Soluna Holdings Reports Strong Adjusted EBITDA and Q2’24 Results

(Graphic: Business Wire)

John Belizaire, CEO of Soluna, said, “I am honored to lead such a resilient team. This year's quarterly results show a markedly different company with many opportunities ahead. We have now successfully implemented all of our revenue diversification strategies and I am proud that the results are beginning to show and that we have achieved significant project milestones this quarter.”

Belizaire said, “Our venture into AI, the construction phase of Dorothy 2, the development of Project Kati, and the continued development of our 2 GW pipeline represents the next frontier of growth for our enterprise.”

Finance and Operational Highlights:

-

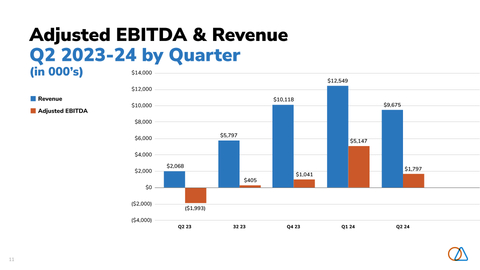

Strong Revenue – Revenue increased by

362% to$9.7 million $2.1 million -

Operating loss – Operating loss significantly improved to

$3.7 million 48% reduction from the$7.1 million -

Strong Adjusted EBITDA – Adjusted EBITDA (non-GAAP) ramped to

$1.8 million $2.0 million $3.8 million -

Strong Cash Growth – Unrestricted cash increased

50% from the end of 2023, reaching$9.6 million - HP Enterprise Partnership – Soluna has partnered with Hewlett Packard Enterprise to launch Soluna Cloud. By utilizing Soluna Cloud, enterprise customers can rapidly deploy AI workloads on a more sustainable and scalable platform, made possible by renewable energy, direct liquid cooling (DLC), and waste-heat recovery.

-

Signed Definitive Power Purchase Agreement with EDF Renewables – Project Kati is Soluna’s second Renewable Computing data center project in

Texas . It will be co-located at a wind facility owned by EDF Renewables and Masdar. Project Kati will be executed in two phases, with each phase delivering 83 MW of renewable energy capacity to power high-performance computing applications, including Bitcoin Hosting and AI. -

Completed Spring Demand Response Period and Began Summer Period – As part of its Demand Response Plan, Soluna has earned

$1.2 million -

Reduced Convertible Debt – Driven by strong share price momentum and trading volume, Convertible Note Holders reduced their principal balance through conversions from

$7.7 million $5.3 million

Financial Summary:

Key financial results for the second quarter include:

-

The strong second-quarter revenue of

$9.7 million 22% revenue decrease compared to the first quarter of 2024, despite the challenges posed by the Bitcoin halving in April, which drove the lower Adjusted EBITDA, as expected. The second quarter resulted in a revenue increase of362% compared to the second quarter of 2023. -

Cryptocurrency Mining Revenue increased by

$3.6 million -

Data Hosting Revenue increased by approximately

$3.7 million -

Adjusted EBITDA of

$1.8 million $2.0 million $1.8 million $3.8 million

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||

Second Quarter 2024 |

||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| Project Dorothy 1B | Project Dorothy 1A | Project Sophie | Project Marie | Other | Total | |||||||||||||

| Cryptocurrency mining revenue | $ | 4,484 |

$ | - |

$ | - |

$ | - |

$ | - |

$ | 4,484 |

||||||

| Data hosting revenue | - |

3,567 |

1,331 |

- |

- |

4,898 |

||||||||||||

| Demand response services | - |

- |

- |

- |

293 |

293 |

||||||||||||

| Total revenue | $ | 4,484 |

$ | 3,567 |

$ | 1,331 |

$ | - |

$ | 293 |

$ | 9,675 |

||||||

| Cost of cryptocurrency mining, exclusive of depreciation | $ | 1,883 |

$ | - |

- |

- |

- |

1,883 |

||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

1,758 |

418 |

- |

- |

2,176 |

||||||||||||

| Cost of revenue- depreciation | 1,073 |

282 |

151 |

- |

- |

1,506 |

||||||||||||

| Total cost of revenue | $ | 2,956 |

$ | 2,040 |

$ | 569 |

$ | - |

$ | - |

$ | 5,565 |

||||||

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||

Second Quarter 2023 |

||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| Project Dorothy 1B | Project Dorothy 1A | Project Sophie | Project Marie | Other | Total | |||||||||||||

| Cryptocurrency mining revenue | $ | - |

$ | - |

$ | 915 |

$ | - |

$ | - |

$ | 915 |

||||||

| Data hosting revenue | - |

456 |

692 |

- |

5 |

1,153 |

||||||||||||

| Demand response services | - |

- |

- |

- |

- |

- |

||||||||||||

| Total revenue | $ | - |

$ | 456 |

$ | 1,607 |

$ | - |

$ | 5 |

$ | 2,068 |

||||||

| Cost of cryptocurrency mining, exclusive of depreciation | $ | 224 |

$ | - |

936 |

- |

- |

1,160 |

||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

508 |

251 |

- |

- |

759 |

||||||||||||

| Cost of revenue- depreciation | 14 |

185 |

332 |

8 |

- |

539 |

||||||||||||

| Total cost of revenue | $ | 238 |

$ | 693 |

$ | 1,519 |

$ | 8 |

$ | - |

$ | 2,458 |

||||||

-

Gross Profit improved by

$4.5 million $390 thousand $4.1 million

-

Gross profit for the second quarter of 2024 compared to the first quarter of 2024 decreased by

$2.8 million $2.9 million

-

General and administrative expenses, excluding depreciation and amortization for the second quarter of 2024 increased by approximately

$1.3 million 32% over the second quarter of 2023 - to$5.4 million $4.1 million

The unaudited financial statements are available online, here. A presentation of this Second Quarter Update can also be found online, here.

___

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the

In addition to figures prepared in accordance with GAAP, Soluna from time to time presents alternative non-GAAP performance measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss, adjusted earnings per share, free cash flow. These measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global superpower using computing as a catalyst. The company designs, develops and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna’s pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications including Bitcoin Mining, Generative AI, and other compute intensive applications. Soluna’s proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions, and superior returns. To learn more visit solunacomputing.com. Follow us on X (formerly Twitter) at @SolunaHoldings.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240815547957/en/

John Tunison

Chief Financial Officer

Soluna Holdings, Inc.

jtunison@soluna.io

Source: Soluna Holdings, Inc.