Global exploration budget for metals jumps 35% year-on-year to $11.2 billion

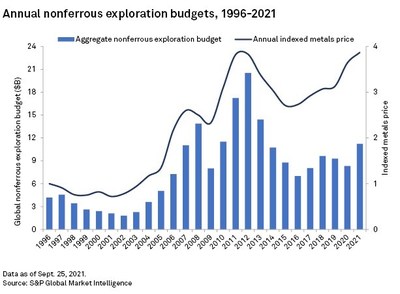

The 2021 global exploration budget report from S&P Global Market Intelligence reveals a substantial recovery in the mining exploration sector, with a 35% increase year-over-year, reaching $11.2 billion from $8.3 billion in 2020. Key insights include robust metal prices, with gold averaging $1,784 per ounce and copper at $4.25 per pound in August 2021. Canada leads budget allocations at $2.1 billion, while Africa sees less growth. Junior explorers have increased budgets by 62%, totaling $4.1 billion, although major firms still account for half of the total budget.

- Global nonferrous exploration budget increased by 35% year-over-year to $11.2 billion.

- Gold and copper prices have risen significantly, with gold averaging $1,784/oz and copper $4.25/lb in August 2021.

- Canada's exploration budget allocation rose by $800.5 million to a record $2.1 billion.

- Junior mining sector's budget increased by 62% to $4.1 billion.

- Africa's exploration budget increased only 12%, returning to 2019 levels.

- Grassroots exploration budgets remain low at 26%, the second lowest on record.

Insights

Analyzing...

NEW YORK, Oct. 18, 2021 /PRNewswire/ -- Newly released 2021 global exploration budget from S&P Global Market Intelligence's Corporate Exploration Strategies series shows that the mining exploration sector has emerged from the downturn caused by the COVID-19 pandemic. The aggregate annual global nonferrous exploration budget has increased by

Kevin Murphy, Principal Analyst with the Metals & Mining Research team at S&P Global Market Intelligence, says, " A faster-than-expected recovery in market conditions and easing of lockdowns allowed explorers to reactivate programs by mid-2020, which caused some programs to carry over into 2021. Along with higher metals prices and increased financing activities, this has led to a strong budget recovery in 2021. As we move into the last quarter this year, metal prices and financings remain robust, and the risk of further pandemic-related shutdowns has declined. As a result, we expect the aggregate exploration budget to increase between

Key takeaways include:

- Gold and base metals dominate exploration focus: While the gold price has varied over recent months, its August 2021 average of

$1,784 per ounce was14% higher than its January 2020 average of$1,560 /oz. Base metals have had even more impressive gains, with copper's August 2021 average of$4.25 per pound up55% from January 2020. - Canada soars while Africa underperforms: While allocations to all regions have increased in 2021, Canada has attracted a particularly large share of the global budget with an increase of

$800.5 million year over year to$2.1 billion , hitting its record high since 2012. Africa underperformed with allocations up just12% to$1.1 billion , returning the region to its 2019 level. - Junior budgets surge but majors still drive exploration: The junior sector has increased their planned allocations by

62% year over year to a total of$4.1 billion . Despite this increase, the majors continue to account for half of global exploration budget at a total of$5.6 billion . - Early-stage exploration budget hits all-time low: In 2020, grassroots share of allocations hit an all-time low of

24% while minesite hit an all-time high of41% as the pandemic made large scale programs more difficult. While grassroots share recovered modestly this year due to increased activity in Australia and Canada, its global budget share is the second lowest on record at26% .

The Metals and Mining Research team will be hosting a live webinar to present the latest Corporate Exploration Strategies 2021 research on 19 October 2021. To register for the event, please visit this webpage.

S&P Global Market Intelligence's Metals and Mining Research team offers comprehensive coverage on mining companies, projects and mines worldwide, exploration budgets and trend analysis, reserves replacement studies, Mine Economics cost curves, commodity market analysis and industry outlook insights. The Metals and Mining offering complements S&P Global Market Intelligence's broad universe of research sector coverage including energy, enterprise technology, leveraged loans, financial institutions, and TMT (Technology, Media and Telecom).

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world's foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Vivian Liu

S&P Global Market Intelligence

P. +852 91791132

E. Vivian.Liu@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/global-exploration-budget-for-metals-jumps-35-year-on-year-to-11-2-billion-301401999.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-exploration-budget-for-metals-jumps-35-year-on-year-to-11-2-billion-301401999.html

SOURCE S&P Global