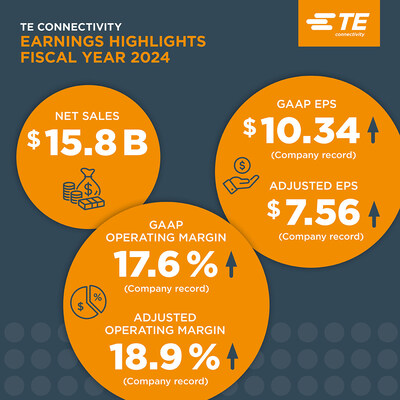

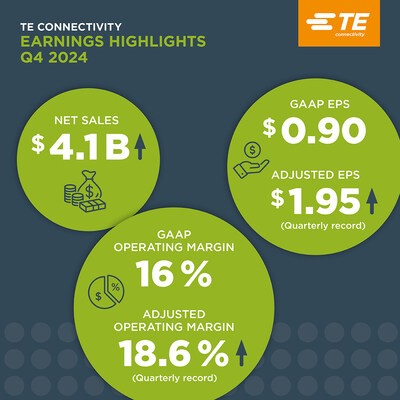

TE Connectivity announces fourth quarter and fiscal 2024 results with full year records for operating margin, EPS and cash generation

TE Connectivity (NYSE: TEL) reported strong Q4 and fiscal 2024 results, with Q4 net sales of $4.1 billion, up 1% year-over-year. The company achieved record adjusted EPS of $1.95 in Q4, up 10% year-over-year. Full-year highlights include net sales of $15.8 billion, record operating margins, and record cash flow generation of $3.5 billion from operations. The board authorized a $2.5 billion increase in share repurchase program. For Q1 FY25, TE expects net sales of approximately $3.9 billion and adjusted EPS of $1.88.

TE Connectivity (NYSE: TEL) ha registrato risultati solidi per il quarto trimestre e per l'anno fiscale 2024, con vendite nette nel Q4 di 4,1 miliardi di dollari, in aumento dell'1% rispetto all'anno precedente. L'azienda ha raggiunto un utile per azione rettificato record di 1,95 dollari nel Q4, con un incremento del 10% rispetto all'anno precedente. I punti salienti dell'anno includono vendite nette di 15,8 miliardi di dollari, margini operativi record e una generazione di flusso di cassa record di 3,5 miliardi di dollari dalle operazioni. Il consiglio ha autorizzato un aumento di 2,5 miliardi di dollari nel programma di riacquisto di azioni. Per il primo trimestre dell'anno fiscale 2025, TE prevede vendite nette di circa 3,9 miliardi di dollari e un utile per azione rettificato di 1,88 dollari.

TE Connectivity (NYSE: TEL) reportó resultados sólidos para el cuarto trimestre y el año fiscal 2024, con ventas netas en el Q4 de 4.1 mil millones de dólares, un aumento del 1% interanual. La compañía alcanzó un EPS ajustado récord de 1.95 dólares en el Q4, un incremento del 10% en comparación con el año anterior. Los aspectos destacados del año incluyen ventas netas de 15.8 mil millones de dólares, márgenes operativos récord y una generación de flujo de efectivo de 3.5 mil millones de dólares provenientes de operaciones. La junta autorizó un aumento de 2.5 mil millones de dólares en el programa de recompra de acciones. Para el primer trimestre del año fiscal 2025, TE espera ventas netas de aproximadamente 3.9 mil millones de dólares y un EPS ajustado de 1.88 dólares.

TE Connectivity (NYSE: TEL)는 2024 회계연도 4분기 및 연간 실적을 발표했으며, 4분기 순매출 41억 달러로 전년 대비 1% 증가했습니다. 회사는 4분기에 조정된 주당순이익 1.95달러를 기록하며, 이는 전년 대비 10% 증가한 수치입니다. 연간 주요 하이라이트로는 순매출 158억 달러, 기록적인 운영 마진, 그리고 영업 현금 흐름 35억 달러가 포함되어 있습니다. 이사회는 25억 달러 증가를 승인하여 자사주 매입 프로그램을 확장했습니다. 2025 회계연도 1분기에는 TE가 약 39억 달러의 순매출과 1.88달러의 조정 EPS를 예상하고 있습니다.

TE Connectivity (NYSE: TEL) a annoncé de solides résultats pour le quatrième trimestre et l'exercice 2024, avec un chiffre d'affaires net de 4,1 milliards de dollars au T4, en hausse de 1 % par rapport à l'année précédente. L'entreprise a atteint un bénéfice par action ajusté record de 1,95 dollar au T4, en augmentation de 10 % par rapport à l'année précédente. Les faits marquants de l'année comprennent un chiffre d'affaires net de 15,8 milliards de dollars, des marges opérationnelles record et une génération de flux de trésorerie record de 3,5 milliards de dollars provenant des opérations. Le conseil d'administration a autorisé une augmentation de 2,5 milliards de dollars dans le programme de rachat d'actions. Pour le premier trimestre de l'exercice 2025, TE prévoit des ventes nettes d'environ 3,9 milliards de dollars et un bénéfice par action ajusté de 1,88 dollar.

TE Connectivity (NYSE: TEL) hat für das vierte Quartal und das Geschäftsjahr 2024 starke Ergebnisse gemeldet, mit einem Nettoumsatz im Q4 von 4,1 Milliarden Dollar, was einem Anstieg von 1 % im Jahresvergleich entspricht. Das Unternehmen erzielte im Q4 einen Rekord von 1,95 Dollar beim bereinigten Gewinn pro Aktie, was einem Anstieg von 10 % im Vergleich zum Vorjahr entspricht. Zu den Höhepunkten des gesamten Jahres gehören Nettoumsätze von 15,8 Milliarden Dollar, Rekordbetriebsgewinne und ein Rekord bei der Cashflow-Generierung von 3,5 Milliarden Dollar aus dem operativen Geschäft. Der Vorstand genehmigte eine Erhöhung um 2,5 Milliarden Dollar im Aktienrückkaufprogramm. Für das erste Quartal des Geschäftsjahres 2025 erwartet TE einen Nettoumsatz von etwa 3,9 Milliarden Dollar und einen bereinigten Gewinn pro Aktie von 1,88 Dollar.

- Record Q4 adjusted EPS of $1.95, up 10% year-over-year

- Record full-year operating margins with GAAP at 17.6% and adjusted at 18.9%

- Strong cash flow generation with $3.5 billion from operations

- Transportation segment achieved 20% adjusted operating margin

- $2.5 billion increase in share repurchase program authorization

- GAAP EPS declined 49% year-over-year in Q4, including $0.78 tax-related impact

- Q1 FY25 guidance includes $0.04 tax headwinds compared to prior year

Insights

TE Connectivity delivered a robust fiscal 2024 with several notable achievements. The record adjusted EPS of

Key financial metrics demonstrate solid execution:

- Q4 sales of

$4.1 billion with2% organic growth - Record free cash flow of

$2.8 billion for FY24 - Transportation segment achieving

20% adjusted operating margin

The company's strategic positioning in next-generation automotive technologies and AI infrastructure presents significant growth opportunities. The Transportation segment's performance, particularly in electrification, aligns with global EV adoption trends. The focus on AI programs in the Communications segment is timely given the explosive growth in data center investments.

Q1 FY25 guidance of

Board of directors authorizes

GALWAY,

Fourth Quarter Highlights

- Net sales were above guidance at

$4.1 billion 1% on a reported basis year over year and2% organically. - GAAP diluted earnings per share (EPS) from continuing operations were

$0.90 49% year over year, including a one-time tax-related impact of$0.78 $1.95 10% year over year. - Operating margins were

16.0% and adjusted operating margins were a fourth quarter record at18.6% , driven by strong operational performance. - Cash flow from operating activities was approximately

$1 billion $833 million $952 million

Full Year Highlights

- Net sales were

$15.8 billion - GAAP operating margin was

17.6% and adjusted operating margin was18.9% , each a record, driven by strong operational performance. - Record GAAP EPS was

$10.34 $7.56 12% . - Generated record cash flow for the full year, including:

- Cash flow from operating activities of approximately

$3.5 billion - Free cash flow of

$2.8 billion

- Cash flow from operating activities of approximately

- Returned approximately

$2.8 billion $340 million

Share Repurchase Authorization

- The Company's board of directors authorized a

$2.5 billion

"Our team finished the fiscal year strong, delivering quarterly sales that were above guidance and a record

"Our teams will build on our momentum from 2024 and we expect first quarter sales and adjusted EPS to be up year over year. We will continue to capitalize on our operational strengths and innovations in long-term growth trends such as electrification and data connectivity in transportation, renewable energy and AI. In a reinforcement of our long-term value creation model, I'm pleased that our board authorized a

First Quarter FY25 Outlook

For the first quarter of fiscal 2025, the company expects net sales of approximately

Beginning in fiscal 2025, the company will have two reportable segments – Transportation Solutions and Industrial Solutions – resulting from a reorganization announced in the fourth quarter of fiscal 2024. The company will also provide recast financial information in an 8-K filing later this quarter.

Information about TE Connectivity's use of non-GAAP financial measures is provided below. For reconciliations of these non-GAAP financial measures, see the attached tables.

Any share repurchase by the company will be made in accordance with applicable securities laws in the open market or in private transactions. The repurchase program is subject to business and market conditions, and may be commenced, suspended or discontinued at any time or from time to time without prior notice.

Conference Call and Webcast

The company will hold a conference call for investors today beginning at 8:30 a.m. ET. The conference call may be accessed in the following ways:

- At TE Connectivity's website: investors.te.com

- By telephone: For both "listen-only" participants and those participants who wish to take part in the question-and-answer portion of the call, the dial-in number in

the United States is (800) 715-9871 and for international callers, the dial-in number is (646) 307-1963. - A replay of the conference call will be available on TE Connectivity's investor website at investors.te.com at 11:30 a.m. ET on Oct. 30, 2024.

About TE Connectivity

TE Connectivity plc (NYSE: TEL) is a global industrial technology leader creating a safer, sustainable, productive, and connected future. Our broad range of connectivity and sensor solutions enable the distribution of power, signal and data to advance next-generation transportation, renewable energy, automated factories, data centers, medical technology and more. With more than 85,000 employees, including 8,000 engineers, working alongside customers in approximately 130 countries, TE ensures that EVERY CONNECTION COUNTS. Learn more at www.te.com and on LinkedIn, Facebook, WeChat, Instagram and X (formerly Twitter).

Non-GAAP Financial Measures

We present non-GAAP performance and liquidity measures as we believe it is appropriate for investors to consider adjusted financial measures in addition to results in accordance with accounting principles generally accepted in the

The following provides additional information regarding our non-GAAP financial measures:

- Organic Net Sales Growth (Decline) – represents net sales growth (decline) (the most comparable GAAP financial measure) excluding the impact of foreign currency exchange rates, and acquisitions and divestitures that occurred in the preceding twelve months, if any. Organic Net Sales Growth (Decline) is a useful measure of our performance because it excludes items that are not completely under management's control, such as the impact of changes in foreign currency exchange rates, and items that do not reflect the underlying growth of the company, such as acquisition and divestiture activity. This measure is a significant component in our incentive compensation plans.

- Adjusted Operating Income and Adjusted Operating Margin – represent operating income and operating margin, respectively, (the most comparable GAAP financial measures) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, and other income or charges, if any. We utilize these adjusted measures in combination with operating income and operating margin to assess segment level operating performance and to provide insight to management in evaluating segment operating plan execution and market conditions. Adjusted Operating Income is a significant component in our incentive compensation plans.

- Adjusted Income Tax (Expense) Benefit and Adjusted Effective Tax Rate – represent income tax (expense) benefit and effective tax rate, respectively, (the most comparable GAAP financial measures) after adjusting for the tax effect of special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any.

- Adjusted Income from Continuing Operations – represents income from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects.

- Adjusted Earnings Per Share – represents diluted earnings per share from continuing operations (the most comparable GAAP financial measure) before special items including restructuring and other charges, acquisition-related charges, impairment of goodwill, other income or charges, and certain significant tax items, if any, and, if applicable, the related tax effects. This measure is a significant component in our incentive compensation plans.

- Free Cash Flow (FCF) – is a useful measure of our ability to generate cash. The difference between net cash provided by operating activities (the most comparable GAAP financial measure) and Free Cash Flow consists mainly of significant cash outflows and inflows that we believe are useful to identify. We believe Free Cash Flow provides useful information to investors as it provides insight into the primary cash flow metric used by management to monitor and evaluate cash flows generated from our operations. Free Cash Flow is defined as net cash provided by operating activities excluding voluntary pension contributions and the cash impact of special items, if any, minus net capital expenditures. Voluntary pension contributions are excluded from the GAAP financial measure because this activity is driven by economic financing decisions rather than operating activity. Certain special items, including cash paid (collected) pursuant to collateral requirements related to cross-currency swap contracts, are also excluded by management in evaluating Free Cash Flow. Net capital expenditures consist of capital expenditures less proceeds from the sale of property, plant, and equipment. These items are subtracted because they represent long-term commitments. In the calculation of Free Cash Flow, we subtract certain cash items that are ultimately within management's and the Board of Directors' discretion to direct and may imply that there is less or more cash available for our programs than the most comparable GAAP financial measure indicates. It should not be inferred that the entire Free Cash Flow amount is available for future discretionary expenditures, as our definition of Free Cash Flow does not consider certain non-discretionary expenditures, such as debt payments. In addition, we may have other discretionary expenditures, such as discretionary dividends, share repurchases, and business acquisitions, that are not considered in the calculation of Free Cash Flow.

Forward-Looking Statements

This release contains certain "forward-looking statements" within the meaning of the

TE CONNECTIVITY LTD. | |||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) | |||||||||||

For the Quarters Ended | For the Years Ended | ||||||||||

September 27, | September 29, | September 27, | September 29, | ||||||||

2024 | 2023 | 2024 | 2023 | ||||||||

(in millions, except per share data) | |||||||||||

Net sales | $ | 4,068 | $ | 4,035 | $ | 15,845 | $ | 16,034 | |||

Cost of sales | 2,685 | 2,750 | 10,389 | 10,979 | |||||||

Gross margin | 1,383 | 1,285 | 5,456 | 5,055 | |||||||

Selling, general, and administrative expenses | 433 | 412 | 1,732 | 1,670 | |||||||

Research, development, and engineering expenses | 195 | 174 | 741 | 708 | |||||||

Acquisition and integration costs | 5 | 7 | 21 | 33 | |||||||

Restructuring and other charges, net | 99 | 57 | 166 | 340 | |||||||

Operating income | 651 | 635 | 2,796 | 2,304 | |||||||

Interest income | 26 | 21 | 87 | 60 | |||||||

Interest expense | (15) | (19) | (70) | (80) | |||||||

Other expense, net | (5) | (3) | (16) | (16) | |||||||

Income from continuing operations before income taxes | 657 | 634 | 2,797 | 2,268 | |||||||

Income tax (expense) benefit | (381) | (81) | 397 | (364) | |||||||

Income from continuing operations | 276 | 553 | 3,194 | 1,904 | |||||||

Income (loss) from discontinued operations, net of income taxes | — | (1) | (1) | 6 | |||||||

Net income | $ | 276 | $ | 552 | $ | 3,193 | $ | 1,910 | |||

Basic earnings per share: | |||||||||||

Income from continuing operations | $ | 0.91 | $ | 1.77 | $ | 10.40 | $ | 6.04 | |||

Income (loss) from discontinued operations | — | — | — | 0.02 | |||||||

Net income | 0.91 | 1.76 | 10.40 | 6.06 | |||||||

Diluted earnings per share: | |||||||||||

Income from continuing operations | $ | 0.90 | $ | 1.75 | $ | 10.34 | $ | 6.01 | |||

Income (loss) from discontinued operations | — | — | — | 0.02 | |||||||

Net income | 0.90 | 1.75 | 10.33 | 6.03 | |||||||

Weighted-average number of shares outstanding: | |||||||||||

Basic | 303 | 313 | 307 | 315 | |||||||

Diluted | 305 | 316 | 309 | 317 | |||||||

TE CONNECTIVITY LTD. | |||||

CONSOLIDATED BALANCE SHEETS (UNAUDITED) | |||||

September 27, | September 29, | ||||

2024 | 2023 | ||||

(in millions, except share data) | |||||

Assets | |||||

Current assets: | |||||

Cash and cash equivalents | $ | 1,319 | $ | 1,661 | |

Accounts receivable, net of allowance for doubtful accounts of | 3,055 | 2,967 | |||

Inventories | 2,517 | 2,552 | |||

Prepaid expenses and other current assets | 740 | 712 | |||

Total current assets | 7,631 | 7,892 | |||

Property, plant, and equipment, net | 3,903 | 3,754 | |||

Goodwill | 5,801 | 5,463 | |||

Intangible assets, net | 1,174 | 1,175 | |||

Deferred income taxes | 3,497 | 2,600 | |||

Other assets | 848 | 828 | |||

Total assets | $ | 22,854 | $ | 21,712 | |

Liabilities, redeemable noncontrolling interests, and shareholders' equity | |||||

Current liabilities: | |||||

Short-term debt | $ | 871 | $ | 682 | |

Accounts payable | 1,728 | 1,563 | |||

Accrued and other current liabilities | 2,147 | 2,218 | |||

Total current liabilities | 4,746 | 4,463 | |||

Long-term debt | 3,332 | 3,529 | |||

Long-term pension and postretirement liabilities | 810 | 728 | |||

Deferred income taxes | 199 | 185 | |||

Income taxes | 411 | 365 | |||

Other liabilities | 870 | 787 | |||

Total liabilities | 10,368 | 10,057 | |||

Commitments and contingencies | |||||

Redeemable noncontrolling interests | 131 | 104 | |||

Shareholders' equity: | |||||

Common shares, | 139 | 142 | |||

Accumulated earnings | 14,533 | 12,947 | |||

Treasury shares, at cost, 16,656,681 and 10,487,742 shares, respectively | (2,322) | (1,380) | |||

Accumulated other comprehensive income (loss) | 5 | (158) | |||

Total shareholders' equity | 12,355 | 11,551 | |||

Total liabilities, redeemable noncontrolling interests, and shareholders' equity | $ | 22,854 | $ | 21,712 | |

TE CONNECTIVITY LTD. | |||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | |||||||||||

For the Quarters Ended | For the Years Ended | ||||||||||

September 27, | September 29, | September 27, | September 29, | ||||||||

2024 | 2023 | 2024 | 2023 | ||||||||

(in millions) | |||||||||||

Cash flows from operating activities: | |||||||||||

Net income | $ | 276 | $ | 552 | $ | 3,193 | $ | 1,910 | |||

(Income) loss from discontinued operations, net of income taxes | — | 1 | 1 | (6) | |||||||

Income from continuing operations | 276 | 553 | 3,194 | 1,904 | |||||||

Adjustments to reconcile income from continuing operations to net cash provided by operating activities: | |||||||||||

Depreciation and amortization | 232 | 200 | 826 | 794 | |||||||

Deferred income taxes | 401 | 44 | (789) | (77) | |||||||

Non-cash lease cost | 34 | 23 | 134 | 129 | |||||||

Provision for losses on accounts receivable and inventories | (13) | (6) | 57 | 76 | |||||||

Share-based compensation expense | 27 | 28 | 127 | 123 | |||||||

Impairment of held for sale businesses | — | 7 | — | 74 | |||||||

Other | 18 | 16 | 71 | 101 | |||||||

Changes in assets and liabilities, net of the effects of acquisitions and divestitures: | |||||||||||

Accounts receivable, net | (216) | 56 | (134) | (146) | |||||||

Inventories | 97 | 278 | (30) | (45) | |||||||

Prepaid expenses and other current assets | 13 | 47 | 25 | 17 | |||||||

Accounts payable | 60 | (69) | 159 | (1) | |||||||

Accrued and other current liabilities | 159 | 35 | (165) | 21 | |||||||

Income taxes | (111) | (34) | (83) | 17 | |||||||

Other | 65 | (40) | 85 | 145 | |||||||

Net cash provided by operating activities | 1,042 | 1,138 | 3,477 | 3,132 | |||||||

Cash flows from investing activities: | |||||||||||

Capital expenditures | (213) | (194) | (680) | (732) | |||||||

Proceeds from sale of property, plant, and equipment | 4 | 1 | 16 | 4 | |||||||

Acquisition of businesses, net of cash acquired | — | (2) | (339) | (110) | |||||||

Proceeds from divestiture of businesses, net of cash retained by businesses sold | — | — | 59 | 48 | |||||||

Other | 3 | — | (6) | 22 | |||||||

Net cash used in investing activities | (206) | (195) | (950) | (768) | |||||||

Cash flows from financing activities: | |||||||||||

Net increase (decrease) in commercial paper | (54) | 42 | (75) | (40) | |||||||

Proceeds from issuance of debt | 348 | — | 348 | 499 | |||||||

Repayment of debt | (350) | — | (352) | (591) | |||||||

Proceeds from exercise of share options | 37 | 10 | 89 | 43 | |||||||

Repurchase of common shares | (761) | (271) | (2,062) | (945) | |||||||

Payment of common share dividends to shareholders | (196) | (184) | (760) | (725) | |||||||

Other | (18) | (4) | (57) | (34) | |||||||

Net cash used in financing activities | (994) | (407) | (2,869) | (1,793) | |||||||

Effect of currency translation on cash | 8 | (6) | — | 2 | |||||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | (150) | 530 | (342) | 573 | |||||||

Cash, cash equivalents, and restricted cash at beginning of period | 1,469 | 1,131 | 1,661 | 1,088 | |||||||

Cash, cash equivalents, and restricted cash at end of period | $ | 1,319 | $ | 1,661 | $ | 1,319 | $ | 1,661 | |||

Supplemental cash flow information: | |||||||||||

Interest paid on debt, net | $ | 26 | $ | 27 | $ | 64 | $ | 75 | |||

Income taxes paid, net of refunds | 91 | 71 | 475 | 425 | |||||||

TE CONNECTIVITY LTD. | |||||||||||

RECONCILIATION OF FREE CASH FLOW (UNAUDITED) | |||||||||||

For the Quarters Ended | For the Years Ended | ||||||||||

September 27, | September 29, | September 27, | September 29, | ||||||||

2024 | 2023 | 2024 | 2023 | ||||||||

(in millions) | |||||||||||

Net cash provided by operating activities | $ | 1,042 | $ | 1,138 | $ | 3,477 | $ | 3,132 | |||

Capital expenditures, net | (209) | (193) | (664) | (728) | |||||||

Free cash flow (1) | $ | 833 | $ | 945 | $ | 2,813 | $ | 2,404 | |||

(1) Free cash flow is a non-GAAP financial measure. See description of non-GAAP financial measures. | |||||||||||

TE CONNECTIVITY LTD. | |||||||||||||||||||||||

CONSOLIDATED SEGMENT DATA (UNAUDITED) | |||||||||||||||||||||||

For the Quarters Ended | For the Years Ended | ||||||||||||||||||||||

September 27, | September 29, | September 27, | September 29, | ||||||||||||||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

($ in millions) | |||||||||||||||||||||||

Net Sales | Net Sales | Net Sales | Net Sales | ||||||||||||||||||||

Transportation Solutions | $ | 2,311 | $ | 2,413 | $ | 9,398 | $ | 9,588 | |||||||||||||||

Industrial Solutions | 1,180 | 1,159 | 4,481 | 4,551 | |||||||||||||||||||

Communications Solutions | 577 | 463 | 1,966 | 1,895 | |||||||||||||||||||

Total | $ | 4,068 | $ | 4,035 | $ | 15,845 | $ | 16,034 | |||||||||||||||

Operating | Operating | Operating | Operating | Operating | Operating | Operating | Operating | ||||||||||||||||

Income | Margin | Income | Margin | Income | Margin | Income | Margin | ||||||||||||||||

Transportation Solutions | $ | 404 | 17.5 | % | $ | 411 | 17.0 | % | $ | 1,847 | 19.7 | % | $ | 1,451 | 15.1 | % | |||||||

Industrial Solutions | 137 | 11.6 | 162 | 14.0 | 588 | 13.1 | 602 | 13.2 | |||||||||||||||

Communications Solutions | 110 | 19.1 | 62 | 13.4 | 361 | 18.4 | 251 | 13.2 | |||||||||||||||

Total | $ | 651 | 16.0 | % | $ | 635 | 15.7 | % | $ | 2,796 | 17.6 | % | $ | 2,304 | 14.4 | % | |||||||

Adjusted | Adjusted | Adjusted | Adjusted | Adjusted | Adjusted | Adjusted | Adjusted | ||||||||||||||||

Operating | Operating | Operating | Operating | Operating | Operating | Operating | Operating | ||||||||||||||||

Income (1) | Margin (1) | Income (1) | Margin (1) | Income (1) | Margin (1) | Income (1) | Margin (1) | ||||||||||||||||

Transportation Solutions | $ | 446 | 19.3 | % | $ | 444 | 18.4 | % | $ | 1,917 | 20.4 | % | $ | 1,665 | 17.4 | % | |||||||

Industrial Solutions | 184 | 15.6 | 184 | 15.9 | 683 | 15.2 | 713 | 15.7 | |||||||||||||||

Communications Solutions | 125 | 21.7 | 71 | 15.3 | 387 | 19.7 | 299 | 15.8 | |||||||||||||||

Total | $ | 755 | 18.6 | % | $ | 699 | 17.3 | % | $ | 2,987 | 18.9 | % | $ | 2,677 | 16.7 | % | |||||||

(1) Adjusted operating income and adjusted operating margin are non-GAAP financial measures. See description of non-GAAP financial measures. | |||||||||||||||||||||||

TE CONNECTIVITY LTD. | |||||||||||||||||

RECONCILIATION OF NET SALES GROWTH (DECLINE) (UNAUDITED) | |||||||||||||||||

Change in Net Sales for the Quarter Ended September 27, 2024 | |||||||||||||||||

versus Net Sales for the Quarter Ended September 29, 2023 | |||||||||||||||||

Net Sales | Organic Net Sales | Acquisition/ | |||||||||||||||

Growth (Decline) | Growth (Decline) (1) | Translation (2) | (Divestiture) | ||||||||||||||

($ in millions) | |||||||||||||||||

Transportation Solutions (3): | |||||||||||||||||

Automotive | $ | (56) | (3.2) | % | $ | (10) | (0.5) | % | $ | — | $ | (46) | |||||

Commercial transportation | (16) | (4.3) | (13) | (3.8) | (3) | — | |||||||||||

Sensors | (30) | (10.6) | (29) | (10.5) | (1) | — | |||||||||||

Total | (102) | (4.2) | (52) | (2.2) | (4) | (46) | |||||||||||

Industrial Solutions (3): | |||||||||||||||||

Industrial equipment | (42) | (10.8) | (81) | (20.4) | 3 | 36 | |||||||||||

Aerospace, defense, and marine | 44 | 13.6 | 44 | 13.6 | — | — | |||||||||||

Energy | 23 | 10.0 | 31 | 13.7 | (8) | — | |||||||||||

Medical | (4) | (1.8) | (2) | (1.1) | (2) | — | |||||||||||

Total | 21 | 1.8 | (8) | (0.6) | (7) | 36 | |||||||||||

Communications Solutions (3): | |||||||||||||||||

Data and devices | 100 | 34.1 | 101 | 34.5 | (1) | — | |||||||||||

Appliances | 14 | 8.2 | 19 | 11.2 | (5) | — | |||||||||||

Total | 114 | 24.6 | 120 | 26.0 | (6) | — | |||||||||||

Total | $ | 33 | 0.8 | % | $ | 60 | 1.5 | % | $ | (17) | $ | (10) | |||||

Change in Net Sales for the Year Ended September 27, 2024 | |||||||||||||||||

versus Net Sales for the Year Ended September 29, 2023 | |||||||||||||||||

Net Sales | Organic Net Sales | Acquisitions/ | |||||||||||||||

Growth (Decline) | Growth (Decline) (1) | Translation (2) | (Divestitures) | ||||||||||||||

($ in millions) | |||||||||||||||||

Transportation Solutions (3): | |||||||||||||||||

Automotive | $ | 5 | 0.1 | % | $ | 210 | 3.0 | % | $ | (46) | $ | (159) | |||||

Commercial transportation | (69) | (4.5) | (62) | (4.1) | (7) | — | |||||||||||

Sensors | (126) | (11.3) | (119) | (10.8) | (7) | — | |||||||||||

Total | (190) | (2.0) | 29 | 0.3 | (60) | (159) | |||||||||||

Industrial Solutions (3): | |||||||||||||||||

Industrial equipment | (321) | (18.8) | (425) | (24.9) | 3 | 101 | |||||||||||

Aerospace, defense, and marine | 166 | 14.1 | 181 | 15.4 | 3 | (18) | |||||||||||

Energy | 36 | 4.1 | 43 | 4.9 | (27) | 20 | |||||||||||

Medical | 49 | 6.3 | 51 | 6.5 | (2) | — | |||||||||||

Total | (70) | (1.5) | (150) | (3.3) | (23) | 103 | |||||||||||

Communications Solutions (3): | |||||||||||||||||

Data and devices | 112 | 9.6 | 118 | 10.2 | (6) | — | |||||||||||

Appliances | (41) | (5.6) | (27) | (3.7) | (14) | — | |||||||||||

Total | 71 | 3.7 | 91 | 4.8 | (20) | — | |||||||||||

Total | $ | (189) | (1.2) | % | $ | (30) | (0.2) | % | $ | (103) | $ | (56) | |||||

(1) Organic net sales growth (decline) is a non-GAAP financial measure. See description of non-GAAP financial measures. | |||||||||||||||||

(2) Represents the change in net sales resulting from changes in foreign currency exchange rates. | |||||||||||||||||

(3) Industry end market information is presented consistently with our internal management reporting and may be periodically revised as management deems necessary. | |||||||||||||||||

TE CONNECTIVITY LTD. | ||||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES | ||||||||||||||||

For the Quarter Ended September 27, 2024 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

Adjustments | ||||||||||||||||

Acquisition- | Restructuring | |||||||||||||||

Related | and Other | Adjusted | ||||||||||||||

Charges (1) | Charges, Net (1) | Tax Items (2) | (Non-GAAP) (3) | |||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Operating income: | ||||||||||||||||

Transportation Solutions | $ | 404 | $ | — | $ | 42 | $ | — | $ | 446 | ||||||

Industrial Solutions | 137 | 4 | 43 | — | 184 | |||||||||||

Communications Solutions | 110 | 1 | 14 | — | 125 | |||||||||||

Total | $ | 651 | $ | 5 | $ | 99 | $ | — | $ | 755 | ||||||

Operating margin | 16.0 | % | 18.6 | % | ||||||||||||

Income tax expense | $ | (381) | $ | (1) | $ | (22) | $ | 238 | $ | (166) | ||||||

Effective tax rate | 58.0 | % | 21.8 | % | ||||||||||||

Income from continuing operations | $ | 276 | $ | 4 | $ | 77 | $ | 238 | $ | 595 | ||||||

Diluted earnings per share from continuing operations | $ | 0.90 | $ | 0.01 | $ | 0.25 | $ | 0.78 | $ | 1.95 | ||||||

(1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. | ||||||||||||||||

(2) Represents income tax expense related to an increase in the valuation allowance for deferred tax assets of a Swiss subsidiary. | ||||||||||||||||

(3) See description of non-GAAP financial measures. | ||||||||||||||||

TE CONNECTIVITY LTD. | ||||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES | ||||||||||||||||

For the Quarter Ended September 29, 2023 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

Adjustments | ||||||||||||||||

Acquisition- | Restructuring | |||||||||||||||

Related | and Other | Adjusted | ||||||||||||||

Charges (1) | Charges, Net (1) | Tax Items (2) | (Non-GAAP) (3) | |||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Operating income: | ||||||||||||||||

Transportation Solutions | $ | 411 | $ | 1 | $ | 32 | $ | — | $ | 444 | ||||||

Industrial Solutions | 162 | 6 | 16 | — | 184 | |||||||||||

Communications Solutions | 62 | — | 9 | — | 71 | |||||||||||

Total | $ | 635 | $ | 7 | $ | 57 | $ | — | $ | 699 | ||||||

Operating margin | 15.7 | % | 17.3 | % | ||||||||||||

Income tax expense | $ | (81) | $ | (1) | $ | (3) | $ | (49) | $ | (134) | ||||||

Effective tax rate | 12.8 | % | 19.2 | % | ||||||||||||

Income from continuing operations | $ | 553 | $ | 6 | $ | 54 | $ | (49) | $ | 564 | ||||||

Diluted earnings per share from continuing operations | $ | 1.75 | $ | 0.02 | $ | 0.17 | $ | (0.16) | $ | 1.78 | ||||||

(1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. | ||||||||||||||||

(2) Represents income tax benefits associated with a decrease in the valuation allowance for certain tax loss and credit carryforwards. | ||||||||||||||||

(3) See description of non-GAAP financial measures. | ||||||||||||||||

TE CONNECTIVITY LTD. | ||||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES | ||||||||||||||||

For the Year Ended September 27, 2024 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

Adjustments | ||||||||||||||||

Acquisition- | Restructuring | |||||||||||||||

Related | and Other | Adjusted | ||||||||||||||

Charges (1) | Charges, Net (1) | Tax Items (2) | (Non-GAAP) (3) | |||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Operating income: | ||||||||||||||||

Transportation Solutions | $ | 1,847 | $ | — | $ | 67 | $ | 3 | $ | 1,917 | ||||||

Industrial Solutions | 588 | 19 | 75 | 1 | 683 | |||||||||||

Communications Solutions | 361 | 2 | 24 | — | 387 | |||||||||||

Total | $ | 2,796 | $ | 21 | $ | 166 | $ | 4 | $ | 2,987 | ||||||

Operating margin | 17.6 | % | 18.9 | % | ||||||||||||

Income tax (expense) benefit | $ | 397 | $ | (3) | $ | (29) | $ | (1,016) | $ | (651) | ||||||

Effective tax rate | (14.2) | % | 21.8 | % | ||||||||||||

Income from continuing operations | $ | 3,194 | $ | 18 | $ | 137 | $ | (1,012) | $ | 2,337 | ||||||

Diluted earnings per share from continuing operations | $ | 10.34 | $ | 0.06 | $ | 0.44 | $ | (3.28) | $ | 7.56 | ||||||

(1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. | ||||||||||||||||

(2) Includes a | ||||||||||||||||

(3) See description of non-GAAP financial measures. | ||||||||||||||||

TE CONNECTIVITY LTD. | ||||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES | ||||||||||||||||

For the Year Ended September 29, 2023 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

Adjustments | ||||||||||||||||

Acquisition- | Restructuring | |||||||||||||||

Related | and Other | Adjusted | ||||||||||||||

Charges (1) | Charges, Net (1) | Tax Items (2) | (Non-GAAP) (3) | |||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Operating income: | ||||||||||||||||

Transportation Solutions | $ | 1,451 | $ | 3 | $ | 211 | $ | — | $ | 1,665 | ||||||

Industrial Solutions | 602 | 27 | 84 | — | 713 | |||||||||||

Communications Solutions | 251 | 3 | 45 | — | 299 | |||||||||||

Total | $ | 2,304 | $ | 33 | $ | 340 | $ | — | $ | 2,677 | ||||||

Operating margin | 14.4 | % | 16.7 | % | ||||||||||||

Income tax expense | $ | (364) | $ | (6) | $ | (85) | $ | (49) | $ | (504) | ||||||

Effective tax rate | 16.0 | % | 19.1 | % | ||||||||||||

Income from continuing operations | $ | 1,904 | $ | 27 | $ | 255 | $ | (49) | $ | 2,137 | ||||||

Diluted earnings per share from continuing operations | $ | 6.01 | $ | 0.09 | $ | 0.80 | $ | (0.15) | $ | 6.74 | ||||||

(1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. | ||||||||||||||||

(2) Represents income tax benefits associated with a decrease in the valuation allowance for certain tax loss and credit carryforwards. | ||||||||||||||||

(3) See description of non-GAAP financial measures. | ||||||||||||||||

TE CONNECTIVITY LTD. | ||||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES | ||||||||||||||||

For the Quarter Ended December 29, 2023 | ||||||||||||||||

(UNAUDITED) | ||||||||||||||||

Adjustments | ||||||||||||||||

Acquisition- | Restructuring | |||||||||||||||

Related | and Other | Adjusted | ||||||||||||||

Charges (1) | Charges, Net (1) | Tax Items (2) | (Non-GAAP) (3) | |||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Operating income: | ||||||||||||||||

Transportation Solutions | $ | 478 | $ | — | $ | 14 | $ | 3 | $ | 495 | ||||||

Industrial Solutions | 141 | 7 | 6 | 1 | 155 | |||||||||||

Communications Solutions | 79 | 1 | 1 | — | 81 | |||||||||||

Total | $ | 698 | $ | 8 | $ | 21 | $ | 4 | $ | 731 | ||||||

Operating margin | 18.2 | % | 19.1 | % | ||||||||||||

Income tax (expense) benefit | $ | 1,105 | $ | (1) | $ | (5) | $ | (1,254) | $ | (155) | ||||||

Effective tax rate | (158.1) | % | 21.2 | % | ||||||||||||

Income from continuing operations | $ | 1,804 | $ | 7 | $ | 16 | $ | (1,250) | $ | 577 | ||||||

Diluted earnings per share from continuing operations | $ | 5.76 | $ | 0.02 | $ | 0.05 | $ | (3.99) | $ | 1.84 | ||||||

(1) The tax effect of each non-GAAP adjustment is calculated based on the jurisdictions in which the expense (income) is incurred and the tax laws in effect for each such jurisdiction. | ||||||||||||||||

(2) Includes an | ||||||||||||||||

(3) See description of non-GAAP financial measures. | ||||||||||||||||

TE CONNECTIVITY LTD. | |||

RECONCILIATION OF FORWARD-LOOKING NON-GAAP FINANCIAL MEASURES | |||

TO FORWARD-LOOKING GAAP FINANCIAL MEASURES | |||

As of October 30, 2024 | |||

(UNAUDITED) | |||

Outlook for | |||

Quarter Ending | |||

December 27, | |||

2024 | |||

Diluted earnings per share from continuing operations | $ | 1.64 | |

Restructuring and other charges, net | 0.23 | ||

Acquisition-related charges | 0.01 | ||

Adjusted diluted earnings per share from continuing operations (1) | $ | 1.88 | |

Net sales growth | 1.8 | % | |

Translation | (0.8) | ||

(Acquisitions) divestitures, net | (0.6) | ||

Organic net sales growth (1) | 0.4 | % | |

(1) See description of non-GAAP financial measures. | |||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/te-connectivity-announces-fourth-quarter-and-fiscal-2024-results-with-full-year-records-for-operating-margin-eps-and-cash-generation-302290688.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/te-connectivity-announces-fourth-quarter-and-fiscal-2024-results-with-full-year-records-for-operating-margin-eps-and-cash-generation-302290688.html

SOURCE TE Connectivity plc