StoneCo Reports Second Quarter 2024 Results

StoneCo (Nasdaq: STNE) reported its Q2 2024 financial results, showcasing strong performance across key metrics. Key highlights include:

Total Revenue and Income: R$3,205.9 million, up 8.5% YoY. Adjusted EBITDA: R$1,587.2 million, increasing 5.9% YoY with a 49.5% margin. Adjusted EBT: R$652.2 million, up 45.9% YoY. Adjusted Net Income: R$497.1 million, growing 54.4% YoY. MSMB Card TPV: R$97.8 billion, up 17.4% YoY. Active Banking Clients: 2.7 million with R$6.5 billion in deposits. Share Repurchase: Repurchased 9.67 million shares for R$724 million in 3Q24. Additionally, the company allocated $295 million for a tender offer of its 2028 bonds, achieving nearly 60% participation. Despite market headwinds, StoneCo remains confident in meeting its 2024 guidance.StoneCo (Nasdaq: STNE) ha riportato i risultati finanziari del secondo trimestre 2024, mostrando una forte performance in tutti i principali indicatori. I punti salienti includono:

Ricavi Totali e Reddito: R$3.205,9 milioni, +8,5% rispetto all'anno precedente. EBITDA Rettificato: R$1.587,2 milioni, in aumento del 5,9% rispetto all'anno precedente con un margine del 49,5%. EBT Rettificato: R$652,2 milioni, +45,9% rispetto all'anno precedente. Reddito Netto Rettificato: R$497,1 milioni, in crescita del 54,4% rispetto all'anno precedente. TPV delle Carte MSMB: R$97,8 miliardi, +17,4% rispetto all'anno precedente. Clienti Bancari Attivi: 2,7 milioni con R$6,5 miliardi in depositi. Riacquisto di Azioni: Riacquistate 9,67 milioni di azioni per R$724 milioni nel terzo trimestre del 2024. Inoltre, l'azienda ha destinato $295 milioni per un'offerta pubblica d'acquisto delle sue obbligazioni del 2028, raggiungendo una partecipazione di quasi il 60%. Nonostante le difficoltà del mercato, StoneCo rimane fiduciosa nel raggiungimento delle previsioni per il 2024.StoneCo (Nasdaq: STNE) informó sobre sus resultados financieros del segundo trimestre de 2024, mostrando un sólido desempeño en métricas clave. Los aspectos destacados incluyen:

Ingresos Totales y Ganancias: R$3.205,9 millones, un aumento del 8,5% interanual. EBITDA Ajustado: R$1.587,2 millones, aumentando un 5,9% interanual con un margen del 49,5%. EBT Ajustado: R$652,2 millones, un aumento del 45,9% interanual. Ingreso Neto Ajustado: R$497,1 millones, creciendo un 54,4% interanual. TPV de Tarjetas MSMB: R$97,8 mil millones, un incremento del 17,4% interanual. Clientes Bancarios Activos: 2,7 millones con R$6,5 mil millones en depósitos. Recompra de Acciones: Recompradas 9,67 millones de acciones por R$724 millones en el 3T24. Además, la compañía asignó $295 millones para una oferta de adquisición de sus bonos de 2028, logrando casi el 60% de participación. A pesar de las dificultades del mercado, StoneCo sigue confiando en cumplir con sus expectativas para 2024.StoneCo (Nasdaq: STNE)는 2024년 2분기 재무 결과를 발표하며 주요 지표에서 견고한 성과를 보였습니다. 주요 사항은 다음과 같습니다:

총 수익 및 소득: R$3,205.9 백만, 전년 대비 8.5% 증가. 조정된 EBITDA: R$1,587.2 백만, 전년 대비 5.9% 증가하며 49.5%의 마진을 기록했습니다. 조정된 EBT: R$652.2 백만, 전년 대비 45.9% 증가. 조정된 순 소득: R$497.1 백만, 전년 대비 54.4% 성장. MSMB 카드 TPV: R$97.8억, 전년 대비 17.4% 증가. 활성 은행 고객: 270만명, R$6.5억의 예금 보유. 자사주 매입: 3분기 724백만 R$에 9.67백만 주를 매입. 또한, 회사는 2028년 채권에 대한 입찰제안에 2.95억 달러를 배정하여 거의 60%의 참여율을 달성했습니다. 시장의 도전에도 불구하고, StoneCo는 2024년 목표 달성에 대한 자신감을 유지하고 있습니다.StoneCo (Nasdaq: STNE) a publié ses résultats financiers du deuxième trimestre 2024, mettant en avant une solide performance dans les principales indicateurs. Les points clés comprennent :

Revenus Totaux et Revenus : R$3.205,9 millions, en hausse de 8,5 % par rapport à l'année précédente. EBITDA Ajusté : R$1.587,2 millions, en augmentation de 5,9 % par rapport à l'année précédente avec une marge de 49,5 %. EBT Ajusté : R$652,2 millions, en hausse de 45,9 % par rapport à l'année précédente. Revenu Net Ajusté : R$497,1 millions, en croissance de 54,4 % par rapport à l'année précédente. TPV des cartes MSMB : R$97,8 milliards, en hausse de 17,4 % par rapport à l'année précédente. Clients Bancaires Actifs : 2,7 millions avec R$6,5 milliards en dépôts. Rachat d'Actions : Rachat de 9,67 millions d'actions pour R$724 millions au 3T24. De plus, l'entreprise a alloué 295 millions de dollars pour une offre publique d'achat de ses obligations de 2028, atteignant presque 60 % de participation. En dépit des défis du marché, StoneCo reste confiant quant à l'atteinte de ses prévisions pour 2024.StoneCo (Nasdaq: STNE) hat die finanziellen Ergebnisse für das 2. Quartal 2024 veröffentlicht und dabei eine starke Leistung in den wichtigsten Kennzahlen gezeigt. Die Highlights sind:

Gesamtumsatz und Einkommen: R$3.205,9 Millionen, ein Anstieg von 8,5% im Jahresvergleich. Bereinigtes EBITDA: R$1.587,2 Millionen, eine Steigerung um 5,9% im Jahresvergleich bei einer Marge von 49,5%. Bereinigtes EBT: R$652,2 Millionen, +45,9% im Jahresvergleich. Bereinigtes Nettoeinkommen: R$497,1 Millionen, +54,4% im Jahresvergleich. MSMB Karten-TPV: R$97,8 Milliarden, +17,4% im Jahresvergleich. Aktive Bankkunden: 2,7 Millionen mit R$6,5 Milliarden an Einlagen. Aktienrückkauf: Rückkauf von 9,67 Millionen Aktien für R$724 Millionen im 3. Quartal 2024. Darüber hinaus hat das Unternehmen 295 Millionen USD für ein Übernahmeangebot seiner 2028er Anleihen bereitgestellt und eine Beteiligung von nahezu 60% erreicht. Trotz der Marktherausforderungen bleibt StoneCo zuversichtlich, die Prognosen für 2024 zu erfüllen.- Total Revenue and Income: R$3,205.9 million, up 8.5% YoY.

- Adjusted EBITDA: R$1,587.2 million, increasing 5.9% YoY.

- Adjusted EBITDA Margin: 49.5%, up from 49.0% sequentially.

- Adjusted EBT: R$652.2 million, up 45.9% YoY.

- Adjusted EBT Margin: 20.3%, up 5.2 percentage points YoY.

- Adjusted Net Income: R$497.1 million, growing 54.4% YoY.

- MSMB Card TPV: R$97.8 billion, up 17.4% YoY.

- Active Banking Clients: 2.7 million, up 61.7% YoY.

- Client Deposits: R$6.5 billion, up 65.2% YoY.

- Share Repurchase: Repurchased 9.67 million shares for R$724 million.

- Cost of Services: R$841.4 million, up 22.8% YoY.

- Provision for Loan Losses: R$18.1 million in Q2 2024.

- Net Revenue from Transaction Activities: R$807.5 million, down 3.9% YoY.

- NPL over 90 days: Increased to 2.60% from 1.47% in Q1 2024.

Insights

StoneCo's Q2 2024 results demonstrate solid growth and improved profitability. Key highlights include:

- Total revenue up

8.5% YoY toR$3.21 billion - Adjusted net income up

54.4% YoY toR$497.1 million - MSMB Card TPV grew

17.4% YoY toR$97.8 billion - Active client base up

29.5% YoY to 3.9 million

The company is showing strong execution on its strategic priorities, with improvements in monetization, banking engagement and efficiency. The

StoneCo's results indicate it's gaining market share in Brazil's competitive payments space. The

- Take rate improved 7 bps YoY to

2.54% , showing pricing power - Banking clients reached 2.7 million, up

61.7% YoY - Credit portfolio grew to

R$712 million with low NPLs

The cross-selling of financial services to software clients is a promising strategy, driving stronger TPV growth in key verticals. The company's focus on efficiency is also paying off, with admin expenses down

StoneCo's technology investments are yielding results. Notable developments:

- Piloting interest-bearing products like time deposits

- Structuring of 'Giro Fácil', a short-term overdraft solution

- Successful cross-selling of financial services to software clients

The integration of Pagar.me SMB clients into Stone's full banking solution contributed

GEORGE TOWN, Grand Cayman, Aug. 14, 2024 (GLOBE NEWSWIRE) -- StoneCo Ltd. (Nasdaq: STNE, B3: STOC31) (“Stone” or the “Company”) today reports its financial results for its second quarter ended June 30, 2024.

| Adjusted EBT | MSMB CTPV (Card TPV) |

| R | R |

| + | + |

| Adjusted Net income | Adjusted Basic EPS |

| R | R |

| + | + |

Business Overview

Stone has made significant progress in the second quarter across our strategic priorities, advancing in critical areas as we work towards our 2024 and long-term targets.

Highlighting our strong growth within Financial Services, MSMB Card TPV increased by

In banking, we continued to drive engagement, reaching 2.7 million active banking clients and R

Our credit portfolio also continues to grow, reaching R

In software, our initiative to cross-sell financial services to software clients continues to progress well, particularly in the gas station and retail verticals. This effort has led to stronger card TPV growth among software clients in priority verticals compared to the overall MSMB card TPV growth.

We have also maintained our focus on efficiency. Administrative expenses have decreased by

As a result of these positive developments, our adjusted basic EPS demonstrated strong growth, reaching R

In light of this commitment and considering short-term market fluctuations, we allocated capital to repurchase an additional 9.67 million shares, totaling R

Operating and Financial Highlights for 2Q24

MAIN CONSOLIDATED ADJUSTED FINANCIAL METRICS

Table 1: Main Consolidated Financial Metrics

| Main Consolidated Financial Metrics (R$mn) | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % | 1H24 | 1H23 | y/y % |

| Total Revenue and Income | 3,205.9 | 3,084.9 | 3.9% | 2,954.8 | 8.5% | 6,290.8 | 5,666.4 | 11.0% |

| Adjusted EBITDA | 1,587.2 | 1,512.0 | 5.0% | 1,498.8 | 5.9% | 3,099.2 | 2,750.2 | 12.7% |

| Adjusted EBITDA margin (%) | 49.5% | 49.0% | 0.5 p.p. | 50.7% | (1.2 p.p.) | 49.3% | 48.5% | 0.7 p.p. |

| Adjusted EBT | 652.2 | 567.6 | 14.9% | 447.0 | 45.9% | 1,219.8 | 771.0 | 58.2% |

| Adjusted EBT margin (%) | 20.3% | 18.4% | 1.9 p.p. | 15.1% | 5.2 p.p. | 19.4% | 13.6% | 5.8 p.p. |

| Adjusted Net Income | 497.1 | 450.4 | 10.4% | 322.0 | 54.4% | 947.6 | 558.6 | 69.6% |

| Adjusted Net income margin (%) | 15.5% | 14.6% | 0.9 p.p. | 10.9% | 4.6 p.p. | 15.1% | 9.9% | 5.2 p.p. |

| Adjusted Net Cash | 5,256.9 | 5,139.8 | 2.3% | 4,327.2 | 21.5% | 5,256.9 | 4,327.2 | 21.5% |

- Total Revenue and Income reached R

$3,205.9 million in the quarter, up8.5% year over year. This growth was mostly driven by a10.6% increase in financial services revenues, mainly as a result of consistent active client base growth and higher client monetization. - Adjusted EBITDA was R

$1,587.2 million in the quarter, an increase of5.9% year over year and5.0% quarter over quarter. Adjusted EBITDA Margin increased from49.0% to49.5% sequentially, primarily due to consolidated revenue growth, combined with lower selling expenses as a percentage of revenues. - Adjusted EBT was R

$652.2 million in 2Q24, a45.9% increase year over year, with an adjusted EBT margin of20.3% , a 5.2 percentage points increase over the same period. Adjusted EBT was up14.9% sequentially, with adjusted EBT margin increasing 1.9 percentage point. The quarter over quarter margin increase is primarily attributed to consolidated revenue growth, combined with lower financial and selling expenses as percentage of revenues, being partially offset by more normalized levels of other operating expenses. - Adjusted Net Income reached R

$497.1 million in 2Q24, a54.4% growth year over year, with an adjusted net margin of15.5% compared with R$450.4 million and a margin of14.6% in 1Q24. The sequential margin increase was primarily driven by the same factors that impacted Adjusted EBT margin, partially compensated by a higher effective tax rate. - Adjusted Net Cash position was R

$5,256.9 million in 2Q24, representing a21.5% increase year over year or2.3% sequentially. The R$117.1 million quarter over quarter growth is mainly explained by cash generation from our operations with the main outflows being capex and buyback of shares.

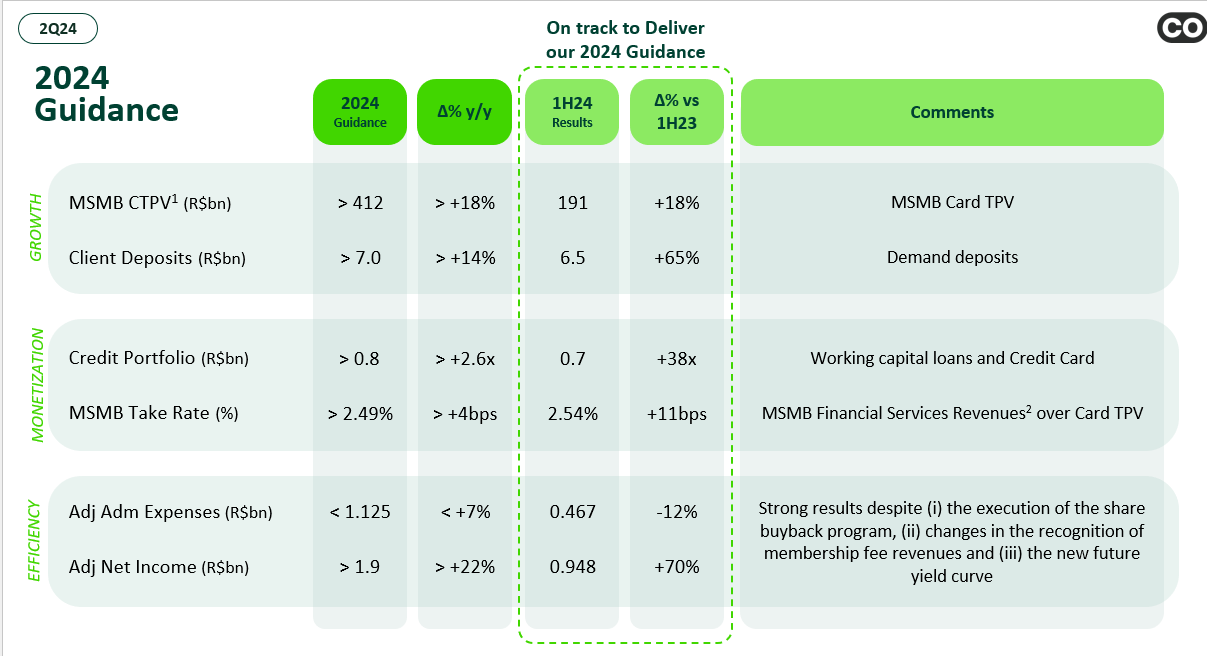

OUTLOOK

We are on track to deliver our 2024 guidance. The profitability achieved in 1H24 has positioned us favorably to meet our full-year guidance, despite several headwinds. These include a ~R

| On track to deliver our 2024 Guidance | |||||||||

| 2024 Guidance | 2024 Guidance | ∆% y/y | 1H24 | ∆% vs 1H23 | Comments | ||||

| MSMB CTPV (Card TPV) (R$bn) | > 412 | > + | 191 | + | MSMB Card TPV | ||||

| Clients Deposits (R$bn) | > 7.0 | > + | 6.5 | Demand deposits | |||||

| Growth ↑ | |||||||||

| Credit Portfolio (R$bn) | > 0.8 | > +2.6x | 0.7 | +38x | Working capital loans and Credit Card | ||||

| MSMB Take Rate (%) | > | > +4bps | +15bps | MSMB Financial Services Revenues over Card TPV | |||||

| Monetization ↑ | |||||||||

| Adjusted Administrative Expenses (R$bn) | < 1.125 | < + | 0.948 | - | Strong results despite (i) the execution of the share buyback program, (ii) changes in the recognition of the membership fee revenues and (iii) the new future yield curve | ||||

| Adjusted Net Income (R$bn) | > 1.9 | > + | 0.467 | + | |||||

| Efficiency ↑ | |||||||||

MAIN OPERATING METRICS

Table 2: Payments

| Payments Operating Metrics | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % |

| Total TPV1 (R$bn) | 126.1 | 117.3 | 103.7 | ||

| CTPV2 (Card TPV) | 110.9 | 105.8 | 97.4 | ||

| PIX QR Code | 15.2 | 11.5 | 6.3 | ||

| MSMB TPV1 | 109.3 | 101.9 | 87.7 | ||

| CTPV2 (Card TPV) | 97.8 | 93.4 | 83.3 | ||

| PIX QR Code | 11.5 | 8.5 | 4.3 | ||

| Key Accounts TPV1 | 16.8 | 15.3 | 16.0 | ||

| CTPV2 (Card TPV) | 13.1 | 12.3 | 14.1 | ( | |

| PIX QR Code | 3.8 | 3.0 | 2.0 | ||

| Active Client Base ('000) | 3,904.1 | 3,720.6 | 3,014.7 | ||

| MSMB | 3,860.2 | 3,676.2 | 2,962.0 | ||

| Key Accounts | 51.8 | 51.9 | ( | 62.6 | ( |

| Net Adds ('000) | 183.6 | 198.5 | ( | 196.6 | ( |

| MSMB | 184.0 | 204.9 | ( | 203.9 | ( |

| Key Accounts | (0.1) | (6.4) | ( | (5.0) | ( |

- Total TPV (including PIX QR Code) reached R

$126.1 billion in 2Q24,21.6% higher on a year over year basis. This growth is mainly explained by (i) continuous growth in the MSMB segment, with CTPV (Card TPV) growing17.4% and (ii) the increase in PIX QR Code volumes which grew141.5% compared with the prior-year period. - Total Payments Active Client base reached 3.9 million with a net addition of 183,600 active clients in the quarter.

MSMB (Micro and SMB clients)

- MSMB Active Payment Clients were 3.9 million in 2Q24, growing

30.3% year over year. The quarterly net addition was 184,000, a10.2% quarter over quarter decrease, which can be mainly attributed to higher net adds in 1Q24 due to a specific marketing campaign in that period. - MSMB TPV (including PIX QR Code) was R

$109.3 billion in the quarter, an year over year increase of24.6% and7.2% sequentially.- MSMB CTPV (Card TPV) was R

$97.8 billion , growing17.4% year over year and4.7% sequentially. The year over year increase was primarily driven by the continuous growth of our active payments client base in the segment. - MSMB PIX QR Code reached R

$11.5 billion in the quarter, 1.6x higher year over year or a34.8% growth over the previous quarter. From 2Q24 onwards, MSMB PIX QR Code volumes will include those from Pagar.me SMB clients, who are now fully integrated into the complete Stone banking solution, which contributed with R$1.4 billion in the quarter.

- MSMB CTPV (Card TPV) was R

________________________

1 TPV means “Total Payment Volume”. Considers all volumes settled by StoneCo, including PIX QR Code),defined as transactions from dynamic POS QR Code and static QR Code, unless otherwise noted.

2 CTPV means “Card Total Payments Volume” and considers only card volumes settled by the Company.

Table 3: Banking

| Banking Operating Metrics | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % |

| MSMB Active Client Base ('000) | 2,704.2 | 2,379.7 | 1,672.0 | ||

| Client Deposits (R$mn) | 6,471.6 | 5,985.0 | 3,918.6 | ||

| MSMB ARPAC (R$) | 25.7 | 29.3 | ( | 25.3 | |

- Banking solutions

- Banking active client base in 1Q24 was 2.7 million active clients, up

61.7% year over year or13.6% quarter over quarter. The sequential growth was mainly a result of (i) the increase of our payments active client base, (ii) the continued activation of new banking accounts within our existing Stone payments client base, in line with the execution of our strategy of selling integrated solutions, and (iii) the migration of Pagar.me clients to the full banking solution. - Total deposits achieved R

$6.5 billion in the quarter, increasing65.2% year over year and8.1% quarter over quarter. The sequential increase is mainly attributed to the growth in our banking active client base. - Banking ARPAC was R

$25.7 per client per month, representing a1.2% increase year over year and a12.6% decrease quarter over quarter. The quarter over quarter decrease is mainly explained by (i) a lower average CDI in the period which impacts our floating revenues and (ii) higher contribution of Ton clients in the MSMB Active Banking Client Base, as Ton clients generate lower revenue contribution compared to Stone clients.

- Banking active client base in 1Q24 was 2.7 million active clients, up

Table 4: Credit

| Credit Metrics | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % |

| Consolidated credit metrics | |||||

| Portfolio (R$mn) | 711.8 | 539.6 | 18.7 | ||

| Provisions for losses (R$mn) | (18.1) | (44.8) | ( | (3.7) | |

| Working capital loans metrics | |||||

| Active contracts | 24,264 | 18,754 | 672 | ||

| Portfolio (R$mn) | 681.6 | 531.7 | 18.7 | ||

| Disbursements (R$mn) | 275.6 | 294.9 | ( | 19.0 | |

| Provision for losses (R$mn) | (16.9) | (44.4) | ( | (3.7) | |

| Accumulated provision for losses (R$mn) | (123.1) | (106.3) | (3.7) | ||

| Provisions ratio | ( | ( | 1.92 p.p. | ( | 1.96 p.p. |

| NPL 15-90 days | 0.66 p.p. | 2.55 p.p. | |||

| NPL > 90 days | 1.13 p.p. | n.a. | n.a. | ||

- Working Capital loans:

- In 2Q24 we disbursed R

$275.6 million , reaching 24,264 contracts and a portfolio of R$681.6 million at month-end. The Company remains focused on offering this credit solution to the SMB client segment. - Provision for expected working capital losses was R

$16.9 million in the quarter compared with R$44.4 million in the previous quarter. We have started to converge provision levels to our expected loss levels as the portfolio matures. As a result, the ratio of accumulated loan loss provision expenses over the working capital portfolio was18.1% in the period compared with20.0% in previous quarters. - Working capital NPL 15-90 days was

2.85% and NPL over 90 days was2.60% in 2Q24 compared with2.20% and1.47% in 1Q24 respectively. This expected increase is a natural result of the portfolio maturation process.

- In 2Q24 we disbursed R

Table 5: Monetization

| Take Rate | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % |

| MSMB | 0.01 p.p. | 0.07 p.p. | |||

| Key Accounts | 0.04 p.p. | 0.19 p.p. | |||

- MSMB Take Rate was flat sequentially in 2Q24 at

2.54% . For more information about reconciling our reported take rates with our financial services revenue, please refer to the “Build-up Take Rate” tab in our Results Spreadsheet.

Table 6: Software

| Software Operating Metrics (R$bn) | 2Q24 | 1Q24 | Δ q/q % | 2Q23 | Δ y/y % |

| CTPV3 (Card TPV) Overlap | 5.5 | 5.1 | n.a. | n.a. | |

- CTPV (Card TPV) Overlap is measured by the MSMB CTPV overlap between financial services and the priority verticals, being a key metric to measure our cross sell performance. In 2Q24, CTPV Overlap was R

$5.5 billion , representing an8.2% increase on a quarter over quarter basis, higher than MSMB CPTV growth of4.7% over the same period. This growth can be mainly attributed to the Gas Station and Retail verticals, which are the ones we are mostly focused on at the moment.

Income Statement

Table 7: Statement of Profit or Loss (IFRS, as Reported)

| Statement of Profit or Loss (R$mn) | 2Q24 | % Rev. | 1Q24 | % Rev. | Δ q/q % | 2Q23 | % Rev. | Δ y/y% |

| Net revenue from transaction activities and other services | 807.5 | 25.2% | 749.8 | 24.3% | 7.7% | 840.1 | 28.4% | (3.9%) |

| Net revenue from subscription services and equipment rental | 453.3 | 14.1% | 456.7 | 14.8% | (0.8%) | 457.3 | 15.5% | (0.9%) |

| Financial income | 1,826.7 | 57.0% | 1,741.1 | 56.4% | 4.9% | 1,462.6 | 49.5% | 24.9% |

| Other financial income | 118.4 | 3.7% | 137.3 | 4.4% | (13.7%) | 194.8 | 6.6% | (39.2%) |

| Total revenue and income | 3,205.9 | 100.0% | 3,084.9 | 100.0% | 3.9% | 2,954.8 | 100.0% | 8.5% |

| Cost of services | (841.4) | (26.2%) | (809.9) | (26.3%) | 3.9% | (685.3) | (23.2%) | 22.8% |

| Provision for expected credit losses4 | (18.1) | (0.6%) | (44.8) | (1.5%) | (59.7%) | 0.0 | 0.0% | n.a. |

| Administrative expenses | (255.5) | (8.0%) | (257.0) | (8.3%) | (0.6%) | (303.9) | (10.3%) | (15.9%) |

| Selling expenses | (524.9) | (16.4%) | (529.7) | (17.2%) | (0.9%) | (411.9) | (13.9%) | 27.4% |

| Financial expenses, net | (851.1) | (26.5%) | (896.5) | (29.1%) | (5.1%) | (1,073.8) | (36.3%) | (20.7%) |

| Mark-to-market on equity securities designated at FVPL | 0.0 | 0.0% | 0.0 | 0.0% | n.a. | 0.0 | 0.0% | n.a. |

| Other income (expenses), net | (80.9) | (2.5%) | (108.1) | (3.5%) | (25.1%) | (56.7) | (1.9%) | 42.6% |

| Loss on investment in associates | (0.4) | (0.0%) | 0.3 | 0.0% | n.m. | (0.8) | (0.0%) | (48.7%) |

| Profit (loss) before income taxes | 651.7 | 20.3% | 484.0 | 15.7% | 34.6% | 422.3 | 14.3% | 54.3% |

| Income tax and social contribution | (153.4) | (4.8%) | (110.4) | (3.6%) | 38.9% | (115.1) | (3.9%) | 33.3% |

| Net income (loss) for the period | 498.3 | 15.5% | 373.6 | 12.1% | 33.4% | 307.2 | 10.4% | 62.2% |

________________________

3 CTPV means “Card Total Payments Volume” and considers only card volumes settled by the Company.

4 In 2Q23, credit revenues were recognized net of provision for expected credit losses in Financial Income. From 3Q23 onwards, provision for expected losses is allocated in Cost of services.

Total Revenue and Income

Net Revenue from Transaction Activities and Other Services

Net Revenue from Transaction Activities and Other Services was R

In 2Q24, considering our new internal accounting methodology, membership fees contributed with R

Quarter over quarter, Net Revenue from Transaction Activities and Other Services increased

Net Revenue from Subscription Services and Equipment Rental

Net Revenue from Subscription Services and Equipment Rental decreased

Financial Income

Financial Income was R

Quarter over quarter, financial income increased

Other Financial Income

Other Financial Income was R

Costs and Expenses

Cost of Services

Cost of Services were R

Compared with 1Q24, Cost of Services were

Provisions for loan losses from our credit product contributed with R

Administrative Expenses

Administrative Expenses were R

Compared with the previous quarter, Administrative Expenses were slightly lower. The

Selling Expenses

Selling Expenses were R

Compared with 1Q24, Selling Expenses decreased

Financial Expenses, Net

Financial Expenses, Net were R

Compared with 1Q24, Financial Expenses, Net were

Other Income (Expenses), Net

Other Expenses, Net were R

Compared with the previous quarter, Other Expenses, net were R

Income Tax and Social Contribution

The Company recognized R

Net Income (Loss) and EPS

In 2Q24 Net Income was R

IFRS basic EPS was R

Adjustments to Net Income by P&L Line

Table 8: Adjustments to Net Income by P&L Line

| Adjustments to Net Income by P&L line (R$mn) | 2Q24 | 1Q24 | 2Q23 |

| Cost of services | 0.0 | 0.0 | 0.0 |

| Administrative expenses | 20.3 | 25.0 | 34.8 |

| Selling expenses | 0.0 | 0.0 | 0.0 |

| Financial expenses, net | 1.5 | 7.3 | 14.2 |

| Other operating income (expense), net | (21.3) | 51.3 | (24.2) |

| Gain (loss) on investment in associates | 0.0 | 0.0 | 0.0 |

| Profit (loss) before income taxes | 0.5 | 83.6 | 24.7 |

| Income tax and social contribution | (1.6) | (6.8) | (10.0) |

| Net income (loss) for the period | (1.2) | 76.8 | 14.8 |

Below we comment the adjustments in our P&L in the quarter:

- Administrative Expenses include -R

$20.3 million related to amortization of fair value adjustments on acquisitions, mostly related to the Linx and other software companies’ acquisitions. - Financial Expenses include -R

$1.5 million of expenses related to effects from (i) earn out interests on business combinations, and (ii) financial expenses from fair value adjustments on acquisitions. - Other Expenses, net include R

$21.3 million from fair value of call options related to acquisitions, earn-out interests, divestment of assets and fair value adjustments on acquisitions. - Income Tax and Social Contribution includes R

$1.6 million related to taxes from the adjusted items. Adjusting for those effects, our Income Tax and Social Contribution was R$155.0 million with an effective tax rate in 2Q24 of23.8% .

Considering the adjustments to net income abovementioned, our Adjusted Profit and Loss Statement is presented below:

Table 9: Statement of Profit or Loss (Adjusted)

| Adjusted Statement of Profit or Loss (R$mn) | 2Q24 | % Rev. | 1Q24 | % Rev. | Δ q/q % | 2Q23 | % Rev. | Δ y/y% |

| Net revenue from transaction activities and other services | 807.5 | 25.2% | 749.8 | 24.3% | 840.1 | 28.4% | ( | |

| Net revenue from subscription services and equipment rental | 453.3 | 14.1% | 456.7 | 14.8% | ( | 457.3 | 15.5% | ( |

| Financial income | 1,826.7 | 57.0% | 1,741.1 | 56.4% | 1,462.6 | 49.5% | ||

| Other financial income | 118.4 | 3.7% | 137.3 | 4.4% | ( | 194.8 | 6.6% | ( |

| Total revenue and income | 3,205.9 | 100.0% | 3,084.9 | 100.0% | 3.9% | 2,954.8 | 100.0% | 8.5% |

| Cost of services | (841.4) | (26.2%) | (809.9) | (26.3%) | (685.3) | (23.2%) | ||

| Provision for expected credit losses4 | (18.1) | (0.6%) | (44.8) | (1.5%) | ( | 0.0 | 0.0% | n.a. |

| Administrative expenses | (235.2) | (7.3%) | (232.0) | (7.5%) | (269.1) | (9.1%) | ( | |

| Selling expenses | (524.9) | (16.4%) | (529.7) | (17.2%) | ( | (411.9) | (13.9%) | |

| Financial expenses, net | (849.5) | (26.5%) | (889.2) | (28.8%) | ( | (1,059.7) | (35.9%) | ( |

| Other income (expenses), net | (102.3) | (3.2%) | (56.7) | (1.8%) | (81.0) | (2.7%) | ||

| Loss on investment in associates | (0.4) | (0.0%) | 0.3 | 0.0% | n.m | (0.8) | (0.0%) | ( |

| Adj. Profit before income taxes | 652.2 | 20.3% | 567.6 | 18.4% | 14.9% | 447.0 | 15.1% | 45.9% |

| Income tax and social contribution | (155.0) | (4.8%) | (117.2) | (3.8%) | (125.0) | (4.2%) | ||

| Adjusted Net Income | 497.1 | 15.5% | 450.4 | 14.6% | 10.4% | 322.0 | 10.9% | 54.4% |

For the P&L lines that are adjusted, the variations can be explained by the same factors as in the IFRS statement apart from the ones mentioned below.

Adjusted Administrative expenses decreased

Adjusted other expenses, net increased

Adjusted Net Income (Loss) and EPS

Table 10: Adjusted Net Income Reconciliation

| Net Income Bridge (R$mn) | 2Q24 | % Rev. | 1Q24 | % Rev. | Δ q/q% | 2Q23 | % Rev. | Δ y/y% |

| Net income (loss) for the period | 498.3 | 15.5% | 373.6 | 12.1% | 33.4% | 307.2 | 10.4% | 62.2% |

| Amortization of fair value adjustment (a) | 13.4 | 0.4% | 12.3 | 0.4% | 35.7 | 1.2% | ( | |

| Other expenses (b) | (12.9) | (0.4%) | 71.3 | 2.3% | n.m | (11.0) | (0.4%) | |

| Tax effect on adjustments | (1.6) | (0.1%) | (6.8) | (0.2%) | ( | (10.0) | (0.3%) | ( |

| Adjusted net income (as reported) | 497.1 | 15.5% | 450.4 | 14.6% | 10.4% | 322.0 | 10.9% | 54.4% |

| Basic Number of shares | 307.8 | n.a. | 309.1 | n.a. | ( | 313.1 | n.a. | ( |

| Diluted Number of shares | 314.8 | n.a. | 316.1 | n.a. | ( | 318.7 | n.a. | ( |

| Adjusted basic EPS (R$) (c) | 1.61 | n.a. | 1.46 | n.a. | 1.02 | n.a. | ||

(a) Related to acquisitions. Consists of expenses resulting from the changes of the fair value adjustments as a result of the application of the acquisition method.

(b) Consists of the fair value adjustment related to associates call option, earn-out and earn-out interests related to acquisitions, loss of control of subsidiary and divestment of assets.

(c) Calculated as Adjusted Net income attributable to owners of the parent (Adjusted Net Income reduced by Adjusted Net Income attributable to Non-Controlling interest) divided by basic number of shares.

Adjusted Net Income was R

Adjusted Net Income was

Adjusted basic EPS was R

EBITDA

EBITDA was R

Table 11: Adjusted EBITDA Reconciliation

| EBITDA Bridge (R$mn) | 2Q24 | % Rev. | 1Q24 | % Rev. | Δ q/q % | 2Q23 | % Rev. | Δ y/y% |

| Profit (Loss) before income taxes | 651.7 | 20.3% | 484.0 | 15.7% | 34.6% | 422.3 | 14.3% | 54.3% |

| (+) Financial expenses, net | 851.1 | 26.5% | 896.5 | 29.1% | (5.1%) | 1,073.8 | 36.3% | (20.7%) |

| (-) Other financial income | (118.4) | (3.7%) | (137.3) | (4.4%) | ( | (194.8) | (6.6%) | ( |

| (+) Depreciation and amortization | 224.2 | 7.0% | 217.3 | 7.0% | 221.7 | 7.5% | ||

| EBITDA | 1,608.5 | 50.2% | 1,460.6 | 47.3% | 10.1% | 1,523.0 | 51.5% | 5.6% |

| (+) Other Expenses (a) | (21.3) | (0.7%) | 51.3 | 1.7% | n.m | (24.2) | (0.8%) | ( |

| Adjusted EBITDA | 1,587.2 | 49.5% | 1,512.0 | 49.0% | 5.0% | 1,498.8 | 50.7% | 5.9% |

(a) Consists of the fair value adjustment related to associates call option, earn-out and earn-out interests related to acquisitions, loss of control of subsidiaries and divestment of assets.

Adjusted EBITDA was R

SEGMENT REPORTING

Below, we provide our main financial metrics broken down into our two reportable segments and non-allocated activities.

Table 12: Financial metrics by segment

| Segment Reporting (R$mn Adjusted) | 2Q24 | % Rev | 1Q24 | % Rev | Δ q/q % | 2Q23 | % Rev | Δ y/y % |

| Total Revenue and Income | 3,205.9 | 100.0% | 3,084.9 | 100.0% | 3.9% | 2,954.8 | 100.0% | 8.5% |

| Financial Services | 2,822.2 | 100.0% | 2,710.3 | 100.0% | 2,551.2 | 100.0% | ||

| Software | 383.7 | 100.0% | 369.1 | 100.0% | 382.9 | 100.0% | ||

| Non-Allocated | 0.0 | n.a. | 5.5 | 100.0% | ( | 20.7 | 100.0% | ( |

| Adjusted EBITDA | 1,587.2 | 49.5% | 1,512.0 | 49.0% | 5.0% | 1,498.8 | 50.7% | 5.9% |

| Financial Services | 1,523.5 | 54.0% | 1,444.0 | 53.3% | 1,427.5 | 56.0% | ||

| Software | 63.9 | 16.7% | 65.8 | 17.8% | ( | 66.5 | 17.4% | ( |

| Non-Allocated | (0.2) | n.a. | 2.2 | 40.3% | n.m | 4.9 | 23.4% | ( |

| Adjusted EBT | 652.2 | 20.3% | 567.6 | 18.4% | 14.9% | 447.0 | 15.1% | 45.9% |

| Financial Services | 607.8 | 21.5% | 528.6 | 19.5% | 398.2 | 15.6% | ||

| Software | 44.6 | 11.6% | 37.2 | 10.1% | 45.5 | 11.9% | ( | |

| Non-Allocated | (0.2) | n.a. | 1.9 | 34.2% | n.m | 3.4 | 16.2% | n.m |

- Financial Services segment Adjusted EBT was R

$607.8 million in the quarter, representing a52.6% year over year increase and15.0% on a quarter over quarter basis. Adjusted EBT margin was21.5% , an increase of 5.9 percentage points from15.6% in 2Q23. This year over year increase was driven by higher revenues from the segment, combined with lower Financial and Administrative Expenses as a percentage of revenues. These effects were partially offset by higher Cost of Services and Selling Expenses as a percentage of revenues. - Software Segment Adjusted EBITDA was R

$63.9 million in 2Q24, with a margin of16.7% , compared with R$66.5 million and a margin of17.4% in the prior-year period. The year over year decrease in Adjusted EBITDA is mainly explained by a non-recurring severance expense of R$3.2 million and by our decision to focus on growing recurring versus non recurring revenues, which has a negative impact on the short term, but should be accretive for the business long-term.

Adjusted Net Cash

Our Adjusted Net Cash, a non-IFRS metric, consists of the items detailed in Table 13 below:

Table 13: Adjusted Net Cash

| Adjusted Net Cash (R$mn) | 2Q24 | 1Q24 | 2Q23 |

| Cash and cash equivalents | 4,743.2 | 4,988.3 | 2,202.7 |

| Short-term investments | 106.6 | 463.7 | 3,493.4 |

| Accounts receivable from card issuers (a) | 27,556.2 | 26,552.2 | 18,573.4 |

| Financial assets from banking solution | 6,967.8 | 6,620.3 | 4,099.3 |

| Derivative financial instrument (b) | 69.1 | 0.2 | 7.6 |

| Adjusted Cash | 39,443.0 | 38,624.6 | 28,376.5 |

| Retail deposits (c) | (6,472.0) | (5,985.0) | (3,918.6) |

| Accounts payable to clients | (18,512.9) | (19,044.4) | (15,555.8) |

| Institutional deposits and marketable debt securities | (5,301.9) | (4,162.6) | (2,390.1) |

| Other debt instruments | (3,787.2) | (3,942.4) | (1,844.5) |

| Derivative financial instrument (b) | (112.2) | (350.5) | (340.2) |

| Adjusted Debt | (34,186.1) | (33,484.9) | (24,049.2) |

| Adjusted Net Cash | 5,256.9 | 5,139.8 | 4,327.2 |

(a) Accounts Receivable from Card Issuers are accounted for at their fair value in our balance sheet.

(b) Refers to economic hedge.

(c) Includes deposits from banking customers and time deposits from retail clients. For more information of retail deposits, please refer to note 5.6.1 in our Financial Statements.

As of June 30, 2024, the Company’s Adjusted Net Cash was R

- R

$731.6 million of cash net income, which is our net income plus non-cash income and expenses as reported in our statement of cash flows; - R

$84.6 million from labor and social security liabilities; - -R

$344.6 million of capex; - -R

$236.5 million from buyback of shares; - -R

$121.3 million from loans operations portfolio which is net of provision expenses and interest; - R

$3.4 million from other effects.

Cash Flow

Table 14: Cash Flow

| Cash Flow (R$mn) | 2Q24 | 2Q23 |

| Net income (loss) for the period | 498.3 | 307.2 |

| Adjustments on Net Income: | ||

| Depreciation and amortization | 224.2 | 221.7 |

| Deferred income tax expenses | 2.0 | 40.9 |

| Gain (loss) on investment in associates | 0.4 | 0.8 |

| Accrued interest, monetary and exchange variations, net | 59.2 | (44.3) |

| Provision (reversal) for contingencies | 23.9 | 7.5 |

| Share-based payment expense | 64.4 | 50.4 |

| Allowance for expected credit losses | 48.3 | 21.6 |

| Loss on disposal of property, equipment and intangible assets | 8.2 | 30.1 |

| Effect of applying hyperinflation accounting | 1.5 | (0.0) |

| Loss on sale of subsidiary | 0.0 | 0.0 |

| Fair value adjustments in financial instruments at FVPL | (189.8) | 8.2 |

| Fair value adjustment to derivatives | (3.4) | 4.0 |

| Remeasurement of previously held interest in subsidiary acquired acquired | (5.7) | 1.2 |

| Working capital adjustments: | ||

| Accounts receivable from card issuers | (395.9) | 1,284.8 |

| Receivables from related parties | (2.6) | 9.7 |

| Recoverable taxes | 54.6 | (9.4) |

| Prepaid expenses | 82.4 | 19.8 |

| Trade Accounts Receivable, banking solution and other assets | 169.3 | 7.9 |

| Loans operations portfolio | (121.3) | 0.0 |

| Accounts payable to clients | (2,237.9) | (1,427.1) |

| Taxes payable | 54.2 | 18.5 |

| Labor and social security liabilities | 84.6 | 67.3 |

| Payment of contingencies | (22.2) | (1.3) |

| Trade accounts payable and other liabilities | 80.4 | (3.3) |

| Interest paid | (262.3) | (303.7) |

| Interest income received, net of costs | 1,080.7 | 538.9 |

| Income tax paid | (11.5) | (18.9) |

| Net cash used in (provided by) operating activity | (716.1) | 832.5 |

| Investing activities | ||

| Purchases of property and equipment | (210.3) | (196.2) |

| Purchases and development of intangible assets | (134.3) | (136.0) |

| Proceeds from (acquisition of ) short-term investments, net | 359.1 | (147.2) |

| Proceeds from disposal long-term investments - equity securities | 57.5 | 0.0 |

| Proceeds from the disposal of non-current assets | 4.2 | 0.0 |

| Acquisition of subsidiary, net of cash acquired | (9.1) | 0.0 |

| Payment for interest in subsidiaries acquired | (134.0) | (28.7) |

| Net cash used in investing activities | (66.8) | (508.1) |

| Financing activities | ||

| Proceeds from institutional deposits and marketable debt securities | 891.1 | 0.0 |

| Payment of institutional deposits and marketable debt securities | (5.4) | 0.0 |

| Payment to other debt instruments | (780.1) | (1,713.1) |

| Proceeds from other debt instruments | 663.4 | 1,748.2 |

| Payment of principal portion of leases liabilities | (14.6) | (18.9) |

| Repurchase of own shares | (236.5) | 0.0 |

| Acquisition of non-controlling interests | 0.1 | (0.3) |

| Dividends paid to non-controlling interests | (0.3) | (0.5) |

| Net cash provided by financing activities | 517.7 | 15.4 |

| Effect of foreign exchange on cash and cash equivalents | 20.1 | 7.3 |

| Change in cash and cash equivalents | (245.1) | 347.1 |

| Cash and cash equivalents at beginning of period | 4,987.1 | 1,855.6 |

| Cash and cash equivalents at end of period | 4,742.0 | 2,202.7 |

Our cash flow in the quarter was explained by:

Net cash used in operating activities was R

Net cash used in investing activities was R

Net cash provided by financing activities was R

Consolidated Balance Sheet Statement

Table 15: Consolidated Balance Sheet Statement

| Balance Sheet (R$mn) | 2Q24 | 4Q23 |

| Assets | ||

| Current assets | 40,846.6 | 37,152.6 |

| Cash and cash equivalents | 4,743.2 | 2,176.4 |

| Short-term investments | 106.6 | 3,481.5 |

| Financial assets from banking solution | 6,967.8 | 6,397.9 |

| Accounts receivable from card issuers | 27,472.0 | 23,895.5 |

| Trade accounts receivable | 438.3 | 459.9 |

| Loans operations portfolio | 474.2 | 210.0 |

| Recoverable taxes | 182.7 | 146.3 |

| Derivative financial instruments | 71.3 | 4.2 |

| Other assets | 390.5 | 380.9 |

| Non-current assets | 11,853.1 | 11,541.0 |

| Long-term investments | 32.4 | 45.7 |

| Accounts receivable from card issuers | 84.3 | 81.6 |

| Trade accounts receivable | 22.0 | 28.5 |

| Loans operations portfolio | 112.6 | 40.8 |

| Receivables from related parties | 0.7 | 2.5 |

| Deferred tax assets | 755.6 | 664.5 |

| Other assets | 133.3 | 137.5 |

| Investment in associates | 79.2 | 83.0 |

| Property and equipment | 1,728.2 | 1,661.9 |

| Intangible assets | 8,905.0 | 8,794.9 |

| Total Assets | 52,699.7 | 48,693.6 |

| Liabilities and equity | ||

| Current liabilities | 30,048.2 | 29,142.7 |

| Retail deposits | 6,472.0 | 6,119.5 |

| Accounts payable to clients | 18,472.9 | 19,163.7 |

| Trade accounts payable | 525.7 | 513.9 |

| Institutional deposits and marketable debt securities | 1,443.9 | 475.3 |

| Other debt instruments | 1,594.0 | 1,404.7 |

| Labor and social security liabilities | 504.0 | 515.7 |

| Taxes payable | 676.3 | 514.3 |

| Derivative financial instruments | 112.2 | 316.2 |

| Other liabilities | 247.2 | 119.5 |

| Non-current liabilities | 7,432.7 | 4,874.9 |

| Accounts payable to clients | 40.0 | 35.5 |

| Institutional deposits and marketable debt securities | 3,858.0 | 3,495.8 |

| Other debt instruments | 2,370.7 | 143.5 |

| Deferred tax liabilities | 613.8 | 546.5 |

| Provision for contingencies | 233.2 | 208.9 |

| Labor and social security liabilities | 30.7 | 34.3 |

| Other liabilities | 286.3 | 410.5 |

| Total liabilities | 37,480.9 | 34,017.6 |

| Equity attributable to owners of the parent | 15,163.6 | 14,622.3 |

| Issued capital | 0.1 | 0.1 |

| Capital reserve | 14,084.4 | 14,056.5 |

| Treasury shares | (490.8) | (282.7) |

| Other comprehensive income (loss) | (468.0) | (320.4) |

| Retained earnings (accumulated losses) | 2,038.0 | 1,168.9 |

| Non-controlling interests | 55.2 | 53.7 |

| Total equity | 15,218.8 | 14,676.0 |

| Total liabilities and equity | 52,699.7 | 48,693.6 |

Other Information

Conference Call

Stone will discuss its 2Q24 financial results during a teleconference today, August 14, 2024, at 5:00 PM ET / 6:00 PM BRT.

The conference call can be accessed live over the Zoom webinar (ID: 854 5992 8852| Password: 819157). It can also be accessed over the phone by dialing +1 646 931 3860 or +1 669 444 9171 from the U.S. Callers from Brazil can dial +55 21 3958 7888. Callers from the UK can dial +44 330 088 5830.

The call will also be webcast live and a replay will be available a few hours after the call concludes. The live webcast and replay will be available on Stone’s investor relations website at https://investors.stone.co/.

About Stone Co.

Stone Co. is a leading provider of financial technology and software solutions that empower merchants to conduct commerce seamlessly across multiple channels and help them grow their businesses.

Investor Contact

Investor Relations

investors@stone.co

Glossary of Terms

- "ARPAC” (Average Revenue Per Active Client)”: Banking ARPAC considers banking revenues, such as floating from demand deposits, card interchange fees, insurance and transactional fees, as well as PIX QR Code revenues.

- Banking Active Clients: clients who have transacted at least R

$1 in the past 30 days. - Banking Deposits: demand deposits from banking customers, including MSMB and Key Account clients.

- "Consolidated Credit Metrics”: refer to our working capital loan and credit card portfolios.

- "Credit Clients”: consider merchants who have an active working capital loan contract with Stone at the end of the period.

- "Credit Revenues”: In 2Q23, credit revenues were recognized net of provision for expected credit losses in Financial Income. From 3Q23 onwards, credit revenues are recognized gross of provision for expected losses, which are allocated in Cost of Services.

- “CTPV”: Means Card Total Payment Volume and refers only to transactions settled through cards. Does not include PIX QR Code volumes.

- “Active Payments Client Base”: refers to MSMBs and Key Accounts. Considers clients that have transacted at least once over the preceding 90 days, except for Ton active clients which consider clients that have transacted once in the preceding 12 months. As from 3Q22, does not consider clients that use only TapTon.

- “Adjusted Net Cash”: is a non-IFRS financial metric and consists of the following items: (i) Adjusted Cash: Cash and cash equivalents, Short-term investments, Accounts receivable from card issuers, Financial assets from banking solution and Derivative financial instrument; minus (ii) Adjusted Debt: Retail deposits, Accounts payable to clients, Institutional deposits and marketable debt securities, Other debt instruments and Derivative financial instrument.

- “Banking”: refers to our digital banking solution and includes insurance products.

- “Financial Services” segment: this segment is comprised of our financial services solutions serving both MSMBs and Key Accounts. Includes mainly our payments, digital banking and credit solutions.

- “Key Accounts”: refers to operations in which Pagar.me acts as a fintech infrastructure provider for different types of clients, especially larger ones, such as mature e-commerce and digital platforms, commonly delivering financial services via APIs. It also includes clients that are onboarded through our integrated partners program, regardless of client size.

- “Membership fees”: refer to the upfront fee paid by merchants for all Ton offerings and specific ones for Stone when they join our client base. Until December 31, 2023, membership fees revenues were recognized fully at the time of acquisition. From January 1, 2024 onwards, the Group recognizes revenues from membership fees deferred through the expected lifetime of the client.

- “MSMB segment”: refer to SMBs – small and medium business (online and offline) and micro-merchants, from our Stone, Pagar.me and Ton products. Considers clients that have transacted at least once over the preceding 90 days, except for Ton active clients which consider clients that have transacted once in the preceding 12 months. As from 3Q22, does not consider clients that use only TapTon.

- “MSMB CTPV Overlap”: refers to the MSMB CTPV in Software installed base within the priority verticals - Gas Station, Retail, Drugstores, Food and horizontal software.

- “Non-allocated”: comprises other smaller businesses which are not allocated in our Financial Services or Software segments. From 2Q24 onwards, revenues in the non-allocated business segment are inexistent, since we divested assets within the segment.

- “NPL (Non-Performing Loans)”: is the total outstanding of the contract whenever the clients default on an installment. More information on the total overdue by aging considering only the individual installments can be found in Note 5.4.1 of the Financial Statements.

- “PIX QR Code”: includes the volume of PIX QR Code transactions from dynamic POS QR Code and static QR Code from MSMB and Key Accounts merchants, unless otherwise noted.

- “Provisions ratio”: calculated as accumulated provisions for expected credit losses divided by the total portfolio amount in the period.

- “Revenue”: refers to Total Revenue and Income net of taxes, interchange fees retained by card issuers and assessment fees paid to payment schemes.

- “Software” segment: composed of our Strategic Verticals (Retail, Gas Stations, Food, Drugstores and horizontal software), Enterprise and Other Verticals. The Software segment includes the following solutions: POS/ERP, TEF and QR Code gateways, reconciliation, CRM, OMS, e-commerce platform, engagement tool, ads solution, and marketplace hub.

- “Take Rate (Key Accounts)”: managerial metric that considers the sum of revenues from financial services solutions offered to Key Account clients, excluding non-allocated revenues, divided by Key Accounts CTPV.

- “Take Rate (MSMB)”: managerial metric that considers the sum of revenues from financial services solutions offered to MSMBs, excluding Ton’s membership fee, TAG revenues and other non-allocated revenues, divided by MSMB CTPV.

- “TPV”: Total Payment Volume. Reported TPV figures consider all card volumes settled by StoneCo, including PIX QR Code transactions from dynamic POS QR Code and static QR Code from MSMB and Key Accounts merchants, unless otherwise noted.

- “Working Capital Portfolio”: is gross of provisions for losses, but net of amortizations.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. These statements identify prospective information and may include words such as “believe”, “may”, “will”, “aim”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “forecast”, “plan”, “predict”, “project”, “potential”, “aspiration”, “objectives”, “should”, “purpose”, “belief”, and similar, or variations of, or the negative of such words and expressions, although not all forward-looking statements contain these identifying words.

Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Stone’s control.

Stone’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: more intense competition than expected, lower addition of new clients, regulatory measures, more investments in our business than expected, and our inability to execute successfully upon our strategic initiatives, among other factors.

About Non-IFRS Financial Measures

To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Stone also presents non-IFRS measures of financial performance, including: Adjusted Net Income, Adjusted EPS (diluted), Adjusted Net Margin, Adjusted Net Cash / (Debt), Adjusted Profit (Loss) Before Income Taxes, Adjusted Pre-Tax Margin, EBITDA and Adjusted EBITDA.

A “non-IFRS financial measure” refers to a numerical measure of Stone’s historical or future financial performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Stone’s financial statements. Stone provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Stone’s performance to that of other companies.

Stone has presented Adjusted Net Income to eliminate the effect of items from Net Income that it does not consider indicative of its continuing business performance within the period presented. Stone defines Adjusted Net Income as Net Income (Loss) for the Period, adjusted for (1) amortization of fair value adjustment on acquisitions, (2) unusual income and expenses. Adjusted EPS (diluted) is calculated as Adjusted Net income attributable to owners of the parent (Adjusted Net Income reduced by Net Income attributable to Non-Controlling interest) divided by diluted number of shares.

Stone has presented Adjusted Profit Before Income Taxes and Adjusted EBITDA to eliminate the effect of items that it does not consider indicative of its continuing business performance within the period presented. Stone adjusts these metrics for the same items as Adjusted Net Income, as applicable.

Stone has presented Adjusted Net Cash metric in order to adjust its Net Cash / (Debt) by the balances of Accounts Receivable from Card Issuers and Accounts Payable to Clients, since these lines vary according to the Company’s funding source together with the lines of (i) Cash and Cash Equivalents, (ii) Short-term Investments, (iii) Debt balances and (iv) Derivative Financial Instruments related to economic hedges of short term investments in assets, due to the nature of Stone’s business and its prepayment operations. In addition, it also adjusts by the balances of Financial Assets from Banking Solutions and Deposits from Banking Customers.

A PDF accompanying this announcement is available at

http://ml.globenewswire.com/Resource/Download/2fc36110-92f6-4c47-b360-e817faa0c6b3