Summa Silver Reports Excellent Metallurgical Test Results from the Hughes High-Grade Silver-Gold Project, Nevada

- None.

- None.

Silver recoveries average

Vancouver, British Columbia--(Newsfile Corp. - August 16, 2023) - Summa Silver Corp. (TSXV: SSVR) (OTCQX: SSVRF) (FSE: 48X) ("Summa" or the "Company") is pleased to report silver and gold recovery results from initial scoping-level metallurgical test work from its Hughes Project, near Tonopah, Nevada. Results demonstrate strong recoveries of silver and gold from the Murray and Belmont areas.

Key Highlights

Outstanding Silver and Gold Recoveries: Representative composite vein samples from the Murray and the Belmont areas returned recoveries ranging from

83.7% to96.7% for silver and95.9% to97.1% for gold from flotation concentrates (see attached figures).High-Grade Concentrate Produced: Both composite samples produced high-grade concentrates with grades of 6,954 g/t silver and 58.5 g/t gold from Belmont plus 1,486 g/t silver and 12.6 g/t gold from Murray.

Conventional Milling Expected: The demonstrated recoveries were produced from a sample grind size of

80% of particles passing 75 microns or smaller which is typical in conventional milling processes.Importance of Gravity Separation: The test work also showed that prior to flotation, gravity separation improved recoveries for silver and gold significantly at both Murray and Belmont.

Drilling at the Ruby Discovery Continues: A 650 m step-out from the recent new vein discovery at Ruby is in progress testing a large and undrilled geophysical anomaly.

Galen McNamara, CEO, stated: "This work represents the first modern metallurgical testing done on our Hughes project in Tonopah, Nevada. As expected, the results confirm the potential for very strong precious metal recoveries. The extremely high concentrate grades from the historic Belmont mine area are of particular interest. With our recent discoveries on the project at Ruby and Sapphire, we are well positioned to continue to unlock value in and around this storied mining district. Additionally, we are preparing a fall drill program at Mogollon to test new targets and more information will be shared when planning is complete."

Metallurgical Test Work Program Summary

A Scoping-level metallurgical test program was designed by Ausenco Engineering Canada Inc. and completed by Base Metallurgical Laboratories in Kamloops, British Columbia. Metallurgical testing was managed by the Company and focused on refining multiple flowsheet options by conducting head sample characterization (assay and mineralogy) tests, cyanide kinetic leaching tests, rougher flotation tests, gravity tests and assay characterization of test work products (e.g., concentrates and tails).

Two representative composite samples of mineralized, epithermal-related vein material were selected from drill holes at the Murray and Belmont targets. These targets have seen the bulk of the recent drill testing by the Company. HC-1 was a 11 m composite sample from 8 holes drilled into the Murray Vein system of the Murray Target and HC-2 was a 13 m composite sample from 10 holes drilled into the Rescue Vein system of the Belmont Target. Samples were analysed for head assay grades which returned 224 g/t Ag with 2.05 g/t Au (HC-1) and 661 g/t Ag with 7.82 g/t Au (HC-2).

Table 1: Metallurgical Test Work Results

| Head Grade | Whole Ore Leach | Gravity + Leach | Gravity + Float + Leach | |||||

| Composite | Ag (g/t) | Au (g/t) | Ag% | Au% | Ag% | Au% | Ag% | Au% |

| HC-1 (Murray) | 224 | 2.05 | 86.1 | 90.9 | 88.9 | 91.9 | 96.7 | 95.9 |

| HC-2 (Belmont) | 661 | 7.82 | 56.8 | 94.6 | 86.3 | 94.6 | 83.7 | 97.1 |

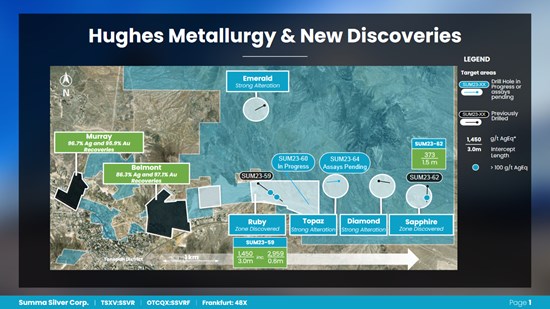

Figure 1: Hughes Metallurgy & New Discoveries

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7983/177392_489bba33e4738afb_002full.jpg

Metallurgical test work results are reported in Table 1. The composite samples responded well to cyanide leaching tests. Whole ore leach tests yielded silver recoveries of

Flotation and leaching of the gravity concentrates have strong implications for maximum recoveries of silver and gold from the Murray vein and for gold from the Rescue veins of the Belmont target. Future work will also focus on investigating grind sensitivities on silver and gold recoveries. As additional targets and veins are drilled by Summa, additional metallurgical test work will be initiated from new zones (e.g., Ruby target).

Methods

At Base Metallurgical Laboratories, the samples were ground in a 2 kg Rod Mill to a 75 µm k80 grind size.

Head assay analyses were conducted via ICP-OES (inductively coupled plasma optical emission spectroscopy) following an aqua regia digest.

Gravity testing was conducted by centrifugal Gold Concentration using a Knelson MD-3 concentrator followed by cleaning on a Mozley C-800 Table. The gravity concentrate was assayed for gold to extinction and the tailings from the Knelson and Mozley table were retained for cyanide leaching.

Samples underwent rougher flotation collecting on four timed concentrates to determine kinetic recover rates for Ag, Au and S. The concentrates were reconstituted and leached in sodium cyanide along with the rougher tailings for precious metal recovery.

Leaching tests were performed directly on whole ore samples as well as samples from gravity concentrates and rougher flotation tailings and rougher flotation concentrates. Tests were completed in bottles on rolls which included 4 kinetic solutions measured after 4, 6, 24 and 48 hours of leaching. Products from the tests were assayed for gold and silver.

Mogollon Project Payment

In connection with Summa's option and joint venture agreement dated August 21, 2020, with Allegiant Gold Ltd. with respect to the Company's Mogollon property, the Company intends to issue, subject to approval from the TSX Venture Exchange, 4,398,831 common shares at a deemed price of

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a junior mineral exploration company. The Company owns a

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

"Galen McNamara"

Galen McNamara, Chief Executive Officer

info@summasilver.com

www.summasilver.com

Investor Relations Contact:

Giordy Belfiore

Corporate Development and Investor Relations

604-288-8004

giordy@summasilver.com

www.summasilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management's current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the release of assays, and the exploration and development of the Company's mineral exploration projects including completion of surveys and drilling activities; and the issuance of shares to satisfy option payments.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; and other related risks and uncertainties.

Forward-looking information are based on management of the parties' reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/177392

FAQ

What are the key highlights of Summa Silver Corp.'s press release?

What is the significance of the gravity separation method mentioned in the press release?

What are the future plans mentioned in the press release?

What is the payment mentioned in connection with Summa's Mogollon property?