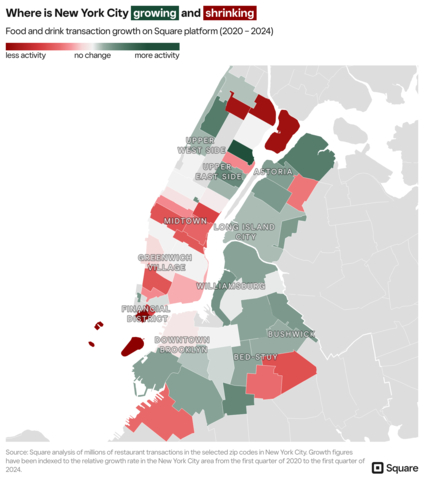

City Neighborhoods and Suburbs of Major Metropolitans Thrive Post-Pandemic, Square Data Finds

Square analysis of millions of restaurant transactions in the selected zip codes in

Square analyzed food and beverage transactions in Q1 2020 versus Q1 2024 in

“The clearest finding we can show today is that American cities are strong, alive, and growing. Some parts of cities, downtown areas indexed to office workers in particular, have struggled,” said Ara Kharazian, Square Research Lead. “However, our national conversation misses the fact that other neighborhoods have flourished, and our findings show the small business environment is healthy, resilient, and strong.”

-

Data shows significant declines in activity in areas with a high density of commercial real estate that index towards office workers, including Midtown Manhattan, the Financial District.

Downtown Brooklyn saw a more moderate decline. -

Other areas of

Brooklyn , like Williamsburg, Bushwick, and Bed-Stuy, have grown, with activity levels up 20-60% since Q1 2020. -

Queens ,Long Island City andAstoria in particular, which have seen increased development and housing construction in recent years, have seen activity levels grow between30% -60% since 2020. -

Activity levels in

Greenwich Village and the West Village, among the most expensive neighborhoods inManhattan , remain relatively unchanged from pre-pandemic.

- With a slow return to work, downtown restaurant transactions in the Financial District and SoMa have declined. New attractions and the return of tourism have contributed to growth in Mission Bay and the Embarcadero.

- Residential areas outside of downtown like Pacific Heights, Outer Richmond, and the Castro, have become hot spots as residents now go out in their local neighborhoods.

-

In the north,

Mill Valley andMarin County saw substantial increases, and in the south,Daly City and parts of San Jose County experienced gains. -

As residents moved to the suburbs, East Bay restaurants also saw increased traffic in

Contra Costa County ,Danville , andCastro Valley .

-

In

Washington, D.C. , data shows significant gains in restaurant activity in neighborhoods which have seen increased housing development, such as Navy Yard and NoMa, as well as parts of Glover Park and Tenleytown. - Conversely, activity has declined near the Capital One Arena, Columbia Heights, and surrounding areas.

- Areas adjacent to the National Mall and tourism sites have remained flat, helping support downtown businesses, while significant declines in activity were observed east of the Potomac River.

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of commerce solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241002881488/en/

For inquiries into Square’s consumer, labor, and business data, please email press@squareup.com.

Source: Block, Inc.