CORRECTING AND REPLACING - Volatus Releases Third Quarter 2024 Financial Results and Provides Corporate Update

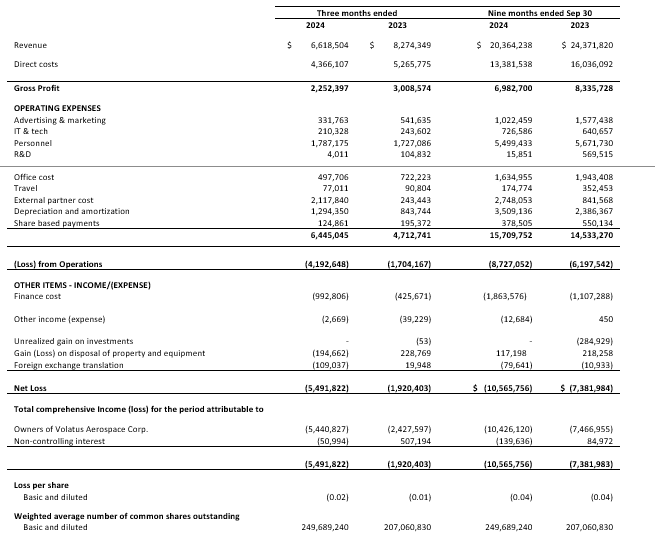

Volatus Aerospace has reported its Q3 2024 financial results, highlighting significant growth and operational achievements. The company generated revenues of $20.36M for the nine months ended Sept 30, 2024, with Q3 revenue at $6.62M. Key highlights include a 44% increase in service revenue from Q1 to Q3 2024, maintaining a 34% gross margin, and positive operating cash flow of $79,634.

The company successfully completed a merger with Drone Delivery Canada, realizing $2.1M in cost synergies within 60 days. Post-quarter, Volatus secured $15M in institutional financing from Investissement Québec and Export Development Canada, plus an additional $2.77M in equity financing. The company expanded operations in Europe, received BVLOS flight approvals, and continued growth in oil and gas, utility inspections, and LiDAR services.

Volatus Aerospace ha riportato i suoi risultati finanziari per il terzo trimestre del 2024, evidenziando una significativa crescita e risultati operativi. L'azienda ha generato ricavi pari a 20.36 milioni di dollari per i nove mesi terminati il 30 settembre 2024, con ricavi nel Q3 pari a 6.62 milioni di dollari. Tra i principali risultati spicca un aumento del 44% nei ricavi da servizi dal Q1 al Q3 2024, mantenendo un margine lordo del 34% e un flusso di cassa operativo positivo di 79.634 dollari.

La società ha completato con successo una fusione con Drone Delivery Canada, realizzando 2.1 milioni di dollari in sinergie di costo entro 60 giorni. Dopo il trimestre, Volatus ha ottenuto 15 milioni di dollari in finanziamenti istituzionali da Investissement Québec e Export Development Canada, oltre a ulteriori 2.77 milioni di dollari in finanziamenti azionari. L'azienda ha ampliato le operazioni in Europa, ottenuto approvazioni per voli BVLOS e continuato la crescita nei settori del petrolio e gas, ispezioni delle utilità e servizi LiDAR.

Volatus Aerospace ha informado sobre sus resultados financieros del tercer trimestre de 2024, destacando un crecimiento significativo y logros operativos. La compañía generó ingresos de 20.36 millones de dólares durante los nueve meses finalizados el 30 de septiembre de 2024, con ingresos en el Q3 de 6.62 millones de dólares. Los aspectos destacados incluyen un aumento del 44% en los ingresos por servicios del Q1 al Q3 de 2024, manteniendo un margen bruto del 34% y un flujo de efectivo operativo positivo de 79,634 dólares.

La empresa completó con éxito una fusión con Drone Delivery Canada, realizando 2.1 millones de dólares en sinergias de costos en 60 días. Después del trimestre, Volatus aseguró 15 millones de dólares en financiamiento institucional de Investissement Québec y Export Development Canada, además de otros 2.77 millones de dólares en financiamiento de capital. La compañía amplió sus operaciones en Europa, recibió aprobaciones de vuelo BVLOS y continuó su crecimiento en petróleo y gas, inspecciones de utilidades y servicios LiDAR.

볼라투스 항공우주는 2024년 3분기 재무 결과를 보고하며 뚜렷한 성장과 운영 성과를 강조했습니다. 이 회사는 2024년 9월 30일 기준 9개월 동안 2,036만 달러의 수익을 올렸으며, 3분기 수익은 662만 달러입니다. 주요 내용으로는 2024년 1분기부터 3분기까지 서비스 수익이 44% 증가하였고, 34%의 매출 총 이익률을 유지하며 운영 현금 흐름이 79,634달러의 긍정적 결과를 보였습니다.

회사는 드론 배달 캐나다와의 합병을 성공적으로 완료하여 60일 이내에 210만 달러의 비용 시너지를 실현했습니다. 분기 후 볼라투스는 퀘벡 투자와 캐나다 수출개발공사로부터 1,500만 달러의 기관 자금을 확보하고, 추가로 277만 달러의 자본 자금을 확보했습니다. 이 회사는 유럽에서 운영을 확장하고 BVLOS 비행 승인을 받았으며, 석유 및 가스, 유틸리티 검사 및 LiDAR 서비스에서 성장을 이어갔습니다.

Volatus Aerospace a publié ses résultats financiers pour le troisième trimestre 2024, mettant en avant une croissance significative et des succès opérationnels. L'entreprise a généré des revenus de 20,36 millions de dollars pour les neuf mois se terminant le 30 septembre 2024, avec des revenus de 6,62 millions de dollars au T3. Parmi les points clés, on note une augmentation de 44% des revenus de services entre le T1 et le T3 2024, tout en maintenant une marge brute de 34% et un flux de trésorerie opérationnel positif de 79 634 dollars.

L'entreprise a réussi à finaliser une fusion avec Drone Delivery Canada, réalisant 2,1 millions de dollars d'économies de coûts en 60 jours. Après le trimestre, Volatus a sécurisé 15 millions de dollars de financements institutionnels auprès d'Investissement Québec et d'Export Development Canada, ainsi qu'un financement de 2,77 millions de dollars en capitaux propres. L'entreprise a élargi ses opérations en Europe, obtenu des approbations de vol BVLOS et continué à croître dans les secteurs du pétrole et du gaz, des inspections d'utilité et des services LiDAR.

Volatus Aerospace hat seine finanziellen Ergebnisse für das 3. Quartal 2024 veröffentlicht und dabei ein signifikantes Wachstum sowie betriebliche Erfolge hervorgehoben. Das Unternehmen erzielte für die neun Monate bis zum 30. September 2024 Einnahmen von 20,36 Millionen US-Dollar, wobei die Q3-Einnahmen bei 6,62 Millionen US-Dollar lagen. Zu den wichtigsten Punkten gehört ein Wachstum von 44% bei den Dienstleistungserlösen von Q1 bis Q3 2024, während ein Bruttomargen von 34% beibehalten und ein positiver operativer Cashflow von 79.634 US-Dollar erzielt wurde.

Das Unternehmen hat erfolgreich eine Fusion mit Drone Delivery Canada abgeschlossen und innerhalb von 60 Tagen Synergien in Höhe von 2,1 Millionen US-Dollar realisiert. Nach dem Quartal sicherte sich Volatus 15 Millionen US-Dollar an institutioneller Finanzierung von Investissement Québec und Export Development Canada sowie zusätzlich 2,77 Millionen US-Dollar an Eigenkapitalfinanzierung. Das Unternehmen erweiterte seine Operationen in Europa, erhielt BVLOS-Fluggenehmigungen und setzte das Wachstum in den Bereichen Öl und Gas, Versorgungsinspektionen und LiDAR-Dienstleistungen fort.

- None.

- None.

Correction: Updated Webinar Registration Link for Volatus Aerospace Q3 Financial Results Announcement

Closed transformational merger of equals transaction with Drone Delivery Canada

Generated positive cash from operating activities in the quarter

Achieved blended gross margin of

Subsequent to quarter end, closed institutionally led

Continued efforts to realize cost and operational synergies post-merger

Volatus will host webinar and live Q&A on Friday, Nov 29, 2024 at 8 am ET

TORONTO, ON / ACCESSWIRE / November 29, 2024 / Volatus Aerospace Corp. (TSXV:FLT)(OTCQB:TAKOF) (Frankfurt:A3DP5Y/ABBA.F)("Volatus" or "the Company"), a leader in aerial solutions, is pleased to announce its financial results for the third quarter ended Sept 30, 2024. All dollar figures are stated in Canadian dollars, unless otherwise indicated.

The Company generated revenues of

Q3 2024 Performance Highlights:

Service revenue increased by

44% from$3.90M in Q1 2024 to$5.5M in Q3 2024. Services revenue increased by17% from Q2 2024.Gross profit was

$2.25M . In Q3 2024, the Company successfully maintained its gross margin percentage of34% , which was a direct result of our strategic shift toward higher efficiency operations and an optimized allocation of capital that led to84% of revenue driven by long-term services.Available cash on hand on Sept 30, 2024, was

$679,437. Subsequently to quarter end, the Company completed the closing of$15M financing backed by Investissement Québec and Export Development Canada, and in early November the Company closed additional$2.77M equity financing. The temporary limitation in growth working capital led to a continued impact in equipment revenue in the current quarter. The Company expects to regain equipment sales starting Q424.The comprehensive loss of (

$5,491,822) in Q3 2024 compared to ($1,920,403) Q3 2023 was due to higher depreciation expenses, interest charges, and$1.5M one-time merger transaction related advisory fees. Excluding external partner cost and depreciation, the SG&A expenses reduced by$592 K. This showcases our efforts to reduce overhead cost and achieve near-term profitability.The Company has realized annualized cost synergies of approximately

$2.1M within 60 days of the merger with Volatus Aerospace Corp. . This Company expects the synergies to be over$3M within the next 2 quarters.Launched operations in Europe to scale BVLOS operations and enhance the capabilities of our OCC (Operations Control Centre).

Received Transport Canada approval for BVLOS Flights Without Visual Observers for Its DroneCare Commercial Project.

Achieved historic Milestone with its Edmonton project by launching phase 2 of the project and expanding cargo services from YEG to Leduc.

Continued expansion in oil and gas sector in the U.S. by leveraging advanced technological applications such as optical gas inspections and magnetometry.

Continued expansion in the UK with the strategic acquisition of UAV Hub and Drone Mentor.

Executed on work for the inspection of 11,000 structures in the US utility sector.

Expanded LiDAR services in Canada and the U.S.

Successfully closed merger of equals with Volatus Aerospace Corp. and completed operational integration to unleash meaningful cost synergies.

Ranked second fastest growth companies in Canada by the Globe and Mail.

Secured

$15M financing from two major Canadian institutional investors - Investissement Québec and Export Development Canada to expand its operations and accelerate the development of its aerial solutions across key core industries such as oil and gas, energy utilities, public safety, and infrastructureSuccessfully completed 2.250 acres solar farm inspection, covering over 400MW of solar power capacity and 762,750 solar panels across 16 solar fields and 1 large substation .

Announced a new collaboration to enhance Beyond Visual Line of Sight (BVLOS) capabilities for Remotely Piloted Aircraft Systems (RPAS) through the integration of Kongsberg's IRIS Terminal into Volatus' state-of-the-art Operations Control Center (OCC)

Closed its previously announced commercially reasonable best efforts private placement and secured

$2.77M in financing

Q3 2024 Operational Highlights

Subsequent to Q3 2024 Operational Highlights

"During Q3 2024, Volatus has been focused on closing the transaction between Drone Delivery Canada and Volatus Aerospace Corp., positioning the Company for growth, and for the future of BVLOS" said Glen Lynch, CEO of Volatus Aerospace. "As we integrate our organization, we look forward to expanding this further, adding remote operational capabilities and cargo delivery to our ever-expanding portfolio."

Outlook for Q4 2024 and 2025

The Company expects Q424 to be a strong quarter backed by growth and working capital. We expect better Gross Margin performance and fulfillment of larger contracts with material improvement in our Adj EBITDA margins.

The drone services and technology sector are experiencing explosive growth as organizations in oil and gas, utility, public safety, and hospitals realize significant cost and time savings. This shift presents a significant opportunity for Volatus, as demand for its high-margin services and solutions continues to grow. Volatus remains a clear leader in this field, with expertise in delivering comprehensive, high-value services, Volatus is well-positioned to capitalize well into 2025.Volatus has a proven track record of delivering strong results in the fourth quarter of the fiscal year, and this trend is expected to continue as we have closed our financings and capitalized the balance sheet. With the closing of the merger of equals behind us, integration well under way, and long-term institutional partners secured, Volatus is now positioned to offer its customers a wide array of products and services across the globe.

Additional Corporate Update

Volatus is pleased to announce that it has acquired additional shares in Synergy Aviation Ltd, increasing its holdings to

The transaction is expected to close on or before 30th, November 2024 and is subject to final approval by the TSX Venture Exchange.

Webinar

In conjunction with this release, Volatus investor relations will host a webinar on Friday, November 29th at 8:00 AM EST at which time Glen Lynch, Chief Executive Officer, and Abhinav Singhvi, Chief Financial Officer, will review financial results and major milestones with Danielle Gagne, Head of Corporate Communications as moderator. Investors are invited to register for the webinar here.

https://us06web.zoom.us/webinar/register/WN_cUZ7om-qQYem36r-0CDnBg#/registration

Audio Replay Options

An audio replay of the event will be archived on the Investor Relations page of the company's website here.

SUMMARY OF RESULTS

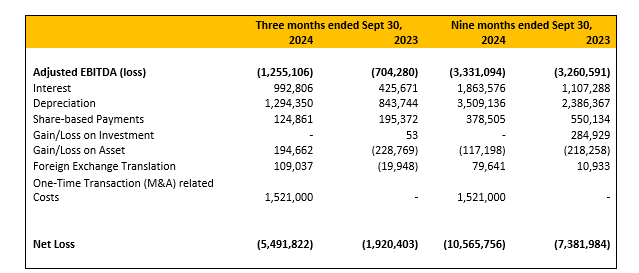

RECONCILIATION OF ADJUSTED EBITDA TO NET LOSS

About Volatus Aerospace:

Volatus Aerospace is a leader in innovative global aerial solutions for intelligence and cargo. With a strong foundation of over 100 years of combined institutional knowledge in aviation, Volatus provides comprehensive solutions using both piloted and remotely piloted aircraft systems (RPAS). We serve industries such as oil and gas, utilities, healthcare, and public safety. Our mission is to enhance operational efficiency, safety, and sustainability through cutting-edge, real-world solutions.

Note Regarding Non-GAAP Measures

In this press release we describe certain income and expense items that are unusual or non-recurring. There are terms not defined by International Financial Reporting Standards (IFRS). Our usage of these terms may vary from the usage adopted by other companies. Specifically, gross profit, gross margin, and Adjusted EBITDA are undefined terms by IFRS that may be referenced herein. We provide this detail so that readers have a better understanding of the significant events and transactions that have had an impact on our results.

Throughout this release, reference is made to "gross profit," "gross margin," and "Adjusted EBITDA" which are non-IFRS measures. Management believes that gross profit, defined as revenue less operating expenses, is a useful supplemental measure of operations. Gross profit helps provide an understanding on the level of costs needed to create revenue. Gross margin illustrates the gross profit as a percentage of revenue. Adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA"). The Company defines Adjusted EBITDA as IFRS comprehensive loss excluding interest expense, depreciation and amortization expense, share-based payments, income tax expense, integration and due diligence costs, one time profit or loss (non-recurring), and impairment of goodwill, property, plant, and equipment and right-of-use assets (ROU). The Company believes that Adjusted EBITDA is a meaningful financial metric as it measures cash generated from operations which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives. Readers are cautioned that these non-IFRS measures may not be comparable to similar measures used by other companies. Readers are also cautioned not to view these non-IFRS financial measures as an alternative to financial measures calculated in accordance with International Financial Reporting Standards ("IFRS"). Adjusted EBITDA does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers and should not be construed as alternatives to comprehensive loss or income determined in accordance with IFRS. For more information with respect to financial measures which have not been defined by GAAP, including reconciliations to the closest comparable GAAP measure, see the "Non-GAAP Measures and Additional GAAP Measures" section of the Company's most recent MD&A which is available on SEDAR.

Forward-Looking Statement

This news release contains statements that constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs, and current expectations of the Company with respect to future business activities and operating performance. Often, but not always, forward-looking information and forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or statements formed in the future tense or indicating that certain actions, events or results "may", "could", "would", "might" or "will" (or other variations of the foregoing) be taken, occur, be achieved, or come to pass. Forward-looking information includes information regarding: (i) the business plans and expectations of the Company; and (ii) expectations for other economic, business, and/or competitive factors. Forward-looking information is based on currently available competitive, financial, and economic data and operating plans, strategies, or beliefs as of the date of this news release, but involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors may be based on information currently available to the Company, including information obtained from third-party industry analysts and other third-party sources, and are based on management's current expectations or beliefs. Any and all forward-looking information contained in this news release is expressly qualified by this cautionary statement. Investors are cautioned that forward-looking information is not based on historical facts but instead reflects expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Forward-looking information and forward-looking statements reflect the Company's current beliefs and is based on information currently available to it and on assumptions it believes to be not unreasonable in light of all of the circumstances. In some instances, material factors or assumptions are discussed in this news release in connection with statements containing forward-looking information. Such material factors and assumptions include, but are not limited to: the commercialization of drone flights beyond visual line of sight and potential benefits to the Company; and meeting the continued listing requirements of the TSXV. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. The forward-looking information contained herein is made as of the date of this news release and, other than as required by law, the Company disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

TSXV: FLT

OTCQB: TAKOF

CONTACT DETAILS

Abhinav Singhvi

Chief Financial officer

+1 833-865-2887

abhinav.singhvi@volatusaerospace.com

COMPANY WEBSITE

https://volatusaerospace.com

SOURCE: Volatus Aerospace Inc.

View the original press release on accesswire.com