Solaris Reports 57m of 1.11% CuEq, 69m of 0.82% CuEq and 69m of 0.77% CuEq in Near Surface Results; Extends Mineralization North, Northwest and Southeast

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) has reported significant drill results from its ongoing 60,000m drilling program at the Warintza Project in Ecuador. The company has extended near-surface, high-grade mineralization to the north, northwest, and southeast of the Mineral Resource Estimate (MRE). Key highlights include:

- SLS-86: 57m of 1.11% CuEq within 105m of 0.88% CuEq from near surface

- SLS-84: 69m of 0.82% CuEq within 102m of 0.64% CuEq from near surface

- SLS-82: 69m of 0.77% CuEq within 249m of 0.38% CuEq from surface

The company is focusing on open lateral extensions of mineralization and converting waste through infill drilling. Step-out platforms have been constructed to test potential expansions to the northwest and southwest, which could significantly enlarge the MRE pit.

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) ha riportato risultati di perforazione significativi dal suo programma di perforazione in corso di 60.000 m al Progetto Warintza in Ecuador. L'azienda ha esteso la mineralizzazione ad alta legge vicino alla superficie a nord, nord-ovest e sud-est della Stima delle Risorse Minerali (MRE). I punti salienti includono:

- SLS-86: 57m di 1.11% CuEq all'interno di 105m di 0.88% CuEq vicino alla superficie

- SLS-84: 69m di 0.82% CuEq all'interno di 102m di 0.64% CuEq vicino alla superficie

- SLS-82: 69m di 0.77% CuEq all'interno di 249m di 0.38% CuEq dalla superficie

L'azienda si sta concentrando su estensioni laterali aperte della mineralizzazione e sulla conversione dei materiali di scarto attraverso perforazioni di riempimento. Sono state costruite piattaforme di estensione per testare espansioni potenziali a nord-ovest e sud-ovest, che potrebbero ampliare significativamente il pozzo MRE.

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) ha informado sobre resultados de perforación significativos de su programa de perforación en curso de 60,000 m en el Proyecto Warintza en Ecuador. La compañía ha ampliado la mineralización de alta ley cerca de la superficie hacia el norte, noroeste y sureste de la Estimación de Recursos Minerales (MRE). Los puntos destacados incluyen:

- SLS-86: 57m de 1.11% CuEq dentro de 105m de 0.88% CuEq cerca de la superficie

- SLS-84: 69m de 0.82% CuEq dentro de 102m de 0.64% CuEq cerca de la superficie

- SLS-82: 69m de 0.77% CuEq dentro de 249m de 0.38% CuEq desde la superficie

La compañía se está enfocando en extensiones laterales abiertas de mineralización y en convertir desechos a través de perforaciones de relleno. Se han construido plataformas de extensión para probar expansiones potenciales al noroeste y suroeste, lo que podría ampliar significativamente el pozo de MRE.

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR)는 에콰도르 워린차 프로젝트에서 진행 중인 60,000m 굴착 프로그램의 중요한 시추 결과를 보고했습니다. 이 회사는 광물 자원 추정치(MRE) 북쪽, 북서쪽, 남동쪽으로 표면 근처의 고품위 광물화를 확장했습니다. 주요 요점은 다음과 같습니다:

- SLS-86: 표면 근처에서 0.88% CuEq의 105m 안에 1.11% CuEq의 57m

- SLS-84: 표면 근처에서 0.64% CuEq의 102m 안에 0.82% CuEq의 69m

- SLS-82: 표면에서 0.38% CuEq의 249m 안에 0.77% CuEq의 69m

회사는 광물화의 개방된 측면 확장과 메우기 시추를 통해 폐기물 전환에 집중하고 있습니다. 북서쪽과 남서쪽으로의 잠재적 확장을 시험하기 위해 확장 플랫폼이 구축되어, MRE 구덩이를 상당히 확대할 수 있을 것입니다.

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) a rapporté des résultats de forage significatifs issus de son programme de forage en cours de 60 000 m au Projet Warintza en Équateur. L'entreprise a étendu la minéralisation de haute qualité proche de la surface au nord, au nord-ouest et au sud-est de l'Estimation des Ressources Minérales (MRE). Les points clés incluent :

- SLS-86 : 57m de 1.11% CuEq au sein de 105m de 0.88% CuEq près de la surface

- SLS-84 : 69m de 0.82% CuEq au sein de 102m de 0.64% CuEq près de la surface

- SLS-82 : 69m de 0.77% CuEq au sein de 249m de 0.38% CuEq depuis la surface

L'entreprise se concentre sur les extensions latérales ouvertes de la minéralisation et la conversion des déchets par le biais de forages de remplissage. Des plateformes d'extension ont été construites pour tester d'éventuelles expansions vers le nord-ouest et le sud-ouest, ce qui pourrait considérablement agrandir le puits de MRE.

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) hat signifikante Bohrergebnisse aus seinem laufenden Bohrprogramm über 60.000 m im Warintza-Projekt in Ecuador berichtet. Das Unternehmen hat die nahefläche, hochgradige Mineralisierung nach Norden, Nordwesten und Südosten der mineralischen Ressourcenschätzung (MRE) erweitert. Zu den wichtigsten Höhepunkten gehören:

- SLS-86: 57m mit 1.11% CuEq innerhalb von 105m mit 0.88% CuEq von der Oberfläche

- SLS-84: 69m mit 0.82% CuEq innerhalb von 102m mit 0.64% CuEq von der Oberfläche

- SLS-82: 69m mit 0.77% CuEq innerhalb von 249m mit 0.38% CuEq von der Oberfläche

Das Unternehmen konzentriert sich auf offene laterale Erweiterungen der Mineralisierung und die Umwandlung von Abfall durch Infill-Bohrungen. Es wurden Plattformen errichtet, um potenzielle Erweiterungen nach Nordwesten und Südwesten zu testen, was den MRE-Steinbruch erheblich vergrößern könnte.

- None.

- None.

Insights

The drilling results from Solaris Resources' Warintza Project show promising extensions of mineralization in multiple directions. The reported intercepts, such as

The company's aggressive 60,000m drilling program with 8 rigs demonstrates a strong commitment to resource expansion. The focus on open lateral extensions and infill drilling suggests a dual strategy of growth and resource confidence improvement. The step-out platforms to the northwest and southwest represent opportunities for significant MRE expansion, which could enhance the project's overall value.

However, investors should note that while these results are encouraging, further drilling and economic studies will be needed to fully assess the impact on the project's viability and potential future production scenarios.

The drilling results reveal a complex geological setting at Warintza. The contact between mineralization and a tabular granodiorite unit to the northwest is particularly intriguing. This geological boundary could be a key control on mineralization distribution and may guide future exploration efforts.

The presence of a large, undrilled molybdenum soil anomaly to the northwest and a

The consistent copper-gold-molybdenum association in the assays is typical of Andean porphyry deposits. The variable grades and thicknesses reported in different drill holes indicate a need for detailed geological modeling to understand the distribution and controls on high-grade zones within the broader mineralized envelope.

Solaris Resources' latest drilling results could have positive implications for the company's valuation. The expansion of mineralization beyond the current MRE boundaries suggests potential for increased resource tonnage, which could translate to a longer mine life or higher production rates in future economic studies.

The company's listing on both TSX and NYSE provides good liquidity and access to capital markets, which is important for funding ongoing exploration and development. The high-grade, near-surface intercepts are particularly significant from an economic perspective, as they could positively impact future open-pit mine designs and reduce stripping ratios.

However, investors should be aware that commodity price fluctuations, particularly in copper, will significantly influence the project's economics. Additionally, the costs associated with the extensive drilling program and future development expenses will need to be carefully managed. While these results are promising, the path from exploration success to profitable production is long and capital-intensive in the mining sector.

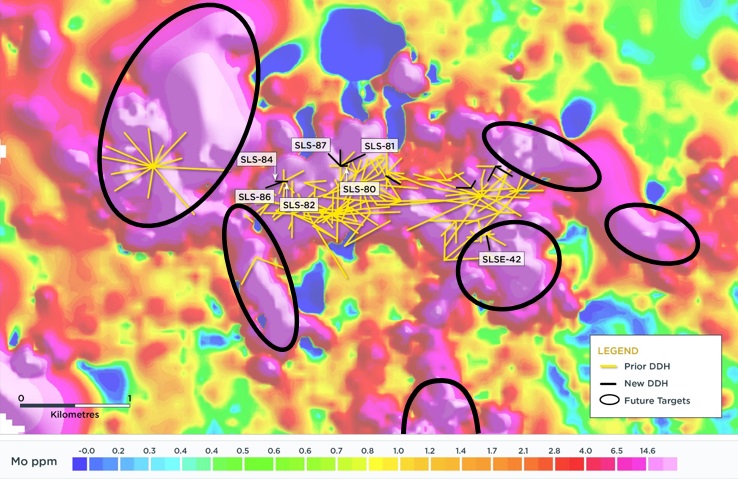

VANCOUVER, British Columbia, Aug. 15, 2024 (GLOBE NEWSWIRE) -- Solaris Resources Inc. (TSX: SLS; NYSE: SLSR) (“Solaris” or the “Company”) is pleased to report drill results from its ongoing 60,000m and 8-rig drilling program at its Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador. Highlights are listed below with detailed results in Figure 1 and Tables 1-2.

Highlights

Additional drilling has extended near surface, high-grade mineralization to the north, northwest and southeast of the Mineral Resource Estimate (“MRE¹”). Ongoing drilling continues to focus on open lateral extensions of mineralization with infill drilling aimed at upgrading mineral resources and converting waste. The primary open vectors are to the northwest, southwest and to the southeast.

A series of holes from a step-out platform extended mineralization to the northwest with high-grades from near surface. Mineralization in this direction comes into contact with a tabular granodiorite unit that separates and underlies the Central deposit from Warintza West and a large, undrilled molybdenum soil anomaly to the northwest.

- SLS-86 (drilled southwest): 57m of

1.11% CuEq² within 105m of0.88% CuEq² from near surface - SLS-84 (drilled west): 69m of

0.82% CuEq² within 102m of0.64% CuEq² from near surface - SLS-82 (drilled east): 69m of

0.77% CuEq² within 249m of0.38% CuEq² from surface

The Company has constructed a series of step-out platforms to the northwest to test the potential of this anomaly and the connection to West and Central. Drilling is underway from the first platform, approximately 1.3km northwest of SLS-86. The same approach is being taken with step-out platforms to the southwest. These represent opportunities for a major expansion of the MRE in a significantly enlarged pit.

Extensional drilling collared on the northern limit of the MRE has extended mineralization to the north, while infill drilling in hole SLS-83 has converted waste within the pit:

- SLS-87 (drilled northwest): 33m of

0.81% CuEq² within 114m of0.38% CuEq² from surface - SLS-81 (drilled northeast): 165m of

0.54% CuEq² within 327m of0.33% CuEq² from surface - SLS-80 (drilled east): 191m of

0.43% CuEq² from near surface

Extensional drilling in the southeast sector has extended mineralization to the south where it remains opens for approximately 600m within a large 0.8km x 0.8km undrilled molybdenum soil anomaly that defines the growth target in this area, with SLSE – 42 returning 300m of

Additional drilling at Warintza East to the northeast encountered low grade mineralization in holes SLSE-37 – 43 that serve to convert undefined waste within the MRE pit shell, with further drilling planned in this direction and to the east.

Complementary district exploration efforts are underway with geotechnical drilling in the Caya-Mateo target area encountering epithermal clay alteration in the sandstone and high temperature alteration in the underlying volcanics. This drilling is expected to provide information to aid in more focused targeting efforts. Fieldwork in the emerging Celestina epithermal gold/silver area continues with the next batch of results expected soon.

Figure 1 – Warintza Drilling and Future Targets

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq² (%) |

| SLS-87 | Aug 15, 2024 | 0 | 114 | 114 | 0.23 | 0.02 | 0.05 | 0.38 |

| Including | 81 | 114 | 33 | 0.64 | 0.02 | 0.06 | 0.81 | |

| SLS-86 | 54 | 159 | 105 | 0.58 | 0.04 | 0.11 | 0.88 | |

| Including | 60 | 117 | 57 | 0.77 | 0.05 | 0.13 | 1.11 | |

| SLS-85 | 0 | 123 | 123 | 0.12 | 0.02 | 0.04 | 0.23 | |

| Including | 102 | 123 | 21 | 0.41 | 0.01 | 0.03 | 0.51 | |

| SLS-84 | 54 | 156 | 102 | 0.38 | 0.04 | 0.07 | 0.64 | |

| Including | 54 | 123 | 69 | 0.52 | 0.04 | 0.10 | 0.82 | |

| SLS-83 | 15 | 265 | 250 | 0.15 | 0.00 | 0.14 | 0.25 | |

| SLS-82 | 0 | 249 | 249 | 0.17 | 0.03 | 0.04 | 0.38 | |

| Including | 48 | 117 | 69 | 0.47 | 0.04 | 0.12 | 0.77 | |

| SLS-81 | 0 | 327 | 327 | 0.20 | 0.02 | 0.04 | 0.33 | |

| Including | 84 | 249 | 165 | 0.35 | 0.03 | 0.04 | 0.54 | |

| SLS-80 | 69 | 260 | 191 | 0.34 | 0.01 | 0.04 | 0.43 | |

| SLSE-43 | 0 | 295 | 295 | 0.13 | 0.01 | 0.02 | 0.18 | |

| SLSE-42 | 0 | 359 | 359 | 0.38 | 0.02 | 0.06 | 0.53 | |

| Including | 21 | 321 | 300 | 0.42 | 0.02 | 0.06 | 0.57 | |

| SLSE-41 | 0 | 258 | 258 | 0.07 | 0.00 | 0.02 | 0.09 | |

| SLSE-40 | 6 | 39 | 33 | 0.13 | 0.00 | 0.02 | 0.16 | |

| SLSE-39 | 60 | 318 | 258 | 0.19 | 0.01 | 0.04 | 0.26 | |

| Including | 60 | 102 | 42 | 0.30 | 0.01 | 0.04 | 0.38 | |

| SLSE-38 | 93 | 152 | 59 | 0.19 | 0.00 | 0.03 | 0.23 | |

| Including | 108 | 132 | 24 | 0.26 | 0.00 | 0.05 | 0.31 | |

| SLSE-37 | 153 | 258 | 105 | 0.12 | 0.02 | 0.02 | 0.23 | |

| Including | 360 | 419 | 59 | 0.11 | 0.02 | 0.01 | 0.21 |

Notes to Table 1: True widths are interpreted to be very close to drilled widths due to the bulk-porphyry style mineralized zones at Warintza.

Table 2 - Collar Locations

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-87 | 800198 | 9648473 | 1338 | 295 | 315 | -60 |

| SLS-86 | 799685 | 9648332 | 1374 | 251 | 250 | -50 |

| SLS-85 | 800199 | 9648475 | 1336 | 274 | 0 | -60 |

| SLS-84 | 799684 | 9648330 | 1374 | 200 | 270 | -69 |

| SLS-83 | 800621 | 9648398 | 1332 | 265 | 120 | -58 |

| SLS-82 | 799682 | 9648329 | 1373 | 302 | 90 | -85 |

| SLS-81 | 800198 | 9648471 | 1339 | 400 | 65 | -52 |

| SLS-80 | 800200 | 9648473 | 1338 | 260 | 90 | -77 |

| SLSE-43 | 801615 | 9648467 | 1104 | 296 | 210 | -60 |

| SLSE-42 | 801528 | 9647849 | 1154 | 360 | 170 | -70 |

| SLSE-41 | 801612 | 9648466 | 1105 | 259 | 120 | -50 |

| SLSE-40 | 801616 | 9648469 | 1104 | 141 | 90 | -75 |

| SLSE-39 | 801385 | 9648268 | 1244 | 318 | 270 | -67 |

| SLSE-38 | 801615 | 9648469 | 1104 | 152 | 0 | -90 |

| SLSE-37 | 801388 | 9648263 | 1243 | 419 | 30 | -80 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Refer to press release dated July 22, 2024. NI 43-101 Technical Report to be released within 45 days of the July 22, 2024 news release and available on the Company's website and Sedar+.

- Copper-equivalence grade calculation for reporting assumes metal prices of US

$4.00 /lb Cu, US$20.00 /lb Mo, and US$1,850 /oz Au, and recoveries of90% Cu,85% Mo, and70% Au based on preliminary metallurgical testwork. CuEq formula: CuEq (%) = Cu (%) + 5.604 × Mo (%) + 0.623 × Au (g/t).

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secure Company facility located on site. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Both ALS Labs and Bureau Veritas lab are independent of Solaris. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. The drillhole data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards. Heliborne magnetic, LIDAR and other layers of data quality for Warintza district exploration were validated by a qualified external professional using data validation procedures under high industry standards. The data has been verified by Jorge Fierro, M.Sc., DIC, PG, using data validation and quality assurance procedures under high industry standards.

Qualified Person

The scientific and technical content of this press release has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Jorge Fierro is a Registered Professional Geologist through the SME (registered member #4279075).

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes a world class copper resource with expansion and discovery potential at its Warintza Project in Ecuador; a series of grass roots exploration projects with discovery potential in Peru and Chile; and significant leverage to increasing copper prices through its

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will” and “expected” and similar expressions are intended to identify forward-looking statements. These statements include statements that ongoing drilling continues to focus on open lateral extensions of mineralization with infill drilling aimed at upgrading mineral resources and converting waste, the primary open vectors are to the northwest, southwest and to the southeast of the Mineral Resource Estimate (“MRE”), the Company has constructed a series of step-out platforms to the northwest to test the potential of this anomaly and the connection to West and Central, drilling is underway from the first platform, approximately 1.3km northwest of SLS-86, the same approach is being taken with step-out platforms to the southwest. These represent opportunities for a major expansion of the MRE in a significantly enlarged pit, extensional drilling in the southeast sector has extended mineralization to the south where it remains opens for approximately 600m within a large 0.8km x 0.8km undrilled molybdenum soil anomaly that defines the growth target in this area, additional drilling at Warintza East to the northeast encountered low grade mineralization in holes SLSE-37 – 43 that serve to convert undefined waste within the MRE pit shell, with further drilling planned in this direction and to the east, complementary district exploration efforts are underway with geotechnical drilling in the Caya-Mateo target area encountering epithermal clay alteration in the sandstone and high temperature alteration in the underlying volcanics, this drilling is expected to provide information to aid in more focused targeting efforts, fieldwork in the emerging Celestina epithermal gold/silver area continues with the next batch of results expected soon. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, readers are cautioned that actual results may vary from the forward-looking statements. The Company has based these forward-looking statements and information on the Company’s current expectations and assumptions about future events including assumptions regarding the exploration and regional programs. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Solaris Management’s Discussion and Analysis, for the year ended December 31, 2023 available at www.sedarplus.ca. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.