Silver Storm Announces 107% Increase in Indicated Mineral Resources at La Parrilla

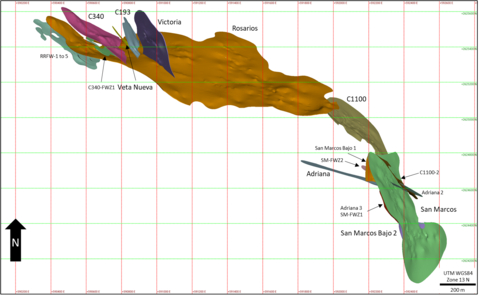

Figure 1: Plan View of Mineral Resource Estimate Vein Wireframes at the Rosarios Mine (Graphic: Business Wire)

Highlights of the Updated Mineral Resource Estimate include:

-

107% increase in Indicated Mineral Resources, from 5.2 Moz Ag.Eq1,2 in the 2023 Mineral Resource Statement to 10.8 Moz Ag.Eq -

58% increase of Inferred Mineral Resources, from 10.3 Moz Ag.Eq in the 2023 Mineral Resource Statement to 16.3 Moz Ag.Eq -

Approximately

90% of the Indicated and85% of the Inferred Mineral Resource tonnage is sulphide mineralization;10% of the Indicated and15% of the Inferred Mineral Resource tonnage is oxide mineralization -

Silver dominant:

66% of the Indicated and69% of the Inferred Updated Mineral Resource gross metal value is derived from silver - 23 additional mineralized structures have been modelled, including several that were previously mined by the former operator, with significant upside potential

-

Total all-in exploration cost of

US /oz Ag.Eq discovered$0.22

Greg McKenzie, President and CEO, commented, “We are incredibly pleased with this latest resource update. We achieved a material

Our sizable Mineral Resource growth in both classification categories is a testament to the hard work and dedication of the team including Will Ansley, COO and Bruce Robbins, P.Geo, our exploration personnel, operating employees and drilling contractor. Silver Storm completed 18,626 metres (“m”) of underground drilling, demonstrating that the previously mined zones continue down plunge and in certain cases even show improved grade and thickness at depth. This significant growth in Mineral Resources enhances the potential of our project, supports our goal to restart the mine and join the exclusive rank of silver producers.”

The wireframe models of the veins contributing to the updated Mineral Resource Estimate of Rosarios and Quebradillas mines are presented in Figure 1 and Figure 2, respectively.

Mineral Resources Summary

Indicated Mineral Resources are estimated at 1,197,000 tonnes (“t”) grading 280 g/t Ag.Eq* (187 g/t Ag, 0.10 g/t Au,

Inferred Mineral Resources are estimated at 1,988,000 t grading 255 g/t Ag.Eq (175 g/t Ag, 0.12 g/t Au,

The Updated Mineral Resource Estimate includes an additional 138 core boreholes, totaling 18,626 m, as well as an exhaustive reinterpretation of the mineralized structures, completed after the acquisition of La Parrilla in August 2023. The increased information and understanding of the geological framework resulted in an increase of

The Mineral Resource estimation process at La Parrilla is aligned with generally accepted CIM Estimation of Mineral Resources and Mineral Reserves Best Practices Guidelines (November 2019). The Independent qualified person (QP) has applied particular care in the incorporation of the reasonable prospects for eventual economic extraction (“RPEEE”) to Mineral Resources. The QP used a stope optimizer to identify those portions of the block model that can be reasonably expected to be extracted using selective underground mining methods.

Table 1 represents the Mineral Resource Statement for the La Parrilla Mine, effective December 31, 2024.

Figure 3 summarizes the contained metal (Ag.Eq) changes in the Mineral Resources Statement from 2023 to 2024. Additional drilling in 2023 and 2024 confirmed the continuity of vein mineralization, increasing the Indicated Resources Ag.Eq metal content by

Since 2023, the Company has collected significant specific gravity (SG) data, improving confidence in the in-situ density of mineralization in oxidized and sulphide materials, distinct from host rock density. This update has increased the estimated Ag-Eq metal content by over

Table 1: Mineral Resource Statement*, La Parrilla Mine,

Category &

|

Mine |

Quantity

|

Grade |

Contained Metal |

||||||||

Silver |

Gold |

Lead |

Zinc |

Ag-Eq |

Silver |

Gold |

Lead |

Zinc |

Ag.Eq |

|||

(g/t) |

(g/t) |

(%) |

(%) |

(g/t) |

(koz) |

(koz) |

(kt) |

(kt) |

(koz) |

|||

Indicated Mineral Resource |

||||||||||||

Oxides |

||||||||||||

Rosarios |

17 |

636 |

0.07 |

0.00 |

0.00 |

643 |

341 |

0.0 |

0.0 |

0.0 |

345 |

|

|

100 |

253 |

0.16 |

0.00 |

0.00 |

269 |

818 |

0.5 |

0.0 |

0.0 |

867 |

|

Quebradillas |

0.4 |

188 |

0.10 |

0.00 |

0.00 |

197 |

2 |

0.0 |

0.0 |

0.0 |

3 |

|

Subtotal Indicated Oxides |

117 |

308 |

0.15 |

0.00 |

0.00 |

322 |

1,162 |

0.6 |

0.0 |

0.0 |

1,215 |

|

Sulphides |

|

|

|

|

|

|

|

|

|

|

||

Rosarios |

476 |

157 |

0.13 |

1.53 |

1.38 |

243 |

2,403 |

2.1 |

7.3 |

6.6 |

3,723 |

|

|

73 |

302 |

0.17 |

1.13 |

0.83 |

367 |

708 |

0.4 |

0.8 |

0.6 |

861 |

|

Quebradillas |

531 |

172 |

0.05 |

1.99 |

2.47 |

291 |

2,926 |

0.9 |

10.5 |

13.1 |

4,966 |

|

Subtotal Indicated Sulphides |

1,079 |

174 |

0.10 |

1.73 |

1.88 |

275 |

6,037 |

3.4 |

18.6 |

20.3 |

9,550 |

|

Total Indicated Resources |

1,197 |

187 |

0.10 |

1.56 |

1.69 |

280 |

7,199 |

3.9 |

18.6 |

20.3 |

10,765 |

|

Inferred Mineral Resource |

||||||||||||

Oxides |

||||||||||||

Rosarios |

22 |

297 |

0.08 |

0.00 |

0.00 |

304 |

207 |

0.1 |

0.0 |

0.0 |

212 |

|

|

220 |

281 |

0.14 |

0.00 |

0.00 |

294 |

1,988 |

1.0 |

0.0 |

0.0 |

2,080 |

|

Quebradillas |

17 |

221 |

0.09 |

0.00 |

0.00 |

229 |

123 |

0.0 |

0.0 |

0.0 |

128 |

|

Subtotal Inferred Oxides |

259 |

278 |

0.13 |

0.00 |

0.00 |

290 |

2,318 |

1.1 |

0.0 |

0.0 |

2,419 |

|

Sulphides |

||||||||||||

Rosarios |

864 |

144 |

0.13 |

1.46 |

1.33 |

228 |

4,009 |

3.7 |

12.6 |

11.5 |

6,319 |

|

|

151 |

220 |

0.22 |

1.09 |

0.69 |

284 |

1,071 |

1.1 |

1.7 |

1.0 |

1,383 |

|

Quebradillas |

714 |

164 |

0.08 |

1.54 |

2.20 |

268 |

3,772 |

1.9 |

11.0 |

15.7 |

6,149 |

|

Subtotal Inferred Sulphides |

1,729 |

159 |

0.12 |

1.46 |

1.63 |

249 |

8,852 |

6.7 |

25.3 |

28.2 |

13,850 |

|

Total Inferred Resources |

1,988 |

175 |

0.12 |

1.27 |

1.42 |

255 |

11,169 |

7.7 |

25.3 |

28.2 |

16,269 |

|

*(1) |

Block model estimates audited by David F. Machuca-Mory, PhD, PEng, Principal Consultant (Geostatistics), SRK Consulting Canada Inc. |

|

(2) |

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

|

(3) |

Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves. |

|

(4) |

All figures rounded to reflect the relative accuracy of the estimates. |

|

(5) |

Reasonable prospects of eventual economic extraction were considered by applying appropriate cut-off grades, removing unrecoverable portions of the estimates, and reporting within potentially mineable shapes. |

|

(6) |

Metal prices considered were |

|

(7) |

|

|

(8) |

Metallurgical recovery used for oxides based on weighted 2015-2017 actuals was |

|

(9) |

Metallurgical recovery used for sulphides based on weighted 2015-2017 actuals was |

|

(10) |

Metal payable applied was |

|

(11) |

Metal payable applied was |

|

(12) |

Silver equivalent grade is estimated as: Ag.Eq = Ag Grade + [ (Au Grade x Au Recovery x Au Payable x Au Price / 31.1035) + (Pb Grade x Pb Recovery x Pb Payable x Pb Price x 2204.62) + (Zn Grade x Zn Recovery x Zn Payable x Zn Price x 2204.62)] / (Ag Recovery x Ag Payable x Ag Price / 31.1035) |

|

(13) |

Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces or thousands of tonnes |

|

(14) |

Totals may not add up due to rounding |

|

Sensitivity Analysis

In addition to the base case scenario presented in Table 1, Tables 2 through Table 5 below, provide sensitivity analyses which demonstrate the variation in grade, tonnage and contained metal for the Updated Mineral Resource estimate at various cut-off grades for both sulphide and oxide material at La Parrilla. The sensitivity analysis shows the resiliency of the Mineral Resource to changes in the cut-off grade, which reflect the operating cost and metal pricing environment.

Table 2: La Parrilla Silver Mine – Block Model Quantities and Grade Estimates(*) at Various Cut-Off Grades for Indicated Oxide Material (SRK, 2024)

|

Quantity

|

Grade |

Metal Content |

||||

Silver

|

Gold

|

Ag.Eq

|

Silver

|

Gold

|

Ag.Eq

|

||

135 |

163 |

263 |

0.15 |

277 |

1,379 |

0.8 |

1,454 |

140 |

155 |

270 |

0.15 |

284 |

1,343 |

0.7 |

1,414 |

145 |

148 |

276 |

0.15 |

290 |

1,311 |

0.7 |

1,379 |

150 |

140 |

283 |

0.15 |

297 |

1,274 |

0.7 |

1,339 |

160 |

124 |

300 |

0.15 |

314 |

1,196 |

0.6 |

1,252 |

165 |

117 |

308 |

0.15 |

322 |

1,162 |

0.6 |

1,215 |

170 |

110 |

317 |

0.15 |

331 |

1,125 |

0.5 |

1,174 |

180 |

98 |

336 |

0.14 |

349 |

1,054 |

0.5 |

1,096 |

190 |

86 |

356 |

0.14 |

370 |

984 |

0.4 |

1,020 |

200 |

78 |

373 |

0.14 |

386 |

934 |

0.4 |

967 |

210 |

69 |

394 |

0.14 |

407 |

873 |

0.3 |

901 |

(*) Figures in this table should not be misconstrued for a Mineral Resource Statement. The figures are only presented to show the sensitivity of the block model estimates to the selection of a cut-off grade.

Table 3: La Parrilla Silver Mine – Block Model Quantities and Grade Estimates(*) at Various Cut-Off Grades for Indicated Sulphide Material (SRK, 2024)

|

Quantity

|

Grade |

Metal Content |

||||||||

Silver

|

Gold (g/t) |

Lead (%) |

Zinc (%) |

Ag.Eq (g/t) |

Silver (koz) |

Gold (koz) |

Lead (kt) |

Zinc (kt) |

Ag.Eq (kozt) |

||

120 |

1,255 |

161 |

0.10 |

1.60 |

1.74 |

255 |

6,494 |

3.9 |

20.1 |

21.9 |

10,303 |

125 |

1,219 |

164 |

0.10 |

1.62 |

1.77 |

259 |

6,411 |

3.8 |

19.8 |

21.5 |

10,159 |

130 |

1,185 |

166 |

0.10 |

1.65 |

1.79 |

263 |

6,327 |

3.7 |

19.5 |

21.2 |

10,022 |

135 |

1,151 |

169 |

0.10 |

1.67 |

1.82 |

267 |

6,235 |

3.6 |

19.3 |

20.9 |

9,873 |

140 |

1,115 |

171 |

0.10 |

1.70 |

1.85 |

271 |

6,142 |

3.5 |

18.9 |

20.6 |

9,715 |

145 |

1,079 |

174 |

0.10 |

1.73 |

1.88 |

275 |

6,037 |

3.4 |

18.6 |

20.3 |

9,550 |

150 |

1,044 |

177 |

0.10 |

1.75 |

1.91 |

279 |

5,933 |

3.2 |

18.3 |

19.9 |

9,383 |

160 |

979 |

182 |

0.10 |

1.81 |

1.96 |

288 |

5,734 |

3.1 |

17.7 |

19.2 |

9,057 |

165 |

946 |

185 |

0.10 |

1.84 |

1.99 |

292 |

5,622 |

3.0 |

17.4 |

18.9 |

8,880 |

170 |

906 |

189 |

0.10 |

1.87 |

2.03 |

298 |

5,489 |

2.8 |

16.9 |

18.4 |

8,664 |

180 |

842 |

195 |

0.10 |

1.93 |

2.09 |

307 |

5,268 |

2.6 |

16.3 |

17.6 |

8,301 |

(*) Figures in this table should not be misconstrued for a Mineral Resource Statement. The figures are only presented to show the sensitivity of the block model estimates to the selection of a cut-off grade.

Table 4: La Parrilla Silver Mine – Block Model Quantities and Grade Estimates(*) at Various Cut-Off Grades for Inferred Oxide Material (SRK, 2024)

|

Quantity

|

Grade |

Metal Content |

||||

Silver

|

Gold

|

Ag.Eq

|

Silver

|

Gold

|

Ag.Eq

|

||

135 |

376 |

235 |

0.12 |

246 |

2,843 |

1.5 |

2,983 |

140 |

355 |

241 |

0.12 |

253 |

2,756 |

1.4 |

2,889 |

145 |

334 |

248 |

0.12 |

260 |

2,667 |

1.3 |

2,793 |

150 |

315 |

255 |

0.13 |

267 |

2,584 |

1.3 |

2,704 |

160 |

277 |

270 |

0.13 |

282 |

2,406 |

1.1 |

2,514 |

165 |

259 |

278 |

0.13 |

290 |

2,318 |

1.1 |

2,419 |

170 |

238 |

289 |

0.13 |

301 |

2,210 |

1.0 |

2,305 |

180 |

209 |

306 |

0.13 |

319 |

2,059 |

0.9 |

2,141 |

190 |

187 |

322 |

0.13 |

334 |

1,938 |

0.8 |

2,010 |

200 |

166 |

340 |

0.13 |

352 |

1,816 |

0.7 |

1,881 |

210 |

147 |

359 |

0.13 |

371 |

1,699 |

0.6 |

1,754 |

(*) Figures in this table should not be misconstrued for a Mineral Resource Statement. The figures are only presented to show the sensitivity of the block model estimates to the selection of a cut-off grade.

Table 5: La Parrilla Silver Mine – Block Model Quantities and Grade Estimates(*) at Various Cut-Off Grades for Inferred Sulphide Material (SRK, 2024)

|

Quantity

|

Grade |

Metal Content |

||||||||

Silver

|

Gold

|

Lead

|

Zinc

|

Ag.Eq

|

Silver

|

Gold

|

Lead

|

Zinc

|

Ag.Eq

|

||

120 |

2,112 |

145 |

0.12 |

1.34 |

1.49 |

228 |

9,867 |

8.0 |

28.2 |

31.4 |

15,493 |

125 |

2,030 |

148 |

0.12 |

1.36 |

1.52 |

232 |

9,669 |

7.7 |

27.6 |

30.8 |

15,171 |

130 |

1,955 |

151 |

0.12 |

1.38 |

1.54 |

236 |

9,479 |

7.5 |

27.1 |

30.2 |

14,859 |

135 |

1,884 |

153 |

0.12 |

1.41 |

1.57 |

240 |

9,283 |

7.2 |

26.5 |

29.6 |

14,551 |

140 |

1,799 |

157 |

0.12 |

1.44 |

1.60 |

245 |

9,057 |

6.9 |

25.8 |

28.8 |

14,175 |

145 |

1,729 |

159 |

0.12 |

1.46 |

1.63 |

249 |

8,852 |

6.7 |

25.3 |

28.2 |

13,850 |

150 |

1,649 |

163 |

0.12 |

1.49 |

1.66 |

254 |

8,620 |

6.4 |

24.6 |

27.3 |

13,465 |

160 |

1,501 |

169 |

0.12 |

1.54 |

1.71 |

264 |

8,169 |

5.9 |

23.2 |

25.7 |

12,724 |

165 |

1,431 |

173 |

0.12 |

1.57 |

1.74 |

269 |

7,944 |

5.6 |

22.5 |

24.9 |

12,351 |

170 |

1,368 |

176 |

0.12 |

1.60 |

1.77 |

273 |

7,733 |

5.4 |

21.9 |

24.2 |

12,012 |

180 |

1,227 |

184 |

0.12 |

1.66 |

1.83 |

284 |

7,253 |

4.8 |

20.3 |

22.5 |

11,211 |

(*) Figures in this table should not be misconstrued for a Mineral Resource Statement. The figures are only presented to show the sensitivity of the block model estimates to the selection of a cut-off grade.

A technical report is being prepared to support the Updated Mineral Resource Estimate in accordance with NI 43-101 and will be available on the Company's website and SEDAR within 45 days of the date of this release

Quality Assurance / Quality Control

Silver Storm uses a quality assurance/quality control (QA/QC) program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates, and reference standards in each batch of samples sent for analysis. The drill core is photographed, logged, and cut in half, with one half retained in a secured location for verification purposes and one half shipped for analysis. Sample preparation (crushing and pulverizing) is performed at ALS Geochemistry, an independent ISO 9001:2001 certified laboratory, in

From 2007 to 2012, First Majestic Silver (“FMS”) implemented a quality control program to evaluate silver assay results from La Parrilla Laboratory for chip and core samples by submitting one core sample for every 20 original samples to Inspectorate in

In the opinion of the Independent QP, the quality of the analytical data collected for silver, gold, lead and zinc from

In the opinion of the Independent QP, a reasonable level of verification has been completed and no material issues would have been left unidentified from the verification programs undertaken. Drill data are typically verified prior to Mineral Resource estimation through software program checks, comparison to original hard copy data, and peer review. The quality of the drill data is sufficiently reliable to support Mineral Resource estimation.

Qualified Person

The Independent Qualified Person for the Mineral Resource Estimate disclosure is Dr. David Machuca-Mory, PEng, of SRK Consulting (

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the

You are cautioned not to assume that any part or all of Mineral Resources will ever be converted into Reserves. Pursuant to CIM Definition Standards, “Inferred Mineral Resources” are that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and can not be converted to a Mineral Reserve. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Under Canadian reporting guidelines, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource is economically or legally mineable. Disclosure of “contained ounces” in a Mineral Resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “Reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. Information regarding Mineral Resources contained or referenced in this news release may not be comparable to similar information made public by companies that report according to

About Silver Storm Mining Ltd.

Silver Storm Mining Ltd. holds advanced-stage silver projects located in

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward Looking Statements:

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations. Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management and Qualified Persons (in the case of technical and scientific information) expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to the estimated Mineral Resources of La Parrilla and the future exploration performance, the ability to eventually place the La Parrilla Complex back into production, and, the timing and completion of an updated technical report for La Parrilla Complex.

In making the forward-looking statements included in this news release, the Company and Qualified Persons (in the case of technical and scientific information) have applied several material assumptions, including that the Company´s financial condition and development plans do not change because of unforeseen events, that future metal prices and the demand and market outlook for metals will remain stable or improve, management’s ability to execute its business strategy and no unexpected or adverse regulatory changes with respect to La Parrilla. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, there being no assurance that the Company’s current and future exploration programs will grow the Mineral Resource base or upgrade Mineral Resource confidence, the risk that the assumptions referred to above prove not to be valid or reliable, the risk that the Company is unable to achieve its goal of placing La Parrilla back into production; market conditions and volatility and global economic conditions including increased volatility and potentially negative capital raising conditions resulting from the continued or escalation of the COVID-19 pandemic, risk of delay and/or cessation in planned work or changes in the Company’s financial condition and development plans; risks associated with the interpretation of data (including in respect of third party mineralized material) regarding the geology, grade and continuity of mineral deposits, the uncertainty of the geology, grade and continuity of mineral deposits and the risk of unexpected variations in Mineral Resources, grade and/or recovery rates; risks related to gold, silver and other commodity price fluctuations; employee relations; relationships with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour, the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses and permits and the presence of laws and regulations that may impose restrictions on mining, including the Mexican mining reforms; risks relating to environmental regulation and liability; the possibility that results will not be consistent with the Company’s expectations.

Such forward-looking information represents managements and Qualified Persons (in the case of technical and scientific information) best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250211572259/en/

Greg McKenzie, President & CEO

Ph: +1 (416) 504-2024

greg.mckenzie@silverstorm.ca

Source: Silver Storm Mining Ltd.