SolGold PLC - SolGold Early Production Open Pit Strategy

SolGold (LSE:SOLG)(TSX:SOLG) has announced plans to investigate early production opportunities through open-pit and sub-level caving at its Cascabel project. The company will initiate a targeted drilling program at the Tandayama resource area, consisting of 5,400 metres across 11 priority holes and up to 15 holes total, with a budget of US$3.25m.

The drilling program, scheduled to begin in early May 2025, will employ three drilling rigs to establish measured and indicated resources, define near-surface mineralization limits, and test for open pittable resources. The program is expected to take three months, with assay results available one month later.

The drilling strategy includes setting two rigs for 6 priority holes on the southern pit 1, one rig on pit 2 in the north for 4 priority holes, and two additional holes planned for the zone between pits 1 and 2. The company is also exploring potential at nearby tenements, including Aguinaga and Blanca Nieves, while working with G Mining Services on various trade-off studies to enhance project efficiency.

SolGold (LSE:SOLG)(TSX:SOLG) ha annunciato l'intenzione di esplorare opportunità di produzione anticipata tramite miniere a cielo aperto e sub-level caving nel suo progetto Cascabel. L'azienda avvierà un programma di perforazione mirato nell'area di risorse Tandayama, che prevede 5.400 metri distribuiti su 11 fori prioritari e fino a un massimo di 15 fori, con un budget di 3,25 milioni di dollari USA.

Il programma di perforazione, previsto per l'inizio di maggio 2025, utilizzerà tre trivelle per stabilire risorse misurate e indicate, definire i limiti della mineralizzazione superficiale e verificare la presenza di risorse estraibili a cielo aperto. La durata stimata è di tre mesi, con risultati delle analisi disponibili un mese dopo la conclusione.

La strategia di perforazione prevede l'impiego di due trivelle per 6 fori prioritari nella cava 1 a sud, una trivella nella cava 2 a nord per 4 fori prioritari e due fori aggiuntivi previsti nella zona tra le cave 1 e 2. L'azienda sta inoltre esplorando potenziali nelle concessioni vicine, tra cui Aguinaga e Blanca Nieves, collaborando con G Mining Services su diversi studi di compromesso per migliorare l'efficienza del progetto.

SolGold (LSE:SOLG)(TSX:SOLG) ha anunciado planes para investigar oportunidades de producción temprana mediante minería a cielo abierto y subnivel en su proyecto Cascabel. La compañía iniciará un programa de perforación dirigido en el área de recursos Tandayama, que consistirá en 5,400 metros repartidos en 11 perforaciones prioritarias y hasta 15 perforaciones en total, con un presupuesto de 3.25 millones de dólares estadounidenses.

El programa de perforación, programado para comenzar a principios de mayo de 2025, empleará tres equipos de perforación para establecer recursos medidos e indicados, definir los límites de mineralización cercana a la superficie y evaluar recursos explotables a cielo abierto. Se espera que el programa dure tres meses y que los resultados de los análisis estén disponibles un mes después.

La estrategia de perforación incluye asignar dos equipos para 6 perforaciones prioritarias en la fosa 1 al sur, un equipo en la fosa 2 al norte para 4 perforaciones prioritarias, y dos perforaciones adicionales planeadas en la zona entre las fosas 1 y 2. La compañía también explora potencial en concesiones cercanas, incluyendo Aguinaga y Blanca Nieves, mientras colabora con G Mining Services en varios estudios de compensación para mejorar la eficiencia del proyecto.

SolGold (LSE:SOLG)(TSX:SOLG)는 Cascabel 프로젝트에서 노천 채굴과 서브레벨 케이빙을 통한 조기 생산 기회를 조사할 계획을 발표했습니다. 회사는 Tandayama 자원 지역에서 목표 시추 프로그램을 시작할 예정이며, 11개의 우선 구멍에 걸쳐 총 5,400미터, 최대 15개 구멍을 시추하며 예산은 325만 달러입니다.

2025년 5월 초 시작 예정인 시추 프로그램은 세 대의 시추 장비를 사용하여 측정 및 표시 자원을 확립하고, 지표 근처 광물화 한계를 정의하며, 노천 채굴 가능한 자원을 시험할 예정입니다. 프로그램은 약 3개월간 진행되며, 분석 결과는 한 달 후에 나올 예정입니다.

시추 전략은 남쪽 1번 광구에서 우선 구멍 6개를 위해 두 대의 장비를 배치하고, 북쪽 2번 광구에서 우선 구멍 4개를 위해 한 대의 장비를 배치하며, 1번과 2번 광구 사이 지역에 추가로 두 개의 구멍을 계획하고 있습니다. 회사는 또한 Aguinaga와 Blanca Nieves를 포함한 인근 광구에서 잠재력을 탐색 중이며, 프로젝트 효율성을 높이기 위해 G Mining Services와 다양한 트레이드오프 연구를 진행하고 있습니다.

SolGold (LSE:SOLG)(TSX:SOLG) a annoncé son intention d'explorer des opportunités de production précoce via des exploitations à ciel ouvert et par sub-level caving sur son projet Cascabel. La société lancera un programme de forage ciblé dans la zone de ressources Tandayama, comprenant 5 400 mètres répartis sur 11 trous prioritaires et jusqu'à 15 trous au total, avec un budget de 3,25 millions de dollars US.

Le programme de forage, prévu pour début mai 2025, utilisera trois foreuses afin d'établir des ressources mesurées et indiquées, de définir les limites de la minéralisation proche de la surface, et de tester les ressources exploitables en ciel ouvert. Le programme devrait durer trois mois, avec les résultats des analyses disponibles un mois plus tard.

La stratégie de forage comprend l'installation de deux foreuses pour 6 trous prioritaires dans la fosse 1 au sud, une foreuse dans la fosse 2 au nord pour 4 trous prioritaires, ainsi que deux trous supplémentaires prévus dans la zone entre les fosses 1 et 2. La société explore également le potentiel des concessions voisines, notamment Aguinaga et Blanca Nieves, tout en collaborant avec G Mining Services sur diverses études d'arbitrage pour améliorer l'efficacité du projet.

SolGold (LSE:SOLG)(TSX:SOLG) hat Pläne angekündigt, frühe Produktionsmöglichkeiten durch Tagebau und Untertagebau mittels Sub-Level Caving in seinem Cascabel-Projekt zu untersuchen. Das Unternehmen wird ein gezieltes Bohrprogramm im Ressourcengebiet Tandayama starten, das 5.400 Meter über 11 Prioritätsbohrlöcher und insgesamt bis zu 15 Bohrlöcher umfasst, mit einem Budget von 3,25 Millionen US-Dollar.

Das Bohrprogramm, das Anfang Mai 2025 beginnen soll, wird drei Bohrgeräte einsetzen, um gemessene und angezeigte Ressourcen zu ermitteln, die Grenzen der oberflächennahen Mineralisierung festzulegen und nach abbauwürdigen Ressourcen im Tagebau zu suchen. Das Programm soll drei Monate dauern, die Analyseergebnisse werden einen Monat später erwartet.

Die Bohrstrategie sieht vor, zwei Bohrgeräte für 6 Prioritätsbohrlöcher im südlichen Tagebau 1 einzusetzen, ein Bohrgerät im nördlichen Tagebau 2 für 4 Prioritätsbohrlöcher und zwei zusätzliche Bohrlöcher in der Zone zwischen Tagebau 1 und 2 zu planen. Das Unternehmen erkundet zudem Potenziale in nahegelegenen Konzessionen, darunter Aguinaga und Blanca Nieves, und arbeitet mit G Mining Services an verschiedenen Abwägungsstudien zur Verbesserung der Projekteffizienz.

- Early production strategy could accelerate revenue generation

- US$3.25m funded drilling program to establish new measured and indicated resources

- Multiple potential deposits identified for development (Tandayama, Aguinaga, Blanca Nieves)

- Working with G Mining Services on efficiency improvements for mining, milling, and metallurgical recoveries

- Additional capital expenditure required for drilling program

- Results and economic viability of early production strategy still uncertain

- Three-month drilling program plus one month for assays indicates no immediate production

SolGold to target early production open pit strategy to expedite production at Cascabel

BISHOPSGATE, LONDON / ACCESS Newswire / April 15, 2025 / SolGold plc ("SolGold" or "the Company") (LSE:SOLG)(TSX:SOLG) announces that as part of SolGold's previously announced re-set strategy it is investigating options for early production from open-pit and sub-level caving opportunities in and around Cascabel.

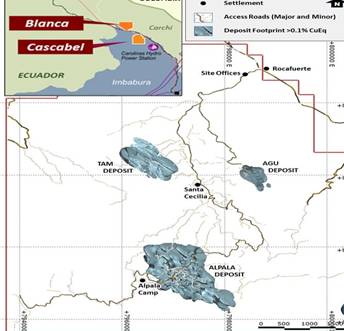

The map below (Figure 1) shows SolGold's nearby targets around the Alpala deposit. The Tandayama deposit is one of a few deposits that has the potential to significantly de-risk the project in the early years ahead of full production at the Alpala deposit. The intention over the coming years, in parallel with completing a detailed feasibility study is to ensure that the potential of nearby tenements, Aguinaga and Blanca Nieves are assessed and understood.

Tandayama Drilling Program

As a first step in the plan, the Company has resolved to conduct a targeted drill program of 5,400 metres over 11 priority holes and up to 15 holes in total, which is budgeted at US

The program is expected to commence in early May 2025, utilising three drilling rigs to establish resources in the measured and indicated categories, define limits to near surface mineralisation, and test for open pittable at or near surface resources on which expedited open pit mining activities may be commenced. The program is expected to take approximately three months with assay results available a month later.

The program will entail:

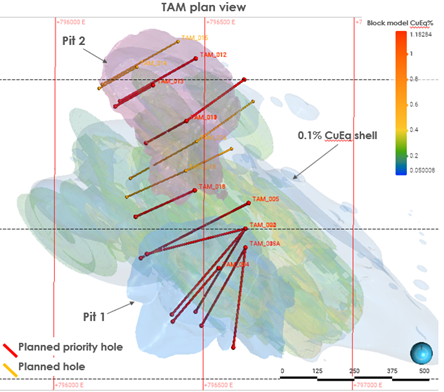

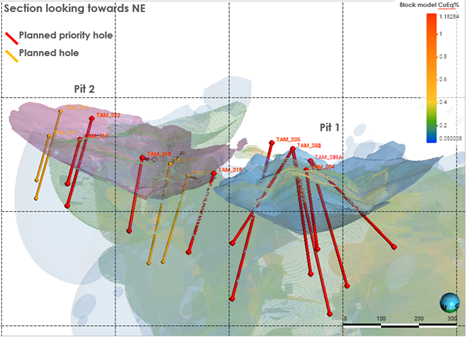

(A) Setting two rigs for 6 priority holes on the southern pit 1 (Figures 2 and 3);

(B) Locating one rig on pit 2 in the north, to drill 4 priority holes to test the mineralisation, which is open to the north, west and northwest. Then, 6 more holes to follow to complete pit 2 (Figures 2 and 3); and

(C) Two holes are planned for the zone between pits 1 and 2, where is some speculation that the mineralised zone may join between pits 1 and 2 (Figures 2 and 3).

Chief Executive Officer, Dan Vujcic commented:

"The Tandayama drilling plan is part of SolGold's intention of improving the Cascabel development plan. The ability to bring forward production greatly enhances the financeability and thereby value of the project, especially in the new metal price environment. SolGold is working closely with study manager G Mining Services on various trade off studies to potentially expedite the Cascabel project, particularly in the areas of tails and waste rock management, power supply and improving underground access, mining and milling efficiencies and metallurgical recoveries."

CONTACTS

Dan Vujcic Chief Executive Officer | Tel: +44 (0) 20 3807 6996 |

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition and development of world-class copper and gold deposits and continues to strive to deliver objectives efficiently and in the interests of shareholders.

SolGold completed and released a staged development plan Pre Feasibility Study on 16 February 2024. The study, completed at US

On 15 July 2024, SolGold announced a gold stream agreement with Franco Nevada and Osisko Royalties (the "Streamers") pursuant to which the Streamers would pay US

SolGold continues to advance de-risking programs, permitting and financing discussions and to reevaluate the project at recent consensus prices for copper and gold.

On 28 October 2024, SolGold appointed G-Mining Services to be the Project Manager for the Feasibility Study.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange and Toronto Stock Exchange (LSE/TSX: SOLG).

See www.solgold.com.au for more information. Follow us on X @SolGold_plc.

Qualified Person

The scientific and technical disclosure included in this news release has been reviewed and approved by Mr Santiago Vaca (M.Sc. P.Geo.), Chief Geologist for the Cascabel project, a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The basis for the scientific and technical information included in this news release is a technical report dated 8 March 2024 and titled "NI 43-101 Technical Report on Pre-feasibility Study for the Cascabel Project, Imbabura Province, Ecuador" (the "PFS Technical Report"), which can be found on the Company's website at https://solgold.com.au/projects/ecuador/cascabel-project/ and on SEDAR+ under the Company's issuer profile at www.sedarplus.ca. Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements, and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time expenditure, metals prices and other affecting circumstances.

This release may contain "forward looking information". Forward looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

SolGold plc UK Company No. 5449516 ARBN 117 169 856 Email:info@solgold.com.au Website: www.solgold.com.au

Corporate Postal Office: PO Box 7059, Cloisters Square PO, Perth, WA 6850 Australia

Registered office: 1 Cornhill, London, EC3V 3ND, UK Phone: +44 (0) 20 3807 6996

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: SolGold PLC

View the original press release on ACCESS Newswire