Standard Uranium Signs Definitive Agreement to Option Atlantic Project in Eastern Athabasca Basin

- None.

- None.

VANCOUVER, British Columbia, Feb. 20, 2024 (GLOBE NEWSWIRE) -- Standard Uranium Ltd. (“Standard Uranium” or the “Company”) (TSX-V: STND) (OTCQB: STTDF) (Frankfurt: FWB:9SU) is pleased to announce that it has signed a definitive option agreement (the “Option Agreement”), dated February 16, 2024, with ATCO Mining Inc. (the “Optionee”), an arms-length company listed on the Canadian Securities Exchange (CSE: ATCM). Pursuant to the Option Agreement, the Optionee has been granted the option (the “Option”) to earn a

The Option is exercisable by the Optionee completing cash payments, arranging for the issuance of Optionee shares to the Company and incurring exploration expenditures on the Project, summarized in Table 1.

Table 1. Summary of Definitive Option Agreement Terms

| Consideration Payments | Consideration Shares | Exploration Expenditures | Operator Fee (10 | ||||

| Year 1 | 3,000,000 | ||||||

| Year 2 | 6,000,000 | ||||||

| Year 3 | 6,000,000 | ||||||

| Totals | $430,000 | 15,000,000 | $6,300,000 | $730,000 | |||

Jon Bey, CEO and Chairman, commented, “The Company is pleased to welcome the ATCO Mining team to the Athabasca Basin, Saskatchewan. We are excited to confirm the Atlantic project will have three partner-funded years of exploration run by our technical team. The Atlantic project has exceptional potential for a high-grade1 unconformity-related uranium discovery, and we are looking forward to kicking off the 2024 exploration season with the Atlantic drill program in beginning in the immediate future.”

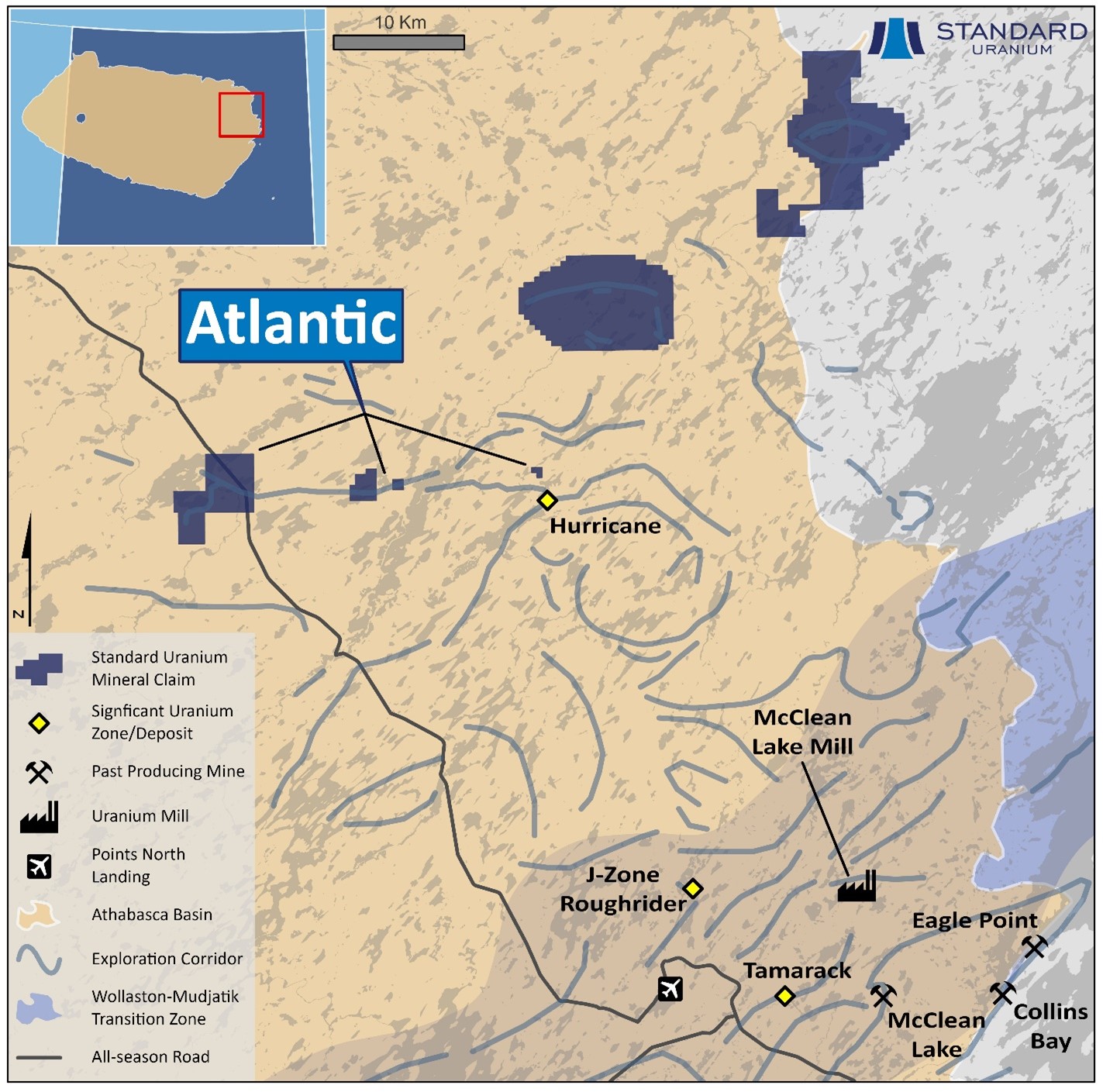

Figure 1. Overview of the eastern Athabasca Basin, highlighting Standard Uranium’s Atlantic project.

“Our technical team and new partners at ATCO are excited to begin drilling the Atlantic project imminently, exploring for high-grade1 unconformity-related uranium mineralization. Our exploration thesis and targeting strategy in this booming district has been reinforced by high-quality geophysical interpretations, and all key vendors and personnel are in place to test our first batch of targets this winter,” said Sean Hillacre, President & VP Exploration for the Company.

1 The Company considers uranium mineralization with concentrations greater than 1.0 wt% U3O8 to be “high-grade”.

Following exercise of the Option, the parties intend to form a joint venture for the further development of the Project. Prior to exercise of the Option, the Company will act as the operator of the Project and will be entitled to charge a

Atlantic Project

The Atlantic project is situated in the Mudjatik geological domain where several recent discoveries have been made, including IsoEnergy’s Hurricane uranium deposit. The Project covers 6.5 km of an 18 km long, east-west trending conductive exploration trend which hosts numerous uranium occurrences. The Company completed a high-resolution ground gravity survey on the project in 2022, revealing multiple subsurface density anomalies, potentially representing significant hydrothermal alteration zones in the sandstone and proximal to basement conductors.

Historical drilling by Cameco in 1992 (Hole BE-04) encountered up to

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of the Company and a “qualified person” as defined in NI 43-101.

About Standard Uranium (TSX-V: STND)

We find the fuel to power a clean energy future

Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in the world’s richest uranium district. The Company holds interest in over 209,867 acres (84,930 hectares) in the world-class Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development.

Standard Uranium has successfully completed four joint venture earn in partnerships on their Sun Dog, Canary, Atlantic and Ascent projects totaling over

Standard Uranium’s Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected.

Standard Uranium’s eight eastern Athabasca projects comprise thirty mineral claims over 32,838 hectares. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries.

Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area.

For further information contact:

Jon Bey, Chief Executive Officer, and Chairman

Suite 918, 1030 West Georgia Street

Vancouver, British Columbia, V6E 2Y3

Tel: 1 (306) 850-6699

E-mail: info@standarduranium.ca

Cautionary Statement Regarding Forward-Looking Statements

This news release contains “forward-looking statements” or “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements include, but are not limited to, statements regarding: execution of the definitive agreement; conditions to the exercise the Option; completion of the Optionee’s go public transaction; the timing and content of upcoming work programs; geological interpretations; timing of the Company’s exploration programs; and estimates of market conditions.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by forward-looking statements contained herein. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Certain important factors that could cause actual results, performance or achievements to differ materially from those in the forward-looking statements are highlighted in the “Risks and Uncertainties” in the Company’s management discussion and analysis for the fiscal year ended April 30, 2023.

Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company’s actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors or assumptions used to develop forward-looking statements include, without limitation: that the transaction with the Optionee will proceed as planned; the future price of uranium; anticipated costs and the Company’s ability to raise additional capital if and when necessary; volatility in the market price of the Company’s securities; future sales of the Company’s securities; the Company’s ability to carry on exploration and development activities; the success of exploration, development and operations activities; the timing and results of drilling programs; the discovery of mineral resources on the Company’s mineral properties; the costs of operating and exploration expenditures; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); uncertainties related to title to mineral properties; assessments by taxation authorities; fluctuations in general macroeconomic conditions.

The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Any forward-looking statements and the assumptions made with respect thereto are made as of the date of this news release and, accordingly, are subject to change after such date. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3a989f0c-a7f9-4500-9666-9ad9b662a44e

FAQ

What is the name of the company that signed the option agreement with Standard Uranium Ltd.?

Where is the Atlantic Project located?

What percentage interest can ATCO Mining Inc. earn in the Atlantic Project over three years?

What is the total cash payments required from ATCO Mining Inc. over the three-year period?