Tapestry, Inc. Reports Fiscal 2023 First Quarter Results

-

Delivered Record First Quarter Revenue of

$1.5 Billion 2% Versus Prior Year on a Reported Basis and Over5% in Constant Currency

-

Fueled International Growth of

4% Versus Prior Year on a Reported Basis and11% in Constant Currency

-

Achieved Diluted EPS of

$0.79

- Maintained Fiscal 2023 Earnings Expectation Excluding Incremental Currency Headwinds

-

Remains on Track to Return a Total of

$1 Billion

Link to Download Tapestry’s Q1 2023 Earnings Presentation, Including Brand Highlights

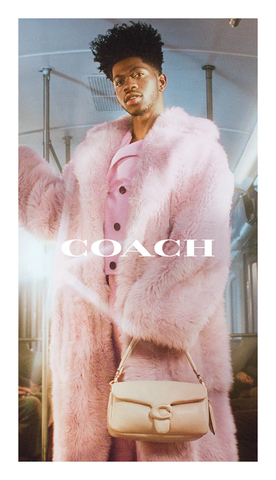

(Photo: Business Wire)

“Moving forward, although the environment is uncertain, our foundation is strong and the clarity of our vision is unchanged. We will continue to be disciplined in advancing our strategic objectives through an unwavering focus on the consumer and a commitment to innovation. Importantly, our competitive advantages and transformation into a more nimble and responsive organization position us to drive sustainable, long-term growth and meaningful shareholder value.”

Shareholder Return Programs

The Company continues to expect to return approximately

-

Share Repurchases: Tapestry remains on track to buy back approximately

$700 million $100 million $33.83 -

Dividend Payments: The Company continues to anticipate paying an annual dividend of

$1.20 20% increase compared to prior year, totaling approximately$300 million

During the first quarter, the Company advanced its strategic priorities focused on building lasting customer relationships, fueling fashion innovation and product excellence, delivering compelling omni-channel experiences and powering global growth. Highlights of the quarter were as follows:

-

Drove customer engagement with our brands, highlighted by an increase in spend per customer, supported by higher units per transaction and stronger purchase frequency; acquired approximately 1.4 million new customers in

North America alone; -

Delivered revenue growth of

2% compared to the prior year; sales rose over5% year-over-year on a constant currency basis, excluding an FX headwind of approximately 370 basis points; -

Achieved a sales increase of

11% at constant currency in International markets, which included outsized gains in Other Asia,Japan andEurope , more than offsetting an11% decline inGreater China due to Covid-related disruption; inNorth America , revenue rose slightly versus prior year on both a reported and constant currency basis; -

Drove omni-channel growth with a low-single-digit increase in direct-to-consumer sales at constant currency, led by a high-single-digit gain in store revenue as consumers continued to return to in-person experiences, which offset a high-single-digit decline in Digital; on a two-year basis, Digital revenue increased over

35% and more than tripled from FY19 pre-pandemic levels; - Fueled fashion innovation and product excellence to drive AUR gains in each brand’s core category at constant currency, driven by planned ticket increases and enabled by data and analytics that enhanced the Company’s go-to-market strategies, including a deeper understanding of consumer preferences;

-

Continued to invest in platform capabilities and brand building, underscored by marketing at

8% of sales, an increase compared to7% of revenue in the prior year period; -

Delivered earnings per diluted share ahead of expectations, including a favorable timing shift of approximately

$0.05 $0.03 $0.03 -

Returned

$175 million

Overview of Fiscal First Quarter 2023 Financial Results

-

Net sales totaled

$1.51 billion $1.48 billion 2% . Excluding a 370 basis point headwind from currency due to the appreciation of theU.S. Dollar, revenue rose over5% versus last year. -

Gross profit totaled

$1.05 billion 70.0% . As anticipated, the Company’s gross margin was negatively impacted by incremental freight expense, which totaled$20 million $1.07 billion 72.2% . -

SG&A expenses totaled

$800 million 53.1% of sales. This compared to reported SG&A expenses in the prior year of$774 million 52.2% of sales. On a non-GAAP basis, SG&A expenses were$762 million 51.4% of sales in the prior year period. -

Operating income was

$254 million 16.9% . This compared to reported operating income of$295 million 19.9% in the prior year. On a non-GAAP basis, prior year operating income was$307 million 20.7% . -

Net interest expense was

$7 million $16 million -

Other expense was

$11 million U.S. Dollar. This compared to$2 million -

Net income was

$195 million $0.79 $227 million $0.80 $235 million $0.82 17.3% , as compared to the prior year tax rate of18.0% on a reported basis and18.6% on a non-GAAP basis.

Balance Sheet and Cash Flow Highlights

-

Cash, cash equivalents and short-term investments totaled

$557 million $1.68 billion -

Inventory at quarter-end was

$1.14 billion $818 million 50% in in-transits year-over-year. -

Free cash flow for the quarter was an outflow of

$198 million $12 million $45 million $33 million

Fiscal Year 2023 Outlook

The Company is updating its Fiscal 2023 earnings outlook due entirely to an estimated headwind of

Tapestry expects the following for Fiscal 2023, which replaces all previous guidance:

-

Revenue of

$6.5 billion $6.6 billion 2% to4% . -

Net interest expense of approximately

$30 $35 million -

Tax rate of approximately

20% ; -

Weighted average diluted share count of approximately 242 million shares, incorporating approximately

$700 million -

Earnings per diluted share of

$3.60 $3.70 $0.50

In addition, the Company reiterates its 2025 strategic growth plan and financial targets as provided at its

The Company's outlook assumes the following:

-

No further appreciation of the

U.S. Dollar; information provided based on spot rates at the time of forecast; -

Continued gradual recovery in

Greater China from Covid-related disruption; no further significant lockdowns or incremental supply chain pressures from the Covid-19 pandemic; - No material worsening of inflationary pressures or consumer confidence; and

- No benefit from the potential reinstatement of the Generalized System of Preferences (GSP).

Given the dynamic nature of these and other external factors, financial results could differ materially from the outlook provided.

Conference Call Details

The Company will host a conference call to review these results at

Upcoming Events

The Company expects to report Fiscal 2023 second quarter results on

To receive notification of future announcements, please register at www.tapestry.com/investors ("Subscribe to E-Mail Alerts").

About

Our global house of brands unites the magic of Coach, kate spade new york and

This information to be made available in this press release may contain forward-looking statements based on management's current expectations. Forward-looking statements include, but are not limited to, the statements under “Fiscal Year 2023 Outlook,” statements regarding the Company’s capital deployment plans, including anticipated annual dividend rates, and statements that can be identified by the use of forward-looking terminology such as "may," "will," “can,” "should," "expect," “potential,” "intend," "estimate," "continue," "project," "guidance," "forecast," “outlook,” “commit,” "anticipate," “goal,” “leveraging,” “sharpening,” transforming,” “creating,” accelerating,” “enhancing,” “innovation,” “drive,” “targeting,” “assume,” “plan,” “progress,” “confident,” “future,” “uncertain,” “on track,” “achieve,” “strategic,” “growth,” “we see significant growth opportunities,” “view,” “stretching what’s possible,” or comparable terms. Future results may differ materially from management's current expectations, based upon a number of important factors, including risks and uncertainties such as the impact of the ongoing Covid-19 pandemic, including impacts on our supply chain due to temporary closures of our manufacturing partners, price increases, temporary store closures, as well as production, shipping and fulfillment constraints, economic conditions, the ability successfully execute our multi-year growth agenda, our ability to control costs, the ability to anticipate consumer preferences and retain the value of our brands, including our ability to execute on our e-commerce and digital strategies, the effects of existing and new competition in the marketplace, risks associated with operating in international markets and our global sourcing activities, our ability to achieve intended benefits, cost savings and synergies from acquisitions, the risk of cybersecurity threats and privacy or data security breaches, the impact of pending and potential future legal proceedings, the impact of tax and other legislation and the risks associated with climate change and other corporate responsibility issues, etc. In addition, purchases of shares of the Company’s common stock will be made subject to market conditions and at prevailing market prices. Please refer to the Company’s latest Annual Report on Form 10-K and its other filings with the

Schedule 1: Consolidated Statement of Operations

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||

| For the Quarter Ended |

|||||

| (in millions, except per share data) | |||||

| (unaudited) | |||||

| QUARTER ENDED | |||||

| Net sales | $ |

1,506.5 |

$ |

1,480.9 |

|

| Cost of sales |

|

451.9 |

|

412.2 |

|

| Gross profit |

|

1,054.6 |

|

1,068.7 |

|

| Selling, general and administrative expenses |

|

800.3 |

|

773.7 |

|

| Operating income |

|

254.3 |

|

295.0 |

|

| Interest expense, net |

|

7.4 |

|

16.1 |

|

| Other expense (income) |

|

10.7 |

|

2.2 |

|

| Income before provision for income taxes |

|

236.2 |

|

276.7 |

|

| Provision for income taxes |

|

40.9 |

|

49.8 |

|

| Net income | $ |

195.3 |

$ |

226.9 |

|

| Net income per share: | |||||

| Basic | $ |

0.81 |

$ |

0.82 |

|

| Diluted | $ |

0.79 |

$ |

0.80 |

|

| Shares used in computing net income per share: | |||||

| Basic |

|

241.5 |

|

278.2 |

|

| Diluted |

|

246.8 |

|

285.2 |

|

Schedule 2: Detail to

| DETAIL TO |

||||||||||||

| For the Quarter Ended |

||||||||||||

| (in millions) | ||||||||||||

| (unaudited) | ||||||||||||

| QUARTER ENDED | ||||||||||||

| % Change vs. FY22 | Constant Currency % Change vs. FY22 |

|||||||||||

| Coach | $ |

1,119.3 |

$ |

1,114.9 |

0 % |

4 % |

||||||

|

321.9 |

|

299.5 |

7 % |

10 % |

|||||||

|

65.3 |

|

66.5 |

(2)% |

- % |

|||||||

| Total Tapestry | $ |

1,506.5 |

$ |

1,480.9 |

2 % |

5 % |

||||||

Schedule 3: Items Affecting Comparability – 1Q22

| GAAP TO NON-GAAP RECONCILIATION | ||||||||

| (in millions, except per share data) | ||||||||

| (unaudited) | ||||||||

| For the Quarter Ended |

||||||||

| Item Affecting Comparability | ||||||||

| GAAP Basis (As Reported) |

Acceleration Program | Non-GAAP Basis (Excluding Items) |

||||||

| Cost of sales | ||||||||

| Coach |

|

831.0 |

|

- |

|

831.0 |

||

|

199.2 |

|

- |

|

199.2 |

|||

|

38.5 |

|

- |

|

38.5 |

|||

| Gross profit(1) | $ |

1,068.7 |

$ |

- |

$ |

1,068.7 |

||

| SG&A expenses | ||||||||

| Coach |

|

465.3 |

|

1.4 |

|

463.9 |

||

|

162.0 |

|

1.4 |

|

160.6 |

|||

|

40.0 |

|

0.4 |

|

39.6 |

|||

| Corporate |

|

106.4 |

|

8.9 |

|

97.5 |

||

| SG&A expenses | $ |

773.7 |

$ |

12.1 |

$ |

761.6 |

||

| Operating income (loss) | ||||||||

| Coach |

|

365.7 |

|

(1.4) |

|

367.1 |

||

|

37.2 |

|

(1.4) |

|

38.6 |

|||

|

(1.5) |

|

(0.4) |

|

(1.1) |

|||

| Corporate |

|

(106.4) |

|

(8.9) |

|

(97.5) |

||

| Operating income (loss) | $ |

295.0 |

$ |

(12.1) |

$ |

307.1 |

||

| Provision for income taxes |

|

49.8 |

|

(3.9) |

|

53.7 |

||

| Net income (loss) | $ |

226.9 |

$ |

(8.2) |

$ |

235.1 |

||

| Net income (loss) per diluted common share | $ |

0.80 |

$ |

(0.02) |

$ |

0.82 |

||

(1) Adjustments within Gross profit are recorded within Cost of sales. |

||||||||

The Company reports information in accordance with

The Company operates on a global basis and reports financial results in

Net sales changes for the Company and each segment are based on absolute sales dollar changes and are not presented in accordance with the Company’s comparable sales definition utilized historically due to the uncertain business environment resulting from the impact of the Covid-19 pandemic.

Management utilizes these non-GAAP and constant currency measures to conduct and evaluate its business during its regular review of operating results for the periods affected and to make decisions about Company resources and performance. The Company believes presenting these non-GAAP measures, which exclude items that are not comparable from period to period, is useful to investors and others in evaluating the Company’s ongoing operating and financial results in a manner that is consistent with management’s evaluation of business performance and understanding how such results compare with the Company’s historical performance. Additionally, the Company believes presenting these metrics on a constant currency basis will help investors and analysts to understand the effect of significant year-over-year foreign currency exchange rate fluctuations on these performance measures and provide a framework to assess how business is performing and expected to perform excluding these effects.

Schedule 4: Condensed Consolidated Balance Sheets

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

| At |

|||||

| (in millions) | |||||

| (unaudited) | (audited) | ||||

| ASSETS | |||||

| Cash, cash equivalents and short-term investments | $ |

557.1 |

$ |

953.2 |

|

| Receivables |

|

269.6 |

|

252.3 |

|

| Inventories |

|

1,139.8 |

|

994.2 |

|

| Other current assets |

|

420.9 |

|

374.1 |

|

| Total current assets |

|

2,387.4 |

|

2,573.8 |

|

| Property and equipment, net |

|

526.3 |

|

544.4 |

|

| Lease right-of-use assets |

|

1,281.6 |

|

1,281.6 |

|

| Other noncurrent assets |

|

2,884.7 |

|

2,865.5 |

|

| Total assets | $ |

7,080.0 |

$ |

7,265.3 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||

| Accounts payable | $ |

510.9 |

$ |

520.7 |

|

| Accrued liabilities |

|

489.8 |

|

628.2 |

|

| Short-term lease liabilities |

|

282.7 |

|

288.7 |

|

| Current debt |

|

25.0 |

|

31.2 |

|

| Total current liabilities |

|

1,308.4 |

|

1,468.8 |

|

| Long-term debt |

|

1,653.4 |

|

1,659.2 |

|

| Long-term lease liabilities |

|

1,273.3 |

|

1,282.3 |

|

| Other liabilities |

|

589.5 |

|

569.5 |

|

| Stockholders' equity |

|

2,255.4 |

|

2,285.5 |

|

| Total liabilities and stockholders' equity | $ |

7,080.0 |

$ |

7,265.3 |

|

Schedule 5: Condensed Consolidated Statement of Cash Flows

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS | |||||

| For the three months ended |

|||||

| (in millions) | |||||

| (unaudited) | (unaudited) | ||||

2022 |

2021 |

||||

| Cash Flows from Operating Activities | |||||

| Net income | $ |

195.3 |

$ |

226.9 |

|

| Adjustments to reconcile net income (loss) to net cash flows from operating activities: | |||||

| Depreciation and amortization |

|

43.8 |

|

50.8 |

|

| Other non-cash items |

|

(10.0) |

|

3.7 |

|

| Changes in operating assets and liabilities |

|

(399.5) |

|

(259.6) |

|

| Net cash provided by (used in) operating activities |

|

(170.4) |

|

21.8 |

|

| Cash Flows from Investing Activities | |||||

| Purchases of property and equipment |

|

(27.3) |

|

(33.4) |

|

| Other items |

|

174.1 |

|

(395.0) |

|

| Net cash provided by (used in) investing activities |

|

146.8 |

|

(428.4) |

|

| Cash Flows from Financing Activities | |||||

| Dividend payments |

|

(72.7) |

|

(69.6) |

|

| Repurchase of common stock |

|

(94.9) |

|

(250.0) |

|

| Other items |

|

(58.6) |

|

(26.6) |

|

| Net cash provided by (used in) financing activities |

|

(226.2) |

|

(346.2) |

|

| Effect of exchange rate on cash and cash equivalents |

|

(13.5) |

|

(2.3) |

|

| Net (decrease) increase in cash and cash equivalents |

|

(263.3) |

|

(755.1) |

|

| Cash and cash equivalents at beginning of period | $ |

789.8 |

$ |

2,007.7 |

|

| Cash and cash equivalents at end of period |

|

526.5 |

|

1,252.6 |

|

Schedule 6: Store Count by Brand – 1Q23

| STORE COUNT | ||||||||

| At |

||||||||

| (unaudited) | ||||||||

| As of | As of | |||||||

| Directly-Operated Store Count: | Openings | (Closures) | ||||||

| Coach | ||||||||

343 |

1 |

(3) |

341 |

|||||

| International | 602 |

10 |

(4) |

608 |

||||

207 |

- |

- |

207 |

|||||

| International | 191 |

3 |

(2) |

192 |

||||

39 |

- |

(1) |

38 |

|||||

| International | 61 |

- |

(1) |

60 |

||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20221110005369/en/

Media:

Andrea Shaw Resnick

Chief Communications Officer

212/629-2618

aresnick@tapestry.com

Analysts and Investors:

Christina Colone

Global Head of Investor Relations

212/946-7252

ccolone@tapestry.com

212/946-8183

Director of Investor Relations

kmueller@tapestry.com

Source: