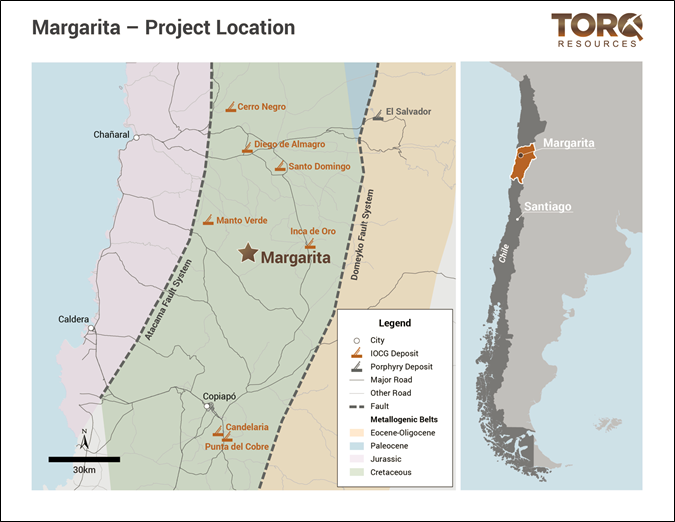

Torq Options Margarita Iron-Oxide-Copper-Gold Project in Chile

Torq Resources Inc. (OTCQX:TRBMF) announced the acquisition of the Margarita Iron-Oxide-Copper-Gold project in Chile, situated 65 km north of Copiapo. The property, covering ~1,045 hectares, is near significant IOCG mines and indicates potential for large-scale copper sulphide deposits. Initial exploration has identified an exploration target of 20-35 million tonnes of copper oxide mineralization at grades of 0.2-0.5%. The company plans rapid advancement to drilling this year, supported by a multi-phase investment totaling $6.2 million for project development.

- Acquisition of Margarita project enhances portfolio in a mining-rich area.

- Identified exploration target of 20-35 million tonnes of copper oxide mineralization.

- Rapid advancement to drilling planned for Q3 2021, indicating proactive exploration strategy.

- No primary copper sulphide mineralization found to date, which raises uncertainty.

- Requires significant cash payments totaling $6.2 million for full acquisition, which may impact financial resources.

VANCOUVER, BC / ACCESSWIRE / March 8, 2021 / Torq Resources Inc. (TSXV:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to announce that it has successfully acquired the option to earn a

A Message from Shawn Wallace, Executive Chair & Director:

"Margarita is the first in what will be a series of acquisitions of high-quality copper-gold exploration projects with district scale potential in Chile, which hosts some of the world's largest and most profitable copper mines. Shareholders and stakeholders can look forward to an exciting flow of news as we initiate exploration at Margarita and continue to add to our portfolio."

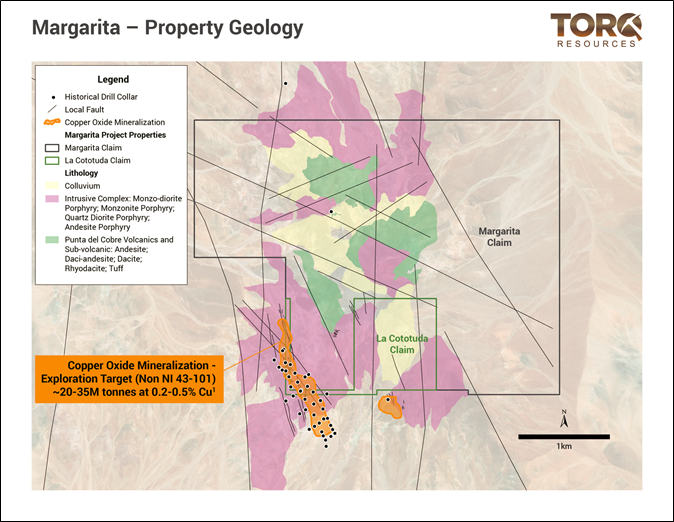

Margarita Property:

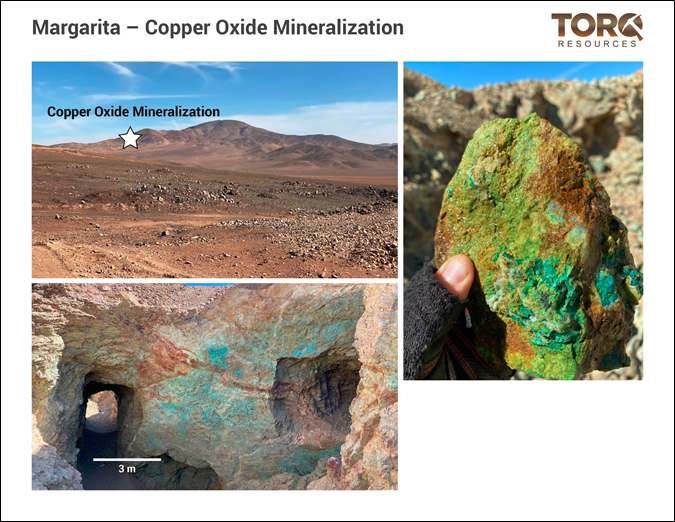

The project is comprised of approximately 1,045 hectares and is flanked by secondary copper oxide mineralization on the southwestern boundary of the property (Figures 2-3). This copper oxide mineralization is defined by 39 drill holes totaling 3,984 metres (m) and represents an exploration target of approximately 20 - 35 million tonnes at 0.2 -

A Message from Michael Henrichsen, Chief Geologist:

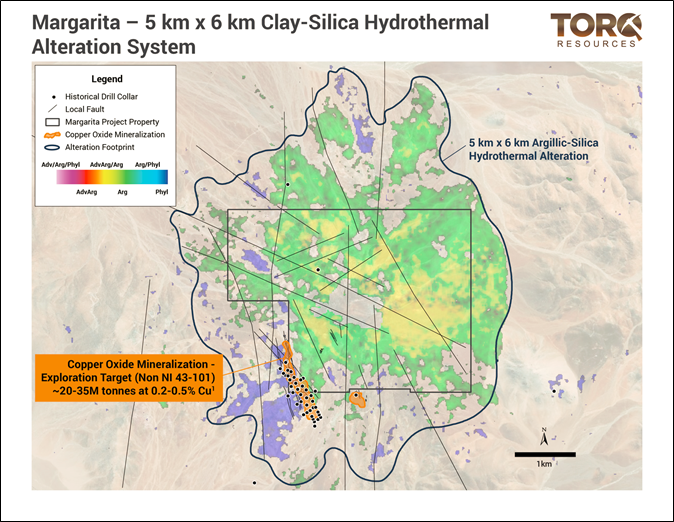

"The Margarita project represents excellent discovery potential for a major deposit due to the strength of the alteration system, large-scale magnetic targets and the presence of copper oxide mineralization along the southwest flanks of the property. With the previous exploration work that has been conducted on the project we can rapidly move to drill stage and provide a high-quality exploration opportunity in a matter of months."

Geology:

The property has a set of geological characteristics that suggest high potential to discover a large-scale IOCG or porphyry copper deposit. This includes a strong argillic-silica hydrothermal alteration system over 15 square kilometres (Figure 4), numerous specular hematite-silica hydrothermal breccia structures, silica-pyrite altered monzonite porphyry bodies, a subparallel system of andesite porphyry dikes and several north-northwest to northeast trending fault zones that are parallel to the Atacama and Chivato crustal scale fault zones (Figure 2), which are important regional controls on copper mineralization.

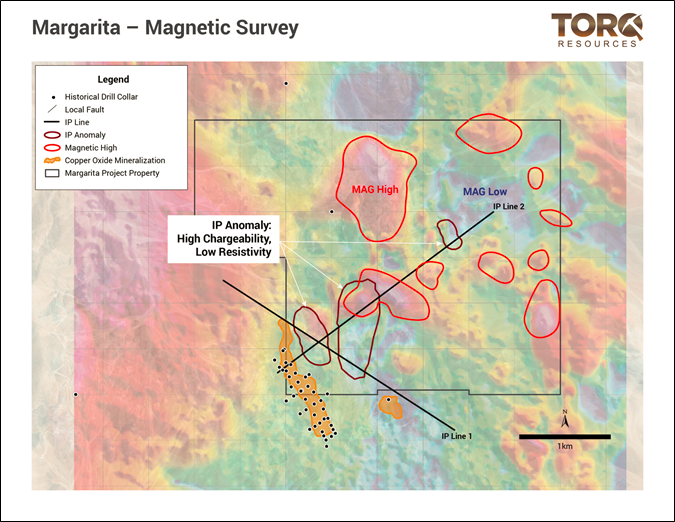

Geophysics:

A magnetic survey over the Margarita project shows a circular magnetic low surrounded by magnetic highs beneath the hydrothermal alteration system (Figure 4). The magnetic highs are associated with less altered, andesitic to rhyodacitic rock units that may correspond to dome structures, which are considered to be part of the mineralizing intrusive hydrothermal system that characterizes the property. The lower magnetic responses correspond to strongly altered units that include various porphyritic and breccia bodies as well as andesitic dykes and provide a clear large-scale 1.5 km by 1.5 km geophysical target within the property boundaries.

In addition, two 3 km lines of induced polarization geophysics have been historically surveyed over the project area crossing the alteration system in NE and NW directions (Figure 5). Both lines show coincident high chargeability and low resistivity responses that are consistent with hydrothermal alteration with associated sulphide mineralization. Collectively, these responses show the potential for copper sulphide mineralization at shallow depths.

Historical Copper Oxide Drilling:

Out of the 39 drill holes with known assay results available that define the copper oxide mineralization, 13 are within the land package of the Margarita - Cototuda agreements, totaling approximately 1500 m. The historical drill holes are located in the southwestern corner of the property in a zone of strong hydrothermal alteration. Copper oxide mineralization with reported grades of 0.2 -

Exploration Plan:

Torq plans to advance the Margarita project to drill stage rapidly by conducting a geological mapping program and a property-wide induced polarization geophysical survey to define drill targets. The first drill program on the property is being planned for Q3 of 2021.

Option Terms:

The Company acquired the rights that constitute the Margarita project through two option agreements: 1) The Margarita claims with Minera Viento Norte (MVN), a local Chilean company, and 2) The La Cototuda claims with a small-scale mining company (Figure 2). Under these option agreements the Company can acquire

Table 1. Margarita Claims: Minera Viento Norte

Period from Signing Definitive Agreement and Initial Payment | Cash Payments (USD) | Work Expenditure Requirement Until |

Within 60 days of signing the Definitive Agreement | (Initial Payment) | |

within 6 months | 50,000 | 400,000 |

within 18 months | 100,000 | 1,150,000 |

within 30 months | 300,000 | 1,500,000 |

within 42 months | 1,200,000 | |

within 54 months | 2,000,000 | |

within 66 months | 2,500,000 | |

Total |

The Margarita NSR is

Table 2: La Cototuda Claims: Small-scale mining company

Period from Signing Definitive Agreement and Initial Payment | Cash Payments (USD) | No Expenditure Requirement |

Upon signing the Agreement | (Initial Payment) | |

within 12 months | 250,000 | |

within 24 months | 250,000 | |

within 36 months | 350,000 | |

Total |

There is no NSR relating to the La Cototuda claims.

In relation to the option arrangement of the Margarita project, a finders fee of 466,666 shares of the Company will be issued, subject to customary TSX Venture Exchange acceptance.

Figure 1: Illustrates the location of the Margarita project within the Cretaceous Coastal Cordillera belt and its proximity to major deposits in the area.

Figure 2: Illustrates the basic property geology of the Margarita project and the location of the copper oxide mineralization that flanks the southwestern margin of the property.

Figure 3: Illustrates the copper oxide mineralization along a fault zone on the southwestern margin of the project area.

Figure 4: Illustrates the large-scale clay-silica alteration system that is centered on the Margarita property.

Figure 5: Illustrates the magnetic highs surrounding a magnetic low in the northeast region of the project area. The magnetic highs are associated with less altered, andesitic to rhyodacitic rock units that may correspond to dome structures that are considered to be part of the mineralizing intrusive hydrothermal system that characterizes the property. The lower magnetic responses correspond to strongly altered units that include various porphyritic and breccia bodies as well as andesitic dykes and provide a clear large scale 1.5 km by 1.5 km geophysical target within the property boundaries

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD,

Shawn Wallace

Executive Chairman

For further information on Torq Resources, please contact Natasha Frakes, Manager of Corporate Communications at (778) 729-0500 or info@torqresources.com.

About Torq Resources

Torq is a junior exploration company focused on establishing a top-tier mineral portfolio. The Company's management team has raised over

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements". Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] The exploration target is conceptual in nature and insufficient exploration has been undertaken in the areas that this exploration target relates to estimate a mineral resource. The exploration target therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve. It is uncertain if further exploration will result in the estimation of a mineral resource.

SOURCE: Torq Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/633941/Torq-Options-Margarita-Iron-Oxide-Copper-Gold-Project-in-Chile

FAQ

What is the Margarita Iron-Oxide-Copper-Gold project acquired by Torq Resources?

What are the exploration targets at the Margarita project?

When does Torq Resources plan to start drilling at the Margarita project?

What is the total investment required for the Margarita project acquisition?