Hillandale Advisors Delivers Open Letter To Steel Connect's Board of Directors

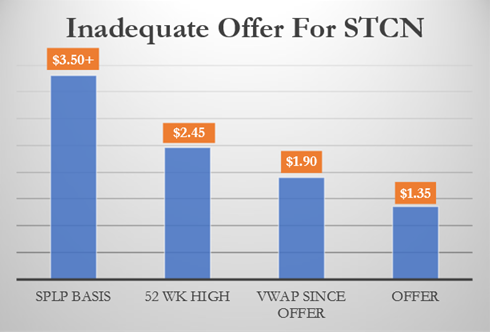

Hillandale Advisors, representing approximately 2.0% of Steel Connect's (STCN) minority shares, criticized Steel Partners Holdings' (SPLP) merger proposal. They argue that the offer undervalues STCN, with a 61% discount to SPLP's acquisition price and minimal recognition of STCN's $2 billion in tax assets. Hillandale plans to vote against the merger, advocating for an alternative structure that could allow minority shareholders to benefit from tax savings. They expressed concerns over the Board's lack of engagement with minority shareholders regarding these significant financial aspects.

- Hillandale proposes an alternative structure that could yield an additional $2.00+ per share for minority shareholders.

- Hillandale's active engagement highlights potential value in STCN's tax assets.

- The merger proposal is viewed as a 61% discount to SPLP's initial investment, indicating a severe undervaluation.

- The current proposal offers little to no recognition of STCN's $2 billion tax assets, which could lead to a significant loss for minority shareholders.

- Concerns over the Board's unwillingness to engage meaningfully with minority shareholders may lead to governance and accountability issues.

Insights

Analyzing...

- Offer from Steel Partners Substantially Undervalues the Company and Its

$2 Billion in Tax Assets (NOLs) - Hillandale Plans to Vote All Shares Against Proposed Merger

- Proposes Alternative Structure to Unlock the Value of NOLs for Minority Shareholders

CHARLOTTE, NC / ACCESSWIRE / July 14, 2022 / Hillandale Advisors invests in undervalued companies and seeks to execute on opportunities to unlock value for the benefit of all shareholders. Hillandale delivered an open letter to the Board of Directors of Steel Connect, Inc. (STCN) raising concerns about the company's proposal to merge with Steel Partners Holdings L.P. (SPLP). SPLP's offer significantly undervalues the company and its

https://www.hillandaleadvisors.com/news

July 14, 2022

Board of Directors

Steel Connect, Inc.

2000 Midway Lane

Smyrna, TN 37167

Dear Members of the Board:

We are writing as long-term shareholders of Steel Connect (STCN), holding roughly

Most importantly, the latest offer delivers little to no value for STCN's

We are open to an alternative structure where SPLP appropriately shares in the significant tax savings expected from STCN's

* Tax shelter could range from 21

Ultimately, it appears that SPLP, with its control and influence over the STCN Board, is proposing a deal that works best for SPLP, and not STCN minority shareholders. We are open to other structures, but will not support the current proposal, in its current form. We encourage shareholders to review our past letters to the STCN Board and decide for themselves.

Respectfully,

Matthew Hultquist

Hillandale Advisors

Matt@HillandaleAdvisors.com

www.HillandaleAdvisors.com

Board of Directors:

Mr. Warren G. Lichtenstein, Executive Chairman

Mr. Glen M. Kassan

Mr. Jack L. Howard

Mr. Jeffrey J. Fenton

Mr. Jeffrey S. Wald

Ms. Maria Molland

Ms. Renata Simril

CC: Houlihan Lokey, Financial Advisor to Special Committee

Dentons US, Legal Advisor to Special Committee

About Hillandale Advisors

Hillandale Advisors is a private investment and advisory firm founded in 2017 in Charlotte, North Carolina. We are long-term oriented value investors with a focus on special situations, spin-offs and tax assets (NOLs).

Investor Contact:

Matthew Hultquist, (704) 574-5659,

Matt@HillandaleAdvisors.com

https://www.hillandaleadvisors.com

SOURCE: Hillandale Advisors

View source version on accesswire.com:

https://www.accesswire.com/708439/Hillandale-Advisors-Delivers-Open-Letter-To-Steel-Connects-Board-of-Directors