SolGold PLC Announces Completion of New Cascabel Pre-Feasibility Study

- Reduced initial capital expenditure by $1bn compared to previous estimates.

- Potential for accelerated cash flow and project development.

- Efficient utilization of only 18% of the Alpala mineral resource, indicating multi-generational mining potential.

- Strong focus on sustainable mining practices and renewable energy integration.

- CEO emphasizes commitment to sustainability, innovation, and stakeholder value.

- Project showcases a 24% internal rate of return, $3.2bn after-tax NPV8%, and a 4-year payback period.

- Initial 28-year mine plan includes significant copper, gold, and silver production.

- Phased Approach Block Cave Mine strategy reduces financial risk and technical challenges.

- Focus on responsible mining practices and environmental impact reduction.

- Integration of renewable energy sources into the project's energy supply strategy.

- None.

Announces Successful Completion of New Cascabel Pre-Feasibility Study with

Significantly Reduced Initial Capital Cost and

$5.4b n pre-tax Net Present Value ("NPV8% ") and33% internal rate of return ("IRR")$3.2b n after-tax NPV8% ,24% IRR and 4-year payback period from the start of processing[1]- Average production[2] of 123ktpa of copper, 277kozpa of gold and 794kozpa of silver - 182ktpa copper equivalent ("CuEq")[3] - with peak[4] copper production of 216ktpa (370ktpa CuEq)

- Pre-production capital of

$1.55b n for the initial mine development, first process plant module and infrastructure 85% of Mineral Reserves are classified as Proven in updated Mineral Reserve Estimate- Initial 28-year mine plan of 540Mt containing 3.2Mt Cu @

0.60% , 9.4Moz Au @ 0.54 g/t and 28Moz Ag @ 1.62 g/t based on the updated Mineral Reserve Estimate[5] - The Project economics have been calculated based on the economic terms and conditions previously negotiated with the Ecuadorian Government[6]

BISHOPSGATE, UK / ACCESSWIRE / February 16, 2024 / SolGold (LSE:SOLG)(TSX: SOLG) is pleased to announce the successful completion of a new Pre-Feasibility Study ("PFS" or "Study"), prepared in accordance with National Instrument 43-101 ("NI 43-101") that supports a Phased Block Cave Mine at its flagship Cascabel Project ("Cascabel" or "Project") in Ecuador. Cascabel is

Key Highlights of the Pre-Feasibility Study

- Excellent economic viability of a Cascabel Phased Approach Block Cave Mine

- +

$1b n initial capital expenditure savings compared to previous estimates, reflecting efficient project development strategies, lower technical risk attributed to the phased strategy - Potential for accelerated cash flow and project development

- The current Cascabel mine plan reflects the profitable exploitation of only

18% of the Alpala measured and indicated mineral resource through a 28-year mine life - the size of the entire resource indicates the mine's potential to be a multi-generational mining asset - Strong commitment to responsible and sustainable mining practices, including the use of renewable energy (hydropower) and an environmentally conscious Project footprint reduction

Scott Caldwell, SolGold's CEO and President of SolGold Ecuador, commented:

"Cascabel is not just a mining project; it's a promise of responsible mining, lasting value for all stakeholders and a sustainable legacy for the planet. With reduced capital needs and lower risk compared to previous approaches, together with our ongoing commitment to sustainability and responsible mining, Cascabel is more than copper and gold; it's a story of innovation, collaboration and a vision for a greener and more prosperous tomorrow for the people of Ecuador. This Study was conducted with the best outcomes for all our stakeholders in mind."

Summary of Cascabel PFS Results

Table 1: Economic and Operating Summary

| Key PFS Outcomes (US$) | Base Case | |

| Economic Assumptions | Copper ($/lb) |

|

| Gold ($/oz) | ||

| Silver ($/oz) | ||

| Operating Parameters | Throughput | Phase 1: 12Mtpa; Phase 2: 24Mtpa |

| Initial Project LOM | 28 years | |

| Total Ore Mined | 540 Mt | |

| Average Copper Grade / Recovery | ||

| Average Gold Grade / Recovery | 0.54 g/t | | |

| Average Silver Grade / Recovery | 1.62 g/t | | |

| Production | Total CuEq Produced | 4.3 Mt |

| Total Copper Produced | 2.9 Mt | |

| Total Gold Produced | 6.9 Moz | |

| Total Silver Produced | 18.4 Moz | |

| Annual CuEq Production (peak/average) | 370 kt | 182 kt | |

| Annual Copper Production (peak/average) | 216 kt | 123 kt | |

| Annual Gold Production (peak/average) | 734 koz | 277 koz | |

| Annual Silver Production (peak/average) | 1,159 koz | 794 koz | |

| Capital | Pre-production | |

| Post-production | ||

| Operating Costs ($/t processed) | Mining Costs | |

| Processing Costs | ||

| G&A Costs | ||

| Tailings, Port and Infrastructure Costs | ||

| Total Operating Costs | ||

| Cash Costs | LOM Average Net Cash Cost ($/lb Cu) | |

| LOM Average AISC ($/lb Cu) | ||

| Financials | Pre-tax NPV | |

| After-tax NPV | ||

| Capital payback period | 4 years | |

Average Annual Free Cash Flow (first 5 years of production) | ||

| First 10-Years Free Cash Flow Generation | ||

Reduced Initial Capital Expenditure

Compared to previously considered development scenarios, the Phased Approach Block Cave Mine has substantially reduced the initial capital expenditure required to develop Cascabel. This approach optimizes project development by gradually scaling up operations, effectively managing costs and minimizing financial risk.

After a ramp-up period of approximately two years, the initial block cave will achieve a production rate of 12 million tonnes per annum ("Mtpa"). The initial cave will extract high-grade ore, averaging approximately

Lower Technical Risk

The phased development strategy also contributes to a reduction in technical risk. Incrementally advancing the Project provides an opportunity to implement and fine-tune mining and processing methodologies, ensuring a more efficient and stable production process. This approach enhances the Project's overall resilience and minimizes potential challenges associated with large-scale development. A practical height-of-draw for this deposit was determined to be 400m which is considered to be more technically feasible than other alternatives.

Accelerated Cash Flow

The Study's results indicate a strong potential for accelerated cash flow generation. With a reduced initial capital burden and lower technical risk, Cascabel is expected to deliver a quicker path to positive cash flow.

Commitment to Responsible Mining

SolGold remains committed to responsible and sustainable mining practices. The Company's dedication to environmental, social and governance (ESG) standards remains unwavering. Cascabel's development will continue to prioritize minimizing environmental impact, promoting community engagement and ensuring ethical practices throughout the Project's lifecycle.

Integration of Renewable Energy

SolGold is proud to prioritize sustainability and environmental responsibility in the development of the Cascabel Project. The Company is actively integrating renewable energy supplied by governmental and private sources into the Project's energy supply strategy as part of a net zero commitment.

Project Description

Cascabel is located in northern Ecuador approximately a three hours' drive north of Quito, the capital city of Ecuador. Access is via sealed highways through the closest major centre of Ibarra, located approximately 80 km south of the property. Infrastructure in the region and throughout Ecuador is generally of a high standard, with excellent road access, power and water sources readily available in the local area.

Cascabel Project - Alpala Underground: Mineral Resource Estimate ("MRE") #4

Table 2: Cascabel Project Alpala Underground Mineral Resource Estimate (Effective Date November 11, 2023)

Cut-Off Grade (CuEq%) | Resource Category | Tonnage (Mt) | Grade | Contained Metal | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | CuEq (Mt) | Cu (Mt) | Au (Moz) | Ag (Moz) | |||

0.21 | Measured | 1,576 | 0.64 | 0.43 | 0.35 | 1.16 | 10.0 | 6.7 | 17.5 | 58.6 |

Indicated | 1,437 | 0.39 | 0.28 | 0.20 | 0.71 | 5.6 | 4.0 | 9.3 | 32.7 | |

Measured + Indicated | 3,013 | 0.52 | 0.35 | 0.28 | 0.94 | 15.6 | 10.7 | 26.8 | 91.3 | |

Inferred | 607 | 0.36 | 0.26 | 0.19 | 0.56 | 2.2 | 1.5 | 3.7 | 11.0 | |

Notes:

- Dr Arseneau, P. Geo. Associate Consultant with SRK Consulting (Canada) is responsible for this Mineral Resource statement and is an "independent Qualified Person" as such term is defined in NI 43-101.

- Reasonable prospects of eventual economic extraction were assessed by enclosing the mineralised material in the block model estimate in a 3D wireframe shape that was constructed with adherence to a minimum mining unit with geometry appropriate for a block cave.

- The cut-off grade for the shape was defined as the cut-off grade under a breakeven, eventual economic extraction criterion. The cut-off grade of

0.21% CuEq was calculated using (copper grade (%)) + (gold grade (g/t) x 0.683). - All material within this shape was reported in the Mineral Resource statement as block caving is a non-selective method, and all material extracted is treated as mill feed.

- The material inside the shape without a Mineral Resource category was reported as planned dilution.

- The resulting shape contained planned internal and edge dilution that the QP considers appropriate.

- Cut-off inputs included:

- Metal prices of Cu at US

$3.60 /lb and Au at US$1,700 /oz, - Recoveries of Cu

93% and Au83% , - Costs including mining, processing, general and administration (G&A), and off-site realization (TCRC), including royalties.

- Metal prices of Cu at US

- The QP considers that the Mineral Resource has reasonable prospects for eventual economic extraction by an underground mass mining method such as block caving.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Figures may not add up due to rounding.

Cascabel Project - Alpala Underground: Mineral Reserve Estimate

The Mineral Reserves have been estimated for a block caving method and take into account the effect of mixing indicated material with dilution from low-grade or barren material originating from within the caved zone and the overlying cave backs. The Mineral Resources reflected in MRE#4 are inclusive of the Mineral Reserve estimate, which represents only

Table 3: Cascabel Project Alpala Underground Mineral Reserve Estimate

| Mineral Reserve Category | Tonnage (Mt) | Grade | Contained Metal | ||||

Cu (%) | Au (g/t) | Ag (g/t) | Cu (Mt) | Au (Moz) | Ag (Moz) | ||

| Proven | 457.5 | 0.64 | 0.60 | 1.7 | 2.9 | 8.9 | 24.9 |

| Probable | 82.2 | 0.36 | 0.22 | 1.2 | 0.3 | 0.6 | 3.1 |

| Total | 539.7 | 0.60 | 0.54 | 1.6 | 3.2 | 9.4 | 28.0 |

Notes:

- CIM Definition Standards were followed for Mineral Reserves.

- Mineral Reserves for the Cascabel Project have an effective date of December 31, 2023

- The Mineral Reserve reported above was not additive to the Mineral Resource.

- The Mineral Reserve is based on the November 11, 2023 Mineral Resource.

- Totals may not match due to rounding.

- Mineral Reserves are reported using long-term metal prices of US

$1,700 /oz Au, US$3.60 /lb Cu, US$19.90 /oz Ag. - Mineral Reserves are constrained within a block cave design, using the following input parameters: height of draw of 400 m; mixing horizon of 350 m;

15% dilution (at 350 m column height); overall operating cost of US$15.00 /t; metallurgical recoveries that range from 85-92% for copper and 70-81% for gold; a footprint development cost of US$1,750 /m2; cut-off value of US$15.00 /t. - Units are metric tonnes, metric grams, troy ounces and imperial pounds. Gold ounces and copper pounds are estimates of in-situ material and do not account for processing losses.

- The Mineral Reserve Estimate as of 31 December 2023 for Alpala was independently verified by Jarek Jakubec, C.Eng., FIMMM. Mr. Jakubec fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101 and is the Qualified Person under NI 43-101 for the Mineral Reserve.

Mining

Underground mining will utilize the block cave mining method, a low-cost, bulk mining method. After a ramp-up period of approximately two years, the initial cave will achieve a production rate of 12Mtpa. The initial cave will extract high-grade ore, averaging

Ore from the mine will be transported to the underground primary crushers by load haul dump loaders ("LHDs") and crushed to minus 160 mm. The crushed ore will be conveyed directly to the coarse ore stockpile adjacent to the mill at the surface.

Process Plant

Ore will be reclaimed from the coarse ore stockpile and conveyed to a conventional semi-autogenous grinding ball mill crusher ("SABC") circuit. Slurry from the ball mill will be pumped to the flotation circuit, where concentrate will be floated, filtered and stored for transport by truck to the port site concentrate storage barn. Tailings will flow by gravity to the Tailings Storage Facility.

Production Plan

Additional mining optimization studies indicated that the optimum production profile for the Cascabel Project is, to begin with a processing rate of 12Mtpa, extracting high-grade ore for 6 years, and then expanding the process plant by an additional 12Mtpa, increasing to a total processing rate of 24Mtpa. The initial 12Mtpa throughput rate is expected to be achieved six years after the start of Project development. Over the current life of mine, the plant is expected to produce 2.9 million tonnes of copper, 6.9 million ounces of gold and 18.4 million ounces of silver.

Tandayama-Ameríca (TAM) Deposit

The TAM deposit, located approximately 6 kilometres northeast of the Apala deposit, further emphasizes the significant potential of the Cascabel Project. The TAM deposit outcrops at the surface, resulting in a low strip ratio, offering an excellent opportunity to provide additional mill feed for up to 7 years and the potential for an earlier start of metal production from an open-cut mining method.

The current evaluation of the TAM deposit is not at a PFS level and is, therefore, not included in the Cascabel Project economics presented above or in the PFS mine plan. The Company will begin the additional metallurgical testing, waste rock characteristic testing, geotechnical, hydrogeology, and detailed mine planning required to finalize planning efforts.

Table 4: Tandayama-Ameríca Mineral Resource Statement (Effective Date November 11, 2023)

Potential Mining Method | Cut-off Grade (CuEq %) | Resource Category | Tonnage (Mt) | Grade | Contained Metal | ||||

Cu (%) | Au (g/t) | CuEq (%) | Cu (Mt) | Au (Moz) | CuEq (Mt) | ||||

Open Pit | 0.16 | Indicated | 492 | 0.22 | 0.20 | 0.35 | 1.1 | 3.1 | 1.7 |

Inferred | 45 | 0.18 | 0.18 | 0.31 | 0.1 | 0.3 | 0.1 | ||

Underground | 0.19 | Indicated | 230 | 0.26 | 0.18 | 0.39 | 0.6 | 1.3 | 0.9 |

Inferred | 201 | 0.21 | 0.21 | 0.36 | 0.4 | 1.4 | 0.7 | ||

Total Indicated | 722 | 0.23 | 0.19 | 0.36 | 1.7 | 4.5 | 2.6 | ||

Total Inferred | 247 | 0.21 | 0.21 | 0.35 | 0.5 | 1.6 | 0.9 | ||

Notes:

- Dr. Gilles Arseneau, P. Geo., Associate Consultant with SRK Consulting (Canada), is responsible for this Mineral Resource statement and is an "independent Qualified Person" as such term is defined in NI 43-101.

- Reasonable prospects of eventual economic extraction were assessed by:

- First presenting the mineralised material in the block model estimate to a conventional Lersch-Grossman open pit optimisation routine based on a cut-off grade of 0.16 % CuEq, and the cost and revenue assumptions listed below. Mineralised material inside the revenue factor one pit and above the cut-off grade were then reported in the "Open pit" section of the Mineral Resource statement.

- Subsequently, the remaining material was enclosed in a 3D wireframe shape that was constructed with adherence to a minimum mining unit with geometry appropriate for a block cave.

- The Cut-off grade for the underground shape was defined as the cut-off grade under a breakeven, eventual economic extraction criterion. The cut-off grade of

0.19% CuEq was calculated using (copper grade (%)) + (gold grade (g/t) x 0.683). - All material within the underground shape was reported in the "Underground" section of the Mineral Resource statement, as block caving is a non-selective method, and all material extracted is treated as mill feed.

- The resulting shape contained planned internal and edge dilution that the QP considers appropriate.

- Cut-off/Cut-off inputs included:

- Metal prices of Cu at US

$3.60 /lb and Au at US$1,700 /oz, - Recoveries of Cu

93% and Au83% , - Costs including mining, processing and general and administration (G&A) and

- Off-site realization (TCRC), including royalties.

- Metal prices of Cu at US

- The QP considers that the Mineral Resource has reasonable prospects for eventual economic extraction by open pit or an underground mass mining method such as block caving, as presented in the Mineral Resource statement.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are reported inclusive of those Mineral Resources that were converted to Mineral Reserves.

- Numbers may not add up due to rounding.

Environmental, Social and Governance ("ESG")

SolGold's unwavering commitment to the highest social and environmental sustainability of our projects positions the Company as a leading advocate of responsible mining practices, particularly in Ecuador. As SolGold advances the Cascabel Project, we remain dedicated to the highest transparency standards and ESG principles.

In line with our corporate values, SolGold has established a comprehensive framework encapsulating the following key ESG criteria:

- Environment: We are deeply committed to managing our carbon footprint and maximizing the use of renewable resources. We aim to minimize the ecological impact of our operations and contribute to a cleaner environment and biodiversity conservation.

- Social: SolGold champions diversity and equitable wages within our workforce. We believe that fostering an inclusive workplace and ensuring fair compensation are fundamental to the well-being of our employees and the communities in which we operate.

- Governance: SolGold is dedicated to adhering to the highest standards of governance practices. We stand for transparency, integrity, and accountability in all our operations, aligning ourselves with global best practices.

Over the past decade, we have forged robust community partnerships in Ecuador underpinned by extensive engagement efforts. These relationships underscore our commitment to responsible resource development and mutual prosperity.

In accordance with Ecuadorian law, an Environmental and Sustainability Impact Assessment ("EISA") is required before obtaining authorization for construction and operations. SolGold is committed to ensuring the EISA is aligned with international standards. These standards encompass the Equator Principles, the International Finance Corporation ("IFC") Performance Standards, Environmental, Health, and Safety Guidelines, as well as the Sustainable Development Goals ("SDG"), as well as other international standards that apply to the mining sector.

Furthermore, SolGold will undertake a comprehensive evaluation to manage and reduce the project's overall carbon footprint. Our initiatives will encompass maximizing the utilization of renewable energy sources, exploring electrification of mobile and fixed equipment options, optimizing operational efficiency through process integration and other innovative strategies to minimize our environmental footprint.

Our commitment to ESG principles remains unwavering, and we are dedicated to ensuring that the Cascabel Project sets the benchmark for responsible and sustainable mining practices in Ecuador and beyond.

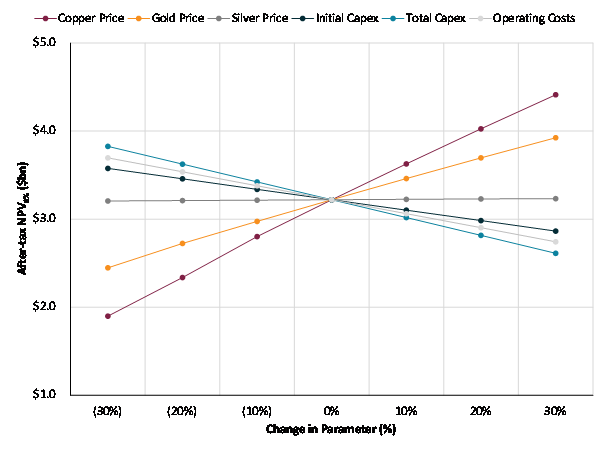

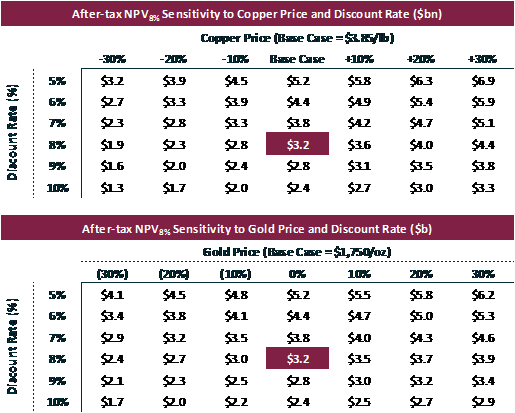

Sensitivity Analysis

A sensitivity analysis was performed on the Study's after-tax NPV

Figure 1: After-tax NPV

Figure 2: Metal Price and Discount Rate Sensitivity

Outstanding Opportunities and Upside Options

Opportunities for further optimization of the Cascabel Project that management will continue to investigate include:

- Process plant design optimization following additional metallurgical test work focusing on improved gold recovery and other by-product recovery

- Viability of the TAM open-cut mine to provide early mill feed

- Continue to examine the impacts of utilizing tunnel boring technology to accelerate underground development

- Further define the economic benefits of renewable energy, such as hydro and solar, on the project

- Continue to examine the economic impact of the sub-level cave mining method on the upper portions of the Alpala deposit

- Process plant design optimization following additional metallurgical test work

Next Steps

SolGold intends to release a NI 43-101 technical report on Cascabel within 45 days of this release (the "Technical Report").

SolGold expects to commence the technical work to further advance and de-risk the Cascabel Project.

Qualified Persons

The Qualified Persons for the "Cascabel Project, Ecuador, NI 43-101 Technical Report on Pre-Feasibility Study", which has an effective date of December 31, 2023, are detailed in the table below.

| Category | Name | Company |

| Mineral Resource Estimate | Dr. Gilles Arseneau, P. Geo. | SRK Consulting (Canada) Inc. |

| Mineral Reserve Estimate and Mining (Underground) | Jarek Jakubec, C.Eng., FIMMM | SRK Consulting (Canada) Inc. |

| Mining (Open Pit Tandayama) | Scott Wilson, CPG, SME Registered Member | Resource Development Associates Inc. |

| Environment, Social, Tailings & Water | Tim Rowles, BSc MSc FAusIMM CP RPEQ | Knight Piésold Pty Ltd |

| Metallurgy & Process Plant | Ben Adaszynski, P.Eng | Sedgman Canada Ltd. |

| Surface Infrastructure | Richard Boenke, P.Eng | JDS Energy and Mining Inc. |

| Financial Evaluation and Marketing | Carl Kottmeier, P.Eng | SRK Consulting (Canada) Inc. |

This announcement was approved for release by Scott Caldwell-Chief Executive Officer.

Certain information contained in the announcement would have been deemed inside information.

CONTACTS

Scott Caldwell |

|

Tavistock (Media) |

|

ABOUT SOLGOLD

SolGold is a leading resources company focused on the discovery, definition, and development of world-class copper and gold deposits and continues to strive to deliver objectives efficiently and in the interests of shareholders.

The Company operates with transparency and in accordance with international best practices. SolGold is committed to delivering value to its shareholders while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace, and minimizing environmental impact.

SolGold is listed on the London Stock Exchange and Toronto Stock Exchange (LSE/TSX: SOLG).

See www.solgold.com.au for more information. Follow us on "X" @SolGold plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by SolGold plc (the "Company") and its Officers may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to interpretations of exploration results to date and the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's Directors, including the plan for developing the Project currently being studied as well as the expectations of the Company as to the forward price of copper. Such forward-looking and interpretative statements involve known and unknown risks, uncertainties and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such interpretations and forward-looking statements.

Accordingly, the reader should not rely on any interpretations or forward-looking statements; and save as required by the exchange rules of the TSX and LSE or by applicable laws, the Company does not accept any obligation to disseminate any updates or revisions to such interpretations or forward-looking statements. The Company may reinterpret results to date as the status of its assets and projects changes with time expenditure, metals prices and other affecting circumstances.

This release may contain "forward‑looking information". Forward‑looking information includes, but is not limited to, statements regarding the Company's plans for developing its properties. Generally, forward‑looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward‑looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward‑looking information, including but not limited to: transaction risks; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, risks relating to the ability of exploration activities (including assay results) to accurately predict mineralization; errors in management's geological modelling and/or mine development plan; capital and operating costs varying significantly from estimates; the preliminary nature of visual assessments; delays in obtaining or failures to obtain required governmental, environmental or other required approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further exploration activities, including drilling; delays in the development of projects; environmental risks; community and non-governmental actions; other risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and those risks set out in the Company's public documents filed on SEDAR+ at www.sedarplus.ca. Accordingly, readers should not place undue reliance on forward‑looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

The findings in the PFS and the implementation of the Cascabel project are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be interpreted as guidance. The information contained herein is a summary only and is qualified in its entirety by reference to the Technical Report (as defined herein).

The Company and its officers do not endorse, or reject or otherwise comment on the conclusions, interpretations or views expressed in press articles or third-party analysis.

The Company recognises that the term World Class is subjective and for the purpose of the Company's projects the Company considers the drilling results at the Alpala porphyry copper-gold deposit at its Cascabel project to represent intersections of a World Class deposit on the basis of comparisons with other drilling intersections from World Class deposits, some of which have become, or are becoming, producing mines and on the basis of available independent opinions which may be referenced to define the term "World Class" (or "Tier 1").

The Company considers that World Class deposits are rare, very large, long life, low cost, and are responsible for approximately half of total global metals production. World Class deposits are generally accepted as deposits of a size and quality that create multiple expansion opportunities and have or are likely to demonstrate robust economics that ensure development irrespective of position within the global commodity cycles, or whether or not the deposit has been fully drilled out, or a feasibility study completed.

Standards drawn from industry experts (1Singer and Menzie, 2010; 2Schodde, 2006; 3Schodde and Hronsky, 2006; 4Singer, 1995; 5Laznicka, 2010) have characterised World Class deposits at prevailing commodity prices. The relevant criteria for World Class deposits, adjusted to current long run commodity prices, are considered to be those holding or likely to hold more than 5 million tonnes of copper and/or more than 6 million ounces of gold with a modelled net present value of greater than US

The Company cautions that the Cascabel Project remains an early-stage project at this time and there is inherent uncertainty relating to any project at prior to the determination of pre-feasibility study and/or defined feasibility study.

On this basis, reference to the Cascabel Project as "World Class" (or "Tier 1") is considered to be appropriate.

[1] Based on long-term commodity price assumptions of (US$):

[2] Average based on years 6 - 23 at full nameplate capacity.

[3] Assumptions for copper equivalent calculations as provided in Table 1 for commodity prices, grades and recoveries. Copper equivalent production (by-product basis) = Recovered Cu tonnes + (Au Price US$/oz) / (Cu Price US$/t) x (Recovered gold ounces) + (Ag Price US$/oz) / (Cu Price US$/t) x (Recovered silver ounces).

[4] Peak based on year 6 from start of production.

[5] See Table 3: Cascabel Project Alpala Underground Mineral Reserve Estimate for details including cut-off assumptions.

[6] See SolGold press release dated 20 July 2023 for additional details.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: SolGold PLC

View the original press release on accesswire.com