Solaris Reports First Drilling Results from 2024 Program and Exploration Update, Including 150m of 0.67% CuEq within 384m of 0.51% CuEq and 284m of 0.53% CuEq from Near Surface

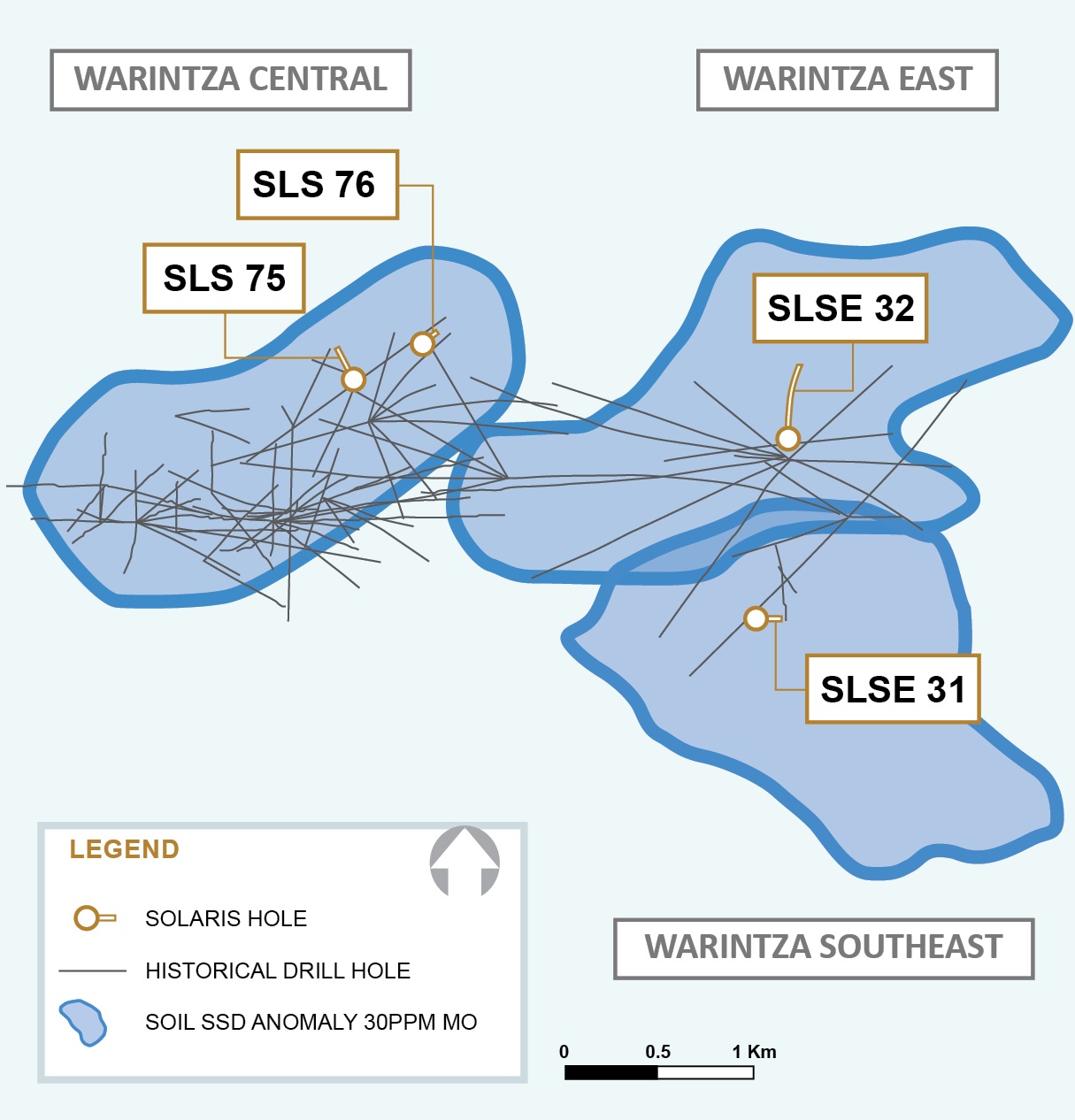

VANCOUVER, British Columbia, April 23, 2024 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) (“Solaris” or the “Company”) is pleased to report the first drill results from its 2024 drilling program and an exploration update at its Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador. Highlights are listed below, with a corresponding image in Figures 1-2 and results in Tables 1-2.

Highlights

Drilling activities ramped up through the first quarter rainy season with six rigs now in operation at Warintza Central, East and Southeast and drilling expected to continue throughout the year in support of expanding and upgrading resources. In addition, follow-up exploration drilling is set to commence at the Patrimonio discovery and regional exploration is underway at the promising Caya epithermal gold target.

- SLS-76 was collared on the northeastern limit of the Northeast Extension zone and drilled northwest, returning 150m of

0.67% CuEq¹ within a broader interval of 384m of0.51% CuEq¹, before the hole was terminated in lower grade mineralization - SLSE-31 was collared on the southern margin of Warintza Southeast and drilled east to the ~300m depth capacity of the KD-200 rig, returning 284m of

0.53% CuEq¹ from near surface, with the final 10m averaging0.75% CuEq¹ and remaining open for extension drilling with a larger rig - SLS-75, drilled northeast from a new 200m step-out platform at Northeast Extension zone, returned 26m of

0.52% CuEq¹ and 46m of0.66% CuEq¹ within a low-grade section from surface with a post-mineral dyke before a final 62m mineralized interval averaging0.51% CuEq¹ - SLSE-32 was collared on the northern margin of Warintza East and drilled north, returning 380m of

0.31% CuEq¹ from surface within a broader interval of 634m of0.27% CuEq¹ where the hole cut the contact of the primary host lithology with bordering lower grade volcanic rock - Exploration drilling is underway at Patrimonio to follow up on the discovery holes (144m of

0.50% CuEq¹ and 148m of0.52% CuEq¹, respectively – refer to press release dated September 12, 2023) while field crews expand sampling coverage over the highest grade part of the anomaly to the south and down-dip of the replacement mineralization to locate the potential porphyry source - Regional exploration programs are underway at the promising Caya epithermal gold target, located 6km to the northeast of Warintza East, where field crews are expanding sampling and alteration mapping to the west to cover an area where evidence of historical artisanal mining has been identified

- Funded for 2024 and 2025 programs with the offtake financing package announced in December, with plans to aggressively expand activities and consolidate the surrounding district with funds from closing the strategic investment announced in January

2024 Drilling Program and Funding

The 2024 drilling program has progressively ramped up over the rainy season with approximately 700m drilled in January, 1800m in February, 3800m in March, and on track for 5,200m in April with six rigs now in operation. A minimum of 30km of drilling is planned in 2024, with a Mineral Resource Update expected by the end of June, and drilling planned to continue thereafter.

The Company is funded for its 2024 and 2025 programs with the offtake financing package announced in December. As at December 31, 2023, the Company had approximately US

The Company plans to aggressively expand activities and consolidate the surrounding district with funding from the closing of the strategic investment (refer to press release dated January 11, 2024). The parties are continuing to work through the Canadian regulatory process to close the transaction and Solaris will update the market when it has a material update to provide.

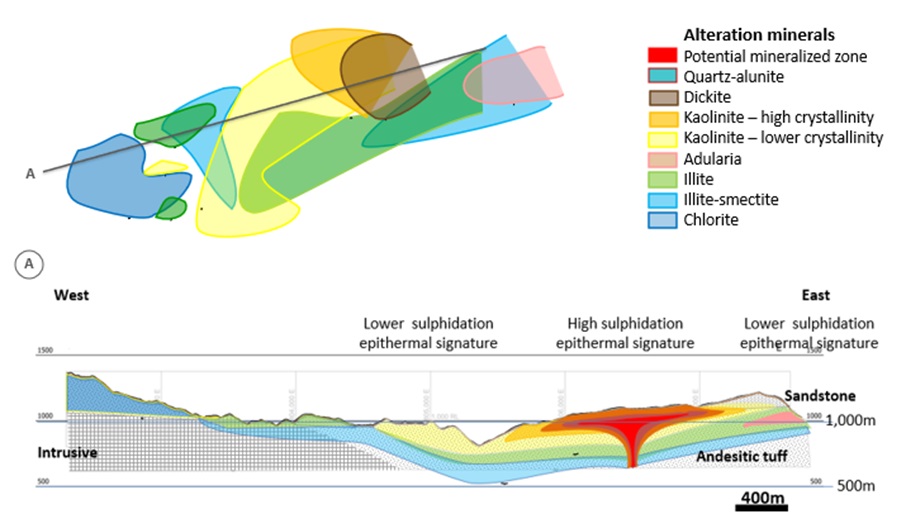

Regional Exploration: Caya Epithermal Gold Target

Field crews have recently been active at the Caya target (refer to Figure 2), where stream sediment sampling has identified a 5km x 3km gold anomaly, 6km northeast of Warintza East. Soil sampling has defined an open-ended area of 0.7km x 1.3km in which anomalous gold and other epithermal pathfinder elements are concentrated and obscured by an overlying stratigraphic unit.

The soil anomaly coincides with clay alteration in which dickite is enclosed by high-crystalinity koalinite that grades outward into clay minerals that were developed at successively lower temperature. Such hydrothermal alteration zoning, combined with sporadic occurrences of vuggy silica that have been found, are typical of high sulphidation epithermal systems.

The target is relatively flat-lying mineralization in permeable strata adjacent to feeder faults. Sampling conducted over the last month has extended the soil grid to the west to cover an area of historical disturbance from past artisanal mining. Given the flat-lying nature of the conceptual target, additional spectral work is being done to refine the alteration zoning in the volcanosedimentary layers that overlie the target. The Company expects to report on the results of this work in more detail in June.

Figure 1 – Plan View of Drilling to Date

Figure 2 – Caya Epithermal Gold Target

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-76 | Apr 23, 2024 | 78 | 462 | 384 | 0.35 | 0.03 | 0.07 | 0.51 |

| Including | 78 | 228 | 150 | 0.46 | 0.04 | 0.08 | 0.67 | |

| SLS-75 | 16 | 42 | 26 | 0.38 | 0.02 | 0.11 | 0.52 | |

| Including | 130 | 176 | 46 | 0.49 | 0.02 | 0.15 | 0.66 | |

| Including | 472 | 534 | 62 | 0.43 | 0.01 | 0.09 | 0.51 | |

| SLSE-32 | 4 | 638 | 634 | 0.21 | 0.01 | 0.02 | 0.27 | |

| Including | 4 | 384 | 380 | 0.25 | 0.01 | 0.03 | 0.31 | |

| SLSE-31 | 26 | 310 | 284 | 0.44 | 0.02 | 0.05 | 0.53 | |

| Including | 300 | 310 | 10 | 0.64 | 0.02 | 0.05 | 0.75 |

Notes to table: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 - Collar Locations

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-76 | 800350 | 9648417 | 1351 | 493 | 330 | -80 |

| SLS-75 | 800531 | 9648518 | 1261 | 534 | 60 | -85 |

| SLSE-32 | 801483 | 9648241 | 1170 | 860 | 0 | -78 |

| SLSE-31 | 801395 | 9647790 | 1184 | 310 | 90 | -80 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US

$3.50 /lb Cu, US$15.00 /lb Mo, and US$1,500 /oz Au, and assumes recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical test work. For additional details on the intervals, refer to press release dated September 12, 2023 for SLSP-01: 144m of0.50% CuEq (0.34% Cu,0.03% Mo, 0.09 g/t Au) and SLSP-02: 148m of0.52% CuEq (0.38% Cu,0.02% Mo, 0.09 g/t Au).

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secured Company facility located in Quito, Ecuador. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Both ALS Labs and Bureau Veritas lab are independent of Solaris. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. Details on the surface sampling conducted at the Project are set out in the technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador (Amended)” with an effective date of April 1, 2022, prepared by Mario E. Rossi and available on the Company’s SEDAR+ profile and website. The drillhole data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards.

Qualified Person

The scientific and technical content of this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes a world class copper resource with expansion and discovery potential at its Warintza Project in Ecuador; a series of grass roots exploration projects with discovery potential in Peru and Chile; and significant leverage to increasing copper prices through its

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements that drilling is expected to continue throughout the year in support of expanding and upgrading resources, follow-up exploration drilling is set to commence at the Patrimonio discovery and regional exploration is underway at the promising Caya epithermal gold target, a minimum of 30km of drilling is planned in 2024, with a Mineral Resource Update expected by the end of June, and drilling planned to continue thereafter, the Company is funded for its 2024 and 2025 programs with the offtake financing package announced in December, additional US

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc87c609-33bf-4757-a881-0d5bbef3c7a2

https://www.globenewswire.com/NewsRoom/AttachmentNg/984d2e6c-fdf0-4302-98d5-739b84bb7b2b