S&P Global Commodity Insights' Platts Launches First-Ever Daily South America Lithium Triangle Price Assessments

Rhea-AI Summary

S&P Global Commodity Insights' Platts has launched the first-ever daily, physical spot market price assessments for South America lithium carbonate, effective September 2, 2024. The new Platts Lithium Triangle (LiT) price assessments aim to bring pricing transparency to an important lithium supply growth market, complementing existing battery metals prices across Asia, Americas, and Europe.

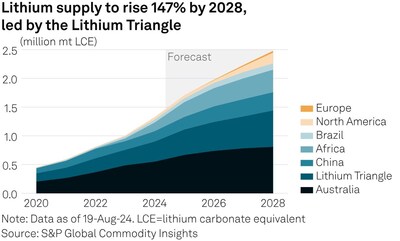

The assessments will reflect a minimum quality of 99.0% Li2CO3, with a minimum of five metric tons, loading 14 to 60 days forward, expressed in US dollars per metric ton. The Lithium Triangle, encompassing parts of Argentina, Bolivia, and Chile, is projected to be the largest contributor to global lithium supply growth over the next 5 years, with production expected to surpass 631,000 metric tons by 2028.

Positive

- Launch of first-ever daily price assessments for South America lithium carbonate, enhancing market transparency

- Expansion of Platts' pricing information suite for lithium and battery metals across global markets

- Lithium Triangle production projected to surpass 631,000 metric tons by 2028, becoming the largest contributor to global lithium supply growth

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, SPGI declined 0.48%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Brings Pricing Transparency to Important Lithium Supply Growth Market

- Complements Existing Suite of

The launch follows months of engagement with the marketplace and responds to growing demand from market participants for increased transparency, clarity and insights regarding pricing for lithium products from

"We're excited to further our century-plus history of bringing pricing transparency to markets, extending our reach in battery metals to the important South America Lithium Triangle – a region poised to play a pivotal role in global lithium production," said Anna Crowley, Global Head of Metals Pricing, S&P Global Commodity Insights. "Our aim is to provide the essential price benchmarks and insights needed by market participants throughout the critical elements and battery value chain."

The new Platts Lithium Triangle (LiT) price assessments, on a free-on-board (FOB) shipping basis, will reflect a minimum quality of

The Lithium Triangle, encompassing parts of

S&P Global Commodity Insights data shows that in 2023, the Lithium Triangle produced 268,716 metric tons of Lithium Carbonate Equivalent (LCE) equivalent to

"Not only is this the first daily price assessment for the emerging lithium production hub known as the Lithium Triangle, but the Platts LiT FOB assessment's relevance and usefulness goes well beyond

The new

The new daily end-of-trading-day price assessment follows a

For more details, visit Platts Assessments Methodology Guide.

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

Jeff Marn +1 202-560-0776, jeff.marn@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-platts-launches-first-ever-daily-south-america-lithium-triangle-price-assessments-302236789.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-platts-launches-first-ever-daily-south-america-lithium-triangle-price-assessments-302236789.html

SOURCE S&P Global Commodity Insights