SmartMetric Says That, According to the Federal Reserve, Credit Cards Dominate the Payment Method Used by Consumers

- Increased use of credit cards as the preferred payment method.

- SmartMetric's innovative biometric fingerprint activated credit card technology.

- All-time high number of credit card accounts in the United States.

- Limited consumer use of mobile app payments.

- No significant increase in mobile app payments since 2020.

Insights

Analyzing...

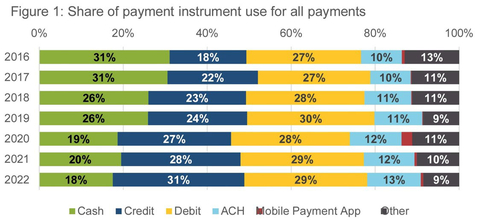

Share of payment instrument use for all payments (Graphic: Business Wire)

The report went on to say, “through the 2022 survey, we found that some of the major payment trends that started early in Covid-19 public health emergency have continued into the pandemic’s later stages. Notably, consumers have continued to use credit cards more often and credit cards were the most used payment method in 2022. By contrast, consumers' use of debit cards and cash in 2022 remained consistent with 2020 levels.”

What is interesting in this report is that mobile app payments hardly figure at all as a general consumer payment method. Credit Cards still remain the pre-eminent form of consumer payment.

“The Federal Reserve's payment method report states that credit cards dominate while mobile payment apps hardly figure at all as a consumer payment method," said SmartMetric’s President and CEO, Chaya Hendrick.

Another key takeaway from 2022 payment trends was the leveling-off of mobile app payments. Although consumers rapidly shifted toward online and remote payments in 2020, the average number of mobile app payments has not increased since that time, indicating that consumer use of mobile payment apps may have reached a peak earlier in the pandemic.

“The long heralded demise of the plastic credit and debit card has proven to be a failure with the proof that credit and debit cards are the preferred payment method by far," said Chaya Hendrick.

“The SmartMetric biometric fingerprint activated credit card brings ultimate security to the most used payment method, cards," said SmartMetric.

SmartMetric is the first truly biometric credit card having its own internal rechargeable battery that allows the card to operate at all card readers including ATMs and gas pumps.

The SmartMetric GEN4 biometric credit card uniquely has an internal hardware system that detects if the finger being used is in fact a real live finger. No live finger confirmation, no card use activation, according to SmartMetric.

The SmartMetric biometric credit card is the only advanced biometric payments card product with an internal rechargeable battery that allows the card to be used in all card usage cases such as restaurants and ATMs. Having its own power inside the card allows the SmartMetric biometric card to work prior to the card being inserted into a card reader.

The SmartMetric biometric fingerprint recognition technology built inside of the credit and debit card uses embedded biometric technology built by SmartMetric to positively recognize the card holder and then, only after a positive fingerprint recognition, turn on the card's EMV contact and contactless payments chip.

According to an article published by Finder.com 1 the number of credit card accounts open in

The average American owns three credit cards.

To view the SmartMetric Biometric Card please follow this link - Video of the SmartMetric Biometric Card. To view the company website: www.smartmetric.com

1 2023 Credit card debt and spending statistics in the US | finder.com

Safe Harbor Statement: Forward-Looking Statements in this press release, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Also such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, if we are unable to access the capital necessary to fund current operations or implement our plans for growth; changes in the competitive environment in our industry and the markets where we operate; our ability to access the capital markets; and other risks discussed in the Company's filings with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20231208250969/en/

SmartMetric, Inc.

Chaya Hendrick

Tel: (702) 990-3687

Mobile: (305) 607-3910 (Pacific Time)

ceo@smartmetric.com

www.smartmetric.com

Source: SmartMetric, Inc.