State Street Global Advisors Survey: Inflation Causing Stress and Anxiety; Nearly Half of Investors Believe It Has Not Peaked

- Nearly half of investors say rising inflation is causing them stress and anxiety.

- Majority are changing their spending behavior, cutting back on discretionary expenses including dining out and entertainment.

-

One-in-four investors (

25% ) cancelled a vacation planned for the year ahead due to rising inflation.

- Majority of investors believe the US economy is headed for a recession in the next 6-12 months.

- Generation X is significantly more concerned than Millennials and Boomers about the economic outlook, maintaining their current standard of living, retiring on time and affording expenses in retirement.

- Less than half of investors are confident they will reach their financial goals due to rising inflation.

In the past 12 months, rising inflation has caused the greatest proportion of investors (

“As Americans work to defend themselves against the corrosive effect of inflation on their finances, we’re encouraged to see the majority are making tradeoffs in discretionary spending, rather than sacrificing contributions to their long-term savings goals,” said

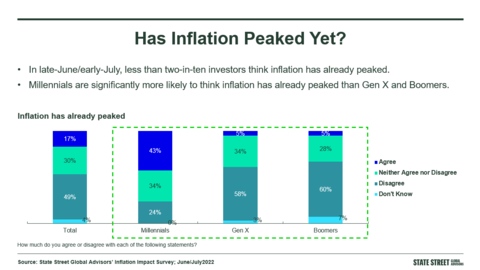

Has Inflation Peaked Yet?

With so many already tightening their belts, it is no surprise that

Furthermore, they don’t believe the worst is over. Less than two-in-ten investors (

Millennials and Inflation: Glass Half-Full?

Millennials are significantly more optimistic that inflation has already topped out than Gen X and Boomers;

Record high inflation isn’t dampening Millennials’ optimism that they’ll reach their financial goals, either;

Sandwich Generation Shows Signs of Distress

In

When it comes to the overall economic outlook for our country in the next 12 months,

The outlook for their personal financial situation wasn’t much better:

Being able to afford to retire when planned is another worry with

Generation X Takes Action Against Inflation

Examination of the money moves each generation has made in the last 12 months reveals significantly more members of Generation X have cut back on spending compared to Millennials and Boomers.

A greater percentage of Gen X-ers than Millennials and Boomers have seen their finances derailed by inflation and have had to cut back on discretionary spending like dining out or entertainment (

“These are challenging times for many Americans. About half of all investors believe that the lessons learned by navigating the current inflationary environment will have a lasting impact on their spending and saving habits moving forward,” Williams noted. “Making prudent financial decisions during times of uncertainty could make committing to a budget or investment discipline easier when the economy improves. For those looking for help managing through the uncertainty, now is the time to talk to a financial advisor to make sure they’re on track to meet their financial goals.”

For more on SPDR’s point of view on the market, economy and inflation read our 2022 Mid-Year Outlook and 5 Burning Questions Give Investors Insight: Durable Rebound or More Pain to Come?

Click here for the latest Bond Compass, SPDR’s quarterly outlook on fixed-income.

For more on State Street’s outlook on the global markets and economy click here.

For more resources on ETF basics visit our ETF education landing page.

To learn more about how investors are using low-cost ETFs to achieve a variety of investment objectives, read Build a Low-Cost Core Portfolio with SPDR ETFs.

About State Street Global Advisors’

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com.

About

For four decades,

*

†This figure is presented as

Important Risk Disclosures

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing involves risk, including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Bond funds contain interest rate risk (as interest rates rise bond prices usually fall). There are additional risks for funds that invest in mortgage-backed and asset-backed securities including the risk of issuer default; credit risk and inflation risk.

Non-diversified funds that focus on a relatively small number of securities tend to be more volatile than diversified funds and the market as a whole.

Passively managed funds hold a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

Actively managed funds do not seek to replicate the performance of a specified index. The fund is actively managed and may underperform its benchmarks. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. Investing in the Fund involves risks, including the risk that investors may receive little or no return on the investment or that investors may lose part or even all of the investment.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s

Distributor:

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

© 2022

All Rights Reserved.

4860949.1.1.AM.RTL Exp. Date:

View source version on businesswire.com: https://www.businesswire.com/news/home/20220808005847/en/

+1 617 662 9927

DHEINDEL@StateStreet.com

Source: