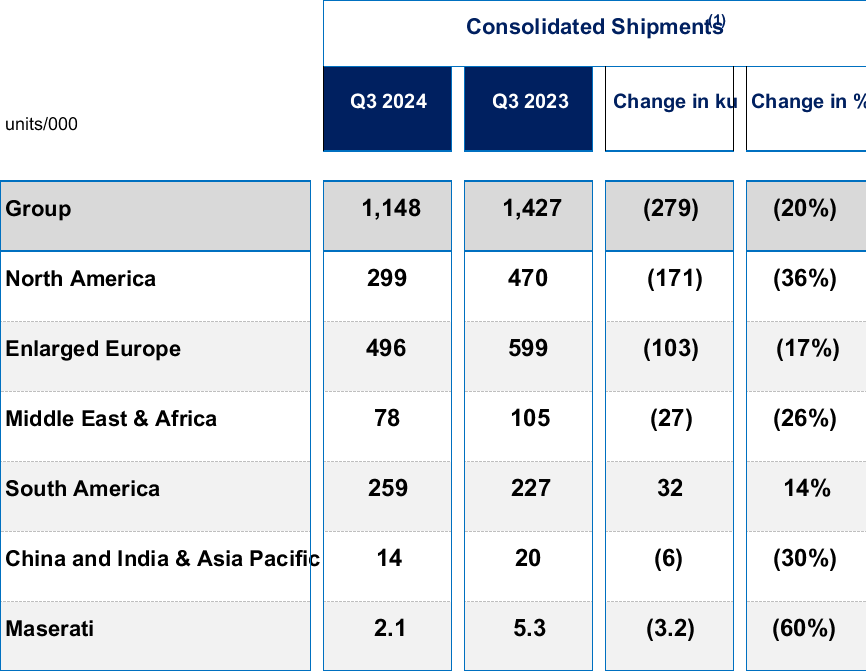

Stellantis Reports Q3 2024 Consolidated Shipment Estimates

Stellantis (NYSE: STLA) reported an estimated 20% decline in Q3 2024 consolidated shipments to 1,148,000 units compared to the same period in 2023. The decline was more severe than the 15% sales drop due to product portfolio transitions and dealer inventory reduction initiatives. In North America, shipments fell by approximately 170,000 units, with over 100,000 units attributed to planned production cuts. Despite this, U.S. market share increased month-over-month in Q3.

In Enlarged Europe, shipments were about 100,000 units lower than the previous year, primarily due to delayed launches of Smart Car platform products. The outlook for new European product launches remains strong, with 50,000 orders for the new Citroën C3 and 80,000 for the new Peugeot 3008. Shipments in Stellantis' 'Third Engine' regions remained unchanged overall, with increases in South America offsetting declines in other areas.

Stellantis (NYSE: STLA) ha riportato un calo stimato del 20% nelle spedizioni consolidate del Q3 2024, scendendo a 1.148.000 unità rispetto allo stesso periodo del 2023. Il declino è stato più severo rispetto al calo delle vendite del 15% causato da transizioni del portafoglio prodotti e il ridimensionamento dell'inventario presso i concessionari. In Nord America, le spedizioni sono diminuite di circa 170.000 unità, con oltre 100.000 unità attribuite a tagli pianificati nella produzione. Nonostante ciò, la quota di mercato negli Stati Uniti è aumentata mese su mese nel Q3.

In Europa allargata, le spedizioni sono state di circa 100.000 unità inferiori rispetto all'anno precedente, principalmente a causa di ritardi nel lancio dei prodotti della piattaforma Smart Car. Le prospettive per i nuovi lanci di prodotti europei rimangono forti, con 50.000 ordini per la nuova Citroën C3 e 80.000 per la nuova Peugeot 3008. Le spedizioni nelle regioni 'Terzo Motore' di Stellantis sono rimaste complessivamente invariate, con i guadagni in Sud America che hanno compensato i cali in altre aree.

Stellantis (NYSE: STLA) reportó una disminución estimada del 20% en los envíos consolidados del Q3 2024, alcanzando 1.148.000 unidades en comparación con el mismo periodo de 2023. La caída fue más severa que la disminución del 15% en las ventas debido a transiciones en el portafolio de productos y reducción de inventario en concesionarios. En América del Norte, los envíos cayeron aproximadamente 170.000 unidades, con más de 100.000 unidades atribuidas a cortes de producción planificados. A pesar de esto, la cuota de mercado en EE. UU. aumentó mes a mes en el Q3.

En Europa Ampliada, los envíos fueron aproximadamente 100.000 unidades inferiores al año anterior, principalmente debido a retrasos en el lanzamiento de productos de la plataforma Smart Car. Las perspectivas para los nuevos lanzamientos de productos europeos siguen siendo fuertes, con 50.000 pedidos para el nuevo Citroën C3 y 80.000 para el nuevo Peugeot 3008. Los envíos en las regiones de 'Tercer Motor' de Stellantis se mantuvieron en general sin cambios, con aumentos en América del Sur compensando las disminuciones en otras áreas.

스텔란티스 (NYSE: STLA)는 2024년 3분기 통합 출하량이 20% 감소한 1,148,000대에 이를 것으로 보고했습니다. 이 감소폭은 제품 포트폴리오 전환과 대리점 재고 축소 이니셔티브로 인한 15%의 판매 감소보다 더 큽니다. 북미에서는 출하량이 약 170,000대 감소했으며, 그 중 100,000대 이상은 계획된 생산 감축에 기인합니다. 그럼에도 불구하고 3분기 미국 시장 점유율이 전월 대비 증가했습니다.

확대된 유럽에서는 출하량이 지난해보다 약 100,000대 낮았으며, 주로 스마트 카 플랫폼 제품의 출시 지연으로 인해 발생했습니다. 새로운 유럽 제품 출시 전망은 여전히 강세를 보이며, 새로운 시트로엥 C3에 대한 50,000건의 주문과 새로운 푸조 3008에 대한 80,000건의 주문이 있습니다. 스텔란티스의 '제3 엔진' 지역에서의 출하량은 전반적으로 변동이 없었으며, 남미의 증가는 다른 지역의 감소를 상쇄했습니다.

Stellantis (NYSE: STLA) a annoncé une baisse estimée de 20% des expéditions consolidées au T3 2024, s'élevant à 1 148 000 unités par rapport à la même période en 2023. Cette baisse a été plus sévère que la baisse de 15% des ventes due à des transitions de portefeuille de produits et des initiatives de réduction des stocks chez les concessionnaires. En Amérique du Nord, les expéditions ont chuté d'environ 170 000 unités, dont plus de 100 000 unités attribuées à des réductions de production prévues. Malgré cela, la part de marché aux États-Unis a augmenté d'un mois sur l'autre au T3.

En Europe élargie, les expéditions étaient d'environ 100 000 unités inférieures à l'année précédente, principalement en raison des retards de lancement des produits de la plateforme Smart Car. Les perspectives pour de nouveaux lancements de produits européens restent solides, avec 50 000 commandes pour la nouvelle Citroën C3 et 80 000 pour la nouvelle Peugeot 3008. Les expéditions dans les régions 'Troisième moteur' de Stellantis sont restées globalement inchangées, les augmentations en Amérique du Sud compensant les baisses dans d'autres domaines.

Stellantis (NYSE: STLA) meldete einen geschätzten Rückgang von 20% bei den konsolidierten Auslieferungen im Q3 2024, mit 1.148.000 Einheiten im Vergleich zum gleichen Zeitraum 2023. Der Rückgang war stärker als der Rückgang der Verkäufe um 15% aufgrund von Portfolioübergängen und Initiativen zur Reduzierung des Händlerinventars. In Nordamerika fielen die Auslieferungen um etwa 170.000 Einheiten, wobei über 100.000 Einheiten auf geplante Produktionskürzungen zurückzuführen sind. Trotz alledem stieg der US-Marktanteil von Monat zu Monat im Q3.

In erweiterte Europa waren die Auslieferungen etwa 100.000 Einheiten niedriger als im Vorjahr, hauptsächlich aufgrund von Verzögerungen beim Launch von Produkten der Smart-Car-Plattform. Die Aussichten für neue europäische Produkteinführungen bleiben stark, mit 50.000 Bestellungen für den neuen Citroën C3 und 80.000 für den neuen Peugeot 3008. Die Auslieferungen in den 'Dritten Motor'-Regionen von Stellantis blieben insgesamt unverändert, wobei die Zuwächse in Südamerika die Rückgänge in anderen Bereichen ausglichen.

- U.S. market share increased month-over-month in Q3 from 7.2% in July to 8.0% in September

- Strong outlook for new European product launches with 50,000 orders for Citroën C3 and 80,000 for Peugeot 3008

- Shipments in South America increased, offsetting declines in other 'Third Engine' regions

- 20% decline in Q3 2024 consolidated shipments to 1,148,000 units

- North American shipments fell by approximately 170,000 units

- Enlarged Europe shipments were about 100,000 units lower than the previous year

- Delayed launches of Smart Car platform products in Europe

Insights

Stellantis' Q3 2024 consolidated shipments declined

Key regional insights:

- North America: Shipments down by ~170,000 units, with over 100,000 due to planned production cuts.

- Enlarged Europe: ~100,000 unit decrease, primarily from delayed Smart Car platform launches.

- 'Third Engine' markets: Flat overall, with South American growth offsetting declines elsewhere.

Despite the shipment decline, there are positive indicators:

- U.S. market share increased sequentially (July:

7.2% , September:8.0% ) - Strong European order books (50,000 for Citroën C3, 80,000 for Peugeot 3008)

This strategic inventory management and product transition phase may pressure short-term results but aims to strengthen Stellantis' future market position, particularly in electric and multi-energy vehicles.

Stellantis' Q3 shipment data reveals a company in transition, balancing short-term pain for long-term gain. The

This strategy aligns with industry trends towards leaner inventories and electrification. Key observations:

- North American inventory reduction of 50,000 units (

-11.6% ) shows disciplined management. - Delayed European launches highlight the challenges in new platform rollouts.

- Strong order books for new models (Citroën C3, Peugeot 3008) suggest potential future demand.

The company's focus on "multi-energy offerings" and new generation products, like the Dodge Charger Daytona and Jeep Wagoneer S, indicates a strategic pivot towards electrification. This transition period may create short-term volatility but positions Stellantis to compete in the evolving automotive landscape.

Investors should monitor the success of these new product launches and the pace of inventory normalization in coming quarters to gauge the effectiveness of this strategy.

Stellantis Reports Q3 2024 Consolidated Shipment Estimates

Decline reflects inventory reduction initiatives, as well as impacts of new product launches, progress on both are expected to set the Company up more strongly for the future

AMSTERDAM, October 16, 2024 - Stellantis is initiating a practice of publishing global quarterly consolidated shipment estimates and providing commentary on related business trends. The term shipments describes volumes of vehicles delivered to our dealers, distributors, or directly from the Company to retail and fleet customers, which directly drive revenue recognition.

Consolidated shipments for the three months ending September 30, 2024, were an estimated 1,148 thousand units, representing a

- In North America, shipments declined approximately 170 thousand units, of which more than 100 thousand units related to pre-announced production cuts intended to reduce dealer inventory as well as product portfolio gaps as the group transitions to new multi-energy offerings with new generation of products to be launched, starting in late 2024 with the Dodge Charger Daytona and Jeep Wagoneer S. However, U.S. sales to final customers supported market share increases month over month during the third quarter from

7.2% in July, to7.9% in August, to8.0% in September while inventory was reduced by 50K units (-11.6% ) compared to the end of the prior quarter. - In Enlarged Europe, shipments from our plants were approximately 100 thousand units lower than the prior year due primarily to delayed launches of products based on its Smart Car platform, including the Citroën C3 (which began shipping in September). Outlook for new European product launches is strong with orders of 50K units for the all-new Citroën C3, and 80K units for the all-new Peugeot 3008, for example.

- In Stellantis’ “Third Engine” (2), shipments were in total unchanged, as increases in South America offset declines in Middle East & Africa, China and India & Asia Pacific.

(1) Consolidated shipments only include shipments by Company’s consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers).

Consolidated shipment volumes for Q3 2024 presented here are unaudited and may be adjusted. Final figures will be provided in our official revenue/shipments report. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

(2) The “Third Engine” refers to the aggregation of the South America, Middle East & Africa and China and India & Asia Pacific segments for presentation purposes only.

# # #

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is one of the world’s leading automakers aiming to provide clean, safe and affordable freedom of mobility to all. It’s best known for its unique portfolio of iconic and innovative brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, FIAT, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Stellantis is executing its Dare Forward 2030, a bold strategic plan that paves the way to achieve the ambitious target of becoming a carbon net zero mobility tech company by 2038, with single-digit percentage compensation of the remaining emissions, while creating added value for all stakeholders. For more information, visit www.stellantis.com.

| @Stellantis |  | Stellantis |  | Stellantis |  | Stellantis | |

| For more information, contact: investor.relations@stellantis.com communications@stellantis.com www.stellantis.com | ||||||||

Safe harbor statement

This document contains forward looking statements. Statements regarding future financial performance and the Company’s expectations as to the achievement of certain targeted metrics, including revenues, industrial free cash flows, vehicle shipments, capital investments, research and development costs and other expenses at any future date or for any future period are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Company’s current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the Company’s ability to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; the Company’s ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; the Company’s ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; the Company’s ability to produce or procure electric batteries with competitive performance, cost and at required volumes; the Company’s ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in the Company’s vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in the Company’s vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; the Company’s ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of the Company’s defined benefit pension plans; the Company’s ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; the Company’s ability to access funding to execute its business plan; the Company’s ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with the Company’s relationships with employees, dealers and suppliers; the Company’s ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; and other risks and uncertainties. Any forward-looking statements contained in this document speak only as of the date of this document and the Company disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning the Company and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission and AFM.

Attachment

FAQ

What was Stellantis' (STLA) consolidated shipment estimate for Q3 2024?

How did Stellantis' (STLA) U.S. market share perform in Q3 2024?

What factors contributed to Stellantis' (STLA) shipment decline in Q3 2024?