Third Federal Savings and Loan Association of Cleveland, MHC Receives Non-Objection for Dividend Waiver

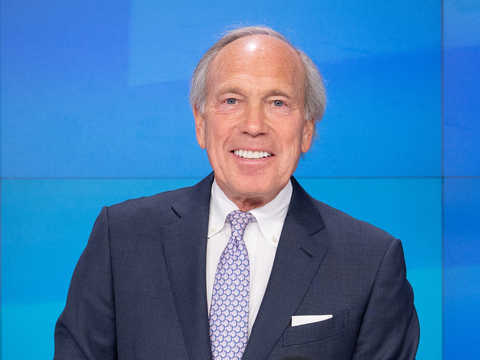

Chairman and CEO Marc A. Stefanski (Photo: Business Wire)

“We appreciate the ongoing support of our members for the MHC dividend waiver and are pleased to announce the non-objection from the Federal Reserve,” said Chairman and CEO Marc A. Stefanski. “The result will allow us the opportunity to maximize the capability to offer dividends to our institutional and individual shareholders. This, along with a focus on capital preservation, and a proactive approach to our business, keeps us strong, stable, and safe.”

The MHC is the mutual holding company and owner of 227,119,132 shares, or

Third Federal Savings and Loan Association is a leading provider of savings and mortgage products, and operates under the values of love, trust, respect, a commitment to excellence and fun. Founded in

This news release contains forward-looking statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The forward-looking statements contained herein include, but are not limited to, the Company’s plans regarding its dividends. These forward-looking statements involve risks and uncertainties that could cause the Company’s results to differ materially from management’s current expectations.

The Company’s risks and uncertainties are detailed in its filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2023. Forward-looking statements are based on the beliefs and assumptions of our management and on currently available information. The Company undertakes no responsibility to publicly update or revise any forward-looking statement.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240809722180/en/

Jennifer Rosa

(216) 429-5037

Source: Third Federal Savings and Loan