State Street Global Advisors Study: Advisors Capture Four Influential Investor Segments With A Combination of Old Fashioned Collaboration and Modern Technology

State Street Global Advisors released its 2024 Influential Investor Segment Study, highlighting key opportunities for advisors by focusing on four high-growth investor groups: hybrid investors, millennials, Gen-X, and women. The study emphasizes the importance of combining technology with traditional advisory relationships to attract and retain clients.

Key findings include the hybrid investors' demand for both professional advice and self-directed investing, millennials' preference for tech-savvy solutions, Gen-X's needs for holistic financial planning, and women's increasing financial autonomy. High advisory fees are a significant concern for many investors, particularly hybrids and Gen-X, influencing their decisions to switch advisors. Advisors are encouraged to adapt to these evolving preferences to ensure long-term business success.

- State Street Global Advisors identifies high-growth investor segments: hybrid investors, millennials, Gen-X, and women.

- Hybrid investors show strong interest in both professional advice and self-directed investing.

- Millennials prioritize tech-savvy and research-driven approaches to financial planning.

- Women control over $10 trillion in US household financial assets, representing a significant market.

- High client retention among women, with 46% maintaining advisor relationships for over 10 years.

- Advisors can gain a competitive advantage by integrating technology with traditional advisory services.

- High advisory fees are a major concern for hybrid investors, with 45% willing to switch advisors over fee increases.

- Gen-X investors feel underserved, with over 50% managing investments themselves due to perceived lack of value for fees.

- Advisors face significant competition from self-directed platforms that offer lower costs and greater control.

- Only a third of advised Gen-X investors receive advanced planning services, indicating a gap in service provision.

Survey Uncovers Insights That Help Advisors Navigate The Intersection of Client Experience and Competitive Advisory Fees

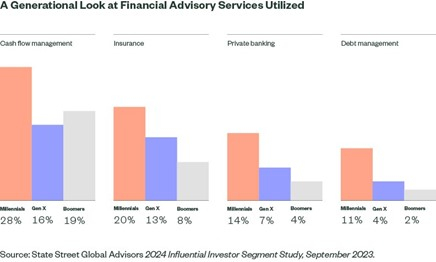

As millennials accumulate wealth and navigate increasingly complex financial needs, they become prime candidates for formal advisory relationships. (Graphic: State Street Global Advisors 2024 Influential Investor Segment Study, September 2023)

“Our study identifies hybrid investors, women, Gen-X, and Millennials, as pivotal pathways for advisors looking to future-proof their business,” said Brie Williams, head of Practice Management at State Street Global Advisors. “By strategically integrating these high-growth investor groups into their client segmentation strategies, advisors can enhance their ability to attract and retain clients, gaining a distinct competitive advantage.”

Three key themes emerged from the study across these investor cohorts: a strong desire for collaborative relationships with advisors, a heightened demand for modernized technology and tools, and a clear expectation of competitive fees aligned with a compelling value proposition.

By recognizing the pivotal role of client experience and ensuring fees are aligned with the value of offered services, advisors can unlock new avenues for growth and success in an increasingly dynamic financial landscape. The study provides insights and considerations to help advisors position their offering to appeal to each segment.

Hybrid Investors

Hybrid Investors are a growing segment of investors who lean into the duality of personalized human advice and the convenience and cost-effectiveness of direct investing. As defined by this study, hybrids maintain a relationship with a traditional advisor alongside at least one self-directed account (self-service or robo platform). When it comes to the importance of leveraging technology, two-thirds indicate a good technology platform is important when selecting an advisor.

“Hybrid investors value financial autonomy, yet they also recognize the benefits of professional advice. While

Since they have a high degree of confidence in selecting their own investments, they also have a heightened awareness of how much they paid for them, and the long-term impact of investment fees on returns. High advisory fees are a hot-button topic for hybrid investors, especially given their ability to readily compare costs between managing their own portfolio and working with an advisor. This poses a risk for advisors with non-competitive fee structures.

The study revealed:

-

60% of hybrid investors compensate their advisors based on assets under management

-

45% indicate they would leave or switch financial advisors if those fees increased

-

43% state the cost savings of using self-directed accounts are a benefit

-

Significantly more hybrid investors (

47% ) than advised-only (27% ) and self-directed only (37% ) have ETFs in their portfolios, which tend to be lower cost and easier to trade

“Hybrid investors’ willingness to collaborate with an advisor only goes so far, as this cohort is quick to reconsider the relationship if they perceive subpar outcomes and higher fees,” added Williams.

Millennial Investors

Born between 1981 and 1996, millennials represent the fastest growing generation of investors, both in numbers and investable assets. Growing up alongside the internet, smart devices and social media, they navigate the digital landscape better than any generation prior.

“Millennials are transforming personal finance, prioritizing financial freedom and embracing innovative engagement solutions tailored to their preferences. With their tech-savvy and research-driven approach, they bring distinct expectations to the table. To remain relevant, advisors must adapt to this evolving landscape, leveraging customer experiences to meet the millennials' needs,” said Williams.

Not surprisingly,

As millennials accumulate wealth and navigate increasingly complex financial needs, they become prime candidates for formal advisory relationships. Despite their historically high rates of direct provider platform use,

Generation X

Gen X has long been underserved in financial services, despite facing pressing needs for guidance. They stand at a crossroads, balancing retirement planning, wealth preservation, eldercare, and support for minor (and sometimes adult) children, making goal planning a complex task.

Interestingly, less than a third of advised Gen X investors received advanced planning services, and even fewer are coached in an effort to remain financially secure. Despite their attempts to manage it all, including their own investing, over

In fact, more self-directed Gen X investors (

What’s keeping them from engaging with an advisor? It comes down to fees and the overall experience. Despite their apparent need for professional investment guidance, the top reason cited for not working with an advisor is the perceived lack of value for the fees (

Women

Women are one of the fastest growing client segments due to the booming SHEconomy, managing over

Interestingly, women in this survey were equally split between advised and self-directed investors, with

Also notable was how thorough self-directed women are in their approach to decision-making. Among self-directed investors, women were much more likely than male investors to use online tools and calculators to aid in their investment decisions. They were also more likely than men to say that access to financial planning tools was a benefit of using self-service platforms.

When choosing an advisor, women’s preferences were somewhat similar to men’s. The overwhelming majority (

"Women investors are leading the charge towards financial empowerment, yet many still strive for greater security. Their journey is not one of despair, but of resilience in navigating the unique challenges they face on the path to financial well-being," said Williams. "With a focus on retirement and long-term planning, women investors are poised to seek advisors who prioritize strategies addressing longevity risks and retirement income solutions."

Yet when it came down to credentials, women tended to be more choosy when it came to the factual attributes that make an advisor look good on paper. Factors they say are extremely important include:

-

Strong credentials/knowledge/performance (

62% women vs.52% men) -

Worked with a well-respected firm (

51% women vs.48% men) -

Referred from a trusted source (

48% women vs.40% men)

Advisors who make it past that scrutiny and prove their value are rewarded with loyalty. According to the study,

Common Financial Goal: Retirement Security

Having enough money to live throughout their retirement years emerged to the top financial goals for each of these segments:

-

Hybrids:

76% -

Millennials:

67% -

Gen X:

79% -

Women:

80%

It comes as no surprise that the majority sought an advisor's help with retirement savings planning and retirement income planning, as these were among the top advisory services used.

What’s Next

Demographic changes, particularly in reshaping engagement standards, are setting expectations at a pace beyond traditional financial services. To achieve sustainable business growth, how an advisory practice adapts is crucial.

“The findings from our study underscore the opportunity for advisors to embrace a growth mindset and tailor their services around investors' preferences and objectives, rather than trying to fit clients into existing offerings,” said Williams. “Changes in consumer behavior are redefining expectations.”

Advisors who fail to recognize and respond to the potential presented by these rapidly expanding investor groups risk letting a significant portion of the market pass them by. By remaining proactive and responsive to these evolving dynamics, advisors can position themselves for long-term success and delight clients throughout their financial journey.

Additional Resources

The 2024 Influential Investor Segment Study eBook provides a comprehensive analysis of the findings.

For more insight on individual investors’ outlook for 2024, read State Street Global Advisors’ Influential Investor Sentiment Survey: Outlook on 2024.

State Street Global Advisors Practice Management landing page provides leading-edge practice management research, insights, and services to help advisors position their businesses for long-term success.

From Skepticism to Strategy: Where Investors Can Find Opportunities as Inflation Cools helps advisors and self-directed investors better understand how they can position portfolios to address top investment goals and concerns.

For more on State Street Global Advisors’ point of view on how advisors can help clients remain confident during uncertain times, read Market Volatility: A Relationship-Building Opportunity for Financial Advisors.

SPDR’s PortfolioTM ETF suite is designed to provide investors with greater choice in low-cost ETFs, with offerings priced as little as two basis points.

About State Street Global Advisors 2024 Influential Investor Segment Study, September 6 – 27, 2023

State Street Global Advisors, in partnership with A2Bplanning and Prodege, conducted The Influential Investor Segment Study, an online survey among a random sample of 1,503 individual investors in the US. Investors surveyed in September 2023 were between the ages of 27 and 77. Among the investors surveyed, participants fell into the following demographic categories:

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. SPDR ETFs are sponsored by affiliates of State Street Global Advisors. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com/etfs.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions and financial advisors. With a rigorous, risk-aware approach built on research, analysis and market-tested experience, we build from a breadth of index and active strategies to create cost-effective solutions. As pioneers in index and ETF investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US

*Pensions & Investments Research Center, as of 12/31/22.

†This figure is presented as of March 31, 2024 and includes ETF AUM of

Important Risk Disclosures

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing involves risk, including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Passively managed funds hold a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Distributor: Distributor State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

State Street Global Advisors, 1 Iron Street,

© 2024 State Street Corporation.

All Rights Reserved.

6281791.1.1.AM.RTL Exp. Date: 6/30/2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20240530508842/en/

Deborah Heindel

+1 617 662 9927

DHEINDEL@StateStreet.com

Source: State Street Corporation

FAQ

What are the key investor segments identified in State Street Global Advisors' 2024 study?

Why are high advisory fees a concern for hybrid investors according to the State Street study?

How do millennials prefer to handle their financial investments as per State Street's study?

What financial challenges do Gen-X investors face according to the 2024 study?