SolGold PLC Announces Release of FY24 Annual Report and Accounts

Rhea-AI Summary

SolGold PLC has released its Annual Report and Accounts for the fiscal year ended June 30, 2024, highlighting significant progress in advancing its flagship Cascabel Project. Key achievements include:

1. An updated Pre-Feasibility Study (PFS) in March 2024, showing robust economics with an after-tax NPV of $3.2 billion and IRR of 24%.

2. Securing an Exploitation Contract in June 2024, granting development and operation rights for 33 years.

3. A $750 million Gold Stream Agreement with Franco-Nevada and Osisko Gold Royalties.

The company's focus for FY2025 includes advancing Cascabel, exploring additional financing opportunities, maintaining high environmental and social governance standards, and assessing strategic partnerships for its Ecuadorian exploration portfolio.

Positive

- Updated Pre-Feasibility Study shows robust project economics with $3.2 billion NPV and 24% IRR

- Secured 33-year Exploitation Contract for Cascabel Project development

- $750 million Gold Stream Agreement signed, strengthening financial position

- Optimized phased development approach reduced initial capital requirements from $2.7 billion to $1.55 billion

- Current metal spot prices exceed PFS assumptions, potentially improving project economics

Negative

- Significant capital still required to fully finance the Cascabel Project development

News Market Reaction 1 Alert

On the day this news was published, SLGGF declined 2.62%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

BISHOPSGATE, LONDON / ACCESSWIRE / September 27, 2024 / The Board of Directors of SolGold (LSE:SOLG)(TSX:SOLG) is pleased to announce the release of the Annual Report and Accounts for the year ended 30 June 2024, which details significant progress and key milestones that position the Company to advance the development of its flagship Cascabel Project ("Cascabel" or the "Project"). The Annual Report and Accounts are available on the Company's website athttps://solgold.com.au/.

2024: A Year of Transformative Progress

Fiscal 2024 was a pivotal year for SolGold, marked by strategic advancements that continue to de-risk and advance the Cascabel Project. Key achievements include:

Updated Pre-Feasibility Study (PFS) (March 2024):The study highlighted robust Project economics, with an after-tax NPV (

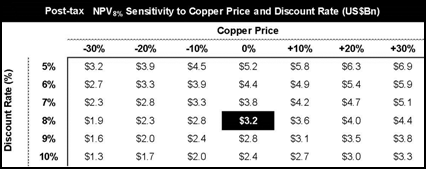

8% ) of US$3.2 billion and an IRR of24% , based on metal prices of US$3.85 /lb Cu, US$1,750 /oz Au, and US$22.50 /oz Ag. The optimized phased development approach also reduced initial capital requirements from US$2.7 billion to US$1.55 billion . Notably, as of the week of September 22, 2024, spot prices have exceeded US$4.60 /lb Cu, US$2,700 /oz Au, and US$32.00 /oz Ag. As a reference, the sensitivity tables from the PFS are provided below:1,2

Exploitation Contract Secured (June 2024):A landmark agreement with the Ecuadorian government granting the right to develop and operate the Cascabel Project for 33 years, which may be renewed.The current contract covers only the period defined in the PFS, which accounts for just

18% of the total project resources identified to date. The Exploitation Contract and existing legislation and regulations establish the legal and financial terms and conditions required for the Cascabel Project's development.3US

$750 million Gold Stream Agreementwith Franco-Nevada and Osisko Gold Royalties (signed shortly after the fiscal year-end) reflects the culmination of our financing efforts and reinforces SolGold's ability to advance Cascabel while preserving long-term value for shareholders.4

Additionally, SolGold strengthened its governance framework with the appointment of three new non-executive directors and continued its commitment to environmental stewardship, community engagement, and operational efficiency.

Coming Ahead:

Looking ahead to fiscal year 2025, SolGold will build on the successes of FY2024 by focusing on the following strategic priorities:

Advancing the Cascabel Project: With a solid financial foundation and de-risked development plan, the Company will continue critical technical studies and progress towards obtaining necessary permits for development.

Project Financing: SolGold will continue to explore additional conditional financing opportunities to secure the remaining capital needed to make Cascabel a turn-key project.

Sustainability and Stakeholder Engagement: The Company remains dedicated to maintaining the highest environmental and social governance standards as it advances critical projects, including continuing its reforestation and water recycling initiatives.

Strategic & Growth Initiatives: SolGold will continue to assess strategic opportunities for joint ventures or partnerships across its broader Ecuadorian exploration portfolio while strongly focusing on Cascabel as the cornerstone of its growth strategy.

Scott Caldwell, President and CEO, stated,"2024 was a year of critical achievements for SolGold, with major milestones that significantly advanced the Cascabel Project and strengthened our financial position. I want to thank our dedicated team, partners, the Ecuadorian government, and local communities for their continued support as we work toward responsible development. Looking ahead, we remain focused on creating sustainable value for our stakeholders while upholding the highest standards of environmental and social responsibility."

For Canadian purposes, the Company has filed its audited financial statements, Management Discussion and Analysis ("MD&A") and Annual Information Form ("AIF") for the year ended 30 June 2024 on SEDAR+ (www.sedarplus.ca).

The Annual Report and Accounts for the year ended 30 June 2024, the AIF and the MD&A are available on the Company's website: https://solgold.com.au/.

The financial statements were approved and authorised for issue by the Board and were signed on its behalf on 26 September 2024.

Endnotes

1. Refer to news releases dated 16 February 2024 on SEDAR+ and the Company's website. Link: 2024-02-16 Release

2. Refer to news releases dated 12 March 2024 on SEDAR+ and the Company's website. Link: 2024-03-12 Release

3. Refer to news releases dated 06 June 2024 on SEDAR+ and the Company's website. Link:2024-06-06 Release

4. Refer to news releases dated 15 July 2024 on SEDAR+ and the Company's website. Link: 2024-07-15 Release

Certain information contained in this announcement would have been deemed inside information.

This announcement has been approved for release by Scott Caldwell, Chief Executive Officer.

CONTACTS Chris Robinson Director of Corporate Operation & Communications | Tel: +44(0) 20 3807 6996 |

Tavistock (Media) Jos Simson/Gareth Tredway | Tel: +44 (0) 20 7920 3150 |

ABOUT SOLGOLD

About SolGold: SolGold is a leading exploration company focused on the discovery and definition of world-class copper-gold deposits. The Company holds a portfolio of exploration projects in Ecuador. SolGold's primary objective is to discover and develop ecological copper and gold deposits through a disciplined exploration approach led by an experienced management team.

SolGold is listed on the London Stock Exchange and Toronto Stock Exchange (LSE/TSX: SOLG).

See www.solgold.com.au for more information. Follow us on X @SolGold_plc.

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements; and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time expenditure, metals prices and other affecting circumstances.

This release may contain "forward looking information". Forward looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: SolGold PLC

View the original press release on accesswire.com