S&P Global Mobility: September U.S. auto sales - smaller volume, little change to underlying dynamics

Rhea-AI Summary

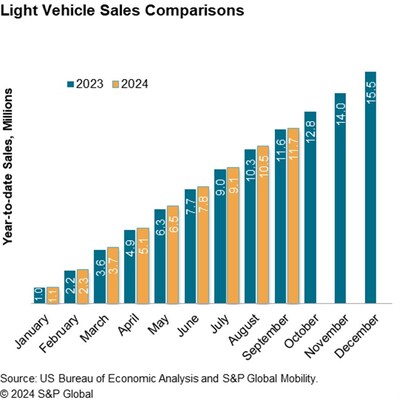

S&P Global Mobility expects U.S. light vehicle sales in September to decline by approximately 12% year-over-year to 1.18 million units. However, this translates to a seasonally adjusted rate (SAAR) of 16.0 million units, up from 15.2 million in August. The auto demand environment remains consistent but unmotivated due to high interest rates and vehicle prices.

Dealer advertised inventory has leveled out since spring, reaching 2.88 million units at the end of August. With 2025 model year vehicles becoming more available, pressure to sell remaining 2024 stock will increase. S&P Global Mobility has lowered its 2024 U.S. sales outlook to 15.9 million units and North American production outlook to 15.5 million units.

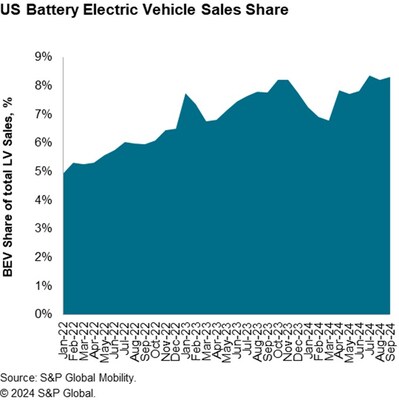

Battery-electric vehicle (BEV) sales continue to show strong development, with share of sales above 8% in June and July. New BEV models like the Chevrolet Equinox EV and Honda Prologue are expected to drive further growth in the fourth quarter.

Positive

- SAAR increased to 16.0 million units in September, up from 15.2 million in August

- Dealer advertised inventory reached 2.88 million units at the end of August

- BEV share of sales has been above 8% in both June and July

- New BEV models expected to drive further growth in Q4

Negative

- U.S. light vehicle sales expected to decline by 12% year-over-year in September

- 2024 U.S. sales outlook lowered to 15.9 million units from 16.0 million

- North American production outlook downgraded to 15.5 million units for 2024

- High interest rates and vehicle prices continue to pressure consumer demand

News Market Reaction 1 Alert

On the day this news was published, SPGI declined 0.61%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Given a relatively small number of selling days (23), and with Labor Day volume counted in August, total

"New vehicle sales remain stuck in neutral," said Chris Hopson, principal analyst at S&P Global Mobility. "The overall tenor of the auto demand environment remains one of consistent, but unmotivated volume levels as consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating to high monthly payments."

Despite increasing to 2.88 million units at the end of August, dealer advertised inventory in the

Continued advances in inventories and incentives are expected, but given reports of some automakers culling output expectations for the remainder of the year, affordability issues are expected to remain stubbornly sticky even as the first interest rate cut was made. In its September 2024 forecast update, S&P Global Mobility has lowered its calendar year 2024 U.S. sales outlook to 15.9 million units, down from a previous projection of 16.0 million units. Similarly, the S&P Global Mobility light vehicle production outlook for

US Light Vehicle Sales | ||||

Sep 24 (Est) | Aug 24 | Sep 23 | ||

Total Light Vehicle | Units, NSA | 1,183,000 | 1,418,771 | 1,340,980 |

In millions, SAAR | 16.0 | 15.1 | 15.8 | |

Light Truck | In millions, SAAR | 12.8 | 12.2 | 12.5 |

Passenger Car | In millions, SAAR | 3.2 | 2.9 | 3.3 |

Source: S&P Global Mobility (Est), | ||||

Strong development of battery-electric vehicle (BEV) sales remains an assumption in the longer term light vehicle sales forecast. According to S&P Global Mobility new registration data, BEV share of sales has been above

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-september-us-auto-sales--smaller-volume-little-change-to-underlying-dynamics-302260065.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-september-us-auto-sales--smaller-volume-little-change-to-underlying-dynamics-302260065.html

SOURCE S&P Global Mobility