 88.50 | 1.40 | 0.12 | Charlotte HW | Au-AA24 |

SB-2020-025 | 88.50 | 89.90 | 1.40 | 0.27 | Au-AA24 | |

SB-2020-025 | 89.90 | 91.05 | 1.15 | 0.30 | Au-AA24 | |

SB-2020-025 | 91.05 | 91.90 | 0.85 | 0.44 | Au-AA24 | |

SB-2020-025 | 91.90 | 92.55 | 0.65 | 0.13 | Au-AA24 | |

SB-2020-025 | 92.55 | 93.20 | 0.65 | 0.26 | Au-AA24 | |

SB-2020-025 | 93.20 | 93.70 | 0.50 | 4.12 | Au-AA24 | |

SB-2020-025 | 93.70 | 94.25 | 0.55 | 0.18 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-025 | 149.60 | 150.40 | 0.80 | 0.77 | Charlotte Zone | Au-AA24 |

SB-2020-025 | 150.40 | 151.40 | 1.00 | 2.30 | Au-AA24 | |

SB-2020-025 | 151.40 | 152.40 | 1.00 | 2.47 | Au-AA24 | |

SB-2020-025 | 152.40 | 153.50 | 1.10 | 0.06 | Au-AA24 | |

SB-2020-025 | 153.50 | 154.60 | 1.10 | 0.68 | Au-AA24 | |

SB-2020-025 | 154.60 | 155.50 | 0.90 | 0.64 | Au-AA24 | |

SB-2020-025 | 155.50 | 156.40 | 0.90 | 0.77 | Au-AA24 | |

SB-2020-025 | 156.40 | 157.70 | 1.30 | 0.00 | Au-AA24 | |

SB-2020-025 | 157.70 | 159.00 | 1.30 | 0.22 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-025 | 274.75 | 275.60 | 0.85 | 2.84 | Knight Zone | Au-AA24 |

SB-2020-025 | 275.60 | 276.40 | 0.80 | 0.79 | Au-AA24 | |

SB-2020-025 | 276.40 | 277.20 | 0.80 | 1.01 | Au-AA24 | |

SB-2020-025 | 277.20 | 278.10 | 0.90 | 0.41 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-026A | 138.00 | 138.75 | 0.75 | 0.30 | Knight Zone | Au-AA24 |

SB-2020-026A | 138.75 | 139.35 | 0.60 | 1.93 | Au-AA24 | |

SB-2020-026A | 139.35 | 139.85 | 0.50 | 19.80 | Au-GRA22 | |

|

|

|

|

|

|

|

SB-2020-026A | 326.00 | 326.50 | 0.50 | 0.32 | Vein 101 (Preliminary Interpretation) | Au-AA24 |

SB-2020-026A | 326.50 | 327.00 | 0.50 | 0.47 | Au-AA24 | |

SB-2020-026A | 327.00 | 327.50 | 0.50 | 0.72 | Au-AA24 | |

SB-2020-026A | 327.50 | 328.15 | 0.65 | 0.34 | Au-AA24 | |

SB-2020-026A | 328.15 | 328.65 | 0.50 | 0.58 | Au-AA24 | |

SB-2020-026A | 328.65 | 329.20 | 0.55 | 0.60 | Au-AA24 | |

SB-2020-026A | 329.20 | 330.00 | 0.80 | 1.09 | Au-AA24 | |

SB-2020-026A | 330.00 | 330.55 | 0.55 | 0.36 | Au-AA24 | |

SB-2020-026A | 330.55 | 331.10 | 0.55 | 0.03 | Au-AA24 | |

SB-2020-026A | 331.10 | 332.00 | 0.90 | 0.29 | Au-AA24 | |

SB-2020-026A | 332.00 | 333.00 | 1.00 | 0.29 | Au-AA24 | |

SB-2020-026A | 333.00 | 334.00 | 1.00 | 0.12 | Au-AA24 | |

SB-2020-026A | 334.00 | 335.00 | 1.00 | 0.54 | Au-AA24 | |

SB-2020-026A | 335.00 | 335.50 | 0.50 | 0.37 | Au-AA24 | |

SB-2020-026A | 335.50 | 336.15 | 0.65 | 0.90 | Au-AA24 | |

SB-2020-026A | 336.15 | 336.80 | 0.65 | 0.52 | Au-AA24 | |

SB-2020-026A | 336.80 | 337.40 | 0.60 | 0.49 | Au-AA24 | |

SB-2020-026A | 337.40 | 337.90 | 0.50 | 2.32 | Au-AA24 | |

SB-2020-026A | 337.90 | 338.40 | 0.50 | 1.32 | Au-AA24 | |

SB-2020-026A | 338.40 | 339.15 | 0.75 | 3.45 | Au-AA24 | |

SB-2020-026A | 339.15 | 339.80 | 0.65 | 2.23 | Au-AA24 | |

SB-2020-026A | 339.80 | 340.35 | 0.55 | 0.71 | Au-AA24 | |

SB-2020-026A | 340.35 | 341.35 | 1.00 | 0.71 | Au-AA24 | |

SB-2020-026A | 341.35 | 341.95 | 0.60 | 0.61 | Au-AA24 | |

SB-2020-026A | 341.95 | 342.45 | 0.50 | 0.45 | Au-AA24 | |

SB-2020-026A | 342.45 | 342.95 | 0.50 | 0.91 | Au-AA24 | |

SB-2020-026A | 342.95 | 343.55 | 0.60 | 2.25 | Au-AA24 | |

SB-2020-026A | 343.55 | 344.05 | 0.50 | 0.16 | Au-AA24 | |

SB-2020-026A | 344.05 | 344.55 | 0.50 | 0.60 | Au-AA24 | |

SB-2020-026A | 344.55 | 345.10 | 0.55 | 2.20 | Au-AA24 | |

SB-2020-026A | 345.10 | 345.65 | 0.55 | 0.61 | Au-AA24 | |

SB-2020-026A | 345.65 | 346.45 | 0.80 | 1.21 | Au-AA24 | |

SB-2020-026A | 346.45 | 347.00 | 0.55 | 0.58 | Au-AA24 | |

SB-2020-026A | 347.00 | 348.00 | 1.00 | 0.38 | Au-AA24 | |

SB-2020-026A | 348.00 | 348.85 | 0.85 | 0.25 | Au-AA24 | |

SB-2020-026A | 348.85 | 349.45 | 0.60 | 0.82 | Au-AA24 | |

SB-2020-026A | 349.45 | 350.00 | 0.55 | 0.91 | Au-AA24 | |

SB-2020-026A | 350.00 | 350.60 | 0.60 | 0.48 | Vein 101 (Preliminary Interpretation) | Au-AA24 |

SB-2020-026A | 350.60 | 351.10 | 0.50 | 0.32 | Au-AA24 | |

SB-2020-026A | 351.10 | 351.60 | 0.50 | 0.42 | Au-AA24 | |

SB-2020-026A | 351.60 | 352.15 | 0.55 | 0.33 | Au-AA24 | |

SB-2020-026A | 352.15 | 352.65 | 0.50 | 0.31 | Au-AA24 | |

SB-2020-026A | 352.65 | 353.20 | 0.55 | 0.11 | Au-AA24 | |

SB-2020-026A | 353.20 | 353.90 | 0.70 | 0.10 | Au-AA24 | |

SB-2020-026A | 353.90 | 354.45 | 0.55 | 0.13 | Au-AA24 | |

SB-2020-026A | 354.45 | 355.00 | 0.55 | 1.24 | Au-AA24 | |

SB-2020-026A | 355.00 | 355.50 | 0.50 | 1.16 | Au-AA24 | |

SB-2020-026A | 355.50 | 356.00 | 0.50 | 0.35 | Au-AA24 | |

SB-2020-026A | 356.00 | 356.50 | 0.50 | 0.28 | Au-AA24 | |

|

|

|

|

|

|

|

SB-2020-027 | 153.30 | 153.80 | 0.50 | 7.18 | Charlotte Zone | Au-AA24 |

SB-2020-027 | 153.80 | 154.30 | 0.50 | 9.22 | Au-AA24 | |

SB-2020-027 | 154.30 | 154.85 | 0.55 | 10.05 | Au-GRA22 | |

SB-2020-027 | 154.85 | 155.40 | 0.55 | 1.75 | Au-AA24 | |

SB-2020-027 | 155.40 | 156.00 | 0.60 | 0.11 | Au-AA24 | |

Notes: Diamond drill hole SB-2020-024 has collar orientation of Azimuth 193; Dip -57. Diamond drill hole SB-2020-025 has collar orientation of Azimuth 080; Dip -70. Diamond drill hole SB-2020-026A has a collar orientation of Azimuth 166; Dip -51.0. Diamond drill hole SB-2020-027 has a collar orientation of Azimuth 152; Dip -50.0. True widths are estimated 65 - | ||||||

High-Grade Veins: Drilling continues to demonstrate structural continuity of the high-grade veins. Importantly, drilling continues to intersect lower-grade vein halos material surrounding the high-grade veins. The high-grade veins directly below the Charlotte Zone continue to be the primary focus of Talisker's 50,000 metre resource drilling program.

Highlights from the high-grade veins include:

- SB-2020-026A

- 51.50 g/t gold over 0.65m from 711.65m to 712.30m within 29.79 g/t gold over 1.15m from 711.65m to 712.80m

- SB-2020-024

- 7.14 g/t gold over 2.15m from 410.90m to 413.05m

- SB-2020-023

- 8.09 g/t gold over 1.40m from 765.65m to 767.05m

Bralorne Gold Project Drill Holes SB-2020-023, 024, 026A High Grade Vein Target | ||||||

Diamond Drill Hole Name | From (m) | To (m) | Interval (m) | Au (g/t) | Zone | Method Reported |

SB-2020-023 | 557.85 | 558.45 | 0.60 | 2.75 | 55 Vein | Au-AA24 |

SB-2020-023 | 558.45 | 558.95 | 0.50 | 5.84 | Au-SCR24 | |

SB-2020-023 | 659.35 | 659.85 | 0.50 | 6.70 | Unknown Vein | Au-SCR24 |

SB-2020-023 | 659.85 | 660.35 | 0.50 | 5.34 | Au-SCR24 | |

SB-2020-023 | 660.35 | 661.05 | 0.70 | 3.85 | Unknown Vein | Au-SCR24 |

SB-2020-023 | 765.65 | 766.15 | 0.50 | 9.41 | 53 Vein | Au-SCR24 |

SB-2020-023 | 766.15 | 767.05 | 0.90 | 7.35 | Au-SCR24 | |

SB-2020-023 | 767.05 | 767.95 | 0.90 | 0.79 | Au-AA24 | |

SB-2020-023 | 767.95 | 768.45 | 0.50 | 1.02 | Au-AA24 | |

SB-2020-023 | 778.20 | 778.75 | 0.55 | 5.92 | 53 FW Vein | Au-SCR24 |

SB-2020-024 | 410.90 | 411.55 | 0.65 | 7.96 | 101 Vein | Au-AA24 |

SB-2020-024 | 411.55 | 412.20 | 0.65 | 3.52 | Au-AA24 | |

SB-2020-024 | 412.20 | 413.05 | 0.85 | 9.27 | Au-AA24 | |

SB-2020-024 | 413.05 | 413.55 | 0.50 | 0.21 | Au-AA24 | |

SB-2020-026A | 711.65 | 712.30 | 0.65 | 51.50 | 73 Vein | Au-GRA22 |

SB-2020-026A | 712.30 | 712.80 | 0.50 | 1.57 | Au-AA24 | |

SB-2020-026A | 712.80 | 713.30 | 0.50 | 0.01 | Au-AA24 | |

SB-2020-026A | 713.30 | 713.80 | 0.50 | 0.16 | Au-AA24 | |

SB-2020-026A | 713.80 | 714.30 | 0.50 | 1.38 | Au-AA24 | |

Notes: Diamond drill hole SB-2020-023 has collar orientation of Azimuth 186; Dip -54. Diamond drill hole SB-2020-024 has collar orientation of Azimuth 193; Dip -57. Diamond drill hole SB-2020-026A has a collar orientation of Azimuth 166; Dip -51.0. True widths are estimated 65 - | ||||||

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior resource company involved in the exploration of gold projects in British Columbia, Canada. Talisker's projects include the Bralorne Gold Complex, an advanced stage project with significant exploration potential from a historical high-grade producing gold mine as well as its Spences Bridge Project where the Company holds ~

For further information, please contact:

Terry Harbort | Mick Carew |

Qualified Person

The technical information contained in this news release relating to the drill results at the Bralorne Gold Project has been approved by Leonardo de Souza (BSc, AusIMM (CP) Membership 224827), Talisker's Vice President, Exploration and Resource Development, who is a "qualified person" within the meaning of National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Sample Preparation and QAQC

Drill core at the Bralorne project is drilled in HQ to NQ size ranges (63.5mm and 47.6mm respectively). Drill core samples are minimum 50 cm and maximum 160 cm long along the core axis. Samples are focused on an interval of interest such as a vein or zone of mineralization. Shoulder samples bracket the interval of interest such that a total sampled core length of not less than 3 m both above and below the interval of interest must be assigned. Sample QAQC measures of unmarked certified reference materials (CRMs), blanks, and duplicates are inserted into the sample sequence and make up

Sample preparation and analyses is carried out by ALS Global, at their laboratory in North Vancouver, British Columbia, Canada. Drill core sample preparation includes drying in an oven at a maximum temperature of 60°C, fine crushing of the sample to at least

Gold and in diamond drill core is analysed by fire assay and atomic absorption spectroscopy (AAS) of a 50g sample (code Au-AA24), while multi-element chemistry is analysed by 4-Acid digestion of a 0.25 g sample split with detection by inductively coupled plasma mass spectrometer (ICP-MS) for 48 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd, Ce, Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W, Y, Zn, Zr).

Gold assay technique Au-AA24 has an upper detection limit of 10ppm. Any sample that produces an over-limit gold value via the Au-AA24 technique is sent for gravimetric finish via method Au-GRA22 which has an upper detection limit of 1,000 ppm Au. Samples where visible gold was observed are sent directly to screen metallics analysis and all samples that fire assay above 3 ppm Au are re-analysed with method Au-SCR24 which employs a 1kg pulp screened to 100 microns with assay of the entire oversize fraction and duplicate 50g assays on the undersize fraction. Where possible all samples initially sent to screen metallics processing will also be re-run through the fire assay with gravimetric finish provided there is enough material left for further processing.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Talisker's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, the operations of the Company and the timing which could be affected by the current global COVID-19 pandemic. Those assumptions and factors are based on information currently available to Talisker. Although such statements are based on reasonable assumptions of Talisker's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While Talisker considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and Talisker is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Figure 1: Map of the Bralorne Gold Project showing drill traces from today's release, major high-grade vein structures projected to surface (white) and surface infrastructure.

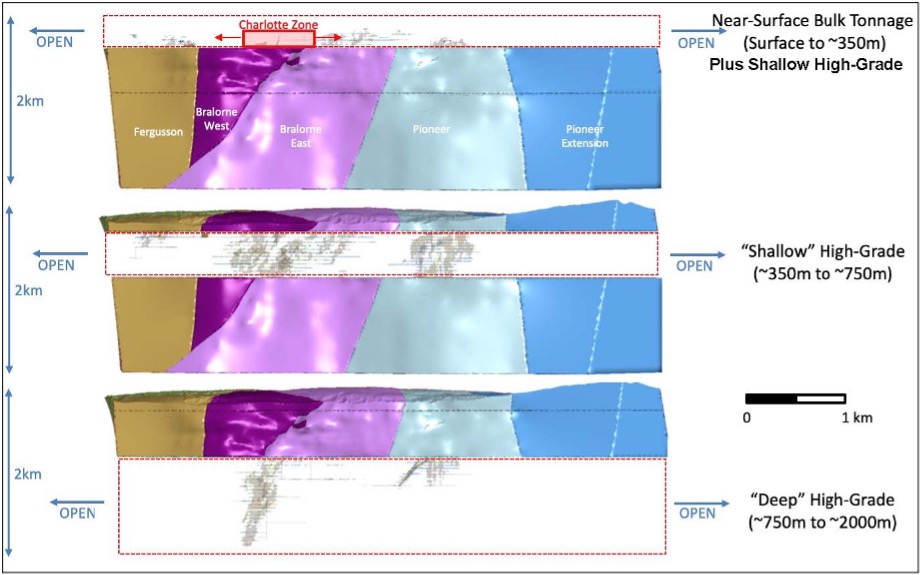

Figure 2: 3D cross-sections through the Bralorne deposit (refer to figure 1 for reference) showing the relative target depths for both the near-surface bulk tonnage gold mineralization at the Charlotte Zone and the high-grade veins below the Charlotte Zone.

Figure 3: Map of the Bralorne West and Bralorne East Zones at the Bralorne Gold Project (see Figure 1) showing drill traces from today's release, major high-grade vein structures projected to surface (white) and surface infrastructure.

SOURCE: Talisker Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/631205/Talisker-Intersects-5150-gt-Gold-Over-065m-Within-2979-gt-Gold-Over-115m-at-the-Bralorne-Gold-Project

FAQ

What are the latest drill results from Talisker Resources' Bralorne Gold Project?

How many drill rigs are currently operational at the Bralorne Gold Project?

What is the scope of Talisker's 2021 drilling program at Bralorne?

What assays are pending for Talisker Resources' Bralorne Gold Project?