Square’s Summer Quarterly Restaurant Report: Service Fees Continue to Grow, Wages Stay Above Inflation

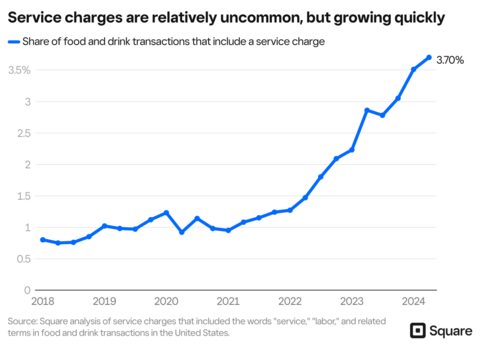

Square data reveals that service fees are growing as more restaurants implement the add-on charge (Graphic: Square)

How common are restaurant service fees?

Service fees, a percentage-based or fixed amount added to a transaction total that is different from a surcharge, are seen by sellers as a way to help offset certain operational or overhead costs across various areas of the business. While they are still relatively uncommon, Square found that they are growing as more restaurants implement the add-on charge. In Q2 2024, about

“Cafe Venetia is an espresso bar and our philosophy has been European from the start. Our business uses a service fee to ensure we can keep our European operating model and support our team’s growth. We ensure our service fees are clearly displayed on all our menus to avoid confusion from customers,” said Leigh Biddlecome, Head of Public Relations at Cafe

“Margins are slimmer than ever for restaurants, and sellers have needed to find ways to offset higher costs,” said Ming-Tai Huh, Head of Restaurants at Square. “We know restaurants use service fees for many reasons like managing unpredictable shifts in their operations or overhead, maintenance, and administrative costs, among others. As a restaurant owner, it’s important to be clear and transparent about these fees so customers can understand dining costs and what fees are being allocated for.”

Wage growth continues to be higher than inflation

According to the Square Payroll Index, when analyzing restaurant worker hourly pay (including base wages, tips, and overtime), yearly growth continued to be higher than the rate of inflation. Even though restaurant workers' pay growth has slowed since COVID highs, average hourly earnings were up

“The result is good news for restaurant workers, but we are starting to see some warning signs of a softening labor market. The rate of wage growth has declined significantly from its 2022 peak, and unemployment, although historically low, has recently ticked up, alongside layoffs,” said Ara Kharazian, Square Research Lead and principal developer of Square Payroll Index.

Cities across the country are continuing to experience strong nightlife. Square analyzed the share of in-person restaurant and bar transactions between 7 pm and 4 am, and found that while

A similar trend can be observed in

Areas of

Following COVID-19,

In

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of commerce solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240813590240/en/

Source: Block, Inc.