Solera National Bancorp Announces First Quarter 2022 Financial Results

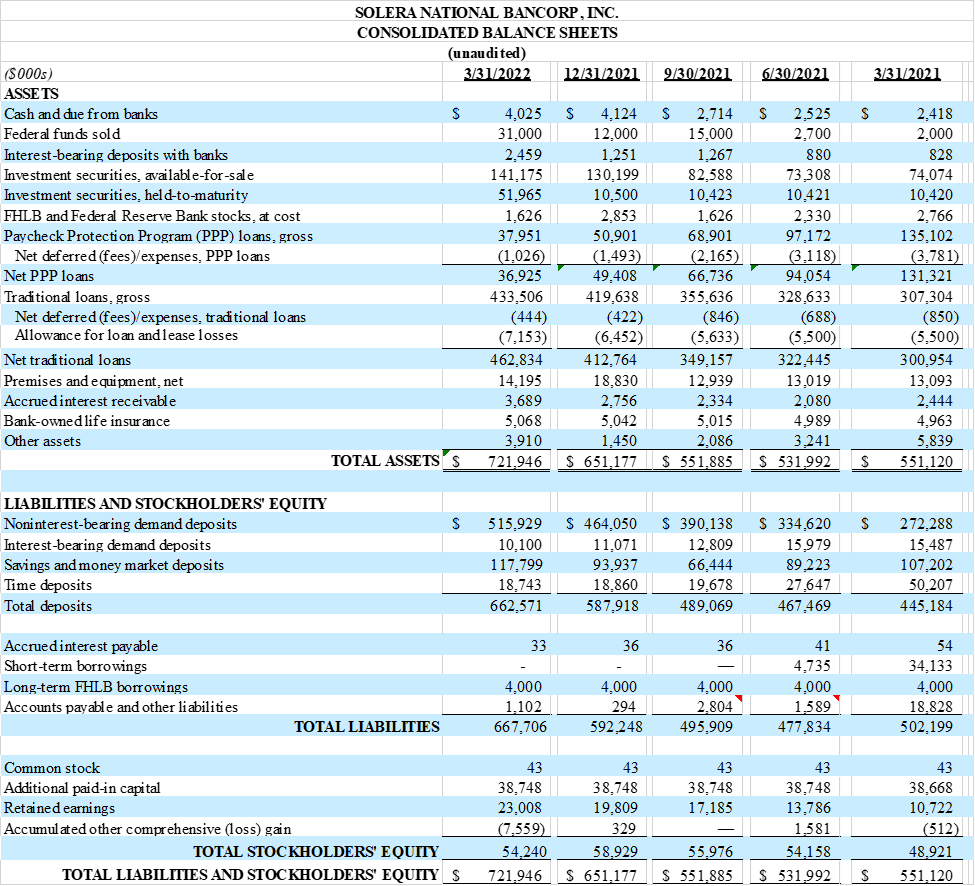

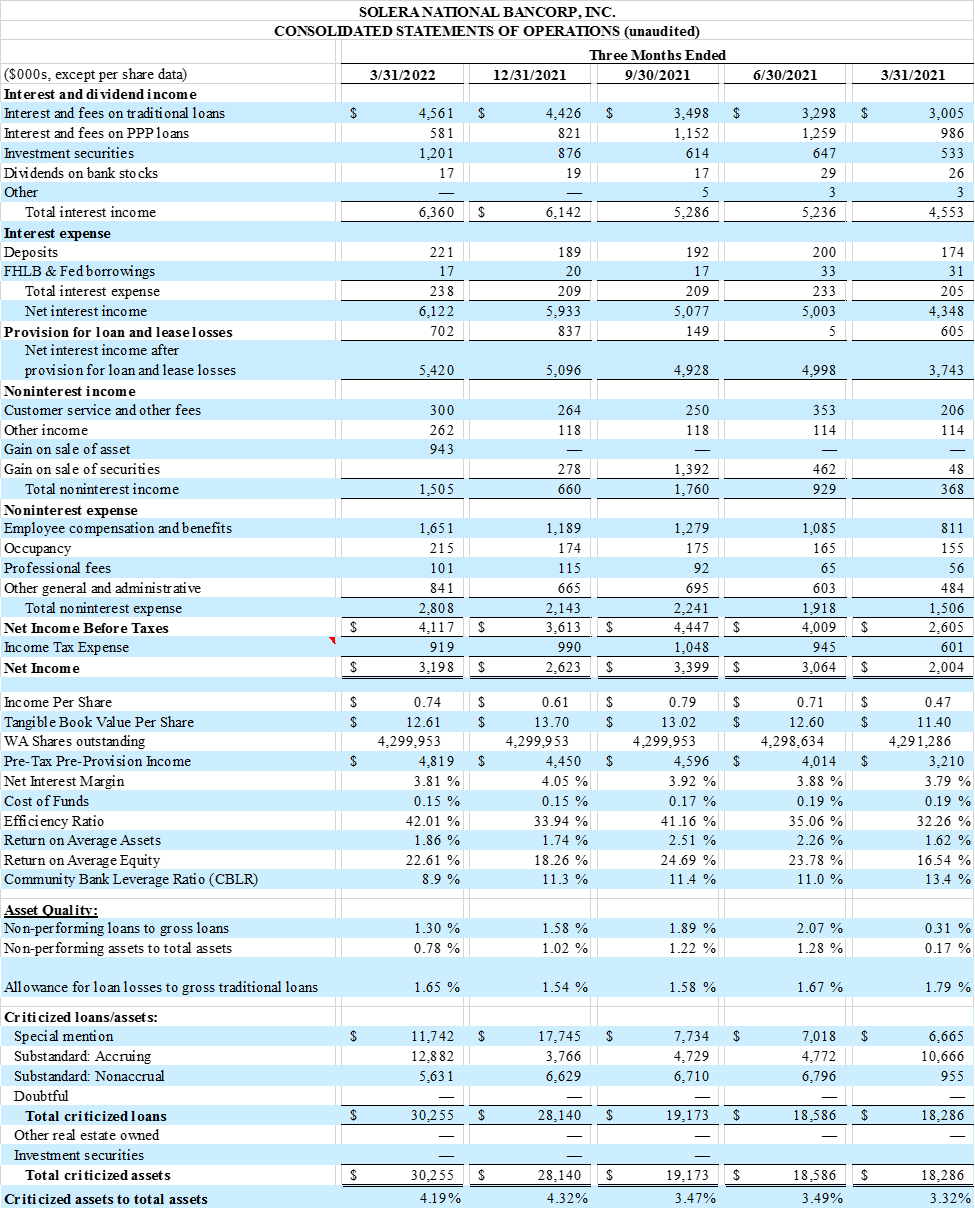

Solera National Bancorp, Inc. (OTC PINK:SLRK) reported a 160% increase in net income for Q1 2022, reaching $3.2 million. The bank achieved record pre-tax earnings of $4.8 million, up from $3.2 million in Q1 2021. Noninterest-bearing deposits surpassed $500 million, reflecting an 89% year-over-year growth. Net interest income surged 141% to $6.1 million, with a strong net interest margin of 3.81%. The tangible book value per share climbed to $12.61. Asset quality remained solid with criticized assets at 4.19%.

- Net income increased by 160% to $3.2 million for Q1 2022.

- Record pre-tax earnings of $4.8 million, compared to $3.2 million in Q1 2021.

- Noninterest-bearing deposits rose to $515.9 million, up 11% quarter-over-quarter and 89% year-over-year.

- Net interest income reached $6.1 million, a 141% increase from Q1 2021.

- Tangible book value per share increased to $12.61.

- Efficiency ratio slightly worsened to 42% from 34% in Q4 2021.

- Criticized assets accounted for 4.19% of total assets.

Insights

Analyzing...

Total Non-Interest Deposits pass

LAKEWOOD, CO / ACCESSWIRE / April 29, 2022 / Solera National Bancorp, Inc. (OTC PINK:SLRK) ("Company"), the holding company for Solera National Bank ("Bank"), a business-focused bank located in the Denver metropolitan area, today reported financial results for the three months ended March 31, 2022. For the first quarter of 2022, net income was

1Q22 Financial Highlights

(Comparison to 1Q21 unless otherwise noted)

- The Company had record pre-tax and pre-provision earnings of

$4.8 million in the first quarter of 2022 compared to$3.2 million in the first quarter of 2021. - Noninterest-bearing deposits rose

11% during the quarter to$515.9 million , which is a$51.9 million increase over the previous quarter and an89% or$243.6 million increase from March 31, 2021. - Net interest income of

$6.1 million for first quarter 2022 represents a141% increase over the$4.3 million earned in the first quarter 2021. - Tangible book value per share reached

$12.61 per share as of March 31, 2022 compared to$11.40 per share as of March 31, 2021. - The Company's impressive efficiency ratio of

42% increased slightly from34% from the fourth quarter 2021. - Net interest margin ended at

3.81% as of March 31, 2022. - Asset quality remained strong with a modest level of criticized assets of

4.19% of total assets and nonperforming assets of0.78% of total assets as of March 31, 2022.

For the three months ended March 31, 2022, the Company reported net income of

Michael Quagliano, Executive Chairman of the Board, commented: "The Company hit a record for our pre-tax and pre-provision income at

Jordan Wright, Vice Chairman of the Board, commented: "The Bank is obviously highly performant and we are just scratching the surface on the tech side of the business that will allow us to scale, improve margin and support future growth."

Cheri Walz, CFO, commented: "We started off 2022 with strong financial performance, we grew our noninterest-bearing deposits a record

About Solera National Bancorp, Inc.

Solera National Bancorp, Inc. was incorporated in 2006 to organize and serve as the holding company for Solera National Bank, which opened for business in September 2007. Solera National Bank is a community bank serving the needs of emerging businesses and real estate investors. At the core of Solera National Bank is welcoming, attentive and respectful customer service, a focus on supporting a growing and diverse economy, and a passion to serve our community through service, education and volunteerism. For more information, please visit http://www.SoleraBank.com.

This press release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this release, which are not historical facts and that relate to future plans or projected results of Solera National Bancorp, Inc. and its wholly-owned subsidiary, Solera National Bank, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. We undertake no obligation to update or revise any forward-looking statement. Readers of this release are cautioned not to put undue reliance on forward-looking statements.

Contacts:

Cheri Walz, EVP & CFO (720) 764-9090

FINANCIAL TABLES FOLLOW

SOURCE: Solera National Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/699590/Solera-National-Bancorp-Announces-First-Quarter-2022-Financial-Results