Square’s Fall Quarterly Restaurant Report: Full-Service Restaurants See Higher Wage Growth, Corresponding to Increased Inflation

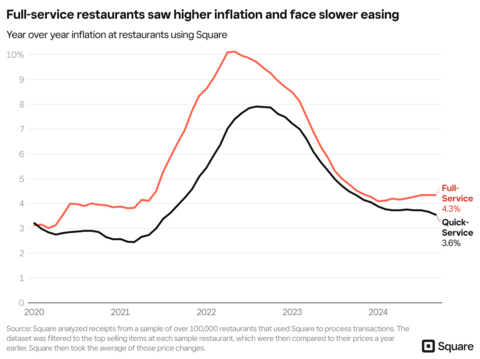

Square's latest Quarterly Restaurant Report reveals significant trends in the restaurant industry. Full-service restaurants have experienced higher inflation (4.3%) compared to quick-service establishments (3.6%) as of September 2024. The report highlights that full-service restaurant workers have seen faster wage growth, with a 73.9% increase since 2017, compared to 60.2% for quick-service workers.

The analysis shows that in 2024, restaurant workers earn about 23% of their income from tips, up from 22% in 2023. Wyoming leads with the highest percentage of tip-based income at 33%. The national average tip rate slightly decreased to 15.4% in 2024 from 15.5% in 2023. Virginia maintains the highest average tip rate at 17.16%.

Il Rapporto Trimestrale sui Ristoranti di Square rivela tendenze significative nel settore della ristorazione. I ristoranti con servizio completo hanno registrato un'inflazione più alta (4,3%) rispetto agli stabilimenti a servizio veloce (3,6%) a partire da settembre 2024. Il rapporto evidenzia che i lavoratori dei ristoranti con servizio completo hanno visto una crescita salariale più rapida, con un aumento del 73,9% dal 2017, rispetto al 60,2% per i lavoratori del servizio veloce.

L'analisi mostra che nel 2024 i lavoratori dei ristoranti guadagnano circa il 23% del loro reddito dai tips, in aumento rispetto al 22% nel 2023. Il Wyoming guida con la percentuale più alta di reddito basato sulle mance, pari al 33%. Il tasso medio nazionale delle mance è leggermente diminuito al 15,4% nel 2024 rispetto al 15,5% nel 2023. La Virginia mantiene il tasso medio di mancia più alto, pari al 17,16%.

El Informe Trimestral sobre Restaurantes de Square revela tendencias significativas en la industria restaurantera. Los restaurantes de servicio completo han experimentado una inflación más alta (4.3%) en comparación con los establecimientos de servicio rápido (3.6%) a partir de septiembre de 2024. El informe destaca que los trabajadores de restaurantes de servicio completo han visto un crecimiento salarial más rápido, con un aumento del 73.9% desde 2017, en comparación con el 60.2% de los trabajadores de servicio rápido.

El análisis muestra que en 2024, los trabajadores de restaurantes ganan aproximadamente el 23% de sus ingresos en propinas, un aumento respecto al 22% en 2023. Wyoming lidera con el mayor porcentaje de ingresos basados en propinas, alcanzando el 33%. La tasa media nacional de propinas disminuyó ligeramente al 15.4% en 2024 desde el 15.5% en 2023. Virginia mantiene la tasa media de propinas más alta, que es del 17.16%.

Square의 최신 분기 레스토랑 보고서는 레스토랑 산업의 중요한 트렌드를 보여줍니다. 풀 서비스 레스토랑은 2024년 9월 기준으로 패스트푸드 업소(3.6%)에 비해 높은 인플레이션(4.3%)을 경험했습니다. 보고서는 풀 서비스 레스토랑 근로자들이 2017년 이후 73.9%의 더 빠른 임금 성장을 보였으며, 이는 패스트푸드 근로자의 60.2%와 비교됩니다.

분석에 따르면, 2024년 레스토랑 근로자들은 소득의 약 23%를 팁으로 벌고 있으며, 이는 2023년 22%에서 증가한 수치입니다. 와이오밍주는 팁 기반 소득의 비율이 33%로 가장 높습니다. 2024년의 전국 평균 팁 비율은 2023년 15.5%에서 15.4%로 소폭 감소했습니다. 버지니아는 17.16%로 가장 높은 평균 팁 비율을 유지하고 있습니다.

Le dernier Rapport Trimestriel sur les Restaurants de Square révèle des tendances significatives dans l'industrie de la restauration. Les restaurants à service complet ont connu une inflation plus élevée (4,3%) par rapport aux établissements de restauration rapide (3,6%) à partir de septembre 2024. Le rapport souligne que les travailleurs des restaurants à service complet ont connu une croissance salariale plus rapide, avec une augmentation de 73,9 % depuis 2017, contre 60,2 % pour les travailleurs de la restauration rapide.

L'analyse montre qu'en 2024, les travailleurs des restaurants gagnent environ 23 % de leurs revenus grâce aux pourboires, en hausse par rapport à 22 % en 2023. Le Wyoming est en tête avec le pourcentage le plus élevé de revenus basés sur les pourboires à 33 %. Le taux moyen national des pourboires a légèrement diminué à 15,4 % en 2024, contre 15,5 % en 2023. La Virginie maintient le taux moyen de pourboire le plus élevé à 17,16 %.

Der aktuelle Quartalsbericht über Restaurants von Square zeigt bedeutende Trends in der Restaurantbranche. Vollservice-Restaurants haben im Vergleich zu Schnellrestaurants (3,6%) eine höhere Inflation (4,3%) erlebt, basierend auf den Daten von September 2024. Der Bericht hebt hervor, dass die Löhne der Mitarbeiter in Vollservice-Restaurants seit 2017 um 73,9% gestiegen sind, während die Löhne der Schnellrestaurant-Mitarbeiter um 60,2% zugenommen haben.

Die Analyse zeigt, dass im Jahr 2024 etwa 23% des Einkommens von Trinkgeldern stammen, im Vergleich zu 22% im Jahr 2023. Wyoming führt mit dem höchsten Prozentsatz an einkommen, das aus Trinkgeldern stammt, nämlich 33%. Der nationale Durchschnitts-Trinkgeldsatz ist 2024 leicht auf 15,4% gesunken, von 15,5% im Jahr 2023. Virginia hat den höchsten durchschnittlichen Trinkgeldsatz von 17,16%.

- Same-store transactions at specialty coffee shops up 6% YoY in Q3 2024

- Restaurant worker tips increased to 23% of income in 2024 from 22% in 2023

- Full-service restaurant inflation remains elevated at 4.3% as of September 2024

- Labor costs growing faster than revenues, compressing margins

- Average tip rate declined to 15.4% in 2024 from 15.5% in 2023

Insights

The latest Square Restaurant Report reveals significant operational trends impacting the food service industry. Full-service restaurants have experienced higher inflation (4.3%) compared to quick-service establishments (3.6%), with notable wage growth disparities. Full-service worker wages have increased by

This data indicates mounting pressure on restaurant margins, particularly in the full-service segment. The trend of rising labor costs outpacing revenue growth suggests potential price increases or operational changes ahead. For Square (SQ), this demonstrates the company's deep market penetration and valuable data insights, which could drive increased adoption of their automation and payment solutions by restaurants seeking to manage costs.

Square's position in the restaurant payment processing and payroll management space shows resilience, with cafe same-store transactions up

The increasing adoption of Square's automation tools amid rising operational costs could drive higher transaction volumes and software subscription revenue. However, restaurant margin pressure might impact transaction volumes and merchant adoption rates. This report primarily serves as a market intelligence tool rather than a direct revenue driver.

Full-service restaurants have experienced higher inflation compared to quick-service restaurants (Graphic: Square)

Full-service restaurants experience higher inflation

Following the COVID-19 pandemic, restaurants began to experience higher inflation caused by a number of factors like labor, supply chain issues, growing food prices, and increased operating costs. When comparing the price change for top selling items at restaurants, Square found that since February 2020, full-service restaurants have been hit harder with inflation compared to quick-service restaurants.

Inflation peaked for full-service restaurants in April 2022 at

“Despite inflation easing, restaurants are continuing to face a number of challenges in their operations whether it’s fluctuating food prices, employee retention, or ballooning payroll costs. Many restaurants are grappling with how to balance these increased expenses while still offering affordability to customers. We’ve seen some restaurants lean on automation and other time-saving technology to keep margins under control,” said Ming-Tai Huh, Head of Food and Beverage at Square.

Wages grow faster among full-service restaurants workers

Increased labor costs have been a contributing factor to inflation in restaurants, with a larger part of a restaurant’s total revenue going towards payroll. This is especially true for full-service restaurants, where workers have seen faster wage growth compared to employees at quick-service restaurants. According to the Square Payroll Index, when tracking average hourly earnings (inclusive of base pay, tips, and overtime), wages for full-service workers have grown

“The cost of labor is growing faster than revenues in some segments, compressing margins in an already tight sector. This trend will likely continue. Restaurants are hesitant to raise prices on consumers, but we remain in a pretty hot labor market so wage increases will have to come from somewhere if restaurants want to remain competitive,” said Ara Kharazian, Square Research Lead and principal developer of Square Payroll Index.

How much of a restaurant worker's income comes from tips?

In 2024, Square found the average restaurant worker earns nearly

Nationally in 2024, Square observed the average tip on a restaurant transaction was

“Tips are a way for customers to reward our employees for their service, but our goal is to welcome anyone in so while tips are highly appreciated, it’s also understandable if tipping isn’t within someone’s budget,” said Jeff Litsey, owner of Calvin Fletcher’s Coffee Company in

Cafe culture differs across the world

Specialty coffee shops and independent cafes continue to be prominent hotspots within their communities, with same-store transactions at these establishments up

Square found that

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of commerce solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241113623640/en/

Source: Block, Inc.