Green Star Royalties Acquires Portfolio of U.S. Forest Carbon Offset Royalties and Receives First Carbon Offset Delivery

- Acquisition of U.S. forest carbon offset royalties by Green Star Royalties through a joint venture with NativState

- Total consideration of $5.6 million for the portfolio of royalties on Improved Forest Management projects in the southeastern United States.

- Diversification and expansion of Green Star's North American nature-based portfolio.

- First carbon offset investment for Green Star with defensive royalty structures and strong investment metrics.

- Partnership with NativState, aiming to become a leading U.S. aggregator of small-to-medium forest landowners.

- Stable and rising demand for premium North American carbon offsets, with current market pricing around $13-$15/t CO2e.

- Expected delivery of approximately 180,000 carbon offsets under the Royalty in 2024, with 75% expected in the first five years.

- Transaction terms include defensive mechanisms and minimum carbon offset volumes over a 20-year period.

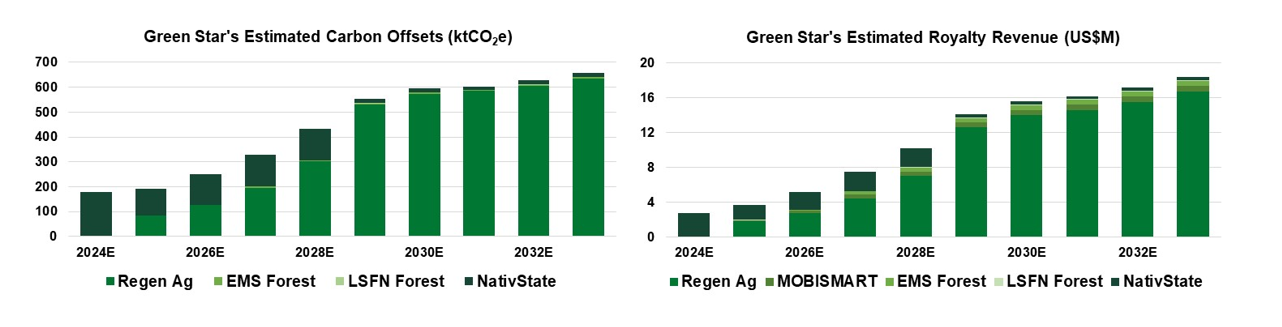

- Green Star's estimated annual carbon offsets and royalty revenues highlight immediate monetizable avoidance and removal carbon offsets.

- None.

TORONTO, ON / ACCESSWIRE / April 25, 2024 / Star Royalties Ltd. ("Star Royalties", or the "Company") (TSXV:STRR),(OTCQX:STRFF), through its joint venture, Green Star Royalties Ltd. ("Green Star"), is pleased to announce the execution of a definitive royalty agreement with NativState LLC ("NativState") to acquire several gross revenue royalties (each a "Royalty", and collectively, the "Royalties") on a carbon offset-issuing portfolio of Improved Forest Management ("IFM") projects in the southeastern United States. NativState is an Arkansas-based forest carbon project developer focused on aggregating small-to-medium forest landowners into IFM projects being developed under the American Carbon Registry ("ACR"). The Royalties are expected to deliver to Green Star premium voluntary carbon offsets over a 20-year period, with a total consideration for the Royalties of

Investment Highlights

- Expansion of Green Star's North American nature-based portfolio: The Royalties on NativState's IFM projects complement and further diversify Green Star's existing portfolio of North American nature-based carbon offset solutions.

- First carbon offset-issuing royalty for Green Star: Project ACR 783 in Arkansas becomes Green Star's first carbon offset-issuing investment with approximately 180,000 carbon offsets expected to be delivered under the Royalty in 2024, inclusive of 120,000 carbon offsets at closing. Approximately

75% of Green Star's attributable carbon offsets from the Royalties are expected to be delivered in the first five years. - Aligned and defensive royalty structure: Green Star and NativState have agreed to several defensive mechanisms, including minimum carbon offset volumes to be delivered over the 20-year royalty term.

- Multiple Royalties with strong investment metrics: The Royalties consist of a

20% Royalty on Project ACR 783 and10% Royalties on an additional 60,000 acres across Arkansas, Louisiana, Mississippi, and Missouri, to be developed by NativState and registered as future ACR projects. At prevailing carbon offset prices, the Royalties are expected to provide significant net present value accretion and allow for an attractive payback period. - Demand and pricing trends for premium North American carbon offsets are stable and rising: Premium North American nature-based carbon offsets remain in limited supply and in increasing demand. Current market pricing for these premium avoidance and removal carbon offsets is approximately

$13 -15/t CO2e and over$20 /t CO2e, respectively. - Partnership with rapidly growing carbon developer: NativState, with over 300,000 acres under management, is striving to become the largest U.S. aggregator of small-to-medium forest landowners. Green Star is proud to be building a long-term partnership with NativState by funding American forest landowners keen to participate in both IFM practices and voluntary carbon markets.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: "We are proud to announce this multi-royalty investment in NativState's portfolio of high-integrity IFM projects in the southeastern United States. This thoughtful transaction transitions Green Star into free cash flow generation and provides desirable economic returns, while expanding and diversifying our existing premium North American portfolio."

"This investment will allow for the conservation of roughly 78,000 acres of prime timberland and is a culmination of extensive due diligence by our team and multiple third-parties. We respect NativState's team and their meticulous approach to building a sustainable business model rooted in forestland conservation and stewardship. NativState's attractive carbon offset issuance profile as well as their objective of enabling American forest landowners to generate carbon revenue made this partnership a natural fit for Green Star."

Stuart Allen, Founder and Chief Executive Officer of NativState, commented: "NativState was founded to give small and medium forest landowners access to global carbon markets. This announcement and our relationship with Green Star mark an important step in making the promise of voluntary carbon markets a reality for our landowner partners. We are thankful for Green Star's trust in NativState, and we look forward to continuing to create value in forest conservation as a project proponent. Each new project brought to market provides our landowners revenue to implement sustainable forest management practices and access to professional foresters. These practices then deliver high-quality carbon offsets to our corporate stakeholders."

Transaction Terms

Green Star has agreed to acquire the Royalties for

Transaction Impact on Green Star's Carbon Offset and Revenue Profiles

The transaction provides Green Star with immediately monetizable avoidance and removal carbon offsets. The Royalties are expected to deliver carbon offsets to Green Star over the 20-year royalty term, with an estimated

Figure 1: Green Star's estimated annual carbon offsets and royalty revenues by investment

Improved Forest Management

IFM is a type of conservation project where the undertaken IFM practices increase carbon storage over a baseline, or a business-as-usual level. IFM projects can both increase net carbon stocks by sequestering carbon from the atmosphere (removal) through photosynthesis due to increased forest cover or maintained existing forest cover relative to the baseline and can reduce greenhouse gas emissions (avoidance) from reduced timber harvesting relative to the baseline. Acceptable IFM practices, including rotation extension, thinning, fire prevention practices, and changes in harvesting techniques, must be deemed allowable practices as per the projects' selected carbon registry methodology.

IFM projects form an important subset of nature-based solutions, a set of land management, conservation and restoration practices aimed at mitigating climate change, while also sustaining biodiversity and other ecosystem services. In the United States, timber harvesting is the most extensive disturbance across forestlands, with the vast majority of timber harvested annually coming from private lands. Consequently, improved forest and land management decisions can have a significant impact on the role of forests as a carbon sink. The removed and avoided carbon emissions as a result of IFM projects, when overseen by a carbon project developer and properly validated and verified through an existing carbon registry methodology, can result in the generation of carbon offsets, tagged as removal and avoidance offsets, respectively. The current market pricing for U.S. premium avoidance and removal carbon offsets is approximately

Royalty Projects

Project ACR 783 - The S&J Taylor Forest Carbon Project, Arkansas

Project ACR 783 is a registered and already-issuing project and represents approximately 18,000 acres of sustainably managed forestland across Southcentral Arkansas. This project is expected to generate approximately 1.5 million carbon offsets over the next twenty years. Green Star now owns a

As project proponents alongside NativState, the S&J Taylor family is committed to conserving working hardwoods and pine forests that have lucrative timber value by foregoing a widespread aggressive harvest that is typical to this part of the United States. The diverse oak, gum, cypress, hickory, and pine forests within the Gulf Coastal Plain eco-region represent an important habitat and provide essential buffers that prevent sedimentation and nutrient runoff between development and waterways. Project ACR 783 aims to maintain forest CO2e stocks by certified and sustainable management, while accomplishing significant carbon sequestration and providing important co-benefits to the Ouachita watershed, local communities, and improved water resources to downstream communities throughout the Gulf Coastal Plain Region.

The project is located in the counties of Cleveland, Grant, Jefferson, and Saline, where this type of land is typically aggressively cut and managed to maximize forestland investment by cutting trees as soon as they have grown to commercial maturity. By enrolling with NativState into Project ACR 783, S&J Taylor looks to generate long-term revenues through sustainable forest management and the voluntary carbon markets. In addition to generating carbon revenues, the project is expected to lead to fewer disturbances on the landscape, increased biodiversity, and improved habitat protection for species of concern. Additional information about Project ACR 783 can be found at ACR 783 | S & J Taylor Forest Project - NativState, https://vimeo.com/922734059, and https://acr2.apx.com/mymodule/reg/prjView.asp?id1=783.

Upcoming ACR Projects

As part of the royalty agreement, NativState will continue to enroll forest landowners across the southern United States into future ACR projects that will be subject to

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

Alex Pernin, P.Geo.

Chief Executive Officer and Director

apernin@starroyalties.com

+1 647 494 5001

Dmitry Kushnir, CFA

Vice President, Investor Relations

dkushnir@starroyalties.com

+1 647 494 5088

About NativState LLC

NativState LLC (www.nativstate.com) is a forest carbon project development company partnering with small-to-medium sized landowners across the southern United States to deliver access to global carbon markets. It works with landowners to improve and conserve their forests while realizing a financial return based on the creation of high-quality carbon credits sold to companies seeking to meet and exceed their carbon emission reduction goals. NativState empowers forest owners with the ability to manage their properties sustainably and provide the co-benefits of improved water quality, improved wildlife habitation, and improved overall health of the forest itself.

About Star Royalties Ltd.

Star Royalties Ltd. is a carbon credit and precious metals royalty and streaming company. The Company innovated the world's first carbon credit royalties in forestry and regenerative agriculture through its pure-green joint venture, Green Star Royalties Ltd., and offers investors exposure to carbon credit and precious metals prices. The Company's objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding the Royalties transaction, future market conditions for metals, minerals and carbon offset credits, future capital raising opportunities, and the future business growth of the Company and Green Star. Forward-looking statements are statements that address or discuss activities, events or developments that the Company or Green Star expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties and Green Star to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved.

A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, carbon pricing and carbon tax legislation and regulations, risks inherent to the development of the ESG-related investments and the creation, marketability and sale of carbon offset credits by the parties, the potential value of mandatory and voluntary carbon markets and carbon offset credits, including carbon offsets, the carbon credits to be provided by NativState, risks related to the IFM projects, changes in legislation and policies including affecting the ACR, risks inherent to royalty companies, title and permitting matters, operation and development risks relating to the parties which develop, market and sell the carbon offset credits from which Green Star will receive royalty payments, changes in crop yields and resulting financial margins regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, dilution, risk inherent to any capital financing transactions, risks inherent to a possible Green Star go-public transaction, the nature of the governance rights between Star Royalties, Cenovus Energy Inc. and Agnico Eagle Mines Ltd. in the operation and management of Green Star and competition, the ability to raise any additional funds into Green Star. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

SOURCE: Star Royalties Ltd.

View the original press release on accesswire.com