Snowflake Reports Financial Results for the First Quarter of Fiscal 2022

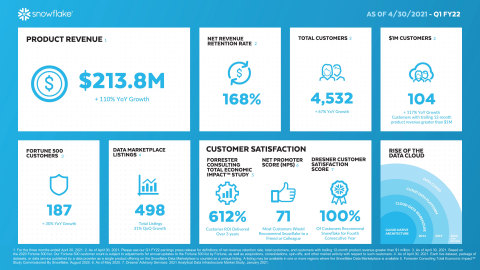

Snowflake (NYSE: SNOW) reported its Q1 FY2022 results, showing a remarkable 110% year-over-year revenue growth of $228.9 million, with product revenue at $213.8 million. Remaining performance obligations reached $1.4 billion, a 206% increase from last year. The net revenue retention rate stood at 168%. Despite strong revenue growth, the company reported an operating loss of $205.6 million. The guidance for Q2 FY2022 anticipates product revenue between $235-240 million, reflecting 88-92% year-over-year growth.

- Product revenue rose 110% year-over-year to $213.8 million.

- Remaining performance obligations grew by 206% to $1.4 billion.

- Net revenue retention rate is high at 168%.

- The company has 4,532 total customers, indicating strong market penetration.

- Operating loss was $205.6 million, representing a 90% increase year-over-year.

Insights

Analyzing...

Snowflake (NYSE: SNOW), the Data Cloud company, today announced financial results for its first quarter of fiscal 2022, ended April 30, 2021.

Snowflake FY22 Q1 Earnings Infographic (Graphic: Snowflake)

Revenue for the quarter was

“Snowflake reported strong Q1 results with triple-digit growth in product revenue, reflecting strength in customer consumption,” said Snowflake CEO Frank Slootman. “Remaining performance obligations showed a robust increase year-on-year, indicating strength in sales across the board.”

First Quarter Fiscal 2022 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the first quarter of fiscal 2022:

|

First Quarter Fiscal 2022 GAAP Results |

|

First Quarter Fiscal 2022 Non-GAAP Results(1) |

||

|

Amount

|

Year/Year

|

|

|

|

Product revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Amount

|

Margin |

|

Amount

|

Margin |

Product gross profit |

|

|

|

|

|

Operating loss |

( |

( |

|

( |

( |

Net cash provided by operating activities |

|

|

|

|

|

Free cash flow |

|

|

|

|

|

Adjusted free cash flow |

|

|

|

|

|

(1) We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section titled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP financial measures, and the table titled “GAAP to Non-GAAP Reconciliations” for a reconciliation of GAAP to non-GAAP financial measures.

Note: Fiscal year ends January 31. Numbers are rounded for presentation purposes.

Financial Outlook:

Our guidance includes GAAP and non-GAAP financial measures.

The following table summarizes our guidance for the second quarter of fiscal 2022:

|

Second Quarter Fiscal 2022 GAAP Guidance |

|

Second Quarter Fiscal 2022 Non-GAAP Guidance(1) |

||

|

Amount

|

Year/Year

|

|

|

|

Product revenue |

|

88 - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margin |

Operating loss |

|

|

|

|

( |

|

|

|

|

|

|

|

Amount

|

|

|

|

|

Weighted-average shares used to compute diluted net loss per share attributable to common stockholders - basic and diluted |

297 |

|

|

|

|

(1) We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section titled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP financial measures.

The following table summarizes our guidance for the full-year fiscal 2022:

|

Full-Year Fiscal 2022 GAAP Guidance |

|

Full-Year Fiscal 2022 Non-GAAP Guidance(1) |

||

|

Amount

|

Year/Year

|

|

|

|

Product revenue |

|

84 - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margin |

Product gross profit |

|

|

|

|

|

Operating loss |

|

|

|

|

( |

Adjusted free cash flow |

|

|

|

|

|

|

|

|

|

|

|

|

Amount

|

|

|

|

|

Weighted-average shares used to compute diluted net loss per share attributable to common stockholders - basic and diluted |

299 |

|

|

|

|

(1) We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section titled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP financial measures.

A reconciliation of non-GAAP guidance measures to corresponding GAAP guidance measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP financial results included in this press release. Our fiscal year ends January 31, and numbers are rounded for presentation purposes.

Conference Call Details

We will host a conference call today, beginning at 2 p.m. Pacific Time on May 26, 2021. Investors and participants can register for the call in advance by visiting http://www.directeventreg.com/registration/event/3280293. After registering, a confirmation will be sent via email, including dial-in details and unique conference call access codes required for call entry.

The call will also be webcast live on the Snowflake Investor Relations website.

An audio replay of the conference call and webcast will be available two hours after its completion and will be accessible for 30 days on t