Telecom Argentina S.A. Announces the Filing of Its Form 20-F with the U.S. Securities and Exchange Commission

Telecom Argentina (NYSE:TEO) has announced the filing of its 2024 Form 20-F with the U.S. Securities and Exchange Commission (SEC), including audited financial statements under IFRS for the year ended December 31, 2024. The company, with a market cap of US$4,781.2 million as of February 27, 2025, has made these documents accessible through their investor relations website and the SEC webpage.

As a leading telecommunications provider in Argentina, Telecom Argentina offers comprehensive services including fixed-line telephony, cellular, data transmission, pay TV, and Internet services. The company also maintains operations in Paraguay (mobile, broadband, satellite TV) and Uruguay (pay TV). As of December 31, 2024, Telecom Argentina has 2,153,688,011 issued and outstanding shares.

Telecom Argentina (NYSE:TEO) ha annunciato il deposito del suo Modulo 20-F per il 2024 presso la Securities and Exchange Commission (SEC) degli Stati Uniti, includendo i bilanci finanziari auditati secondo gli IFRS per l'anno conclusosi il 31 dicembre 2024. L'azienda, con una capitalizzazione di mercato di 4.781,2 milioni di dollari USA al 27 febbraio 2025, ha reso questi documenti accessibili attraverso il proprio sito web per le relazioni con gli investitori e la pagina della SEC.

In qualità di principale fornitore di telecomunicazioni in Argentina, Telecom Argentina offre servizi completi tra cui telefonia fissa, cellulare, trasmissione dati, pay TV e servizi Internet. L'azienda mantiene anche operazioni in Paraguay (mobile, banda larga, TV satellitare) e Uruguay (pay TV). Al 31 dicembre 2024, Telecom Argentina ha 2.153.688.011 azioni emesse e in circolazione.

Telecom Argentina (NYSE:TEO) ha anunciado la presentación de su Formulario 20-F para 2024 ante la Comisión de Valores de EE. UU. (SEC), incluyendo estados financieros auditados bajo IFRS para el año que finalizó el 31 de diciembre de 2024. La compañía, con una capitalización de mercado de 4.781,2 millones de dólares EE. UU. al 27 de febrero de 2025, ha hecho accesibles estos documentos a través de su sitio web de relaciones con inversores y la página de la SEC.

Como proveedor líder de telecomunicaciones en Argentina, Telecom Argentina ofrece servicios integrales que incluyen telefonía fija, celular, transmisión de datos, televisión de pago y servicios de Internet. La empresa también mantiene operaciones en Paraguay (móvil, banda ancha, TV satelital) y Uruguay (TV de pago). Al 31 de diciembre de 2024, Telecom Argentina tiene 2.153.688.011 acciones emitidas y en circulación.

텔레콤 아르헨티나 (NYSE:TEO)는 미국 증권 거래 위원회(SEC)에 2024년 양식 20-F를 제출했다고 발표했으며, 2024년 12월 31일 종료된 회계연도에 대한 IFRS 기준의 감사 재무제표를 포함하고 있습니다. 2025년 2월 27일 기준으로 47억 8,120만 달러의 시가총액을 보유한 이 회사는 투자자 관계 웹사이트와 SEC 웹페이지를 통해 이러한 문서를 제공하고 있습니다.

아르헨티나의 주요 통신 제공업체인 텔레콤 아르헨티나는 유선 전화, 이동통신, 데이터 전송, 유료 TV 및 인터넷 서비스 등 포괄적인 서비스를 제공합니다. 이 회사는 또한 파라과이(모바일, 브로드밴드, 위성 TV)와 우루과이(유료 TV)에서도 운영을 유지하고 있습니다. 2024년 12월 31일 기준으로 텔레콤 아르헨티나는 21억 5,368만 8011주의 발행 및 유통 주식을 보유하고 있습니다.

Telecom Argentina (NYSE:TEO) a annoncé le dépôt de son formulaire 20-F pour 2024 auprès de la Securities and Exchange Commission (SEC) des États-Unis, incluant des états financiers audités selon les normes IFRS pour l'année se terminant le 31 décembre 2024. L'entreprise, avec une capitalisation boursière de 4,781.2 millions de dollars US au 27 février 2025, a rendu ces documents accessibles via son site web de relations avec les investisseurs et la page de la SEC.

En tant que principal fournisseur de télécommunications en Argentine, Telecom Argentina propose des services complets incluant la téléphonie fixe, la téléphonie mobile, la transmission de données, la télévision payante et les services Internet. L'entreprise maintient également des opérations au Paraguay (mobile, haut débit, télévision par satellite) et en Uruguay (télévision payante). Au 31 décembre 2024, Telecom Argentina a 2.153.688.011 actions émises et en circulation.

Telecom Argentina (NYSE:TEO) hat die Einreichung seines Formulars 20-F für 2024 bei der US-amerikanischen Wertpapier- und Börsenaufsichtsbehörde (SEC) bekannt gegeben, einschließlich geprüfter Finanzberichte nach IFRS für das am 31. Dezember 2024 endende Jahr. Das Unternehmen, das zum 27. Februar 2025 eine Marktkapitalisierung von 4.781,2 Millionen US-Dollar hat, hat diese Dokumente über seine Investor-Relations-Website und die SEC-Webseite zugänglich gemacht.

Als führender Telekommunikationsanbieter in Argentinien bietet Telecom Argentina umfassende Dienstleistungen an, darunter Festnetztelefonie, Mobilfunk, Datenübertragung, Pay-TV und Internetdienste. Das Unternehmen unterhält auch Aktivitäten in Paraguay (Mobilfunk, Breitband, Satellitenfernsehen) und Uruguay (Pay-TV). Zum 31. Dezember 2024 hat Telecom Argentina 2.153.688.011 ausgegebene und im Umlauf befindliche Aktien.

- Market cap of US$4.78 billion indicates strong market presence

- Diversified revenue streams across three countries

- Comprehensive service portfolio including mobile, broadband, TV, and telephony

- Exposure to currency risks in Argentina, Paraguay, and Uruguay

- Regulatory uncertainties due to new government policies in Argentina

- Vulnerable to macroeconomic challenges in Latin American markets

Market Cap (NYSE:TEO): US

February 28, 2025

BUENOS AIRES, AR / ACCESS Newswire / February 28, 2025 / Telecom Argentina (NYSE:TEO)(BYMA:TECO2), ("Telecom Argentina" or the "Company"), announces that it has submitted today its 2024 Annual Report on Form 20-F to the U.S. Securities and Exchange Commission ("SEC"), which includes our audited financial statements under International Financial Reporting Standards ("IFRS") as of and for the year ended December 31, 2024.

Telecom Argentina's 2024 Form 20-F and the referred audited financial statements as of and for the year ended December 31, 2024 can be accessed and downloaded from the Investor Relations section of the Company's website at https://inversores.telecom.com.ar/en/sec-presentations.html. In addition, these documents can be found on the SEC webpage (www.sec.gov) under "FILINGS / Company Filing Search", under the CIK code No. 0000932470.

Finally, shareholders are informed that, upon request, the Company will provide a hard copy of the filed 2024 Form 20-F, which includes the audited financial statements as of and for the fiscal year ended December 31, 2024, free of charge. Any such request and/or any questions related to the Company's Form 20-F and the financial statements should be made to the following persons:

*Market Cap as of February 27, 2025

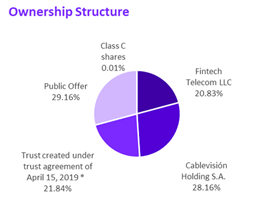

Telecom Argentina is a leading telecommunications company in Argentina, where it offers, either itself or through its controlled subsidiaries local and long distance fixed-line telephony, cellular, data transmission, and pay TV and Internet services, among other services. Additionally, Telecom Argentina offers mobile, broadband and satellite TV services in Paraguay and pay TV services in Uruguay. The Company commenced operations on November 8, 1990, upon the Argentine government's transfer of the telecommunications system in the northern region of Argentina.

As of December 31, 2024, Telecom Argentina owns 2,153,688,011 issued and outstanding shares.

Trustees: Hector Horacio Magnetto and David Manuel Martínez Guzmán

For more information, please contact Investor Relations:

Luis Fernando Rial Ubago |

| Tomás Pellicori |

| Livio Gentile |

|

|

For information about Telecom Argentina's services, visit:

www.telecom.com.ar

www.personal.com.ar

www.personal.com.py

Disclaimer

This document may contain statements that could constitute forward-looking statements, including, but not limited to (i) the Company's expectations for its future performance, revenues, income, earnings per share, capital expenditures, dividends, liquidity and capital structure; (ii) the continued synergies expected from the merger between the Company and Cablevisión S.A. (or the Merger); (iii) the implementation of the Company's business strategy; (iv) the changing dynamics and growth in the telecommunications and cable markets in Argentina, Paraguay, Uruguay and the United States; (v) the Company's outlook for new and enhanced technologies; (vi) the effects of operating in a competitive environment; (vii) the industry conditions; (viii) the outcome of certain legal proceedings; and (ix) regulatory and legal developments. Forward-looking statements may be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "project," "will," "may" and "should" or other similar expressions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. In addition, certain forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Many factors could cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by forward-looking statements. These factors include, among others: (i) the Company's ability to successfully implement our business strategy and to achieve synergies resulting from the Merger; (ii) the Company's ability to introduce new products and services that enable business growth; (iii) uncertainties relating to political and economic conditions in Argentina, Paraguay, Uruguay and the United States, including the policies of the new government in Argentina; (iv) the impact of political developments, including the policies of the new government in Argentina, on the demand for securities of Argentine companies; (v) inflation, the devaluation of the peso, the Guaraní and the Uruguayan peso and exchange rate risks in Argentina, Paraguay and Uruguay; (vi) restrictions on the ability to exchange Argentine or Uruguayan pesos or Paraguayan guaraníes into foreign currencies and transfer funds abroad; (vii) the impact of currency and exchange measures or restrictions on our ability to access the international markets and our ability to repay our dollar-denominated indebtedness; (viii) the creditworthiness of our actual or potential customers; (ix) the nationalization, expropriation and/or increased government intervention in companies; (x) technological changes; (xi) the impact of legal or regulatory matters, changes in the interpretation of current or future regulations or reform and changes in the legal or regulatory environment in which the Company operates, including regulatory developments such as sanctions regimes in other jurisdictions (e.g., the United States) which impact on the Company's suppliers; (xii) the effects of increased competition; (xiii) reliance on content produced by third parties; (xiv) increasing cost of the Company's supplies; (xv) inability to finance on reasonable terms capital expenditures required to remain competitive; (xvi) fluctuations, whether seasonal or in response to adverse macro-economic developments, in the demand for advertising; (xvii) the Company's ability to compete and develop our business in the future; (xviii) the impact of increased national or international restrictions on the transfer or use of telecommunications technology; and (xix) the impact of the outbreak of COVID-19 on the global economy and specifically on the economies of the countries in which we operate, as well as on our operations and financial performance. Many of these factors are macroeconomic and regulatory in nature and therefore beyond the control of the Company's management. Should one or more of these risks or uncertainties materialize, or underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, intended, planned or projected. The Company does not intend and does not assume any obligation to update the forward-looking statements contained in this document. These forward-looking statements are based upon a number of assumptions and other important factors that could cause our actual results, performance or achievements to differ materially from our future results, performance or achievements expressed or implied by such forward-looking statements. Readers are encouraged to consult the Company's Annual Report on Form 20-F and the periodic filings made on Form 6-K, which are periodically filed with or furnished to the United States Securities and Exchange Commission, as well as the presentations periodically filed before the Argentine Securities and Exchange Commission (Comisión Nacional de Valores) and the Buenos Aires Stock Exchange (Bolsas y Mercados Argentinos), for further information concerning risks and uncertainties faced by the Company.

*******

SOURCE: Telecom Argentina S.A.

View the original press release on ACCESS Newswire