GLOBAL PURCHASING ACTIVITY CONTRACTING AT STRONGEST PACE SINCE DECEMBER 2023 AS MANUFACTURERS WORLDWIDE RETRENCH: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

Rhea-AI Summary

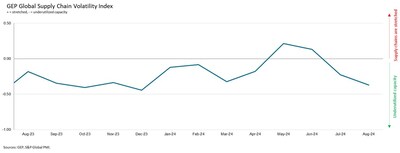

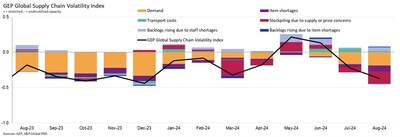

The GEP Global Supply Chain Volatility Index fell to -0.37 in August 2024, indicating the highest level of spare capacity at global suppliers this year. This marks two consecutive months of underutilized capacity and the lowest level of input demand in eight months. Key findings include:

- North American suppliers reported the strongest rise in excess capacity since June 2023

- Asian supply chains showed spare capacity for the first time since March

- Europe's manufacturing recession deepened, especially in Germany and France

- Global demand for raw materials and components shrank at the strongest pace year-to-date

- Safety stockpiling reduced to the greatest extent since March

- Material shortages fell to their lowest level since January 2020

Positive

- Material shortages fell to their lowest level since January 2020, indicating improved supply availability

- Labor supply is generally capable of meeting demand, with muted reports of backlogs due to insufficient staffing

Negative

- Global purchasing activity contracted at the strongest pace since December 2023

- North American suppliers reported the strongest rise in excess capacity since June 2023

- Asian supply chains showed spare capacity for the first time since March 2024

- Europe's manufacturing recession deepened, especially in Germany and France

- Global demand for raw materials and components shrank at the strongest pace year-to-date

- Safety stockpiling reduced to the greatest extent since March, indicating potential concerns about future demand

- Manufacturers are aggressively drawing down inventory, suggesting preparation for a sustained soft patch

News Market Reaction

On the day this news was published, SPGI declined 0.80%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

- North American suppliers report strong rise in excess capacity and the softest demand in eight months, with flagging factory conditions in the

U.S. - Asian suppliers, who experienced growth in the first half of 2024, report spare capacity as Chinese procurement declines

Europe's manufacturing recession deepened in August, withGermany andFrance driving the continent's downturn- In contrast to the EU,

UK manufacturers close to full utilization

Suppliers in all parts of the globe experienced a slowdown in activity during August. Conditions in

For the first time since March, our data shows spare capacity across Asian supply chains. Procurement activity in

"What is most concerning in our August data is that manufacturers are aggressively drawing down their inventory suggesting they're preparing for a sustained soft patch," explained Neha Shah, president, GEP. "To head off a material slowdown in the second half of the year, manufacturers need to see interest rates lowered, and for the

AUGUST 2024 KEY FINDINGS

- DEMAND: Global demand for raw materials, commodities and other necessary components like semiconductors shrank in August at an accelerated pace that was the strongest in the year-to-date. The globe's two economic powerhouses, the

U.S. andChina , both reported lower procurement activity, as well as other major manufacturing hubs likeGermany . - INVENTORIES: Safety stockpiling was reduced to the greatest extent since March. Reports from global businesses of inventories rising because of supply or price concerns were well below historically typical levels as firms targeted cost savings and lean inventory management amid softening economic conditions.

- MATERIAL SHORTAGES: Reports of item shortages fell for a second successive month and were their lowest since January 2020 as weaker demand had clearly boosted vendor stock levels.

- LABOR SHORTAGES: Reports of manufacturers' backlogs because of insufficient staffing capacity were muted in August, holding close to their long-term trend level. This indicates that labor supply is generally capable of meeting demand.

- TRANSPORTATION: After having risen in recent months and reaching the highest level since October 2022 in June and July, global transportation costs cooled slightly in August. They were still slightly greater than their long-term average, however.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA : Index fell sharply to -0.62, from -0.11, signaling the highest level of vendor spare capacity since June 2023. Procurement activity in theU.S. was the weakest across the region during August.EUROPE : Index decreased to -0.53, from -0.49 as the continent's industrial recession intensified. Factory demand inGermany andFrance was deteriorating rapidly.U.K. : Index slipped back into negative territory, falling from 0.11 to -0.14, signaling slack inU.K. supply chains for first time since April.ASIA : Index fell to -0.07, from 0.07, indicating underutilized capacity at suppliers toAsia for first time in five months. Although factory activity remains robust inIndia , procurement managers inChina reported cutbacks.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, October 10, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Media Contacts | ||

Derek Creevey | Joe Hayes | S&P Global Market Intelligence |

Director, Public Relations | Principal Economist | Email: Press.mi@spglobal.com |

GEP | S&P Global Market Intelligence | |

Phone: +1 646-276-4579 | Phone: +44-1344-328-099 | |

Email: derek.creevey@gep.com | Email: joe.hayes@spglobal.com |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/global-purchasing-activity-contracting-at-strongest-pace-since-december-2023-as-manufacturers-worldwide-retrench-gep-global-supply-chain-volatility-index-302244348.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-purchasing-activity-contracting-at-strongest-pace-since-december-2023-as-manufacturers-worldwide-retrench-gep-global-supply-chain-volatility-index-302244348.html

SOURCE GEP