S&P Global Mobility: US auto sales sustain muted progress in March

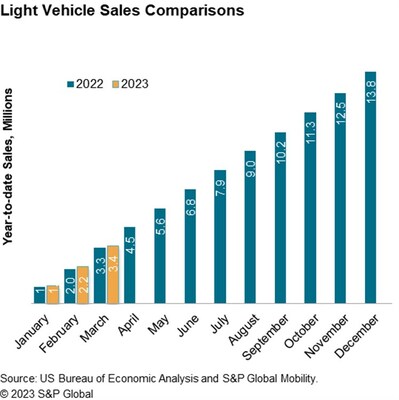

S&P Global Mobility reports that March 2023 US auto sales are projected to reach 1.27 million units, marking an increase of over 11% from the previous month. However, the annualized sales pace is estimated at 13.8 million units, down from 15.9 million units in January. The first quarter average sales rate is 14.9 million units, the strongest since Q2 2021 but still below pre-pandemic levels. Analysts highlight rising vehicle prices and sustained demand despite economic uncertainties. S&P Global Mobility anticipates total 2023 vehicle sales of 14.9 million units, an 8% increase from 2022, aided by improved production and fleet demand.

- Projected March 2023 auto sales of 1.27 million units, up over 11% from February.

- Estimated annualized sales pace of 13.8 million units, leading to a strong first quarter average of 14.9 million units.

- Anticipated total US auto sales of 14.9 million units in 2023, an 8% increase from 2022.

- Annualized sales pace down from January's 15.9 million units.

- Sales momentum may be challenged by rising interest rates and economic headwinds.

An uncertain economic environment and new vehicle affordability concerns keep

US Light Vehicle Sales | ||||

Total Light Vehicle | Units, | 1,270,000 | 1,136,300 | 1,257,800 |

In millions, SAAR | 13.8 | 14.9 | 13.6 | |

In millions, SAAR | 11.1 | 11.9 | 10.8 | |

Passenger Car | In millions, SAAR | 2.7 | 3.0 | 2.8 |

Source: S&P Global Mobility (Est), | ||||

"Incoming reports of sustained – but still muted - retail demand in March reflect that those auto consumers willing, ready, and able to enter into a new vehicle agreement are continuing to do so, even in light of rising interest rates and still-high vehicle price levels," said

S&P Global Mobility projects calendar-year 2023 volume of 14.9 million units in the US, an

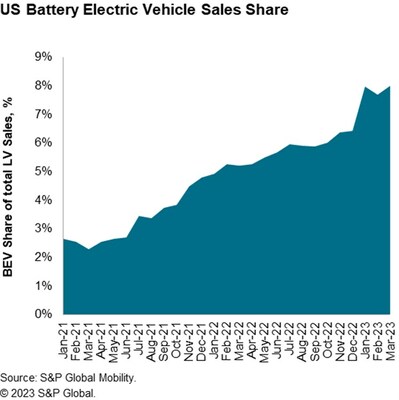

Sustained development of battery-electric vehicle (BEV) sales remains a consistent assumption for 2023. BEV share has hovered around

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of

Media Contact:

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-us-auto-sales-sustain-muted-progress-in-march-301780273.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-us-auto-sales-sustain-muted-progress-in-march-301780273.html

SOURCE S&P Global Mobility