Tellurian Explores Sale of Haynesville Upstream Assets

- None.

- None.

Insights

The decision by Tellurian Inc. to engage Lazard for the potential sale of its upstream business reflects a strategic shift towards optimizing their core operations, specifically the Driftwood LNG project. The upstream segment, which involves exploration and production of natural gas, is capital intensive and poses a different set of risks compared to the midstream and downstream segments. Tellurian's move to divest these assets can be seen as an attempt to reallocate capital and focus on areas with potentially higher returns.

For stakeholders, this could mean a leaner business model with reduced operational complexity and overhead costs. The sale of upstream assets may also provide Tellurian with the necessary liquidity to reduce debt and avoid dilutive equity financing, which would be favorable for existing shareholders. However, this strategy is not without risks, as it increases dependence on third-party suppliers for natural gas, potentially affecting the cost structure and margins for the Driftwood LNG project in the long term.

The announcement indicates that Tellurian is looking to strengthen its balance sheet by reducing debt and lowering general and administrative expenses through the sale of its upstream assets. This is a significant move, as it suggests Tellurian's management is prioritizing financial stability and operational efficiency over vertical integration. By not issuing equity, Tellurian is avoiding shareholder dilution, which is often viewed positively by the market.

Investors should note the production figures of 19.5 billion cubic feet for the last quarter, which will no longer contribute to Tellurian's revenue once the sale is finalized. This potential revenue gap will need to be filled by the Driftwood LNG project's success or other initiatives. Additionally, Tellurian's commitment to environmental stewardship, such as implementing an active emissions monitoring program, may enhance its corporate image and appeal to environmentally conscious investors, potentially impacting the company's valuation positively.

From an ESG perspective, Tellurian's mention of operational safety, environmental stewardship and specific measures like electrifying new production sites and committing to green completions is noteworthy. These initiatives align with the broader industry trend towards sustainable practices and may improve Tellurian's ESG ratings. Such improvements can attract investment from funds focused on sustainability, which are becoming increasingly significant in the market.

However, the sale of upstream assets does not eliminate the environmental impact of these operations; it merely transfers the responsibility to another entity. Stakeholders with a strong focus on ESG may scrutinize the buyer's environmental credentials and the terms of the sale to ensure that Tellurian's sustainability efforts are not undermined by the divestiture.

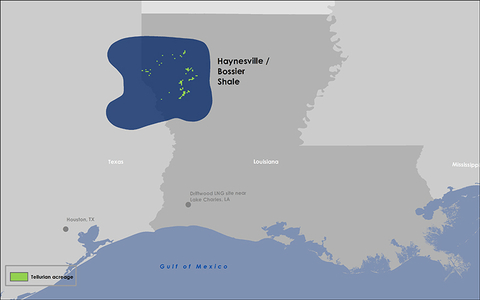

Tellurian natural gas assets 2024 (Graphic: Business Wire)

Chief Executive Officer Octávio Simões said, “As we commercialize Driftwood LNG, Tellurian has been reviewing its strategy, including the dynamics of the

“By unlocking the full value of these high-quality assets, we aim to substantially reduce our debt, further reduce our general and administrative expenses, and provide additional cash, enabling us to develop Driftwood LNG. Currently, this approach is more attractive than issuing equity to fund our 2024 development activities and working capital needs,” Simões added.

Tellurian produced 19.5 billion cubic feet (Bcf) of natural gas for the quarter ended September 30, 2023. Tellurian’s natural gas assets include 31,149 net acres, interests in 159 producing wells and over 400 drilling locations. Tellurian maintains an exemplary operational safety record and demonstrates responsible environmental stewardship. Implementing an active emissions monitoring program, electrifying all new production well sites, and committing to green completions are just a few examples of Tellurian’s efforts to reduce its carbon footprint.

About Tellurian Inc.

Tellurian intends to create value for shareholders by building a low-cost, global natural gas business, profitably delivering natural gas to customers worldwide. Tellurian is developing a portfolio of LNG marketing and trading, infrastructure that includes an ~ 27.6 mtpa LNG export facility and an associated pipeline. Tellurian is based in

For more information, please visit www.tellurianinc.com. Follow us on Twitter at twitter.com/TellurianLNG

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of

View source version on businesswire.com: https://www.businesswire.com/news/home/20240205012839/en/

Media:

Joi Lecznar

EVP Public and Government Affairs

Phone +1.832.962.4044

joi.lecznar@tellurianinc.com

Investors:

Matt Phillips

Vice President, Investor Relations

Phone +1.832.320.9331

matthew.phillips@tellurianinc.com

Source: Tellurian Inc.