SRG 2022 Year End Business Update

Corporate Term Loan Successfully Extended to

By Reducing Loan Balance to

2022 Gross Proceeds from Asset Sales of

2023 Year to Date Gross Proceeds from Asset Sales of

Annualized Interest Savings of

(Graphic: Business Wire)

“We are very pleased to announce the two-year extension of our corporate term loan, which was made possible by the significant progress we have made in advancing our plan of sale,” said

Q4 2022 Disposition Update

-

Generated

$332.5 million -

$190.9 million 7.7% ,6.0% and6.6% respectively; and -

$141.6 million $59.74 $720 thousand $6.5 million

-

-

Prepaid

$240 million $16.8 million $1.03 billion December 31, 2022 .

FY 2022 Disposition Update

-

Generated

$739.7 million -

$348.2 million 7.2% ,5.1% and6.5% respectively; -

$325.5 million $54.66 $681 thousand $13.9 million -

$66.0 million

-

-

Prepaid

$410 million $28.7 million

2023 Year to Date Disposition Update

-

Generated

$232.8 million -

$228.5 million 9.2% and9.3% respectively; and -

$4.3 million $21.23 $264 thousand $0.9 million

-

-

Prepaid

$230 million $16.1 million $800 million February 2, 2023 . -

After giving effect to the

$230 million $100 million February 2, 2023 .

Looking Ahead and Market Update

As of

-

$244.6 million -

$244.4 million

Additionally, the Company has accepted offers and is currently negotiating definitive purchase and sale agreements on assets for total anticipated gross proceeds of approximately

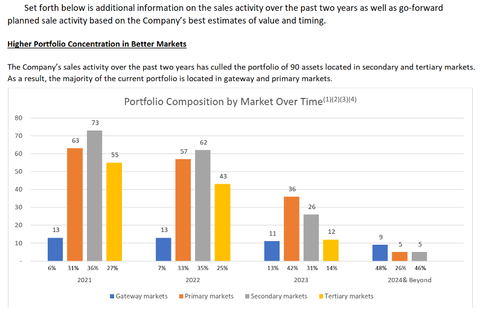

Over the last several months, the Company, along with the commercial real estate market as a whole, has experienced progressively more challenging market conditions, especially with respect to larger scale development sites, as a result of, among other things, the continued rise in interest rates, increases to required return hurdles for institutional buyers, availability of debt capital, higher construction and labor costs for development, decreased demand for speculative office development and slowing rent growth expectations due to potential recession concerns. These conditions apply downward pricing pressure on all of our assets. The assets we have sold to date have been those less impacted by these adverse market trends. In making decisions regarding whether and when to transact on the Company’s remaining assets, the Company will consider various factors including, but not limited to, the breadth of the buyer universe, macroeconomic conditions, the availability and cost of financing, as well as corporate, operating and other capital expenses required to carry the asset. All of these considerations may impact the amounts and timing of distributions to shareholders.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that could cause or contribute to such differences include, but are not limited to: successful completion of Company’s plan of sale; declines in retail, real estate and general economic conditions, including the possibility of a recession, and the impact of rising interest rates on buyer’s ability to finance transactions; the future bankruptcy or insolvency of any of the Company’s tenants; risks relating to redevelopment activities; contingencies to the commencement of rent under leases; the terms of the Company’s indebtedness and other legal requirements to which the Company is subject; failure to achieve expected occupancy and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on the Company’s ability to fund operations and ongoing development; increased risks and costs associated with volatility in commodity and labor prices or as a result of supply chain or procurement disruptions; the Company’s ability to access or obtain sufficient sources of financing to fund the Company’s liquidity needs; rising real estate taxes that we might not be able to pass on to our tenants; the impact of the COVID-19 pandemic on the business of the Company’s tenants and business, income, cash flow, results of operations, financial condition, liquidity and prospects; and environmental, health, safety and land use laws and regulations, as well as potential risks associated with cybersecurity incidents, natural disasters, severe weather conditions and climate change and related legislation and regulations. For additional discussion of these and other applicable risks, assumptions and uncertainties, see the “Risk Factors” and forward-looking statement disclosure contained in the Company’s filings with the

About Seritage

Seritage is principally engaged in the ownership, development, redevelopment, management and leasing of retail and mixed-use properties throughout

View source version on businesswire.com: https://www.businesswire.com/news/home/20230202005081/en/

Interim Chief Financial Officer

(212) 355-7800

IR@Seritage.com

Source: