S&P Global Market Intelligence Quarterly Report Finds Value of Global M&A Transactions Increased Nearly 12% Year-Over-Year in H1

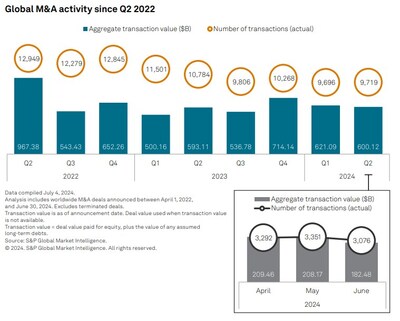

S&P Global Market Intelligence's Q2 2024 Global M&A and Equity Offerings Report reveals a 11.7% increase in the total value of global M&A transactions to $1.221 trillion in H1 2024 compared to H1 2023. However, the number of deals decreased by 12.9% to 19,415. The report highlights that while M&A activity hasn't fully recovered from the 2022 slowdown, dealmakers are pursuing large transactions. Europe saw a significant boost in M&A announcements, with values up 65.4% quarter-over-quarter and 25.4% year-over-year to $182.87 billion in Q2. Global IPOs also declined, with 616 transactions in H1 2024 compared to 674 in H1 2023.

Il rapporto di S&P Global Market Intelligence sul mercato globale delle fusioni e acquisizioni e delle offerte di equity nel secondo trimestre del 2024 rivela un incremento dell'11,7% nel valore totale delle transazioni globali di M&A, raggiungendo $1,221 trilioni nella prima metà del 2024 rispetto alla prima metà del 2023. Tuttavia, il numero di operazioni è diminuito del 12,9% a 19.415. Il rapporto evidenzia che, sebbene l'attività di M&A non si sia completamente ripresa dal rallentamento del 2022, gli operatori di mercato stanno perseguendo transazioni di grandi dimensioni. L'Europa ha registrato un significativo aumento nelle comunicazioni di M&A, con valori in crescita del 65,4% rispetto al trimestre precedente e del 25,4% rispetto all'anno precedente, raggiungendo $182,87 miliardi nel secondo trimestre. Anche le IPO globali sono diminuite, con 616 transazioni nella prima metà del 2024 rispetto a 674 nella prima metà del 2023.

El informe de S&P Global Market Intelligence sobre fusiones y adquisiciones y ofertas de capital del segundo trimestre de 2024 revela un incremento del 11,7% en el valor total de las transacciones globales de M&A, alcanzando $1,221 billones en la primera mitad de 2024 en comparación con la primera mitad de 2023. Sin embargo, el número de acuerdos disminuyó en un 12,9% a 19.415. El informe destaca que, aunque la actividad de M&A no se ha recuperado completamente de la desaceleración de 2022, los responsables de las transacciones están persiguiendo grandes operaciones. Europa vio un notable aumento en los anuncios de M&A, con valores en aumento del 65,4% trimestre a trimestre y del 25,4% año tras año, alcanzando $182,87 mil millones en el segundo trimestre. Las OPI globales también disminuyeron, con 616 transacciones en la primera mitad de 2024 en comparación con 674 en la primera mitad de 2023.

S&P Global Market Intelligence의 2024년 2분기 글로벌 M&A 및 주식 공모 보고서는 2023년 상반기 대비 2024년 상반기 글로벌 M&A 거래의 총 가치가 11.7% 증가하여 1.221 조 달러에 이르렀음을 보여줍니다. 그러나 거래 수는 12.9% 감소하여 19,415 건에 이르렀습니다. 보고서는 M&A 활동이 2022년의 침체에서 완전히 회복되지 않았지만, 거래자들이 대규모 거래를 추구하고 있다고 강조합니다. 유럽은 M&A 발표에서 큰 증가를 보였고, 거래 가치가 분기 대비 65.4%, 연간 25.4% 증가하여 2분기에는 1828.7억 달러에 달했습니다. 글로벌 IPO도 감소하여 2024년 상반기에 616 건의 거래가 이루어졌습니다, 반면 2023년 상반기에는 674 건이었습니다.

Le rapport de S&P Global Market Intelligence sur les fusions et acquisitions mondiales et les offres d'actions du deuxième trimestre 2024 révèle une augmentation de 11,7% de la valeur totale des transactions mondiales de M&A, atteignant 1,221 trillion de dollars dans la première moitié de 2024 par rapport à la première moitié de 2023. Cependant, le nombre d'accords a diminué de 12,9% pour atteindre 19.415. Le rapport souligne que bien que l'activité de M&A ne se soit pas complètement remise du ralentissement de 2022, les acteurs du marché poursuivent des transactions importantes. L'Europe a connu un bond significatif dans les annonces de M&A, avec des valeurs en hausse de 65,4% d'un trimestre à l'autre et de 25,4% d'une année sur l'autre, atteignant 182,87 milliards de dollars au deuxième trimestre. Les IPO mondiales ont également diminué, avec 616 transactions dans la première moitié de 2024 comparé à 674 dans la première moitié de 2023.

Der Bericht von S&P Global Market Intelligence über globale Fusionen und Übernahmen sowie Aktienangebote im zweiten Quartal 2024 zeigt einen Anstieg von 11,7% im Gesamtwert der globalen M&A-Transaktionen auf 1,221 Billionen US-Dollar in der ersten Hälfte von 2024 im Vergleich zur ersten Hälfte von 2023. Allerdings ist die Anzahl der Deals um 12,9% auf 19.415 gesunken. Der Bericht hebt hervor, dass die M&A-Aktivität sich noch nicht vollständig von der Verlangsamung im Jahr 2022 erholt hat, die Deal-Maker jedoch große Transaktionen anstreben. Europa verzeichnete einen signifikanten Anstieg bei den M&A-Ankündigungen, mit Werten, die im Vergleich zum Vorquartal um 65,4% und im Jahresvergleich um 25,4% auf 182,87 Milliarden US-Dollar im zweiten Quartal gestiegen sind. Auch die globalen IPOs sind zurückgegangen, mit 616 Transaktionen in der ersten Hälfte von 2024 im Vergleich zu 674 in der ersten Hälfte von 2023.

- Total value of global M&A transactions increased by 11.7% to $1.221 trillion in H1 2024

- Europe M&A announcements value rose 65.4% quarter-over-quarter and 25.4% year-over-year to $182.87 billion in Q2

- Third straight quarter of year-over-year growth in total value of global deals

- Number of global M&A deals decreased by 12.9% to 19,415 in H1 2024

- Global IPOs declined to 616 transactions in H1 2024 from 674 in H1 2023

- M&A activity has not fully recovered from the 2022 slowdown

Insights

The 11.7% increase in global M&A transaction value to

The sustained growth in transaction value for three consecutive quarters is encouraging, but the overall M&A market remains subdued compared to pre-2022 levels. The 65.4% quarter-over-quarter increase in European M&A value is noteworthy, potentially signaling a shift in regional deal-making dynamics. Investors should monitor how geopolitical developments and central bank policies might influence M&A activity in the coming quarters.

The divergence between M&A deal volume and value reveals a quality over quantity approach in the current market. This trend could be driven by strategic consolidations, industry disruptions, or the need for scale in challenging economic conditions. The decline in global IPOs to 616 in H1 2024 from 674 in H1 2023 suggests continued caution in public markets, possibly due to valuation concerns or regulatory uncertainties.

Looking ahead, the report's mention of political clarity and sustained rate-cutting as potential catalysts for 2025 activity is crucial. Investors should watch for signs of these factors materializing, as they could trigger a broader resurgence in both M&A and IPO markets, potentially creating new investment opportunities across various sectors.

The activity shows that M&A has yet to fully recover from the slowdown in activity that started in 2022 with the rate-hiking cycle, but dealmakers are willing to pursue large transactions. In the second quarter of this year, a pickup in

"A handful of large transactions served as a bright spot for M&A and IPO activity in the second quarter; while the overall number of transactions remains lackluster, the bigger deals are helping bring some growth to the overall value of transactions," said Joe Mantone, lead author of the report at S&P Global Market Intelligence. "Clarity around the political landscape and sustained rate-cutting cycle would certainly create optimism for M&A and IPOs heading into 2025."

Key highlights from the Q2 2024 Global M&A and Equity Offerings Report include:

- The number of global M&A transactions has fallen below 10,000 three times in the last four quarters after having done only once since 2020.

- Large transactions helped boost the total value of Europe M&A announcements by

65.4% quarter-over-quarter and25.4% year-over-year in the second quarter to$182.87 billion - The 616 global IPOs in the first half of 2024 was lower than the 674 transactions in the first half of 2023 and the 819 transactions in the first half of 2022.

The quarterly report provides an overview of global M&A and equity issuance trends, offering insights into the sectors and geographies that are seeing the most activity. It also focuses on deals with the highest valuations and strategies larger players pursue that underscore trends occurring throughout an industry. S&P Global Market Intelligence has produced the quarterly, global M&A and equity offering report since the first quarter of 2018.

To request a copy of the Q2 2024 Global M&A and Equity Offerings Report, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kate Smith

S&P Global Market Intelligence

+1 781 301 9311

Katherine.smith@spglobal.com or press.mi@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-quarterly-report-finds-value-of-global-ma-transactions-increased-nearly-12-year-over-year-in-h1-302216900.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-quarterly-report-finds-value-of-global-ma-transactions-increased-nearly-12-year-over-year-in-h1-302216900.html

SOURCE S&P Global Market Intelligence